Market Summary

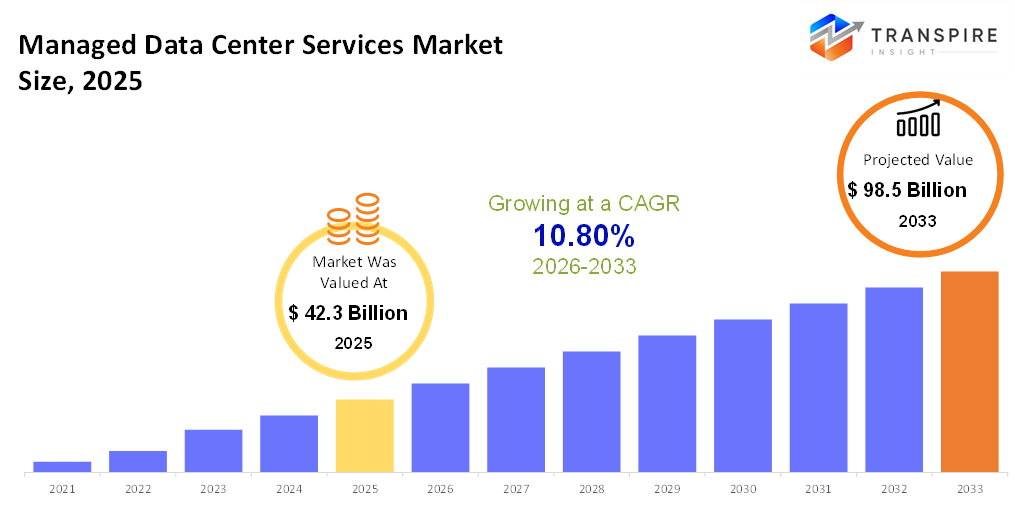

The global Managed Data Center Services market size was valued at USD 42.3 billion in 2025 and is projected to reach USD 98.5 billion by 2033, growing at a CAGR of 10.80% from 2026 to 2033. Market CAGR is supported by factors including the increasing rate of adoption of the cloud, rising cyber threats, and increasing complexities in enterprises. There is an increasing trend among firms for managed services in order to cut operation expenses, as well as rising pressures from regulatory requirements.

Market Size & Forecast

- 2025 Market Size: USD 42.3 Billion

- 2033 Projected Market Size: USD 98.5 Billion

- CAGR (2026-2033): 10.80%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America will continue to have the largest market size during the forecast period because of their well-established cloud ecosystems, extensive investments in cybersecurity, and high spending on enterprise IT, as organizations focus on managed infrastructure for hybrid clouds, regulatory compliance, and massive-scale modernization programs.

- In the United States, growth is driven by early adoption of technology, the high usage of cloud-native applications, and the increasing outsourcing of its IT operations, which is driven by an increasing demand for managed solutions for business continuity and data security.

- The Asia Pacific market is growing with utmost pace due to SME digitization, cloud data centers, and digital initiatives launched and supported by their governments, and enterprises turning towards managed services for their scalable growth and IT system transformations.

- Hybrid and cloud infrastructure management continues to hold the leading position in service type due to the fact that large enterprises are often balancing their legacy systems with cloud platforms in order to have unified visibility into workloads, workload optimization, and operational flexibility-all while avoiding certain risks associated with full-scale cloud migration.

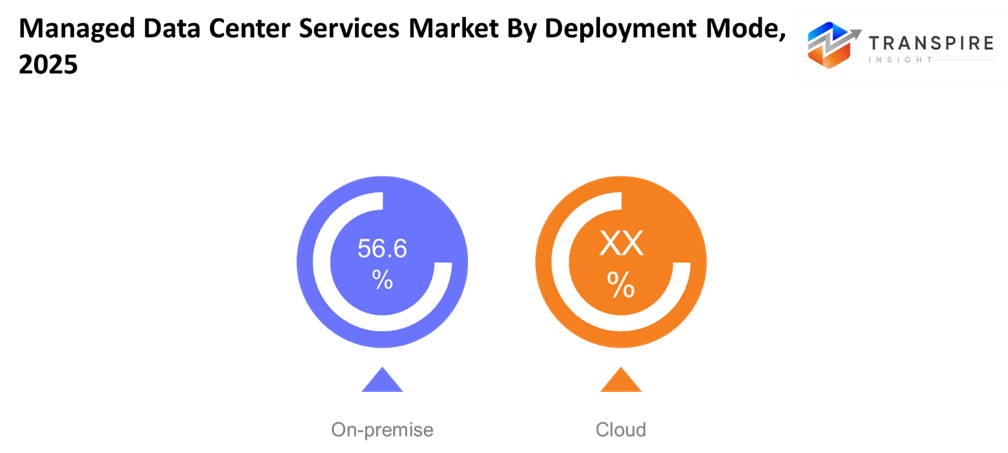

- Cloud deployment dominates adoption trends because it offers scalability, quicker deployment, and less upfront cost, thus enabling enterprises to support remote operations, dynamic workloads, and continuous updates to applications while maintaining performance and availability across distributed business environments.

- Large enterprises are the leading segment of enterprise size, driven by factors such as complex IT architectures and multi-location operations that demand advanced managed services to ensure security, compliance, uptime, and frictionless integration across hybrid and multi-cloud infrastructures.

- BFSI remains the leading end-use segment because financial institutions rely on secure, always-on infrastructure and real-time data processing, which mandates regulatory compliance, managed services as one of the key enablers in mitigating risk and system reliability, and digital banking transformational pursuits.

So, "The market also covers the outsourcing of management of information technology infrastructure, applications, security, and clouds to simplify operations and enable businesses to focus more on their core activities." Solutions provided by this market are used to optimize infrastructure management, monitor performance, protect data, and ensure application availability in the cloud, hybrid, or traditional infrastructure. The growing adoption of digital transformation across various industry verticals has increased dependence on managed services for handling complicated IT environments. Organisations are faced with growing data, security threats, and system availability, which is boosting the adoption of comprehensive management solutions offered by professional managed services providers.

The market is also protected by cloud migration, telecommuting, or cloud migration/telecommuting, which strengthens the market. Many businesses have transformed the perception of managed services from a cost center to a value driver, which helps increase the market. Some factors contributing to the increase in the market are described below.

Managed Data Center Services Market Segmentation

By Type

- Infrastructure Management

Its major coverage area is managing and optimizing various information technology resources like servers, networks, and storage systems. Demand sources include organizations requiring higher uptime and cost-effective operation of information technology resources.

- Security Management

Security management focuses on threat identification, governance, and risk management in the wake of escalating cyber attacks. This segment has significant preference withevent frequency.

- Backup & Disaster Recovery

This assures the protection of the data and the continuity of the businesses in case of a system failure and a possible attack from cyberspace. The relevance of this feature has improved with the rise in data-related businesses and with the need for zero downtime.

- Monitoring & Performance Management

The solutions for monitoring help in analyzing the performance of the systems and take anticipatory steps for handling the issues. Organizations are dependent on this market segment for ensuring the quality of operations and even more in cloud-based systems with the requirement of high availability.

- Application Hosting and Support

This provides support for application deployment, maintenance and optimization. The driving force behind growth is based on an increased dependence on business-critical applications and SaaS platforms.

- Database Management

Database management provides data integrity, performance and security. With the increase in data and real-time analytics enterprises face the need for managed database services.

- Hybrid/Cloud Infrastructure Management

This allows smooth management regardless of whether the work is done in the cloud or internally. Adopting the hybrid approach is preferable among businesses today as it is very scalable as well as offers easy migration options to the cloud.

- Others

It also encompasses niche services such as managing and automating compliance. These are services that facilitate specialized functions and help optimize IT efficiency.

By Deployment Mode

- Cloud

Cloud deployment is dominant because of its ability to be scalable, economical, and remotely accessible. More and more businesses are opting for cloud deployment for digital transformation and flexibility.

- On-premise

On-premise hosting continues to offer value for organizations with high data control and regulatory compliance requirements. It is especially preferred by organizations that have high data sovereignty requirements.

To learn more about this report, Download Free Sample Report

By Enterprise Size

- Small Enterprises

Small enterprises use managed services to reduce IT complexity and operational costs. These services help them move toward enterprise-grade infrastructure without much capital investment in hardware and Security Management.

- Medium Enterprises

Medium enterprises use managed services to support growth and digital expansion. Flexibility and performance optimization remain key drivers of adoption in this segment.

- Large Enterprises

Large enterprises rely on managed services for complex large-scale IT environments. Advanced security, hybrid management and customization are driving demand for this segment.

By End Use

- BFSI

This space has a high demand for security, compliance, and uptime. It is supported by managed services for handling transactions, protecting data, and complying with standards.

- Manufacturing

Vendors apply managed services in making smart factories and automated systems. This will ensure uninterrupted manufacturing and informed decision-making.

- IT & Telecom

Invested in This is because it is one of the industries that has dynamic infrastructure requirements. This is aided by managed services that ensure scalability and service continuity.

- Healthcare

Healthcare service providers rely on managed services in order to ensure a safe environment for data management and system uptime. The adoption of electronic health records and telemedicine solutions drives the market.

- Energy

Energy companies apply the use of managed services to handle essential infrastructure information. Availability and real-time monitoring are the main drivers of growth.

- Education

Learning institutions embrace managed services for the purpose of facilitating digital learning platforms. Cost effectiveness and scalability of the system are the drivers for adopting this service.

- Media and Entertainment

In this sector, high-performance infrastructure for content and streaming is required. Managed services ensure a smooth user experience.

- Others

These include retail, logistics, and the government sectors. They implement managed services in their sectors for better efficiency and cyber resilience.

Regional Insights

North America, including the United States, Canada, and Mexico, can be regarded as a mature market with higher adoption of cloud and hybrid managed services. The region has strong IT spending and a mature digital infrastructure and awareness about cybersecurity policies. The growth of the enterprise application market in Europe, as well as in countries like Germany, the United Kingdom, France, Spain, and Italy and the rest of Europe remains positive and focuses on enterprise modernization and strict data privacy laws.

Asia Pacific, including Japan, China, Australia & New Zealand, South Korea, and India, among others is the fastest-growing market. Countries in Asia/Pac are moving at a rapid pace in terms of digitization in general and startups as well as their acceptance of scalable managed service solutions are increasing due to government initiatives. Cloud migration and IT outsourcing continue to drive gradual growth in South America, led by Brazil and Argentina. Optimization of costs and the reliability of services are key areas of focus for enterprises in changing digital ecosystems.

The Middle East & Africa, comprising Saudi Arabia, the UAE, South Africa, and the rest of MEA, is growing steadily on the back of its smart city projects, digital government initiatives and increasing investments in IT infrastructure modernization.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 2025, Pax8 has revealed a broadened worldwide partnership with Microsoft, embracing Microsoft’s unified Marketplace and unveiling the OneCloud Guided Growth program. This is a move aimed at supporting growth and ripening for Managed Service Providers by providing simpler resale and enablement for Microsoft Cloud, Security, and AI offerings A comprehensive training program for those who take part is included.

- In June 2025, NETGEAR completed the acquisition of India-based cybersecurity startup Exium to enhance managed services and integrated security capabilities for MSPs and enterprise customers. The move underlines an increasing role for managed security services in broader managed service portfolios, amid burgeoning demand globally for cybersecurity.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 42.3 Billion |

|

Market size value in 2026 |

USD 48 Billion |

|

Revenue forecast in 2033 |

USD 98.5 Billion |

|

Growth rate |

CAGR of 10.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Accenture, IBM Corporation, Cisco Systems, Inc., Cognizant Technology Solutions, Tata Consultancy Services Limited, Infosys Limited, Capgemini SE,Wipro Limited, HCL Technologies Limited, DXC Technology Company, Microsoft Corporation, Amazon Web Services, Inc., Fujitsu Limited, NTT DATA Corporation, Hewlett Packard Enterprise Company |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Infrastructure Management, Security Management, Services, Backup & Disaster Recovery, Monitoring & Performance Management, Application Hosting & Support, Database Management, Hybrid/Cloud Infrastructure Management, Other), By Deployment Mode(Cloud, On-premise), By Enterprise Size (Small Enterprises, Medium Enterprises, Large Enterprises), By End Use (BFSI, Manufacturing, IT & Telecom, Healthcare, Energy, Education, Media and Entertainment, Others) |

Key Managed Data Center Services Company Insights

IBM Corporation is a foundational leader in the managed services industry worldwide. IBM has utilized its rich tradition in information technology structure, hybrid cloud platforms and enterprise solutions to implement comprehensive managed services. IBM services include hybrid cloud management, AI-driven operation capabilities, security services, and performance monitoring services. IBM’s overall vision is to combine structured automation, analytics, and orchestration using cloud systems to empower clients to cut costs while at the same time bolstering flexibility. IBM has an impressive market share with widespread presence globally enabling them to develop customized solutions to transform multiple large enterprises.

Key Managed Data Center Services Companies:

- Accenture

- IBM Corporation

- Cisco Systems, Inc.

- Cognizant Technology Solutions

- Tata Consultancy Services Limited

- Infosys Limited

- Capgemini SE

- Wipro Limited

- HCL Technologies Limited

- DXC Technology Company

- Microsoft Corporation

- Amazon Web Services, Inc.

- Fujitsu Limited

- NTT DATA Corporation

- Hewlett Packard Enterprise Company

Global Managed Data Center Services market Report Segmentation

By Type

- Infrastructure Management

- Security Management

- Backup & Disaster Recovery

- Monitoring & Performance Management

- Application Hosting & Support

- Database Management

- Hybrid/Cloud Infrastructure Management

- Other

By Deployment Mode

- Cloud

- On-premise

By Enterprise Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

By End Use

- BFSI

- Manufacturing

- IT & Telecom

- Healthcare

- Energy

- Education

- Media and Entertainment

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636