Market Summary

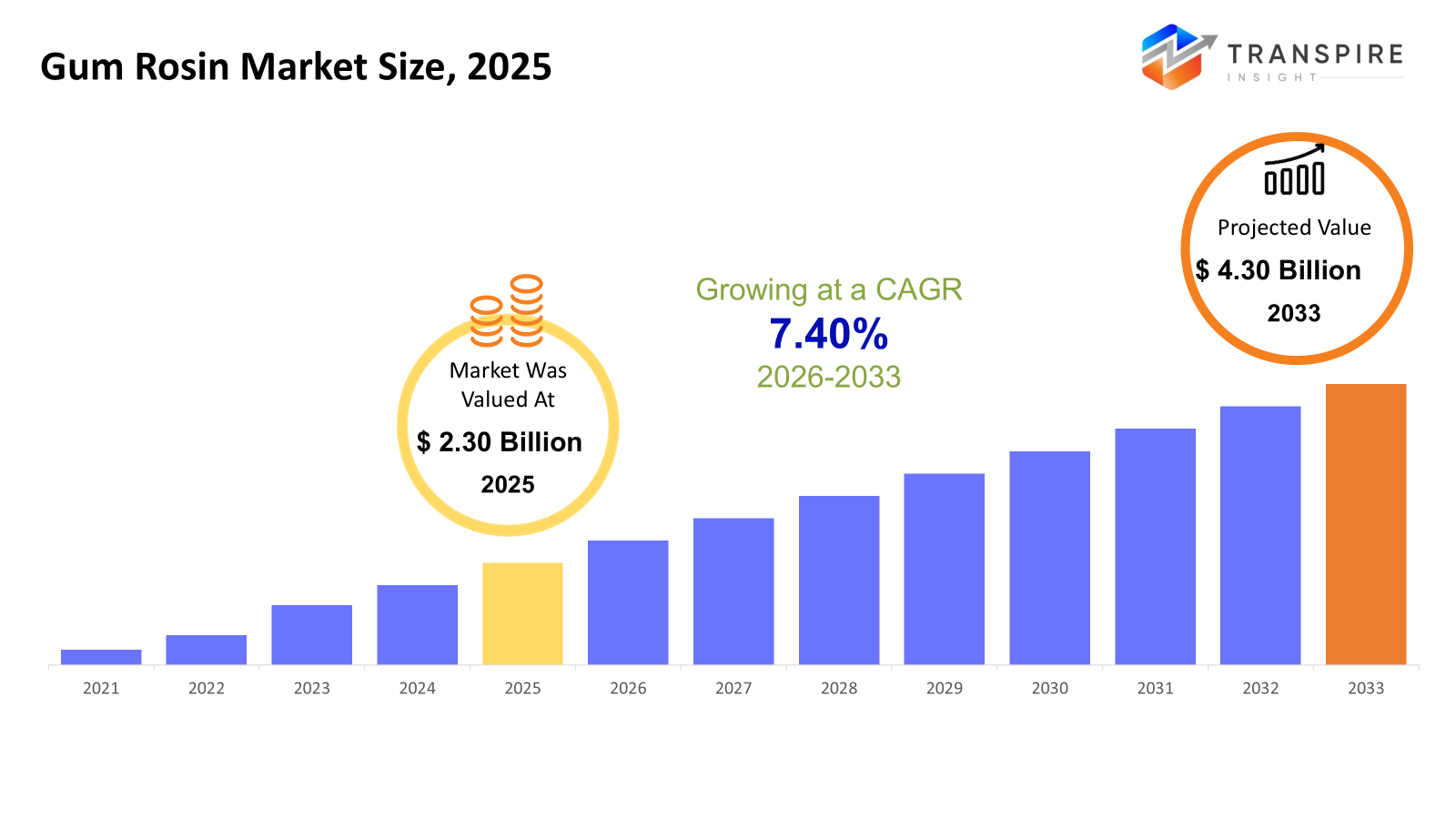

The global Gum Rosin market size was valued at USD 2.30 billion in 2025 and is projected to reach USD 4.30 billion by 2033, growing at a CAGR of 7.40% from 2026 to 2033. Gum rosin finds steady use in adhesives, packaging, rubber, and printing inks, which keeps its market moving forward. Instead of synthetics, more industries lean toward plant-derived inputs, giving the sector an extra push. Construction work picks up speed; so does output in everyday packaged goods and cars, pulling demand higher worldwide. Activity hums louder in Asia Pacific factories, while logistics networks tighten their flow, quietly helping things grow. Though quiet, these shifts add up over time.

Market Size & Forecast

- 2025 Market Size: USD 2.30 Billion

- 2033 Projected Market Size: USD 4.30 Billion

- CAGR (2026-2033): 7.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 45% in 2026. Driving ahead, North America sees steady market gains due to solid demand in packaging, alongside building and vehicle sectors. Top-tier rosin types get most attention there. Growth holds firm where performance matters most.

- Across the region, the United States tops usage. A long-standing presence in adhesives and packaging drives demand here. Meanwhile, more companies are turning to plant-derived inputs. This shift adds further momentum. Growth continues as industries adapt to newer material sources.

- China and India keep pushing growth across the Asia Pacific through massive output jumps. Manufacturing space keeps getting bigger here, too. Packaging needs are climbing fast, thanks to wider consumer markets. Rising FMCG demand adds fuel, making this area move more quickly than others.

- WW Grade shares approximately 48% in 2026. Top-tier quality stands out because of how pure it is, plus a pale shade that works well. This one fits best when used for high-end glues, printing fluids, or surface finishes. It's clean makeup that drives what people want most.

- That comes from gum rosin. It shows up most where things need to hold fast, boxes sealed, walls joined, tags stuck on. Building jobs lean on it just as much as shipping labels do. Not every binder uses it, but most rely heavily on that grip. Wrap it up: if it sticks today, rosins likely helped.

- Big makers often pick direct sales when they want steady quality, big orders, and reliable deliveries. Fewer middle steps mean more control over timing. Some choose it just to keep things running smoothly without delays. Long deals help lock in stable terms, avoiding sudden changes later. This route suits those focused on predictability above all else.

- Packaging takes the lead among end-users, fueled by growing needs for flexible wraps, labels, sturdy boxes. A shift in how goods are shipped and displayed pushes this segment ahead. Not toys or electronics, but what holds them gains fastest traction. Demand climbs quietly, yet steadily, shaped by daily consumer habits. What gets delivered to doorsteps shapes this trend more than any factory output.

Not far off the coast of sustainability goals, gum rosin finds purpose not through hype, but function. From pine sap it comes, slow-dripped and processed into something useful. Because it sticks well, holds fast, and forms thin layers, factories use it where grip matters most. Instead of relying on oil-derived synthetics, some makers turn here first. Blended without fuss into various mixes, it stays relevant no matter if the economy slows or surges. Even in older industries, plus newer ones catching up, orders keep coming.

Starting strong, adhesives take up most of the gum rosin market, especially seen in boxes, stickers, and building jobs. Due to more online shopping, plus a move to bendable wraps, the need stays steady. Paper wrappers getting used more often helps too. Printing colors rely on it just as much as tire mixes do. Viscosity climbs, stretch improves, and machines run smoother, all because of this resin. Ends right there.

Nowhere else do forests feed industry as they do across the Asia Pacific, where trees pour sap into factories just as fast as products roll off assembly lines. Pines stretch from hillsides into warehouses, feeding world markets even as local needs climb, boxes seal tighter, goods move faster, and cars assemble with stickier parts. Across oceans, North America holds steady; old mills keep grinding, new ideas about green materials taking root slowly. Same rhythm, quiet but sure, workshops choosing resins that last, built on decades of making things work without fanfare.

Now, shaping things further are shifting environmental rules along with a stronger push toward cleaner chemical practices. Quality upgrades matter more every day, so makers adjust how they process and design products to fit precise needs. Driven by demand for sustainable materials and better results, one thing remains clear: gum rosin adapts easily, standing out without fuss.

Gum Rosin Market Segmentation

By Grade

- WW Grade

Fine stuff, top shelf when it comes to clean looks and pure form - common pick for high-end glues and surface finishes. Light tone matters here, sets it apart without trying too hard.

- WG Grade

A step down in transparency, yet still top-tier performance. This version works well where color flow matters more than crystal-clear looks. Think printing pastes or flexible coatings instead of glass-like finishes. Clarity takes a back seat here without losing strength. Perfect when smooth blending beats pure shine. Not meant for windows, but great for things that bend. Slight haze does not slow it down in busy industrial uses.

- N Grade

A step above basic, N Grade shows up often in making rubber products, along with everyday factory tasks. Its role fits right in the middle where performance meets practicality across many settings.

- M Grade

M Grade suits soaps, detergents, or tight-budget uses where less vibrant color works better. Yet duller tones often fit these needs just fine.

- K Grade

Some K grade comes out darker, less refined, and often end up in large-scale industrial work instead of fine uses. This kind does not aim for purity, but fits better where exact quality matters less. Think factories, chemical mixes, places needing volume over precision.

To learn more about this report, Download Free Sample Report

By Application

- Adhesive & Sealants

Sticky stuff gets a boost when it comes to holding power, tack, and grip improve in both pressure-activated and heat-applied glues. What sticks now holds tighter, thanks to better cling and stronger links between layers. Performance shifts up a notch without changing how it is used. Not just more sticky, but more sure. Even under stress, connections stay firm.

- Printing Inks

Pouring smoothly, printing inks gain better thickness control while shine rises naturally. Pigments spread more evenly throughout the mix thanks to refined flow behavior. A steady finish appears without streaks when layers settle just right.

- Rubber Compounding

Softness comes through during rubber mixing, helping tires stick together better when made. Processing gets easier because the material holds on more tightly than before.

- Paint & Coatings

Pigments stick better when mixed into coatings this helps surfaces last longer under stress. Film builds smoothly because of how these materials link together during drying.

- Paper Sizing

Waterproofing in paper comes from sizing. This treatment also boosts how well the sheet holds up on the outside. Strength matters during production runs. Resistance to moisture helps keep quality steady through different stages.

- Soaps & Detergents

Bubbles rise when this stuff hits water, cleaning surfaces by breaking down grease. It slips into soaps during making, helping lift dirt away without harsh rubbing.

- Others

Folks also use it for medicines, materials that block electricity, and niche chemical products.

By Distribution Channel

- Direct Sales

Big factories often choose direct sales when they need steady deliveries of special material types.

- Distributors & Traders

Folks who move goods around help smaller shops get what they need without long-term deals. Middle players open doors to more places willing to buy. Smaller orders become possible when these links step in. Access grows easier when stock flows through extra hands.

By End-Users

- Packaging

What wraps things plays a big role because it shows up everywhere in glues and surface covers. It pushes the need higher just by being so common in those areas.

- Construction

From rooftops to floors, it sticks things together where moisture might cause trouble. Sealants hold gaps closed in walls while coatings guard surfaces against wear. Adhesives keep floor tiles fixed without shifting over time.

- Automotive

That comes from chemistry shaped by automotive needs. Tires hold air thanks to layered rubber built with precision. Coatings that resist scratches start in labs tuned to car demands. Underhold seals survive heat because materials adapt relentlessly.

- FMCG

That is where it fits. Print on packages. Works there too. Labels that stay put.

- Textiles

Fibers get treated during manufacturing to improve texture plus strength. Coatings applied help the fabric handle better in production.

- Paper & Pulp

Fibers meet chemistry when making paper, and sizing agents adjust absorbency. Coating solutions change how surfaces feel. Each step shapes performance without altering core structure.

- Chemicals

From time to time, it shows up in making resins, then moves into creating esters. Specialty chemicals often rely on this substance too, though quietly. Not loud about it, just part of how things get built behind the scenes.

- Others

- Beyond that sit electronics, alongside medicines, along with niche manufacturing needs.

Regional Insights

With vast pine forests and factories spread wide, the Asia Pacific leads the gum rosin scene. China, India, along with several Southeast Asian countries, produce large amounts while using much of it themselves due to growth in how goods get packaged, daily-use products made, buildings built, and vehicles assembled. Low production expenses help too, alongside rising shipments abroad, pushing the area further ahead in world markets.

With strong demand from makers of glue, ink, tires, and paper, North America takes up much of the gum rosin space. Leading that charge is the United States, where building projects and box-making stay solid year after year. A growing lean toward plant-sourced inputs adds another push forward. Rules favoring greener goods also help keep things steady on the ground.

Steady need across Europe comes from long-established industries plus tough eco rules that favor renewables. Driven by a push for cleaner production methods, factories there are increasingly turning to bio-based inputs for paints, glues, and niche chemicals. Elsewhere, parts of Latin America, along with areas in the Middle East and Africa, play smaller roles, with their markets inching up as building projects multiply and industry spreads.

To learn more about this report, Download Free Sample Report

Recent Development News

- March 12, 2025 – Gum Rosin increases its use in medical and pharmaceutical applications.

(Source: https://www.mdpi.com/1996-1944/18/10/2266

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.30 Billion |

|

Market size value in 2026 |

USD 2.60 Billion |

|

Revenue forecast in 2033 |

USD 4.30 Billion |

|

Growth rate |

CAGR of 7.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Eastman Chemical Company, Himachal Terpene Products Pvt Ltd., Gravity Chemicals, Acmresinas, SVD Pinechem, OttoKemi, Guangzhou Ecopower New Material Co., Ltd., Pino Pine, Forchem Oy, Perstorp Holding AB, Nisource Inc., Intercontinental Chemicals Ltd., Qingdao Tongchun Chemical Co., Ltd., Changzhou Resinoid Chemical Co., Ltd., Huzhou Chenguang Chemical Co., Ltd., Shanghai Hua Xin Chemical Co., Ltd., Zeachem, and Kumiai Chemical Industry Co., Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

WW Grade, WG Grade, N Grade, M Grade, K Grade), By Application (Adhesives & Sealants, Printing Inks, Rubber Compounding, Paint & Coatings, Paper Sizing, Soaps & Detergent, Others), By Distribution Channel (Direct Sales, Distributors & Traders), By End-Users (Packaging, Construction, Automotive, FMCG, Textiles, Paper & Pulp, Chemicals, Others |

Key Gum Rosin Company Insights

One key name in the gum rosin space is Eastman Chemical Company, known for its wide range of rosin-derived and plant-sourced specialty substances. Its main spotlight lands on uses that demand strength, think glues, surface finishes, rubber goods, ink systems - with an eye fixed firmly on uniformity and excellence. Behind the scenes, modern production methods team up with deep research know-how, shaping tailored versions of rosin chemistry. Across continents, including North America, Europe, and parts of Asia, factories and delivery networks keep operations moving. Sustainability threads through much of what they offer, pushing alternatives rooted in natural raw inputs.

Key Gum Rosin Companies:

- Eastman Chemical Company

- Himachal Terpene Products Pvt Ltd.

- Gravity Chemicals

- ACM resinas

- SVD Pinechem

- OttoKemi

- Guangzhou Ecopower New Material Co., Ltd.

- Pino Pine

- Forchem Oy

- Perstorp Holding AB

- Nisource Inc.

- Intercontinental Chemicals Ltd.

- Qingdao Tongchun Chemical Co Ltd.

- Changzhou Resinoid Chemical Co., Ltd.

- Huzhou Chenguang Chemical Co., Ltd.

- Shanghai Hua Xin Chemical Co., Ltd.

- Zeachem

- Kumiai Chemical Industry Co., Ltd.

Global Gum Rosin Market Report Segmentation

By Grade

- WW Grade

- WG Grade

- N Grade

- M Grade

- K Grade

By Application

- Adhesives & Sealants

- Printing Inks

- Rubber Compounding

- Paint & Coatings

- Paper Sizing

- Soaps & Detergent

- Others

By Distribution Channel

- Direct Sales

- Distributors & Traders

By End-Users

- Packaging

- Construction

- Automotive

- FMCG

- Textiles

- Paper & Pulp

- Chemicals

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions

Find quick answers to common questions.

The approximate Gum Rosin Market size for the market will be USD 4.30 billion in 2033.

Key segments for the Gum Rosin Market are WW Grade, WG Grade, N Grade, M Grade, K Grade), By Application (Adhesives & Sealants, Printing Inks, Rubber Compounding, Paint & Coatings, Paper Sizing, Soaps & Detergent, Others), By Distribution Channel (Direct Sales, Distributors & Traders), By End-Users (Packaging, Construction, Automotive, FMCG, Textiles, Paper & Pulp, Chemicals, Others.

Major Gum Rosin Market players are Eastman Chemical Company, Himachal Terpene Products Pvt Ltd., Gravity Chemicals, Acmresinas, SVD Pinechem, and OttoKemi.

The North America region is leading the Gum Rosin Market.

The Gum Rosin Market CAGR is 7.40%.

- Eastman Chemical Company

- Himachal Terpene Products Pvt Ltd.

- Gravity Chemicals

- Acmresinas

- SVD Pinechem

- OttoKemi

- Guangzhou Ecopower New Material Co., Ltd.

- Pino Pine

- Forchem Oy

- Perstorp Holding AB

- Nisource Inc.

- Intercontinental Chemicals Ltd.

- Qingdao Tongchun Chemical Co Ltd.

- Changzhou Resinoid Chemical Co., Ltd.

- Huzhou Chenguang Chemical Co., Ltd.

- Shanghai Hua Xin Chemical Co., Ltd.

- Zeachem

- Kumiai Chemical Industry Co., Ltd.

Recently Published Reports

-

Dec 2024

Healthcare Polymer Packaging Market

Healthcare Polymer Packaging Market Size, Share & Analysis Report By Packaging Type (Syringes, IV Bottles and Pouches, Clamshells, Blisters, Bottles & Jars, Containers, Tubes, IV Parental Packaging, Others), By Type (Regulated, Non-regulated), By Polymer Type (LDPE (Low-Density Polyethylene), HDPE (High-Density Polyethylene), Homo-polymer (Homo), Random Copolymer (Random), Block Copolymer (Block), PET, Polystyrene, Polyvinyl Chloride, Polyamide/EVOH, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

Hydrophilic Tape (Waterstop) Market

Hydrophilic Tape (Waterstop) Market Size, Share & Analysis Report By Type (Bentonite-Based Hydrophilic Tape, Rubber-Based Hydrophilic Tape), By Application (Residential Buildings, Commercial Buildings, Infrastructure Projects), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

Metalens Market

Metalens Market Size, Share & Analysis Report By Type (Visible Light Metalens, and Infrared Metalens), By Application (Consumer Electronics, Automotive Electronics, Industrial, Medical, and Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

PBT Resin Market

PBT Resin Market Size, Share & Analysis Report By Type (Reinforced PBT Resin, Unreinforced PBT Resin), By Processing Method (Injection Molding, Extrusion, Blow Molding, Others), By End-User (Automotive, Electrical & Electronics, Consumer Appliances, Industrial Machinery, Medical Devices, Packaging, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031