Market Summary

The global Municipal Water Treatment market size was valued at USD 129.40 billion in 2025 and is projected to reach USD 181.10 billion by 2033, growing at a CAGR of 4.29% from 2026 to 2033. The municipal water treatment market is expanding due to rising urban populations, aging water infrastructure, and stricter water quality regulations. Governments are increasing investments to ensure safe drinking water and effective wastewater management. Growing focus on water reuse, contamination control, and climate-resilient infrastructure is driving demand for advanced filtration, disinfection technologies, and treatment services across municipal and industrial users.

Market Size & Forecast

- 2025 Market Size: USD 129.40 Billion

- 2033 Projected Market Size: USD 181.10 Billion

- CAGR (2026-2033): 4.29%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 30% in 2026. A fresh wave of upgrades sweeps through North America's aging systems. Growth creeps forward, slow but sure, shaped by tighter rules on pollution. New filtering methods take root, step by step. Cleaner outputs become normal, pushed by tech that removes more contaminants. Progress here leans on careful updates rather than sudden leaps.

- Out front in North America, the United States dominates because cities keep upgrading their water systems. Spending big on pipes and purification pushes progress here. Rules demanding clean drinking water plus safe waste handling shape daily operations across states. Membrane tech pops up everywhere from Texas to Maine, handling dirty runoff before it spreads. Chemical treatments tag along just as often, mixing into the flow at nearly every plant site. What sticks is how routine these fixes have become.

- City growth speeds up change across the Asia Pacific. Wastewater demands push updates in industry practices. Government plans add momentum alongside funding flows into public water systems. Big spending on sewage networks shapes progress here. Infrastructure expands fast where needs rise quickly.

- Filtration Technology market share is approximately 50% in 2026. Filtration takes the top spot among technologies, due to rising needs for safe drinking water. Advanced membranes team up with sand-based methods, pushing this approach forward. Growing reliance on these systems shapes how people access cleaner supplies.

- Fresh off the back of stricter rules, water treatment gear pulls ahead. Cities are pouring funds into pumps alongside filters that scrub contaminants clean. Disinfection tech sees a boost, too, driven by compliance needs. Automation tags along, making operations smoother without drawing attention. Each piece plays its part quietly under public scrutiny.

- Treating drinkable water does. More people live in cities now, needing clean supplies. Growth pushes systems to work harder. Safe taps are not a luxury; they are essential. That reality drives the most use of these methods.

- Municipal corporations take charge of major water projects because they need to meet strict safety standards. These city-run groups handle both cleaning used water and supplying fresh supplies on a wide scale. Their role grows out of legal duties tied to public well-being and ecological balance. Big systems rise under their oversight simply due to population demands. Managing pollution becomes unavoidable when millions rely on one network.

The Municipal Water Treatment market includes medicines made from living cells, closely matching existing biologic drugs in how safe, effective, and reliable they are, yet usually cheaper. Because these treatments come from biological sources, their production is complicated, needing strict oversight so there’s no real difference in performance versus the original. They are commonly prescribed for illnesses like cancer, rheumatoid arthritis, diabetes, or clotting problems, helping patients access care without high costs. As key biologic drug patents run out across countries, more companies jump in, pushing steady growth in this sector.

Demand for Municipal Water Treatment is going up because medical expenses keep climbing, serious illnesses are spreading, yet cheaper treatments are needed now more than ever. Since biological drugs usually cost a lot and must be taken for years, hospitals, along with insurers, are pushing similar medicines to save money without losing effectiveness. In cancer care or managing immune system disorders - areas where such advanced meds matter most - the push grows even stronger.

Patent expirations on major biologic meds have opened doors for cheaper copies, giving Municipal Water Treatment makers a clear shot at the market. On top of that, clearer rules in places like Europe and the US help doctors and patients trust these options more. Because medical staff are getting more familiar with them, acceptance is growing, especially where insurance covers the cost easily.

The market’s getting a boost from better biomanufacturing tools, smarter testing ways, while drug makers team up more often - fueling longer Municipal Water Treatment lineups. In developing regions, strong potential is opening up as state leaders push cheaper options to get biologics into more hands. Step by step, copycat versions that can swap freely, plus steady rule-maker backing, should heat up the rivalry, widen the reach, and keep the Municipal Water Treatment sector growing in the future.

Municipal Water Treatment Market Segmentation

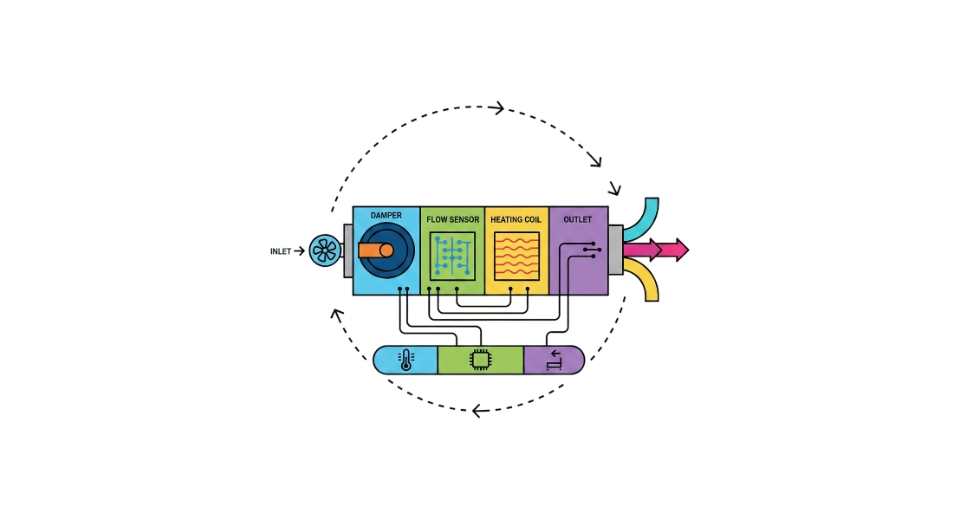

By Technology

- Filtration

Filtration by technology handles particles and pollutants, using sand or membranes alongside newer filtering methods. What works best often depends on the type of debris involved. Some systems rely on layers of material to trap gunk. Others push water through tight barriers. Advanced setups combine several stages for cleaner results.

- Disinfection

Fresh water stays clean when germs are removed through methods like chlorine treatment, ultraviolet light exposure, or ozone bursts. Safety comes from stopping harmful organisms before they spread. Each technique works differently yet reaches the same result - clean liquid ready for use again.

- Chemical Treatment

Acids or bases tweak water's acidity so it stays balanced. Particles clump together when chemicals are added, making them easier to remove. Scaling gets blocked by specific additives during processing. Living organisms struggle to grow because certain treatments stop their spread.

- Sludge Treatment & Handling

Waste from cleaning water needs careful handling. Processing happens after treatment steps finish. Getting rid of the leftover material takes planning. Some methods change their form first. Others move it safely offsite. How thick it is affects what comes next. Drying reduces weight before transport. Storing it too long can cause issues. Treating sludge helps lower risks. Final disposal follows strict rules.

- Others

Other options cover newer methods like ion exchange setups along with advanced oxidation techniques.

To learn more about this report, Download Free Sample Report

By Component

- Water Treatment Chemicals.

Water treatment chemicals include things like coagulants, which help clump particles together. Flocculants follow up by forming larger clusters that settle out easily. Disinfectants come into play to kill harmful microbes present in the liquid. Meanwhile, pH control agents adjust acidity levels so the process runs smoothly. Each of these supports cleaner water without adding complexity.

- Water Treatment Equipment

Filtration units sit alongside pumps inside treatment setups, where disinfection steps follow. Sensors track changes while membranes handle separation tasks across facilities. Each part plays a role in keeping water clean through organized processes.

- Services

From idea to setup, support includes advice on planning. Moving forward, systems are built with precise design work. Once ready, skilled teams handle putting everything in place. Over time, regular checkups keep things running smoothly. Watching performance day by day ensures reliability without pause.

By Application

- Portable Water Treatment

Drinking water treatment takes untreated sources, turning them into safe supplies for cities. What comes out must follow strict health rules before reaching homes. Clean output depends on removing contaminants early in the process.

- Wastewater Treatment

Processing dirty water means cleaning city sewage so it is safe to release back into the rivers. This step removes harmful stuff found in used household and industrial liquids. Cleaned wastewater can also go toward irrigation or factory needs. Before letting water return to nature, treatment ensures fewer pollutants enter ecosystems.

- Stormwater Management

Rain from the streets gets handled to clean it before moving through the drains. This keeps harmful stuff out of water paths below cities.

- Industrial Water Reuse

Fact is, factories can use cleaned city wastewater. This kind of water works just fine for manufacturing tasks. It also fits jobs where drinking quality is not needed. Cleaning it up first makes sense. One person’s waste becomes another’s resource down the line.

By End-Users

- Municipal Corporation

City governments take charge of running water and sewage systems. These local bodies handle day-to-day operations. Public utilities rely on them to keep services working. Oversight often comes from municipal departments. Maintaining pipes and treatment plants falls under their duties. They coordinate repairs when problems arise. Funding upgrades is part of long-term planning. Community needs shape how projects move forward.

- Industrial Users

Factories take cleaned city water to run their work. Some send filtered waste fluid back into public networks. Their needs shape how treatment plants operate. Water flows both ways with these users involved.

- Residential and Commercial

People at home get clean drinking water for regular use. Businesses draw from the same supply to operate. Their needs differ, but rely on one source. Water meant for human use flows into apartments and offices alike. What comes out of taps starts the same way everywhere.

Regional Insights

Water systems across North America stand well developed thanks to strong networks, strict rules, yet steady spending on updates, smart meters plus tools that find leaks play a growing role. Leading the area, the United States pushes ahead because money flows from national programs toward better pipes, alongside the wide use of new filtering methods and ways to recycle used water. Elsewhere nearby, both Canada and Mexico grow their cleaning abilities by following laws, then extending service lines further out. Over in Europe, tough green policies push change, especially within Germany, France, and the United Kingdom, where providers renew aging stations, shift toward powerful filters, safer kill-methods for germs, recycling waste flow to match tight continental cleanliness targets.

A surge in city development across the Asia Pacific pushes demand for cleaner water solutions faster than anywhere else. With cities swelling and factories multiplying, governments pour money into modernizing pipes and purification plants. China moves ahead of the pack, rolling out vast networks and upgrading facilities using high-performance methods. Close behind, India expands its ability to clean drinking water and manage sewage through national programs. In Japan, South Korea, and Australia, attention turns toward smart controls and fine-filter membranes that lift performance. Unexpected upgrades ripple through Southeast Asia too, as capitals strengthen their systems against pollution and shortages. Growth gains speed where crowded hubs stretch existing supplies thin.

Some cities in Latin America, like those in Brazil, Argentina, or Colombia, see slow but steady upgrades in cleaning their tap water, aiming to give more people safe supplies while meeting basic hygiene targets. Still, progress drags behind richer nations because money runs short and pipes often fail to reach everyone. Over in the Middle East and Africa, places with little rainfall are stepping up efforts, quietly building systems that pull drinkable water from seawater or recycle used flows. Nations including Saudi Arabia, the United Arab Emirates, and South Africa now lean on high-tech fixes to keep taps running amid dry conditions. More urban projects there now involve turning saltwater into fresh water or giving wastewater a second life before sending it back into homes. Government plans focused on survival during droughts, along with help from global groups, slowly patched weak networks and strengthened how well towns can clean what they use.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 25, 2025 – Grundfos completed the acquisition of a United States water Treatment company.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 129.40 Billion |

|

Market size value in 2026 |

USD 134.95 Billion |

|

Revenue forecast in 2033 |

USD 181.10 Billion |

|

Growth rate |

CAGR of 4.29% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Veolia Water Technologies, Suez S.A., Xylem Inc., Pentair Plc, American Water Works Company Inc., Aquatech International LLC, Calgon Carbon Corporation, Stantec Inc., Black & Veatch, Mott MacDonalds, BEWG, OriginWater, WesTech Engineering, Kingspan, Wteinfra, Convotech Engineering LLC. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Filtration, Disinfection, Chemical Treatment, Sludge Treatment & Handling, Others) By Component(Water Treatment Chemicals, Water Treatment Equipment, Services) By Application(Portable Water Treatment, Wastewater Treatment, Stormwater Management, Industrial Water Reuse), By End-Users (Municipal Corporations, Industrial Users, Residential and Commercial) |

Key Municipal Water Treatment Company Insights

A leading company in municipal water treatment known for advanced filtration solutions and large-scale system integration, trusted by cities worldwide for clean water delivery. Based in France, Veolia Environnement S.A. operates around the world, offering solutions for clean water and waste processing. Its reach extends into cities and factories alike, serving public and private sectors across continents. Services cover everything from designing systems to running facilities, advising clients, plus applying specialized tech for safe drinking water, cleaning used flows, or recycling water supplies. Known for high-efficiency filters, membrane-based processes, and precise chemical treatments, it supports local governments meeting tough safety and ecological rules. Innovation drives growth - new methods emerge alongside alliances with other firms, along with taking over smaller utilities region by region. Sustainability shapes decisions while smarter ways to manage supply chains evolve under real-world conditions.

Key Municipal Water Treatment Companies:

- Veolia Water Technologies

- Suez S.A.

- Xylem Inc.

- Pentair Plc

- American Water Works Company Inc.

- Aquatech International LLC

- Calgon Carbon Corporation

- Stantec Inc.

- Black & Veatch

- Mott MacDonalds

- BEWG

- OriginWater

- WesTech Engineering

- Kingspan

- Wteinfra

- Convotech Engineering LLC

Global Municipal Water Treatment Market Report Segmentation

By Technology

- Filtration

- Disinfection

- Chemical Treatment

- Sludge Treatment & Handling

- Others

By Component

- Water Treatment Chemicals

- Water Treatment Equipment

- Services

By Application

- Portable Water Treatment

- Wastewater Treatment

- Stormwater Management

- Industrial Water Reuse

By End-Users

- Municipal Corporations

- Industrial Users

- Residential and Commercial

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636