Market Summary

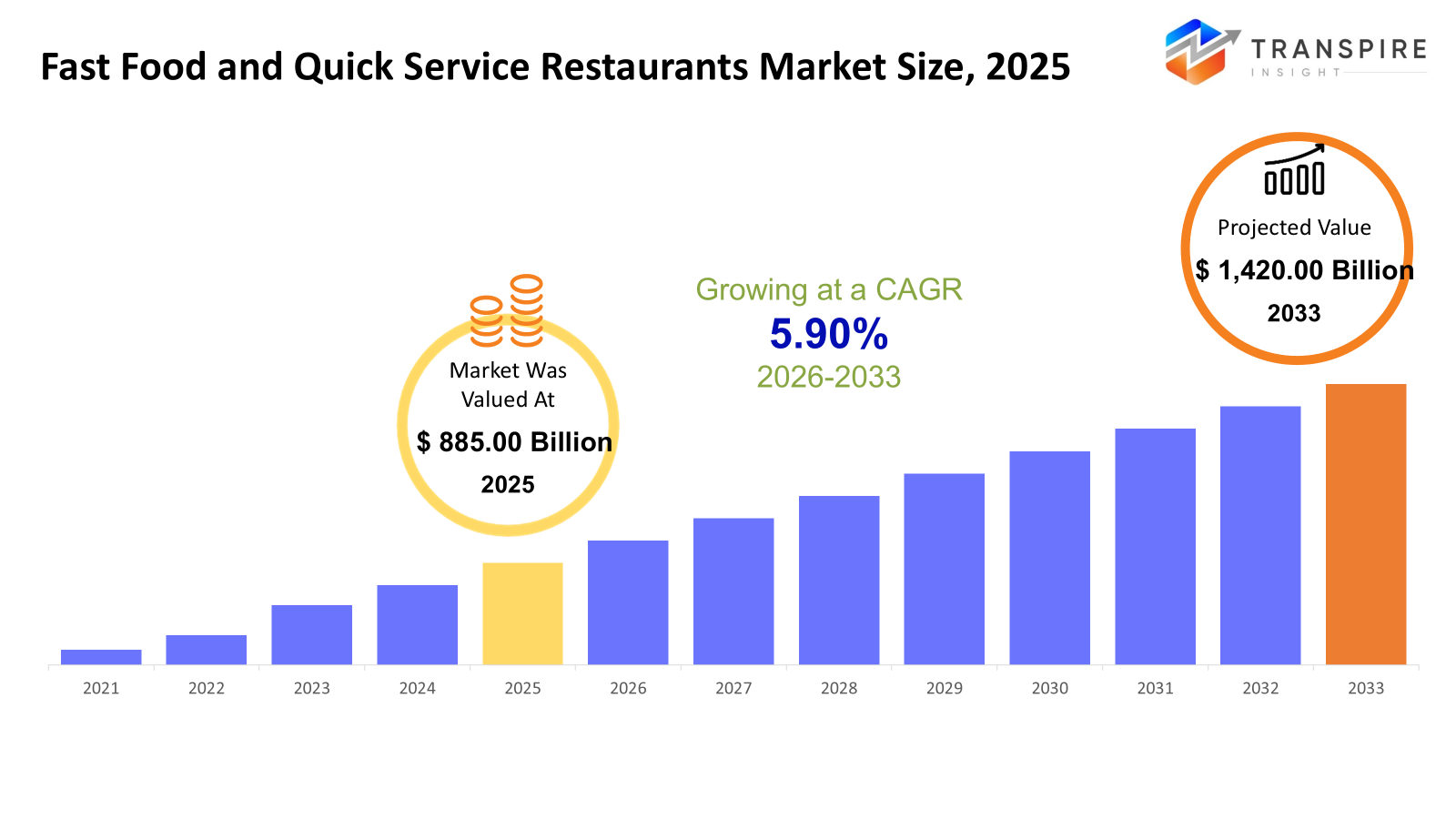

The global Fast Food and Quick Service Restaurant market size was valued at USD 885.00 billion in 2025 and is projected to reach USD 1,420.00 billion by 2033, growing at a CAGR of 5.90% from 2026 to 2033. City life speeds up, so more people grab fast meals on the go. Because schedules get tighter, quick bites fit better than long cooking times. Delivery apps spread fast, making burgers and fries show up at doors within minutes. Cars stay running while drivers pick up orders without leaving their seats. Screens guide choices now instead of paper menus stuck behind glass. New flavors pop up often to keep taste buds curious. Low prices help stretch budgets when eating out happens weekly. Chains open shops where they once never went, reaching new crowds each year. Each change adds up, pushing sales higher bit by bit.

Market Size & Forecast

- 2025 Market Size: USD 885.00 Billion

- 2033 Projected Market Size: USD 1,420.00 Billion

- CAGR (2026-2033): 5.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 35% in 2026. Last on the list but biggest in size, North America leads because quick-service restaurants are everywhere, franchise systems work well there, plus logistics for deliveries have been built out heavily over time.

- Fueled by vast chains, the United States leads across North America. Fast food fills plates often, and here each person eats more than in most places on Earth. That habit runs deep in daily life. Digital tools shape how meals are picked up or delivered.

- Hopping across cities, Asia Pacific surges ahead as growth accelerates. Pushed forward by swelling urban centers, more money in people’s pockets fuels demand. International chains plant flags alongside homegrown quick-service names. Momentum builds not just from global players but also neighborhood favorites stepping up their reach.

- Burgers share approximately 40% in 2026. Burgers lead because they pull in crowds, cost little, yet show up everywhere big fast food names operate.

- Online delivery keeps rising, mobile apps push it forward, while platform aggregators add momentum alongside shifts in how people shop.

- Big names in fast food dominate. Their strength comes from repeat customers who keep coming back. Uniform systems across locations make consistency possible. Growth does not slow down; new spots open constantly around the world.

- Busy workers make up the biggest group of users. Their schedules are tight, so they often go for food that needs little prep. Ready-made options fit well into their routines. Because they value speed, meals that take almost no effort become a natural choice.

Fast food spots now shape a huge chunk of how people eat worldwide, mostly because life moves faster these days. Because more folks live in cities, grabbing something on the run feels normal - no matter if they are in New York or Nairobi. Busy routines push many toward meals that arrive fast, cost little, and require zero planning. Chains keep things predictable: same taste, same setup, whether you walk in or tap on your phone. Locations pop up everywhere in malls, online apps, and even gas stations, making skipping them nearly impossible. Digital orders grow just as quickly as sidewalk storefronts, blending old habits with new tools. What started decades ago as roadside stops now spreads through delivery bags and midnight cravings.

Burgers still lead the pack when it comes to what people buy, with pizza close behind, then chicken items, along with sandwiches and wraps riding high due to loyal fans and steady updates in taste and price. Because tastes shift, quick-service restaurants now mix in fresher picks, meat-free choices, and even local twists that pull in more types of customers. Instead of sticking to old routines, these spots lean on short-run specials, meal bundles, and smart pricing to keep folks coming back, pushing numbers up without drawing too much attention.

One reason markets spread fast is new ways to serve people, like getting food online or staying in your car at pickup windows. Mobile apps work together with electronic payments plus outside delivery networks, making it easier to place orders often. Big-name quick-service restaurants lead because they copy their model everywhere, run tight operations, and push into countries far away. Small local places keep finding space by focusing on nearby tastes and fitting into special corners of the scene.

North America leads in market size because people there eat more fast food on average, the quick-service restaurant network is well established, its online systems are advanced much of that strength comes from the United States. Moving ahead, Asia Pacific grows at the quickest pace thanks to cities expanding fast, wages going up slowly, and major global and local fast-food players opening new spots across the area. On another note, Europe, along with Latin America and parts of Africa, plus the Middle East, keeps adding value over time due to shifting tastes among shoppers, travelers visiting in larger numbers each year, and big branded outlets spreading into more neighborhoods.

Fast Food and Quick Service Restaurant Market Segmentation

By Product Type

- Burgers

Burgers, hands down. Their reach stretches far because nearly every corner has one nearby. People just tend to like them simple, filling, and familiar. Spotting a burger on a menu rarely surprises anyone.

- Pizza

Fresh toppings catch attention fast, while quick drop-off keeps people coming back. A favorite shows up hot when time runs short.

- Sandwiches & Wraps

Packed meals rolled up or tucked between bread show up often when folks want something quick yet decent to eat on the move. Choosing them seems tied to ease, carrying without fuss, plus a sense that they are better than heavy dishes.

- Chicken

Bursting onto the scene, chicken wins favor through varied dishes alongside the rising demand for protein-rich meals. Menu flexibility pushes its climb, while shifting tastes help it spread across plates everywhere. Fast growth follows where flavor meets appetite, especially when choices multiply, and eating habits evolve. Protein cravings lift it higher, even as kitchens keep reinventing how it appears on the table.

To learn more about this report, Download Free Sample Report

By Service Type

- Dine-In

Right there at the table, food comes fast. A place where people sit, eat, and then leave. The look, smell, and feel are part of what you remember. Service happens live, moment by moment. What sticks is how it seemed, not just what was served.

- Takeaway

Busy lives push people toward quick meal options. Because of this, eating out is becoming more common. With time tight, ready-made food fits better into daily routines. So restaurants stay full. Convenience shapes how meals get chosen now. That is why delivery services thrive.

- Drive-Thru

Out on busy streets or quieter neighborhoods, drive-thrus show up where people want meals fast. Cars roll up, windows come down, orders move quick no long lines needed.

- Online Delivery

Food shows up quicker now, thanks to apps that handle orders online. A growing number of people choose this way to get meals without stepping into a restaurant.

By Restaurant Type

- Chain QSRs

Familiar names people trust. Their menus stay the same everywhere you go. Across cities, they are always nearby. That kind of presence builds staying power.

- Independent QSR

Some small food spots keep gaining ground, thanks to hometown tastes and unique angles. Their path up is not flashy, just steady, shaped by what sets them apart

By End-Users

- Working Professionals

Busy people who work often want meals that are fast. Those folks usually pick food they can get easily. Getting lunch without waiting matters a lot. Time saves matter when schedules stay full. Convenience wins every time hunger hits midday.

- Students

Young learners keep coming back, drawn in by low prices along with a wide mix of flavors. What matters most is how cheap it feels without losing fun in every bite.

- Families

Folks show up when deals feel fair, especially if everyone eats well together. Portions that stretch far enough.

- Tourists & Travelers

People on trips often stick to meals they know, especially when time is short. Familiar food feels safe during movement. Speed matters just as much as taste. Choices tend to repeat across cities, borders, and even continents. Routine sneaks in, disguised as preference. Comfort hides in predictable flavors. Movement rarely changes eating habits much.

Regional Insights

Fast food thrives across North America, thanks to people spending heavily on meals outside the home. Home to countless burger joints and taco spots, the United States leads with chains found nearly everywhere. Digital menus, app-based orders, and swift deliveries keep things moving quickly here. Brand names stick in minds easily, helped along by franchise systems that spread fast. Canadians eat their share too, pulled in by city living and apps bringing food to doorsteps. Busy routines make grabbing a meal online more common up north.

A big chunk of the world’s quick-service restaurants sits in Europe, with the United Kingdom, Germany, and France out front. Because more people want meals that save time, the sector keeps moving forward, and tourism adds fuel, too. Global burger names spread here, yet homegrown favorites hold their ground just as hard. What folks order shapes what appears on menus: fresh twists pop up when cravings shift toward lighter, cleaner, plant-powered bites.

Fastest gains appear across Asia Pacific, where city growth, higher personal spending power, and swift moves by both worldwide and local fast food operators fuel momentum - especially visible in China, India, and Southeast Asian nations. Instead of trailing far behind, Latin America keeps pace at a steadier rhythm, lifted by swelling middle-income communities. Meanwhile, fresh movement stirs through the Middle East and Africa, sparked not just by more travelers but also by younger demographics and stronger systems serving meals outside homes. Growth surges here, slows there, but overall direction points upward.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 27, 2025 – Vox AI raised $8.7M seed funding to transform drive-thrus and quick service restaurant operations with autonomous voice AI.

- March 17, 2023 – Ipsos launched a new quick service restaurant suite of solutions to power clients' innovation success.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 885.00 Billion |

|

Market size value in 2026 |

USD 950.00 Billion |

|

Revenue forecast in 2033 |

USD 1,420.00 Billion |

|

Growth rate |

CAGR of 5.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

McDonald’s Corporation, Yum! Brands, Inc. (KFC, Pizza Hut, Taco Bell), Subway IP LLC, Starbucks Corporation, Domino’s Pizza, Inc., The Wendy’s Company, Chipotle Mexican Grill, Inc., Papa John’s International, Inc., Dunkin’ Brands (Dunkin’ Donuts), Burger King (Restaurant Brands International), Sonic Drive-In, Panera Bread, Panda Express, Jollibee Foods Corporation, Chick-fil-A, and Little Caesars Enterprises Inc |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Burgers, Pizza, Sandwiches & Wraps, Chicken), By Service Type (Dine-In, Takeaway, Drive-Thru, Online Delivery), By Restaurant Type (Chain QSRs, Independent QSRs), By End-Users (Working Professionals, Students, Families, Tourists & Travelers) |

Key Fast Food and Quick Service Restaurant Company Insights

From street corners to city centers, McDonald’s runs more than 40,000 spots in over 100 nations, topping the list among quick-service eateries worldwide. Its grip on customers comes not from flash but from familiar choices, repeat visits, and a franchise setup that just works. Behind steady earnings lies a pattern: uniform meals meet reliable service every time. While others stall, it moves ahead. Online orders grow, delivery ties spread, and new items rotate into the lineup. Staying ahead is not luck; it’s motion without pause.

Key Fast Food and Quick Service Restaurant Companies:

- McDonald’s Corporation

- Yum! Brands, Inc. (KFC, Pizza Hut, Taco Bell)

- Subway IP LLC

- Starbucks Corporation

- Domino’s Pizza, Inc.

- The Wendy’s Company

- Chipotle Mexican Grill, Inc.

- Papa John’s International, Inc.

- Dunkin’ Brands (Dunkin’ Donuts)

- Burger King (Restaurant Brands International)

- Sonic Drive-In

- Panera Bread

- Panda Express

- Jollibee Foods Corporation

- Chick-fil-A

- Little Caesars Enterprises Inc

Global Fast Food and Quick Service Restaurant Market Report Segmentation

By Product Type

- Burgers

- Pizza

- Sandwiches & Wraps

- Chicken

By Service Type

- Dine-In

- Takeaway

- Drive-Thru

- Online Delivery

By Restaurant Type

- Chain QSRs

- Independent QSRs

By End-Users

- Working Professionals

- Students

- Families

- Tourists & Traveler

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636