Market Summary

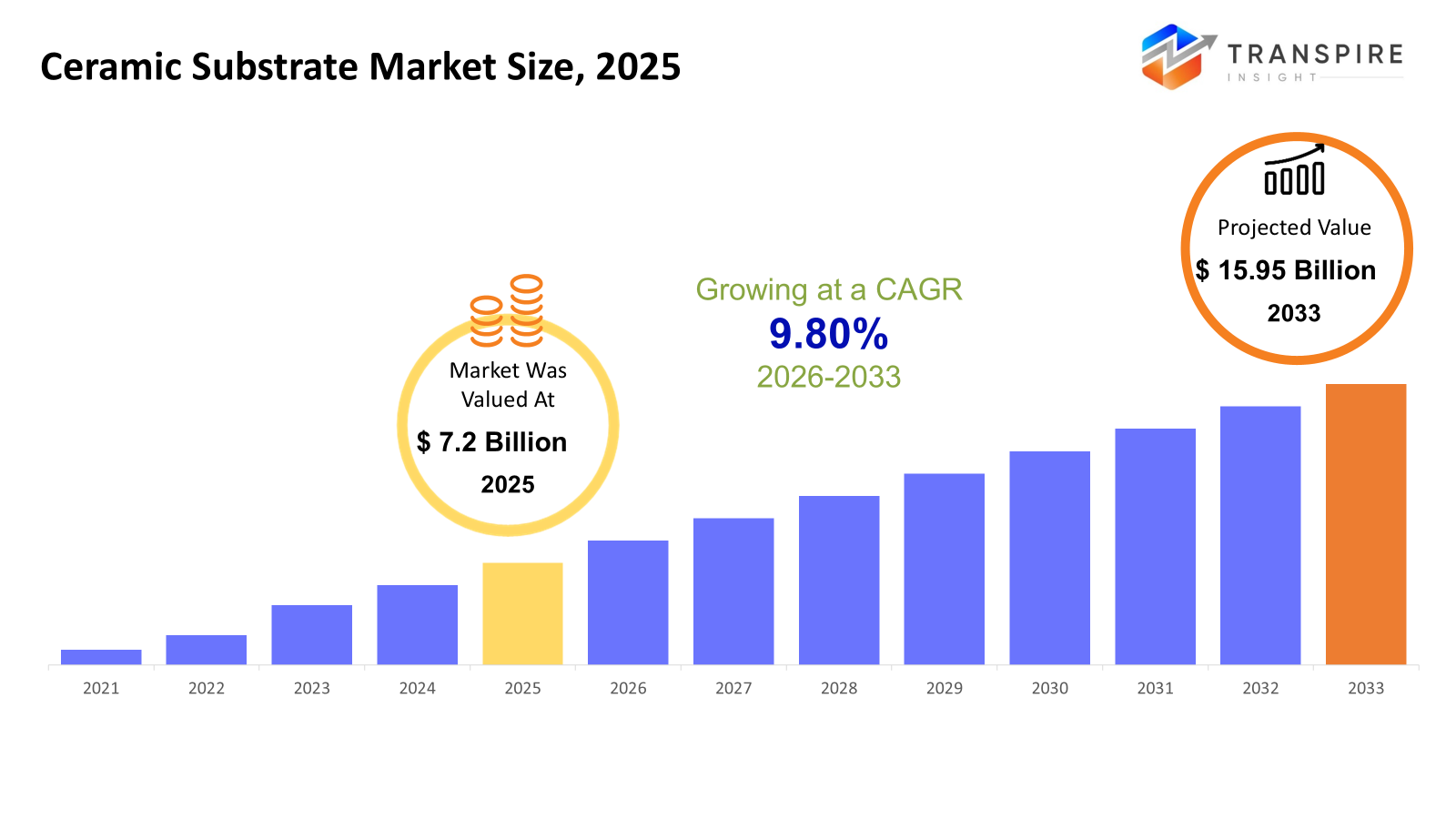

The global Ceramic Substrate market size was valued at USD 7.2 billion in 2025 and is projected to reach USD 15.95 billion by 2033, growing at a CAGR of 9.80% from 2026 to 2033. The Ceramic Substrate Market has been analyzed to register steady CAGR growth, attributed to the increasing requirement for power electronics in electric vehicles, renewable energy systems, and industrial automation solutions. A rise in the construction of 5G infrastructure and the use of high-frequency devices has intensified the requirement for substrates with good thermal conductivity and electric insulation properties. Improvements in multilayer ceramics and the development of new materials are also boosting the performance and dependability, encouraging its industry uptake within the semiconductor and electronic manufacturing sector.

Market Size & Forecast

- 2025 Market Size: USD 7.2 Billion

- 2033 Projected Market Size: USD 15.95 Billion

- CAGR (2026-2033): 9.80%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is at the forefront with regards to technology adoption in power electronics, EV parts, and aerospace, utilizing ceramic substrate materials for enhanced thermal design of electronics, automotive, and industrial applications.

- The United States still supports the growing market mainly because of developments in technology, specifically in semiconductor technology, military technology, and industrial technology, which require innovative ceramic substrate materials.

- The Asia Pacific region accounts for the largest share of global production, while China, Japan, and South Korea are at the forefront of electronics production, LED, and automotive electronics.

- The preferred substrates across all regions remain alumina, balancing cost with performance, while aluminum nitride and silicon nitride are becoming increasingly favored for high power and high temperature applications.

- The multilayer substrates made of ceramics as well as LTCC and HTCC technologies have become a current trend. These have emerged to integrate complex circuitries that can be accommodated in smaller spaces.

- The growth trend for the lighting and power electronics markets will persist as demand for energy-saving lighting and reliable high-power electronic components grows.

- The major demand influences in the electrical and electronics sector, where electronic devices are becoming increasingly compact while containing powerful parts, show continued dominance in this sector in terms of better semiconductor parts as well as effective and efficient heat management.

So, the global ceramic substrate industry has tremendous scope, driven by growing demand for high-performance electronic components. As basic materials for electronic components, ceramic substrates have good conductivity, electrical insulation, and high stability. These materials have applications in power electronics, light-emitting diodes, automobile electronics, and telecommunication. Thus, ceramic substrate materials play an important role in electronic components, enabling further component miniaturization. Other advanced material forms, including alumina, aluminum nitride, silicon nitride, beryllium oxide, etc., offer specified performance characteristics to suit particular demands of several industries. Additionally, this market segment experiences growth owing to increasing adoption levels for multilayer ceramic substrates, as well as high-temperature co-fired ceramics, which support miniature size, circuit density, as well as enhanced thermal performance. In reality, growth factors, including electric vehicles, smart devices, as well as renewable energy, are increasing demands for reliable or thermally stable substrates.

They are instead focused on developing various innovations relating to materials, multiple layers of materials, and production methods that improve overall efficiency and reduce costs of products. Strategic business relationships and geographical expansion strategies are helping grow to meet the increasing demands of emerging markets efficiently. Overall, the market is predicted to grow through sustained CAGRs as electronics, automotive, and industrial industries focus on improving performance, reliability, and miniaturization of products.

Ceramic Substrate Market Segmentation

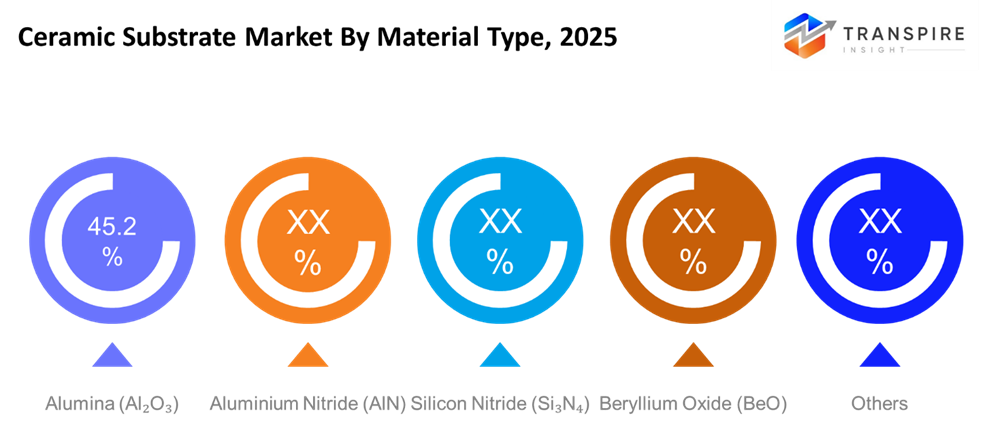

By Material Type

- Alumina (Al₂O₃)

Alumina continues to dominate as the most widely used ceramic material for substrates on account of its excellent balanced properties of cost efficiency, mechanical and electrical strengths. Its wide compatibility, as observed under consumer industrial, and automotive electronics, provides a stable demand base.

- Aluminium Nitride (AlN)

Because of its excellent thermal conductivity, aluminum nitride is increasingly adopted by applications demanding high power and high frequency. Growing use in power electronics and LED modules justifies its increasing market penetration against higher material costs.

- Silicon Nitride (Si₃N₄) Silicon nitride substrates have started to be considered due to their outstanding mechanical toughness and a high resistance to thermal shock. These characteristics give them the potential for use in the most advanced applications, be it in cars or industry, where long operation life at extreme conditions is required.

- Beryllium Oxide (BeO)

Beryllium oxide provides exceptional heat conductivity and electrical insulation properties. However, stringent handling conditions and safety aspects restrict the general applicability of beryllium oxide to exclusive electronic devices.

- Others

Other ceramic materials that find use include zirconia and composite ceramics. They are made necessary by the need for specific properties. These include emerging needs for electronics and research-oriented industrial uses.

To learn more about this report, Download Free Sample Report

By Product Form

- Single-Layer Ceramic Substrates

The single layer ceramic substrate is still widely used due to its cost efficiency and structural simplicity; in fact, they are suitable for standard electronic circuitry configurations. The thermal and electrical stability of these single layer ceramics makes this substrate suitable for large volume applications where performance demands are not high.

- Multilayer Ceramic Substrates

Multilayer ceramic substrates are observing escalating demand, particularly due to miniaturization and increasing complexity in electrical systems. Besides, these substrates have proven beneficial for increasing circuit density while providing improved signal integrity and thermal management.

- HTCC / LTCC Technologies

Also, HTCC substrates offer many key advantages such as excellent mechanical strength, high thermal stability, and ability for operation in extreme environments. Such characteristics of HTCC substrates find applications in areas such as aerospace, defense, high-power electronic devices, etc. The LTCC technology is growing progressively in the field of RF, microwave, and telecommunication devices because the performance of the signal is excellent.

- High-Temperature Co-Fired Ceramic (HTCC)

The substrates used are of HTCC, and they provide better mechanical, as well as high-temperature stability, and are also useful in harsh conditions. This makes HTCC useful for aerospace, military, and various types of electronic devices used in industry.

- Low-Temperature Co-Fired Ceramic (LTCC)

Low Temperature Co-Fired Ceramic (LTCC) technology is seeing a surge in the acceptance of the technology for Radio Frequency, Microwave, and Telecommunication devices because of the excellent signal handling capabilities. Lower temperature co-fired devices allow the addition of passive devices within the substrate, making the design compact and providing better electrical performance.

By Application

- Electronic Circuit Manufacturing

The manufacturing of electronic circuits qualifies as a prominent application segment as a result of the extensive utilization of ceramic substrates within printed circuit boards and semiconductor packaging. Demand exists thanks to the ongoing miniaturization and increased intricacy observed in electronic devices.

- LED Lighting

Ceramic substrates are frequently utilized within LED lighting products for enabling effective heat dissipation. In addition, the substrates ensure increased longevity. Escalating demand for energy-efficient lighting systems worldwide would positively impact the overall market.

- Power Electronics

Applications for power electronics modules involve various uses for ceramic substrates. These uses include heat handling and insulation in high-voltage technology. The need for electric vehicles and renewable energy will create strong demand.

- Automotive Systems

The substrates are used in power modules, sensors, and control units within automotive systems. With vehicle electrification on the rise, including advanced driver-assistance systems, this integration is being accelerated across modern vehicles.

- Medical Devices & Equipment

Medical electronics employ ceramic substrates in view of their reliability, biocompatibility, and stability against sterilization processes. Segment growth is stable, as that for advanced diagnostic and monitoring equipment is going up.

- Industrial Tools

Ceramic substrates, with their great toughness and stability in performance at high operational severity, find a great advantage in industrial tools. Their application enables precision control and reliability in manufacturing and heavy-duty industrial machinery or equipment.

- Telecommunications & RF Modules

The telecommunications and RF modules are now widely dependent upon ceramics for transmitting signals. The expansion of 5G networks and advanced communications facilities is also fueling demand for these materials.

- Others

Other areas include aerospace electronics and instrumentation. These areas require high reliability and performance consistency.

By End-Use Industry

- Electrical & Electronics

Electrical and Electronics industry consumes the majority of ceramic substrates. Ceramic substrates are commonly used for semiconductors and circuit boards. In the recent past, this industry experienced impressive innovations and an increase in penetration.

- Automotive

Automotive end-use demand for ceramic substrates, driven by the trend to broaden use into electrification, power management, and sensors, is expanding at a high pace. This trend can be further amplified by the growing volume of electric vehicle manufacture and the electronic content of each vehicle.

- Consumer Electronics

Ceramic substrates find application in consumer electronics, especially compact and high-performance devices. This is due to trends such as miniaturization of consumer electronics, thermal management, and increasing usage of smart electronic gadgets.

- Telecom & Communication

As to telecom and communication applications, they will be composed of ceramic substrates for RF modules. Additionally, an increase in high-speed connectivity and transmission systems will maintain market growth.

- Medical & Healthcare

Ceramic substrates are also finding their usefulness in the medical and healthcare industry, thanks to the stability of the materials. Investments are being made in healthcare electronics and medical equipment to drive the adoption.

- Aerospace & Defense

Aerospace and defense industry applications demand special ceramic substrates, which are capable of performing well in extreme environmental conditions. The reliability level and long product life add strategic significance.

- Others

Other end-use industries that come into play include the field of automation for industries. It relates to diverse demand because these fields require very high-performance parts.

Regional Insights

North America is the leading region with an expanding base of industries, including automotive and defense. The U.S. dominates North America, an established market with high growth rates for industries such as automotive, defense and industries. It includes high-performance electronic solutions, aerospace modules, and EV power. The automotive industry is also present in Canada and Mexico.

Europe exhibits consistent adoption trends driven by the dynamics of industrial automation, renewable sources of power, and the push for electric vehicle technologies. Germany and the UK are the prominent markets for Europe which are highly focused on the installation of high-quality electronic and automotive systems. France, Italy and Spain contribute to the region's total based on the manufacturing of various kinds of industrial and consumer-grade electronic systems. Rest of Europe reflects moderate adoption potential fueled by the advent of novel technologies and the installation of efficient systems. The region that holds a maximum market share for Asia Pacific comprises major electronics manufacturing countries like China, Japan, South Korea, and India. Japan majorly contributes to manufacturing for high-end material-based electronics and high-density electronics products. China contributes to scale manufacturing for consumer electronics, LEDs, and automotive electronics. Similarly, South Korea’s contribution to semiconductor electronics and telecom electronics plays a major role. Other countries like Australia, New Zealand, and Rest of APAC exhibit gradual growth. South American countries like Brazil and Argentina exhibit gradual increase in electronics adoption for industrial electronics and automotive electronics. The Middle East & African countries like Saudi Arabia, UAE, and South African countries exhibit niched markets for telecom electronics, industrial automation electronics, and defense electronics. Hence, showing opportunities for increased market size.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 2025, Leatec Fine Ceramics is currently struggling to compete in pricing for resistor substrates, thus shifting focus to serve the automotive industry and semiconductors.

(Source:https://www.digitimes.com/news/a20251216PD240/leatec-ceramics-resistor-supplier-automotive.html)

- In September 2025, NGK Insulators, as an example, used its ceramic technology expertise to develop Direct Air Capture system technology, which ranks as part of the most recent developments launched in support of Carbon Neutrality projects.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 7.2 Billion |

|

Market size value in 2026 |

USD 8.3 Billion |

|

Revenue forecast in 2033 |

USD 15.95 Billion |

|

Growth rate |

CAGR of 9.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Kyocera Corporation, Murata Manufacturing Co., Ltd., CoorsTek Inc., CeramTec GmbH, MARUWA Co., Ltd., Rogers Corporation, NGK Spark Plug Co., Ltd., Toshiba Materials Co., Ltd., KOA Speer Electronics, Inc., LEATEC Fine Ceramics Co., Ltd., ICP TECHNOLOGY Co., Ltd,, Heraeus Electronics, Corning Incorporated, NEOTech, TTM Technologies Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material Type (Alumina (Al₂O₃), Aluminium Nitride (AlN), Silicon Nitride (Si₃N₄), Beryllium Oxide (BeO), Others), By Product Form (Single-Layer Ceramic Substrates, Multilayer Ceramic Substrates (MLC), HTCC / LTCC Technologies, High-Temperature Co-Fired Ceramic (HTCC), Low-Temperature Co-Fired Ceramic (LTCC)), By Application(Electronic Circuit Manufacturing, LED Lighting, Power Electronics, Automotive Systems, Medical Devices & Equipment, Industrial Tools., Telecommunications & RF Modules, Others) and By End-Use Industry(Hospitals, Diagnostic Imaging Centers, Specialty Clinics, Research & Academic Institutions, Others) |

Key Ceramic Substrate Company Insights

Kyocera Corporation, on the other hand, can be termed a global leader in providing ceramic substrate products, focusing on many decades of experience in delivering sophisticated ceramic materials. The company specializes in providing products such as alumina, aluminum nitride, and multilayer ceramic substrate products, which are primarily used in sectors such as power electronics, automotive, telecommunications, and other industrial segments. Strengths of Kyocera: Kyocera can be considered to possess major strengths, such as increased capacities, integration, and relationships, particularly in terms of being an auto and semiconductor OEM. Its investments in new generation substrate technology, as well as increased capacities, are purported to complement robust demand for products such as electric vehicle inverters and infrastructure driven by 5G.

Key Ceramic Substrate Companies:

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- CoorsTek Inc.

- CeramTec GmbH

- MARUWA Co., Ltd.

- Rogers Corporation

- NGK Spark Plug Co., Ltd.

- Toshiba Materials Co., Ltd.

- KOA Speer Electronics, Inc.

- LEATEC Fine Ceramics Co., Ltd.

- ICP TECHNOLOGY Co., Ltd.

- Heraeus Electronics

- Corning Incorporated

- NEOTech

- TTM Technologies Inc.

Global Ceramic Substrate Market Report Segmentation

By Material Type

- Alumina (Al₂O₃)

- Aluminium Nitride (AlN)

- Silicon Nitride (Si₃N₄)

- Beryllium Oxide (BeO)

- Others

By Product Form

- Single-Layer Ceramic Substrates

- Multilayer Ceramic Substrates (MLC)

- HTCC / LTCC Technologies

- High-Temperature Co-Fired Ceramic (HTCC)

- Low-Temperature Co-Fired Ceramic (LTCC)

By Application

- Electronic Circuit Manufacturing

- LED Lighting

- Power Electronics

- Automotive Systems

- Medical Devices & Equipment

- Industrial Tools.

- Telecommunications & RF Modules

- Others

By End-Use Industry

- Electrical & Electronics

- Automotive

- Consumer Electronics

- Telecom & Communication

- Medical & Healthcare

- Aerospace & Defense

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions

Find quick answers to common questions.

The approximate Ceramic Substrate Market size for the market will be USD 15.95 billion in 2033.

Key segments for the Ceramic Substrate Market are By Material Type (Alumina (Al₂O₃), Aluminium Nitride (AlN), Silicon Nitride (Si₃N₄), Beryllium Oxide (BeO), Others), By Product Form (Single-Layer Ceramic Substrates, Multilayer Ceramic Substrates (MLC), HTCC / LTCC Technologies, High-Temperature Co-Fired Ceramic (HTCC), Low-Temperature Co-Fired Ceramic (LTCC)), By Application(Electronic Circuit Manufacturing, LED Lighting, Power Electronics, Automotive Systems, Medical Devices & Equipment, Industrial Tools., Telecommunications & RF Modules, Others) and By End-Use Industry(Hospitals, Diagnostic Imaging Centers, Specialty Clinics, Research & Academic Institutions, Others).

Major Ceramic Substrate Market players are Kyocera Corporation, Murata Manufacturing Co., Ltd., CoorsTek Inc., CeramTec GmbH, MARUWA Co., Ltd.

The North America region is leading the Ceramic Substrate Market.

The CAGR of the Ceramic Substrate Market is 9.80%.

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- CoorsTek Inc.

- CeramTec GmbH

- MARUWA Co., Ltd.

- Rogers Corporation

- NGK Spark Plug Co., Ltd.

- Toshiba Materials Co., Ltd.

- KOA Speer Electronics, Inc.

- LEATEC Fine Ceramics Co., Ltd.

- ICP TECHNOLOGY Co., Ltd.

- Heraeus Electronics

- Corning Incorporated

- NEOTech

- TTM Technologies Inc.

Recently Published Reports

-

Dec 2024

Healthcare Polymer Packaging Market

Healthcare Polymer Packaging Market Size, Share & Analysis Report By Packaging Type (Syringes, IV Bottles and Pouches, Clamshells, Blisters, Bottles & Jars, Containers, Tubes, IV Parental Packaging, Others), By Type (Regulated, Non-regulated), By Polymer Type (LDPE (Low-Density Polyethylene), HDPE (High-Density Polyethylene), Homo-polymer (Homo), Random Copolymer (Random), Block Copolymer (Block), PET, Polystyrene, Polyvinyl Chloride, Polyamide/EVOH, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

Hydrophilic Tape (Waterstop) Market

Hydrophilic Tape (Waterstop) Market Size, Share & Analysis Report By Type (Bentonite-Based Hydrophilic Tape, Rubber-Based Hydrophilic Tape), By Application (Residential Buildings, Commercial Buildings, Infrastructure Projects), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

Metalens Market

Metalens Market Size, Share & Analysis Report By Type (Visible Light Metalens, and Infrared Metalens), By Application (Consumer Electronics, Automotive Electronics, Industrial, Medical, and Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

PBT Resin Market

PBT Resin Market Size, Share & Analysis Report By Type (Reinforced PBT Resin, Unreinforced PBT Resin), By Processing Method (Injection Molding, Extrusion, Blow Molding, Others), By End-User (Automotive, Electrical & Electronics, Consumer Appliances, Industrial Machinery, Medical Devices, Packaging, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031