Market Summary

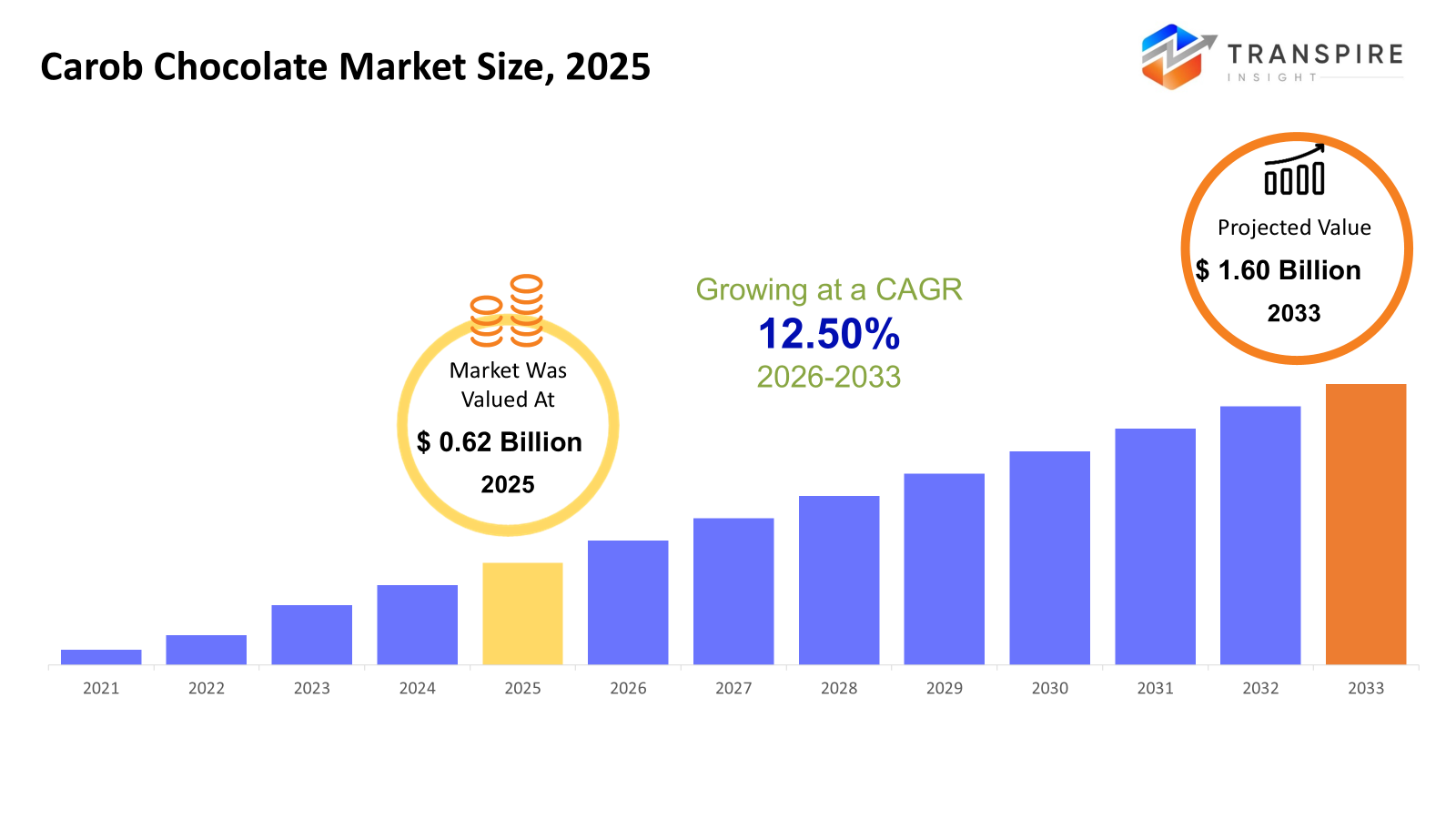

The global Carob Chocolate market size was valued at USD 0.62 billion in 2025 and is projected to reach USD 1.60 billion by 2033, growing at a CAGR of 12.50% from 2026 to 2033. Due to growing consumer demand for low-sugar, allergy-friendly and caffeine-free candy substitutes, the market for carob chocolate is gradually growing. Manufacturers are being encouraged to use carob-based formulations by rising health consciousness, clean-label demands, and fluctuating cocoa prices.

Market Size & Forecast

- 2025 Market Size: USD 0.62 Billion

- 2033 Projected Market Size: USD 1.60 Billion

- CAGR (2026-2033): 12.50%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Due to its high adoption of plant-based diets, health-conscious consumer bases, and innovative premium foods, North America continues to lead the world in demand. Consistent expansion in consumption across mainstream and specialty channels is being reinforced by established retail infrastructure and growing interest in sugar reduction.

- Through product innovation, trends in functional snacking, and robust direct-to-consumer sales, the United States propels regional momentum. Carob chocolate is being marketed by manufacturers as a cocoa substitute that complements clean-label, vegan and diabetic product lines.

- Urbanization, growing bakery industries and rising adoption of Western-style diets are all contributing factors to Asia Pacific's emergence as a high-growth region. The demand for alternative chocolate products is increasing due to the growing middle class and increased awareness of functional meals.

- Because they are well-known, convenient, and simple to market as a healthier alternative to regular chocolate, carob chocolate bars continue to be the most popular product type. Strong retail demand is maintained by innovative tastes, organic variations and reduced-sugar formulas.

- Sugar-free and low-sugar formulations represent the fastest-growing formulation market, driven by diabetes prevalence and sugar-reduction measures. In order to satisfy customer and regulatory demands without sacrificing flavor, manufacturers are using more natural sweeteners.

- Due to customer trust and impulsive buying, offline distribution still accounts for the majority of volume sales, but online channels are expanding quickly because they provide access to premium goods, niche brands and subscription-based health food options.

- As dietary awareness grows in urban homes, retail consumers continue to be the largest end-user category. Growing acceptance of alternative ingredients in daily consumption and changes in lifestyle toward functional snacking increase demand.

So, the manufacturing and consumption of chocolate-like goods made from carob pods rather than cocoa is referred to as the carob chocolate market. Carob chocolate is naturally caffeine-free, lower in fat, and typically seen as a healthier alternative, making it attractive to consumers with dietary restrictions or health-focused preferences. Its mild sweetness and functional versatility enable its use across confectionery, bakery and beverage applications. Growth in the market is strongly associated with more general trends in plant-based nutrition, sugar reduction and clean-label goods. Carob chocolate is becoming more popular as a functional delight rather than a conventional confection as customers get more conscious of ingredient transparency and health effects. Carob-based products are increasingly being positioned by manufacturers in the luxury, organic and fortified product categories.

In addition, cocoa price volatility and sustainability concerns are prompting food makers to investigate alternative ingredients such as carob. This has increased acceptance beyond retail consumption into industrial food processing and specialist production. Over the course of the projection period, sustainable market expansion is anticipated to be supported by ongoing product innovation and growing digital sales channels.

Carob Chocolate Market Segmentation

By Product Type

- Carob Chocolate Bars

Due to their direct consumer consumption and resemblance to conventional chocolate formats, carob chocolate bars are the most commercially visible product type. Demand is encouraged by increased interest in caffeine-free, allergen-friendly and plant-based confectionery. Product innovation focuses on taste infusions, organic labeling and clean-label positioning.

- Carob Chocolate Chips

The main uses for carob chocolate chips are in food processing, baking and confections. Growing demand from bakeries, artisanal food companies, and home bakers looking for chocolate substitutes is what propels growth. Bulk buying trends and steady B2B demand are advantages for these chips. Due to an increase in Western style bakery consumption, adoption is growing across Asia Pacific.

- Others

This area includes carob chocolate powders, spreads, coatings, syrups, and customized forms. Beverages, sweets, and nutraceutical formulations are just a few of the specialized uses for these items. Due to functional placement and customization, this market has higher margins despite having a lesser volume. Innovation in high-end health goods and functional foods supports growth.

To learn more about this report, Download Free Sample Report

By Formulation

- Organic Carob Chocolate

Organic formulations benefit from good alignment with clean-label, non-GMO, and sustainability trends. In North America and Europe, where organic certification affects buying decisions, demand is strongest. Organic carob chocolate is frequently sold through niche retail channels and commands a premium price. Growth is facilitated by regulatory supports for organic agriculture in developed markets.

- Sugar-Free / Low-Sugar Formulations

This industry is driven by increased prevalence of diabetes, obesity, and sugar-reduction measures internationally. Sugar-free carob chocolate is popular among diabetics, fitness enthusiasts, and health-conscious consumers. Demand is particularly significant in North America and metropolitan Asia Pacific markets. Glycemic management and natural sweeteners are prioritized in product development.

- Conventional / Standard

Because it is inexpensive and widely accessible, conventional carob chocolate continues to be the most popular formulation. For mass consumers switching from chocolate made with cocoa, it acts as an entry-level product. In price-sensitive markets like those in South America and several regions of Asia Pacific, this category is dominant. Despite reduced margins, volume sales are still high.

- Functional / Fortified

Products enhanced with fiber, vitamins, minerals, or plant proteins are referred to as functional and fortified carob chocolate. The crossover demand between nutraceuticals and confections supports this market. Functional snacking and preventative health trends are the main drivers of growth. In developed markets with robust wellness ecosystems, adoption is rising.

By Distribution Channel

- Offline

Offline channels include supermarkets, hypermarkets, convenience stores, and specialist health stores. Because of customer confidence and impulsive buying, they make up a sizable portion of global sales. In North America and Europe, offline retail is very prevalent. Sales performance is heavily influenced by shelf visibility and brand placement.

- Online

The fastest-growing channel is online distribution, which is bolstered by direct-to-consumer business models and e-commerce growth. Access to niche brands a greater selection of products, and subscription services are all advantageous to consumers. Growth is notably robust in Asia Pacific and North America. Digital marketing and influencer-driven awareness improve adoption.

By End-User

- Retail Consumers

Due to growing understanding of the health benefits of carob and its alternatives to cocoa, retail consumers make up the largest end-user group. Dietary choices including vegan, caffeine-free and allergy-friendly diets affect consumption. Demand is dominated by households that prioritize health and urban populations. In developed economies, growth is most robust.

- Food Manufacturers & Bakeries

Carob chocolate is used in baked items, snacks, and desserts in this section. In contrast to cocoa, demand is driven by formulation flexibility and cost stability. Carob is preferred by manufacturers for specialist and health-focused product lines. Growing bread industries in Latin America and Asia Pacific contribute to growth.

- Confectionery and Snack Producers

Carob chocolate is used by confectionery manufacturers to create unique, health-conscious goods. This segment benefits from innovation in functional confectionery and reduced-sugar snacks. Compared to mass manufacturers, luxury and niche brands have better adoption rates. Europe and North America lead in product experimentation.

- Health Food Stores / Specialty Buyers

Specialty buyers concentrate on functional, sugar-free and organic varieties of carob chocolate. This section plays a crucial role in brand discovery and premium positioning. Demand is fuelled by wellness-oriented consumers and dietary-restricted groups. Growth is constant although volume is significantly modest.

- Others

This group comprises foodservice providers, nutraceutical companies, and institutional customers. Usage is generally application-specific and customizable. Higher value-added formulations are advantageous to this segment despite its lower scale. Growth potential exists through innovation and cross-industry applications.

Regional Insights

The United States, Canada, and Mexico make up North America, which is a developed and innovative market. Canada has a high demand for niche and organic goods, although the United States leads in both product development and consumption. Mexico makes a contribution via increasing retail availability and raising health consciousness. Europe remains an important market due to increasing consumer awareness of clean-label and organic foods. Strong regulatory frameworks and specialized retail networks enable Germany, the UK, France, Italy, and Spain to dominate regional demand. The remainder of Europe shows continuous adoption led by wellness-focused customers.

Asia Pacific is the fastest-growing regional market, led by Japan, China, Australia & New Zealand, South Korea, and India. Urbanization, growing baking industries, and increased disposable incomes all contribute to growth. Growing Western dietary influence and demand for functional foods benefit the rest of Asia Pacific. South America, which includes Argentina and Brazil, is a developing market where slow adoption is supported by ingredient diversity and price. Growth remains moderate but constant in the rest of South America. Premium imports, specialized retail, and growing health consciousness among urban populations are driving niche growth in the Middle East and Africa area, which is headed by South Africa, Saudi Arabia and the United Arab Emirates.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 2025, In response to global cocoa price volatility and sustainability concerns, CSM Ingredients, a Nexture company, formally announced the launch of Nuaré, a new line of carob-based cocoa substitutes intended to provide affordable, adaptable, and sustainable formulations for bakery and ice cream applications. The press statement highlights customisation capabilities, performance across many product categories (cake coatings, ice-cream coatings, bakery mixes, pastry fillings), and carob’s naturally low carbon footprint and unique sensory profile.

- In June 2024, With 100% recyclable paper packaging, Caroboo's dairy-free, caffeine-free carob chocolatey bars (Mint, Orange, and Salted Caramel Nutty) are now available at 329 Holland & Barrett stores around the UK, resulting in notable year-over-year increase. This action emphasizes sustainable packaging innovation in the carob chocolate market and increases store presence.

(Source:https://s3.industryintel.com/imgxdoc/F661A3625BA0318C02CC8CC707D0B18D.pdf)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 0.62 Billion |

|

Market size value in 2026 |

USD 0.70 Billion |

|

Revenue forecast in 2033 |

USD 1.60 Billion |

|

Growth rate |

CAGR of 12.50% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

CarobCo, The Carob Kitchen, Missy J’s, Mount Carob, Carob World, D&D Chocolates, Australian Carob Co., Caroboo, PANOS Brands, Supertreats UK, Casa do Bosque, Uncommon Carob, Foundation Foods, Carob House, The Australian Carob Co. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Carob Chocolate Bars, Carob Chocolate Chips, Others), By Formulation (Organic Carob Chocolate, Sugar-Free / Low-Sugar Formulations, Conventional / Standard, Functional / Fortified), By Distribution Channel (Offline, Online) and By End-User (Retail Consumers, Food Manufacturers & Bakeries, Confectionery and Snack Producers, Health Food Stores / Specialty Buyers, Others) |

Key Carob Chocolate Company Insights

Known for its high-end product line and robust retail distribution in North America, CarobCo is a prominent innovator in the carob chocolate industry. The company's trademark PureCarob products target plant-based and health-conscious customer niches by emphasizing premium, certified sourcing. CarobCo's competitive stance and market visibility have been reinforced by its strategic growth into mainstream retail, e-commerce, and wholesale relationships. It sets itself apart with a variety of products, such as nibs and dark carob bars, while utilizing supply chain traceability and sustainability practices. The company's strong market share and growth trajectory are supported by its focus on quality, brand recognition, and distribution depth.

Key Carob Chocolate Companies:

- CarobCo

- The Carob Kitchen

- Missy J’s

- Mount Carob

- Carob World

- D&D Chocolates

- Australian Carob Co.

- Caroboo

- PANOS Brands

- Supertreats UK

- Casa do Bosque

- Uncommon Carob

- Foundation Foods

- Carob House

- The Australian Carob Co

Global Carob Chocolate Market Report Segmentation

By Product Type

- Carob Chocolate Bars

- Carob Chocolate Chips

- Others

By Formulation

- Organic Carob Chocolate

- Sugar-Free / Low-Sugar Formulations

- Conventional / Standard

- Functional / Fortified

By Distribution Channel

- Offline

- Online

By End-User

- Retail Consumers

- Food Manufacturers & Bakeries

- Confectionery and Snack Producers

- Health Food Stores / Specialty Buyers

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636