Market Summary

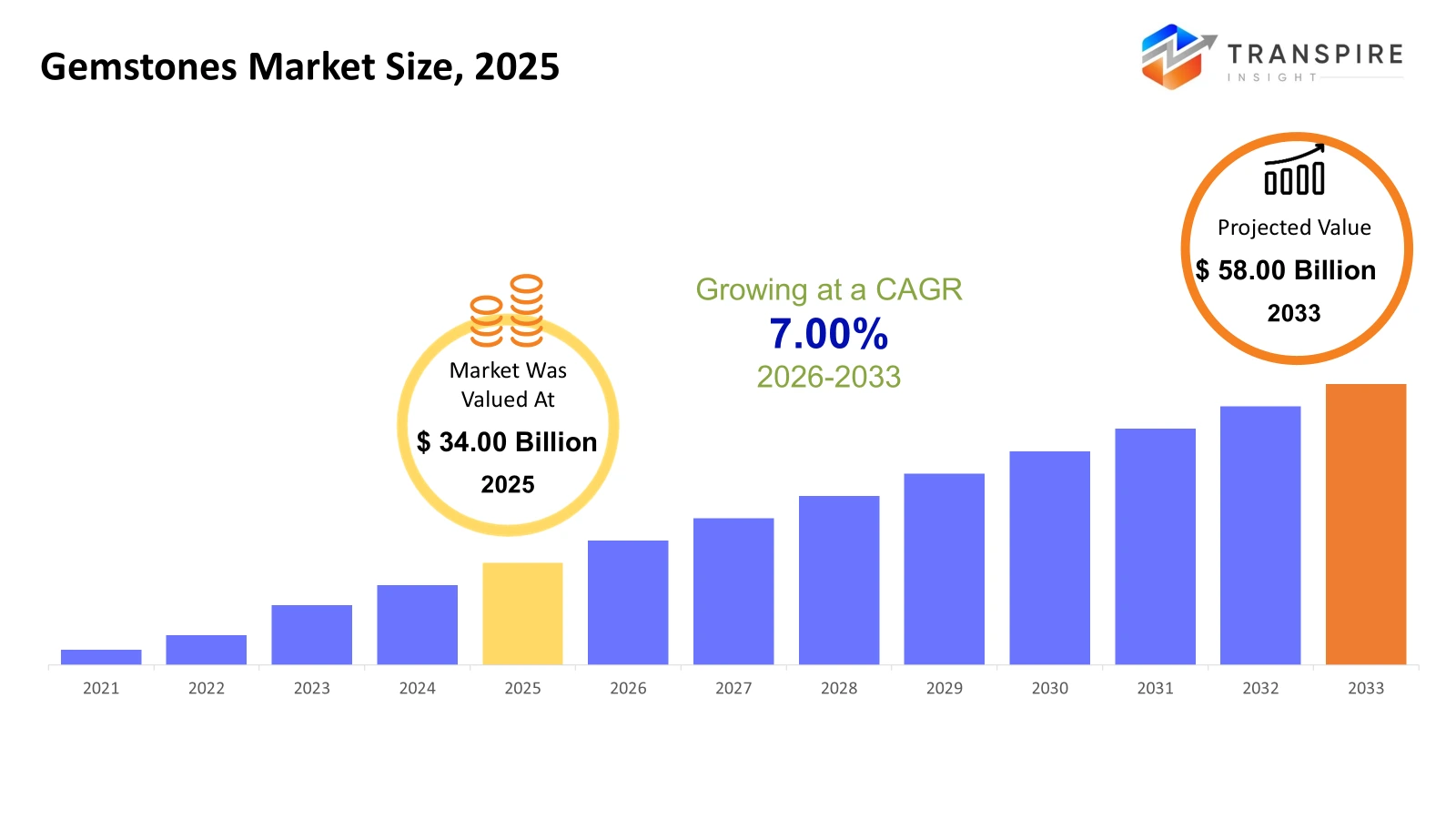

The global Gemstones market size was valued at USD 34.00 billion in 2025 and is projected to reach USD 58.00 billion by 2033, growing at a CAGR of 7.00% from 2026 to 2033. Increasing disposable incomes, growing middle-class populations, and rising luxury spending are boosting gemstone consumption across developed and emerging markets, thus supporting steady revenue growth and long-term market CAGR momentum.

Market Size & Forecast

- 2025 Market Size: USD 34.00 Billion

- 2033 Projected Market Size: USD 58.00 Billion

- CAGR (2026-2033): 7.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North America market reflects a stable demand pattern fueled by high-end jewelry demand, strong bridal culture, and widespread adoption of certified and lab-grown gemstones, thanks to sophisticated retail infrastructure and omnichannel retailing, which has improved consumer accessibility and repeat business.

- The United States market is the key revenue contributor in the region, led by the presence of established luxury brands, high penetration of online gemstone sales, and a growing trend towards the adoption of ethically sourced and traceable gemstones, with lab-grown gemstone demand surging in the younger consumer segments.

- The Asia Pacific market is the fastest-growing market, fueled by the cultural affinity for gemstone jewelry in China and India, growing disposable income, wedding season demand, and increasing penetration of organized retail and jewelry chain stores.

- Precious gemstones are the key revenue contributors, led by their rarity, established investment status, and strong bridal demand, especially in the high-end jewelry segment, with price resilience and global certification standards ensuring long-term positioning.

- Natural gemstones retain better value realization on account of authenticity, natural rarity, and effective branding, although supply constraints and mining regulations affect price stability in global trade channels.

- Jewelry retains the leading application segment on account of fashion trends, gifting practices, and the growing e-commerce platform, with luxury and bridal segments contributing substantially to revenue concentration in organized retail channels.

- Offline retail retains a prominent share in high-value transactions, with consumers preferring offline verification and certification assurance, although online retailing grows with virtual try-on assistance and transparent pricing.

So, The gemstones market includes the mining, processing, trading, and retailing of precious and semi-precious stones used for jewelry, industrial, decorative, and cultural purposes. The market structure combines mining firms, cutting and polishing facilities, certification organizations, trading firms, and branded retailing firms in a globally networked value chain. Demand factors are driven mainly by luxury consumption patterns, cultural practices surrounding weddings and gift-giving, and fashion trends. The growing concern for ethical procurement, responsible mining, and traceability has transformed the procurement process, and certification has become a key factor in sustaining price points and consumer confidence. Innovation in the production of synthetic gems has brought forth competitive pricing models and sustainability benefits, making them more accessible to the middle income classes. On the other hand, industrial uses, especially for industrial-grade diamonds, provide stable volume sales tied to manufacturing and construction industries, ensuring a diversified revenue stream within the overall market system..

Gemstones Market Segmentation

By Type

- Precious Gemstones

Precious gemstones like diamond, ruby, sapphire, and emerald contribute largely to the overall revenue because of their rarity, hardness, and recognized investment potential. The demand is largely driven by luxury jewelry consumption, especially in developed countries. Market price fluctuations are affected by mining production, quality standards, and brand positioning.

- Semi-Precious Gemstones

Semi-precious gemstones like amethyst, topaz, garnet, and turquoise cater to the middle and fashion jewelry markets. Market development is aided by design and innovation, affordability, and the increasing trend for personalized accessories. Market reach in developing countries is improved by easy accessibility and color variations.

By Product Type

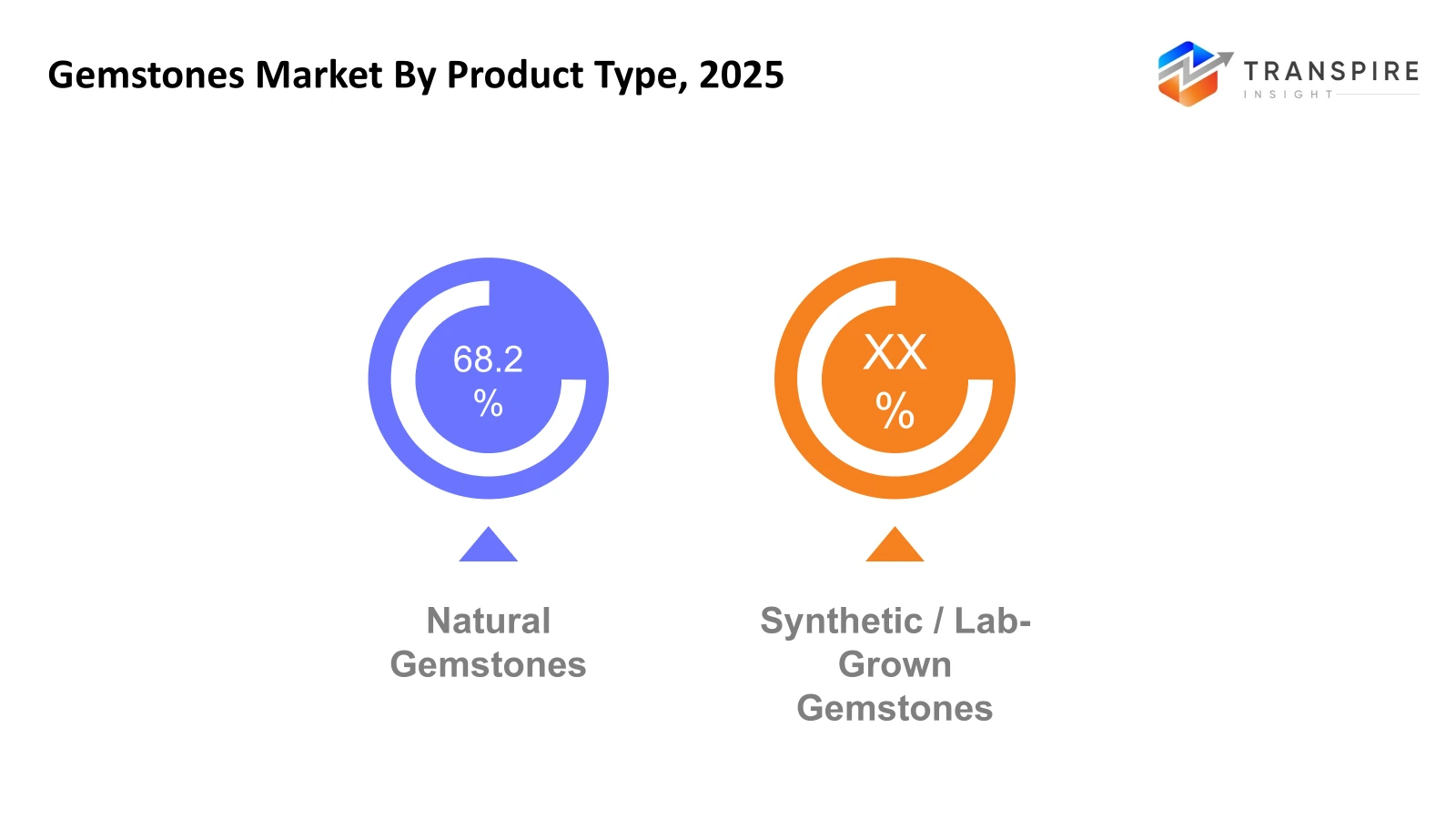

- Natural Gemstones

Natural gemstones lead the high-end market segments because of their natural origin and perceived authenticity. Traceability, origin, and certification by reputable gemological organizations are becoming key factors in purchase decisions. Natural gemstones are less affected by supply chain issues and mining laws.

- Synthetic / Lab-Grown Gemstones

Lab-grown gemstones are becoming popular because of their cost-effectiveness, sustainability strategy, and advancements in technology. They provide a similar appearance and composition to natural gemstones at a relatively lower price point.

To learn more about this report, Download Free Sample Report

By Application

- Jewelry

The jewelry industry is the largest application area, driven by cultural practices, gift giving, and fashion trends. Wedding and high-end jewelry lines are major contributors to the high-end market. Marketing and online retailing are improving consumer reach worldwide.

- Industrial Use

Industrial applications involve gemstones like industrial diamonds for cutting, drilling, and polishing equipment. The demand is directly related to the manufacturing, construction, and automotive industries. Advances in the production of synthetic gemstones improve cost competitiveness in this market.

- Decorative & Collectibles

Decorative gemstones are used in artworks, home decor, and collectibles. Market development is driven by trends and increasing consumer spending. Limited edition and unique gemstones are often sold at a premium in specialized markets.

- Astrology & Healing

The astrology and healing markets are relatively stable, especially in markets with strong cultural influences. Consumer preference is driven by cultural practices and alternative healing trends. Authenticity and certification are essential to maintain credibility in this market.

By Distribution Channel

- Offline Retail

The offline retail sector, encompassing specialty jewelry stores and branded boutiques, continues to be a major player in high-value transactions. Consumers are drawn to the offline retail channel for authenticity and quality checks. Experiential retail and luxury brands are a testament to the offline retail channel’s resilience.

- Online Retail

The online retail sector is growing at a rapid pace, thanks to digital marketing, virtual try-on technology, and accessibility. Price transparency and product assortment improve consumer engagement. Trust, certification, and return policies continue to be important success factors.

Regional Insights

North America, consisting of the United States, Canada, and Mexico, is a mature consumption-driven market with the United States as the Tier 1 revenue generator. Canada and Mexico are Tier 2 markets with increasing organized retailing and trade integration across borders. Europe, consisting of Germany, United Kingdom, France, Spain, Italy, and Rest of Europe, is characterized by strong Tier 1 luxury consumption in Germany, United Kingdom, France, and Italy, with Spain and the rest of Europe as Tier 2 markets driven by traditional craftsmanship and sustainable regulatory paradigms. Asia Pacific includes Japan, China, Australia & New Zealand, South Korea, India, and Rest of Asia Pacific. China and India are Tier 1 high-volume growth engines, while Japan, South Korea, and Australia & New Zealand are Tier 2 premium markets with organized retail expansion. South America consists of Brazil, Argentina, and Rest of South America, with Brazil being a Tier 1 producer and consumer hub backed by domestic gemstone resources. Argentina and other surrounding countries constitute Tier 2 markets that are driven by economic trends and export shipments.

Middle East & Africa consists of Saudi Arabia, United Arab Emirates, South Africa, and Rest of the Middle East & Africa. Saudi Arabia and the United Arab Emirates are Tier 1 markets driven by luxury consumption, and South Africa is a Tier 1 supply base country, with the rest being Tier 2 emerging markets.

To learn more about this report, Download Free Sample Report

Recent Development News

- May 2025, De Beers Group recently announced that its innovative diamond verification tool “DiamondProof” has been rolled out in selected retail stores as of February 2025. This innovation enables retail partners and consumers to verify the authenticity of natural diamonds in an efficient manner, which is a significant trend in the market towards ethical sourcing.

- In January 2025, Mountain Province Diamonds Inc. issued its formal press release regarding production, sales data, and performance at the Gahcho Kué diamond mine for Q4 2024 and the year. The release focused on volume trends, safety optimization, and average realized prices in the face of industry pressures due to price and changing demand.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 34.00 Billion |

|

Market size value in 2026 |

USD 36.00 Billion |

|

Revenue forecast in 2033 |

USD 58.00 Billion |

|

Growth rate |

CAGR of 7.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

De Beers Group, PJSC ALROSA, Rio Tinto Diamonds, Gemfields Group, Petra Diamonds Limited, Swarovski Group, Tiffany & Co., Chow Tai Fook Jewellery Group Limited, Signet Jewelers, Graff Diamonds, Kiran Gems Private Limited, Fura Gems Inc., KGK Group, Lucara Diamond Corporation, and Botswana Diamonds PLC. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Precious Gemstones, Semi-Precious Gemstones), By Product Type (Natural Gemstones, Synthetic / Lab-Grown Gemstones), By Application (Jewelry, Industrial Use, Decorative & Collectibles, Astrology & Healing) and By Distribution Channel (Offline Retail, Online Retail) |

Key Gemstones Company Insights

De Beers Group continues to be one of the most prominent players in the international gemstone industry, especially in the diamond category, because of its diversified mining assets and supply chain. De Beers Group’s legacy of being a leading diamond producer, along with its efforts to ensure ethical sourcing and the use of technology to ensure traceability, further cements its competitive advantage. De Beers Group has also ventured into the retail jewelry business to tap into the higher margins of the value chain, as a result of consumer demand for certified and ethically sourced gemstones.

Key Gemstones Companies:

- De Beers Group

- PJSC ALROSA

- Rio Tinto Diamonds

- Gemfields Group

- Petra Diamonds Limited

- Swarovski Group

- Tiffany & Co.

- Chow Tai Fook Jewellery Group Limited

- Signet Jewelers

- Graff Diamonds

- Kiran Gems Private Limited

- Fura Gems Inc.

- KGK Group

- Lucara Diamond Corporation

- Botswana Diamonds PLC

Global Gemstones Market Report Segmentation

By Type

- Precious Gemstones

- Semi-Precious Gemstones

By Product Type

- Natural Gemstones

- Synthetic / Lab-Grown Gemstones

By Application

- Jewelry

- Industrial Use

- Decorative & Collectibles

- Astrology & Healing

By Distribution Channel

- Offline Retail

- Online Retail

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636