Market Summary

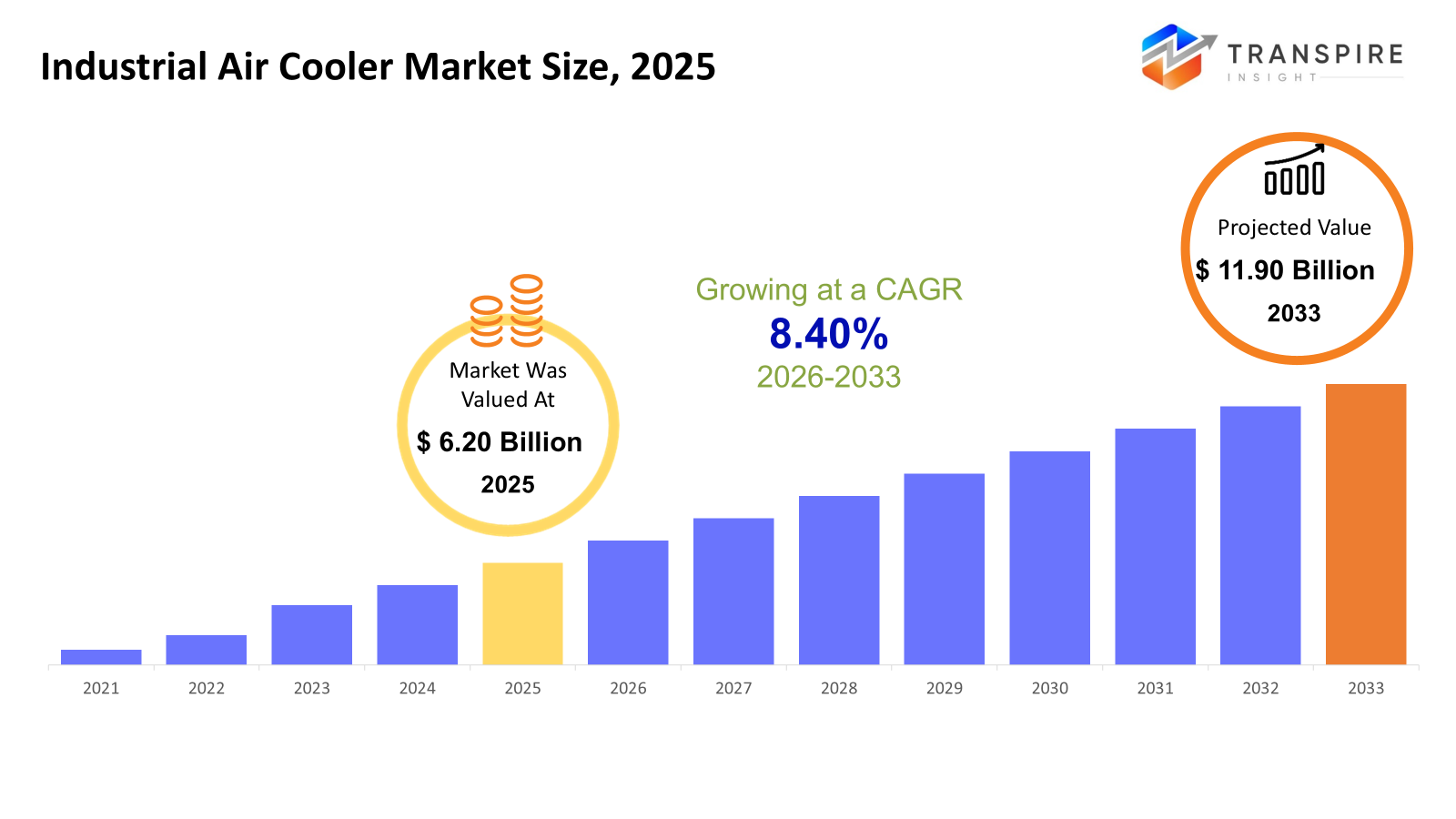

The global Industrial Air Cooler market size was valued at USD 6.20 billion in 2025 and is projected to reach USD 11.90 billion by 2033, growing at a CAGR of 8.40% from 2026 to 2033. With the increase in levels of industrialization and extension of manufacturing infrastructures across the globe, the requirement for efficient cooling systems is on the rise, boosting the market. An increase in energy efficiency regulations and environmental issues will lead to the adoption of eco-friendly cooling systems like air coolers. The growing requirement from industries like food & beverage, pharmaceuticals, and chemicals, who require cooling systems for temperature-dependent processes, is boosting the market’s CAGR. Technology developments for hybrid and high-capacity cooling systems increase the product’s performance, making it more marketable

Market Size & Forecast

- 2025 Market Size: USD 6.20 Billion

- 2033 Projected Market Size: USD 11.90 Billion

- CAGR (2026-2033): 8.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is witnessing growing penetration levels of evaporative coolers and hybrid coolers for a wide array of industrial and commercial markets owing to stringent energy efficiency directives, technology upgrades, and the requirement for consistent temperature management within manufacturing, warehousing, and other large commercial settings.

- The United States is a leader in direct and indirect air coolers installations, particularly for chemical, pharmaceutical, and food processing industries, because of strict regulatory compliance, advanced cooling systems, and the need to maintain consistent operational efficiencies of mid-to-large size industrial units.

- In terms of growth, Asia Pacific is highly competitive, based on its demand for large-capacity evaporative or hybrid air coolers, mainly in China, India, Japan, and Korea, thereby facilitating extensive manufacturing operations, warehouses, and power plants, while keeping sustainability at the core of their cooling needs.

- Evaporative air cooling systems are preferred in North America and Asia Pacific regions because of low running costs, high energy efficiency, and their ability to provide effective cooling for large industrial areas, making them first choice for many manufacturing plants, warehouses, and commercial premises.

- Units greater than 20,000 CFM are used in Asia Pacific regions and North America, specifically for large-scale industrial processes, such as those involving extreme temperature conditions, continuous operations, and energy-efficient cooling needs.

- Various manufacturing plants in important regions continue to use high-capacity and energy-efficient air coolers to ensure optimal performance, machine protection, and comfort for employees in various tier-1 and tier-2 industrial areas with rapid industrialization and production activities.

So, The Industrial Air Cooler Market entails cooling equipment that maintains temperature and air circulation for industries, commercial institutions, and manufacturing enterprises. The equipment range incorporates evaporative air coolers, direct cool air coolers, indirect cool air coolers, and hybrid air coolers. They provide services for small-scale and high-capacity industries. Factors such as increasing industrial production and infrastructure development boost market development in various regional territories. Organizations look to add value to their businesses through energy-efficient and environmentally friendly coolers. The cooling systems have a range of capacities below 5,000 CFM and above 20,000 CFM to cater to various needs of manufacturing units, warehouses, food and beverage enterprises, chemical and pharmaceutical plants, electricity production facilities, and commercial complexes. The expansion of the market results from technological updates and modernization of these coolers with automated features and a need for cost reduction and environmental concerns. The Industrial Air Cooler Market finds high acceptance in regions facing extreme climate conditions and high industrialization counts, requiring cool working environments to be maintained.

Industrial Air Cooler Market Segmentation

By Type

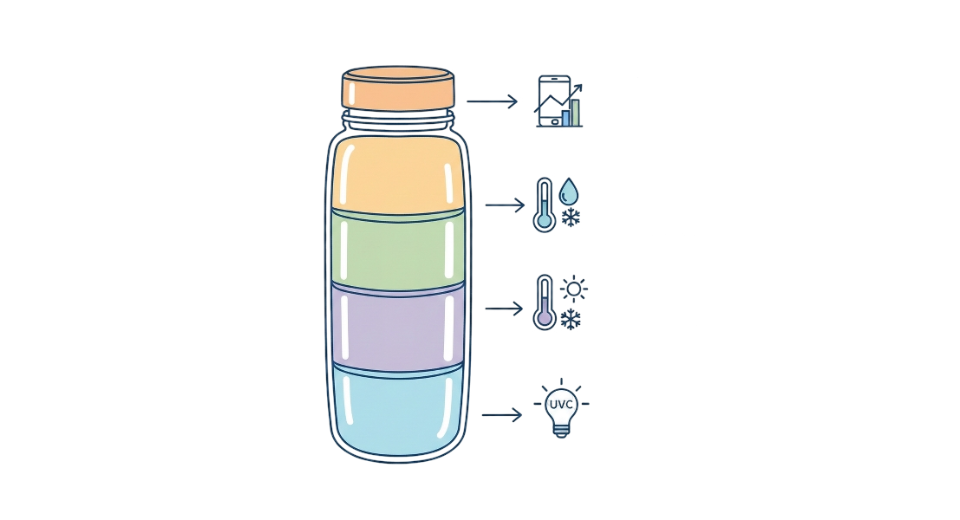

- Evaporative Air Cooler

Evaporative cooling systems are prominently found in hot and dry weather zones, including the Middle East & Africa and Asia Pacific regions. These cooling solutions are energy efficient and eco-friendly, making them the most demanded in large warehouse and industrial areas.

- Direct Air Cooler

Direct air coolers offer high cooling rates through the circulation of conditioned air directly into the area. A high rate of adoptions is recorded in North America and Europe for manufacturing and commercial spaces, where temperature control is a key driver to optimize operational productivity.

- Indirect Air Cooler

Indirect air coolers are used in industries where the humidity level is a critical parameter, such as the food & beverage and chemical industry sectors. The regions of maximum use of indirect air coolers are Europe and America, as they have stricter regulatory requirements for HVAC systems.

- Hybrid Air Cooler

Hybrid air coolers provide the benefits of both evaporative cooling and direct cooling and are best suited for areas with fluctuating climate conditions, such as Asia Pacific and South America. These coolers provide operation flexibility, making them most suitable for large industries with fluctuating production demands.

To learn more about this report, Download Free Sample Report

By Cooling Capacity

- Below 5,000 CFM

Units with less than 5,000 CFM are used by small-scale manufacturing establishments and commercial areas in Europe and North America. The compact design ensures effective usage as a cool air solution without extensive infrastructural changes.

- 5,000–10,000 CFM

Mid-capacity coolers cater to medium-sized warehouses and industrial facilities in Asia Pacific and South America. These units provide optimal balances of consumption and performance. They are effective in meeting moderate cooling requirements while maintaining cost efficiency.

- 10,000–20,000 CFM

10,000 Large industrial operations require units of 10,000 to 20,000 CFM. Europe and Asia Pacific require the same range as North America, to ensure uniform air circulation in vast production and storage units.

- Above 20,000 CFM

Such capacity units are required for heavy industrial, power, and commercial establishments in the Middle East & Africa and Indian markets, particularly due to their strong performance during extreme heat.

By End-Use Industry

- Manufacturing Plants

Air coolers in industries play major roles in keeping temperatures at optimal conditions. This improves safety and boosts efficiency in the industries. There is high demand for air coolers in Asia Pacific and North America due to extensive industrialization activities and large volumes of production.

- Warehouses & Storage Facilities

Warehouses need air coolers to store goods and avoid spoilage. In Europe and South America, air coolers have become common, especially because these systems ensure efficient ventilation systems to prevent temperature-related losses and operational losses.

- Food & Beverage Industry

Temperature-sensitive applications in food processing, as well as beverages, generate demand in food and beverage manufacturing for accurate air cooling solutions. Indirect coolers and hybrids dominate Europe, North America, and Asia Pacific due to stringent hygiene requirements.

- Chemical & Pharmaceutical Industry

In chemical and pharmaceutical industries, cooling systems are required to avoid process disruptions as well as product stability. In terms of adoption, North America and Europe are leaders, along with regulatory compliance and energy-efficient technologies.

- Power Plants

High capacity air coolers need to be installed in the power generation units to ensure efficiency and cooling of the units to avoid overheating. These markets include the Middle East & Africa region, India, and North America.

- Commercial Buildings

Air coolers in commercial buildings offer efficient air conditioning solutions. Europe and North America emphasize air coolers, including hybrid as well as evaporative solutions.

Regional Insights

North America, comprising the United States, Canada, and Mexico, sees high adoption in various industrial and commercial sectors owing to strict standards pertaining to energy efficiency and strong manufacturing sectors. Europe includes Germany, the UK, France, Spain, Italy, and the rest of Europe, which focuses on the adoption of cooling systems compatible with regulatory requirements, majorly for chemical, pharmaceutical, and food processing units. The Asia Pacific region consists of China, India, Japan, South Korea, Australia & New Zealand, and the rest of the region. In this region, heavy industrialization and greater urbanization result in higher market growth and the adoption rate of large-capacity evaporative as well as hybrid systems. South America includes Brazil, Argentina, and the rest of the continent, where gradual adoption across warehouses and manufacturing plants due to economic considerations is continuing. The Middle East & Africa involve Saudi Arabia, UAE, South Africa, and the rest of the region. It relies on high-capacity air coolers that have gained significance as a result of extreme temperatures. There is also a growing impetus toward energy-efficient and hybrid ventilation systems aimed at improving the economic feasibility of industrial operations and power generation.

To learn more about this report, Download Free Sample Report

Recent Development News

- May 2025, Symphony also reported a record revenue of over ₹1,500 crore in FY25, together with the highest March quarter performance, attributable in part to the success of the company in launching 17 new air cooler products, catering to various market segments.

(Source:https://symphonylimited.com/wpcontent/uploads/2025/05/Media_Release_07_05_2025.pdf)

- In December 2024, The company revealed the rollout and production plan of its 17 new air cooler models with record off-season advance orders, indicating market demand and realization of revenues.

(Source:https://symphonylimited.com/wpcontent/uploads/2024/12/Air_cooler_23_12_2024.pdf)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 6.20 Billion |

|

Market size value in 2026 |

USD 6.80 Billion |

|

Revenue forecast in 2033 |

USD 11.90 Billion |

|

Growth rate |

CAGR of 8.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Symphony Limited, Sky Air Cooler, Brize, Evapoler, LANFEST, Fujian Jinghui Environmental Technology Co., Ltd., Seeley International Pty Ltd, Luma Comfort Corporation, Midea Group, Daikin Industries Ltd., Panasonic Corporation, Champion Cooler, Marut Air, Sterling Thermal Technology Limited, and Ram Coolers |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Evaporative Air Cooler, Direct Air Cooler, Indirect Air Cooler, Hybrid Air Cooler), By Cooling Capacity (Below 5,000 CFM, 5,000–10,000 CFM, 10,000–20,000 CFM, Above 20,000 CFM) and By End User (Manufacturing Plants, Warehouses & Storage Facilities, Food & Beverage Industry, Chemical & Pharmaceutical Industry, Power Plants, Commercial Buildings) |

Key Industrial Air Cooler Company Insights

SinterCast AB is a leading innovator in the CG Iron market and includes proprietary CGI production technology with process control systems that ensure high‑material quality consistency. Its advanced thermal analysis solutions are widely adopted among foundries globally, which creates a competitive moat and propels the adoption of CGI worldwide, especially for automotive and industrial applications. SinterCast's strategic partnerships with major OEMs and emphasis on material performance optimization elevate fuel efficiency and structural durability in engine components. Its continuous investment in R&D underpins technological leadership, with expansions into emerging markets where lightweight, high‑strength materials are increasingly prioritized.

Key Industrial Air Cooler Companies:

- Symphony Limited

- Sky Air Cooler

- Brize

- Evapoler

- LANFEST

- Fujian Jinghui Environmental Technology Co., Ltd.

- Seeley International Pty Ltd

- Luma Comfort Corporation

- Midea Group

- Daikin Industries Ltd.

- Panasonic Corporation

- Champion Cooler

- Marut Air

- Sterling Thermal Technology Limited

- Ram Coolers

Global Industrial Air Cooler Market Report Segmentation

By Type

- Evaporative Air Cooler

- Direct Air Cooler

- Indirect Air Cooler

- Hybrid Air Cooler

By Cooling Capacity

- Below 5,000 CFM

- 5,000–10,000 CFM

- 10,000–20,000 CFM

- Above 20,000 CFM

By End-Use Industry

- Manufacturing Plants

- Warehouses & Storage Facilities

- Food & Beverage Industry

- Chemical & Pharmaceutical Industry

- Power Plants

- Commercial Buildings

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636