Market Summary

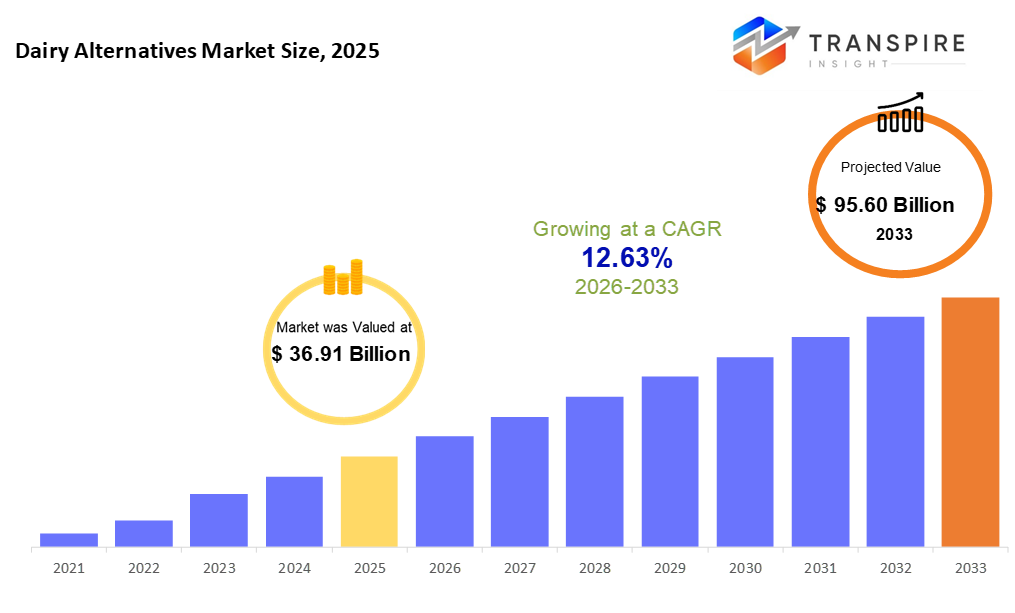

The global Dairy Alternatives market size was valued at USD 36.91 billion in 2025 and is projected to reach USD 95.60 billion by 2033, growing at a CAGR of 12.63% from 2026 to 2033. The dairy alternatives market is growing as consumers increasingly shift toward plant-based diets driven by lactose intolerance concerns, ethical considerations, and sustainability awareness. Expanding vegan and flexitarian populations are supporting demand across milk, yogurt, and dessert alternatives. Product innovation in taste, texture, and nutritional fortification has improved mainstream acceptance. Wider availability through supermarkets and online retail, combined with rising use in beverages and functional nutrition, is further strengthening market growth globally.

Market Size & Forecast

- 2025 Market Size: USD 36.91 Billion

- 2033 Projected Market Size: USD 95.60 Billion

- CAGR (2026-2033): 12.63%

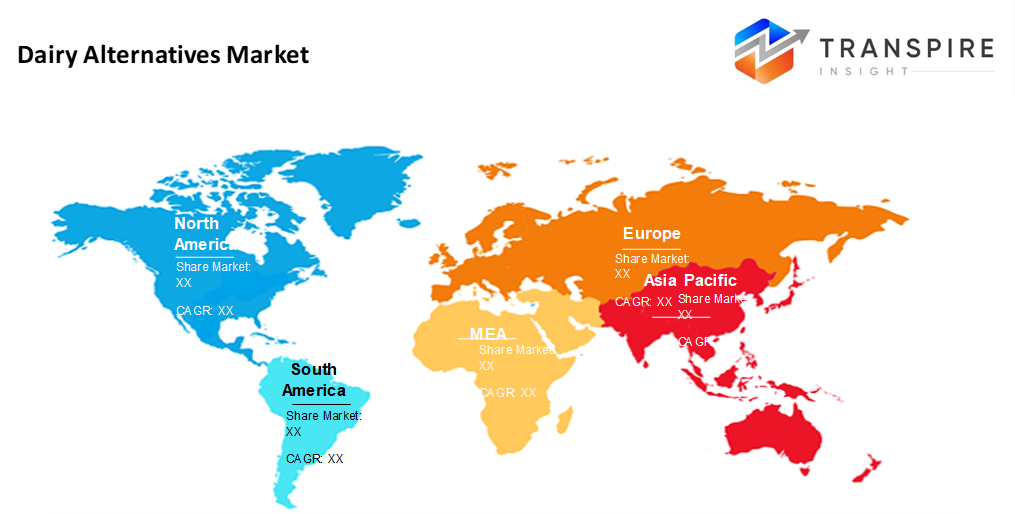

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 27% in 2026. Fueled by widespread familiarity with non-dairy options, the region holds a lead in worldwide sales. Shoppers here lean toward plant-powered eating -partly due to rising discomfort with lactose. Store networks make access simple. Growth follows naturally when products are visible and available.

- Almond milk's rise across the United States ties closely to changing tastes people now lean into choices that skip lactose, feel lighter, and bring cleaner labels. Health pushes the trend, yes, yet ease of access and wider shelves help too. Organic claims matter more these days, not just as a tag but as a reason people reach for cartons. Growth did not happen overnight; it built quietly through years of shifting habits. What started small now fills entire grocery rows once meant only for cow’s milk.

- Out here in the Asia Pacific, demand for dairy substitutes is climbing fast because many people struggle to digest lactose. Health worries nudge choices more every year. Cities swell, habits shift, yet old ways of eating plants stay strong. This mix fuels change without announcing it loudly.

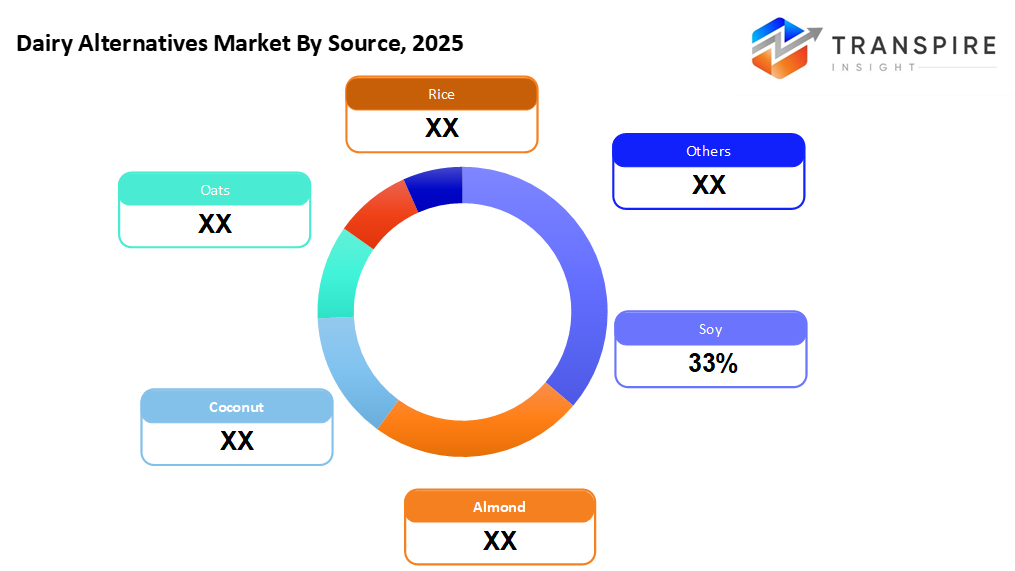

- Soy Segment share approximately 36% in 2026. Still on top worldwide, soy holds the lead because it offers solid nutrition, shows up almost everywhere, and keeps earning trust over the years in meat-free options.

- Out of nowhere, oat and almond drinks started taking up serious shelf space. Now they lead the pack simply because more people are swapping cow milk for these options made from plants.

- Milk substitutes made from plants now top the charts when folks reach for non-dairy sips during daily routines. Drinks built on oats, almonds, or soy show up most often in fridges and cafes alike.

- Most people around the world still buy groceries at big stores because they carry almost everything you need, plus they are easy to find.

Now showing up more on shelves worldwide, non-dairy options are gaining ground. Lactose issues play a role, sure, yet so does a sharper focus on wellness choices. Plant-powered eating patterns, vegan or part-time, are pulling people in, too. Milk substitutes lead the pack, though yogurts, cheeses, butters, creams, and even sweets get remade now. Soy stands out among base ingredients not just because it is rich in protein, but also because it is cheap and flexible. Almonds bring texture, oats add creaminess, coconuts lend richness, while rice offers mildness. Each brings something different when swapping animal products.

Folks are choosing what feels right for their body, the planet, and how animals are treated. That kind now leads the pack since it fits into routines just like regular dairy. Learning about no cholesterol, no lactose, extra vitamins, this pushes more people toward bottles that are not from farms with mooing tenants. New tastes pop up, smoother sips arrive, better labels appear, and folks keep coming back for more.

Now driving things forward, new kinds of dairy substitutes packed with protein, lower in sugar, or designed for health benefits are shaping what people buy. Found mostly in big stores, giant shops, and on internet platforms, these items reach nearly everyone. Lately, companies have turned their attention toward adding nutrients, using simpler ingredients, and wrapping goods in planet-friendly materials. Because habits keep shifting, that direction should hold steady across the years ahead.

Dairy Alternatives Market Segmentation

By Source

When it comes to plant-powered milk options, soy stands out simply because it packs more protein than most others. Its balanced nutrition makes meals feel complete without effort. People tend to reach for it first when switching from animal-based drinks.

- Almond

It is widely used because people enjoy the mild flavor. Not heavy on calories, that helps too. When it comes to plant-based milks or yogurts, many reach for almond first.

- Coconut

Floating in from warm shores, coconut brings a lush creaminess that fits right into milky blends and sweet treats. Its smooth touch pulls in those who love a thick, satisfying bite. Found most often where recipes crave richness, it shapes flavors without trying too hard.

- Oats

Starting strong, oats stand out because they grow quickly. Their eco-friendly nature draws interest. A smooth, rich feel makes them fit well in drinks. Coffee blends especially benefit from their consistency.

- Rice

Starting, rice stands out as a safe choice for those avoiding nuts or soy. Sweet in its own way, it comes without common triggers. People often pick it because it rarely causes reactions. Found everywhere, it stays a go-to when sensitivities are a concern.

- Others

Some folks turn to less common options, such as hemp, pea, or cashew, when they need something different. These fit specific diets, often avoiding allergens that others can’t handle.

To learn more about this report, Download Free Sample Report

By Product Type

- Milk Alternatives

Every day, folks reach for milk alternatives more than anything else when skipping dairy. These picks slide easily into meals and drinks without fuss.

- Cheese Alternatives

Spreading fast, cheese substitutes now show up more often on shelves for those skipping dairy. They are becoming increasingly common, shaped by demand from individuals who avoid lactose or opt for plant-based options. Growth pushes variety into supermarkets, driven less by trends and more by everyday choices.

- Yogurt Alternatives

Folks now find more choices beyond yogurt. These picks bring tangy tastes without dairy. Some packs live cultures for gut health. Instead of milk, makers use nuts or grains. Flavors range from berry to vanilla. Each bite feels familiar yet different. New options pop up every season.

- Butter & Cream Alternatives

Baking needs spark growth in substitutes for butter and cream. These options gain ground as more people cook at home. Driven partly by dietary shifts, new spreads and pourable creams appear on shelves. Choices once rare now show up in everyday aisles. Demand shapes what shows up -slowly replacing traditional dairy items.

- Ice Cream & Desserts

Not just dairy-free options rising, but plant-based sweets are gaining fans, too. Driven by cravings, yes, yet also by changing diets. These choices now stand out in the freezer aisle more than ever. What once felt niche is part of everyday shopping. Flavors continue to evolve beyond basic vanilla substitutes. People reach for them not only for taste but also for alignment with lifestyle picks. Growth here shows no sign of slowing down anytime soon.

- Others

Few options, like creamers or sour cream, fit narrow roles that go beyond typical milk swaps. These sit apart, handling tasks most substitutes are not built for.

By Application

Milk substitutes pop up everywhere in drinks made from plants, think lattes, thick shakes, or blended smoothies. These non-dairy picks blend right in, taking the place of regular milk without slowing things down.

- Food

Fresh ingredients now show up more often in items like dressings, snacks you bake, and ready-to-eat dishes. Some brands mix them right in during production.

- Nutritional Products

Beyond milk, certain plant-based options get a nutritional boost through added vitamins. These appeal to people focused on wellness and active lifestyles. Fortified versions stand out for those tracking their daily intake closely.

- Infants & Clinical Nutrition

Baby food sometimes relies on unique plant-made mixes when regular options cause issues. These blends step in where dairy or soy fail. From hospital wards to homes, they fill gaps for sensitive systems. Not every child processes standard formulas well. Alternatives come into play under medical guidance. Specific diets call for careful substitutions. Plant-based does not mean simple; it means tailored.

By Distribution Channel

- Supermarket & Hypermarket

Folks often pick supermarkets because they stock plenty of items under one roof. These stores make shopping easier by bringing everything together in a single spot.

- Convenience Stores

These shops stock small-sized plant-based options. Usually found near transit spots, they cater to fast choices. That is when these aisles help. Shelves hold ready-to-drink alternatives. Often open late, they fit unplanned needs. Walking past one? Chances are, you will spot chilled cartons inside.

- Online Retail

Fueled by demand, online shops now lead the way in selling high-end plant-based goods. What once started small has grown fast, reaching shoppers who seek specialty items from home. Digital storefronts thrive where unique vegan choices are wanted. Speed and access give these platforms an edge over traditional stores. People click more often when quality meets convenience.

- Specialty Stores

Focusing on specific needs, these shops stock high-end dairy-free options designed for particular diets. Health-conscious buyers often find what they need here, where product function matters most.

- Foodservices

Besides traditional menus, many cafés now include non-dairy milks. Restaurants offer these choices because more guests avoid animal products. Some switch due to allergies, others for personal reasons. These substitutes come from nuts, oats, or soy. They behave like milk but without the lactose. Chefs find them useful in cooking and baking. Diners notice little difference in taste. Popularity grows as awareness spreads slowly. Operators see it as practical, not just trendy.

Regional Insights

Over in North America and Europe, demand for non-dairy options runs deep, thanks to sharp attention on wellness, growing numbers choosing vegan or part-time plant-heavy meals, because shopping channels already reach far into daily life. Take the United States, it leads the charge across North America, with Canada moving at a similar pace, whereas top European spots like the United Kingdom, Germany, France, plus Scandinavia see oat and almond drinks flow regularly through homes. Places such as Eastern Europe and Mexico are not leading yet but inch forward, lifted slowly by bigger store networks and more contact with meat-free, milk-free habits.

Out here, the Asia Pacific area sees the sharpest rise in global demand, driven not just by widespread trouble digesting lactose but also deep roots in eating soy-rich meals. Urban life spreads fast, wallets grow heavier, fueling shifts in what people choose to drink and eat. Leading this shift are China, Japan, and India, where soy stays popular while curiosity about almond and oat options begins to stir. Elsewhere, places like Thailand, Indonesia, and Vietnam quietly build pace - not loud, yet clear as supermarkets spread and more folks start caring how food affects their well-being. Growth is not only happening in big cities anymore; it leaks into smaller towns, changing habits block by block.

Brazil stands out in Latin America, followed closely by Mexico, where city living spreads, and wellness trends grow. Elsewhere on that continent, Argentina plus Chile play smaller yet meaningful roles. Moving into the Middle East and Africa, places like the United Arab Emirates, Saudi Arabia, and South Africa lead the shift toward plant-powered milk options - especially in upscale stores and restaurants. Other countries across those two regions stay behind for now, though knowledge is spreading slowly, helped by products arriving from abroad.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 19, 2025 – Danone launched silk protein to help reignite interest in plant-based dairy.

(Source: https://www.fooddive.com/news/danone-silk-plant-based-dairy/805439/

- May 20, 2025 – Veganz partners with Jindilli Beverages, bringing printed plant-based milk to North America, Australia, and New Zealand.

- April 25, 2025 – Eclipse Foods launched a non-dairy whole milk that replicates the molecular structure of dairy.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 36.91 Billion |

|

Market size value in 2026 |

USD 41.57 Billion |

|

Revenue forecast in 2033 |

USD 95.60 Billion |

|

Growth rate |

CAGR of 12.63% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Chobani LLC, Danone S.A., Hain Celestial, Oatly Group AB, Blue Diamond Growers, SunOpta Inc., Vitasoy, Califia Farms LLC, Nestle S.A., Ripple Foods, Eden Foods Inc., Nutriops, Earth’s Own, Melt organic, Organic Valley, and Living Harvest |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Source (Soy, Almond, Coconut, Oats, Rice, Others) By Product Type(Milk Alternatives, Cheese Alternatives, Yogurt Alternatives, Butter & Cream Alternatives, Ice Cream & Desserts, Others) By Application (Beverages, Food, Nutritional Products, Infants & Clinical Nutrition) By Distribution Channel (Supermarket & Hypermarket, Convenience Stores, Online Retail, Specialty Stores, Food Services) |

Key Dairy Alternatives Company Insights

Founded in 1919, Danone S.A. runs out of Paris, France, reaching more than 120 nations with its food and drink lineup. Instead of sticking to tradition, it leans into plant-powered options via names like Silk, big in North America, and Alpro, which pulls well across European shelves. Choices stretch from soy and almond to oat and coconut versions of milk, yogurt, and even coffee creamers. As tastes shift toward less dairy, the firm adapts by turning old-style plants into spaces that cook up vegan goods. Demand is not slowing down, so neither is expansion in making these items at scale. New spins show up regularly, think protein-boosted milks under the Silk label, meant for those watching what they fuel their bodies with. Despite new twists, you’ll still find them stacked in big grocery chains worldwide.

Key Dairy Alternatives Companies:

- Chobani LLC

- Danone S.A.

- Hain Celestial

- OatlyGroup AB

- Blue Diamond Growers

- SunOpta Inc.

- Vitasoy

- Califia Farms LLC

- Nestlé S.A.

- Ripple Foods

- Eden Foods Inc

- Nutriops

- Earth’s Own

- Melt organic

- Organic Valley

- Living Harvest

Global Dairy Alternatives Market Report Segmentation

By Source

- Soy

- Almond

- Coconut

- Oats

- Rice

- Others

By Product Type

- Milk Alternatives

- Cheese Alternatives

- Yogurt Alternatives

- Butter & Cream Alternatives

- Ice Cream & Desserts

- Other

By Application

- Beverages

- Food

- Nutritional Products

- Infants & Clinical Nutrition

By Distribution Channel

- Supermarket & Hypermarket

- Convenience Stores

- Online Retail

- Specialty Stores

- Foodservice

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636