Market Summary

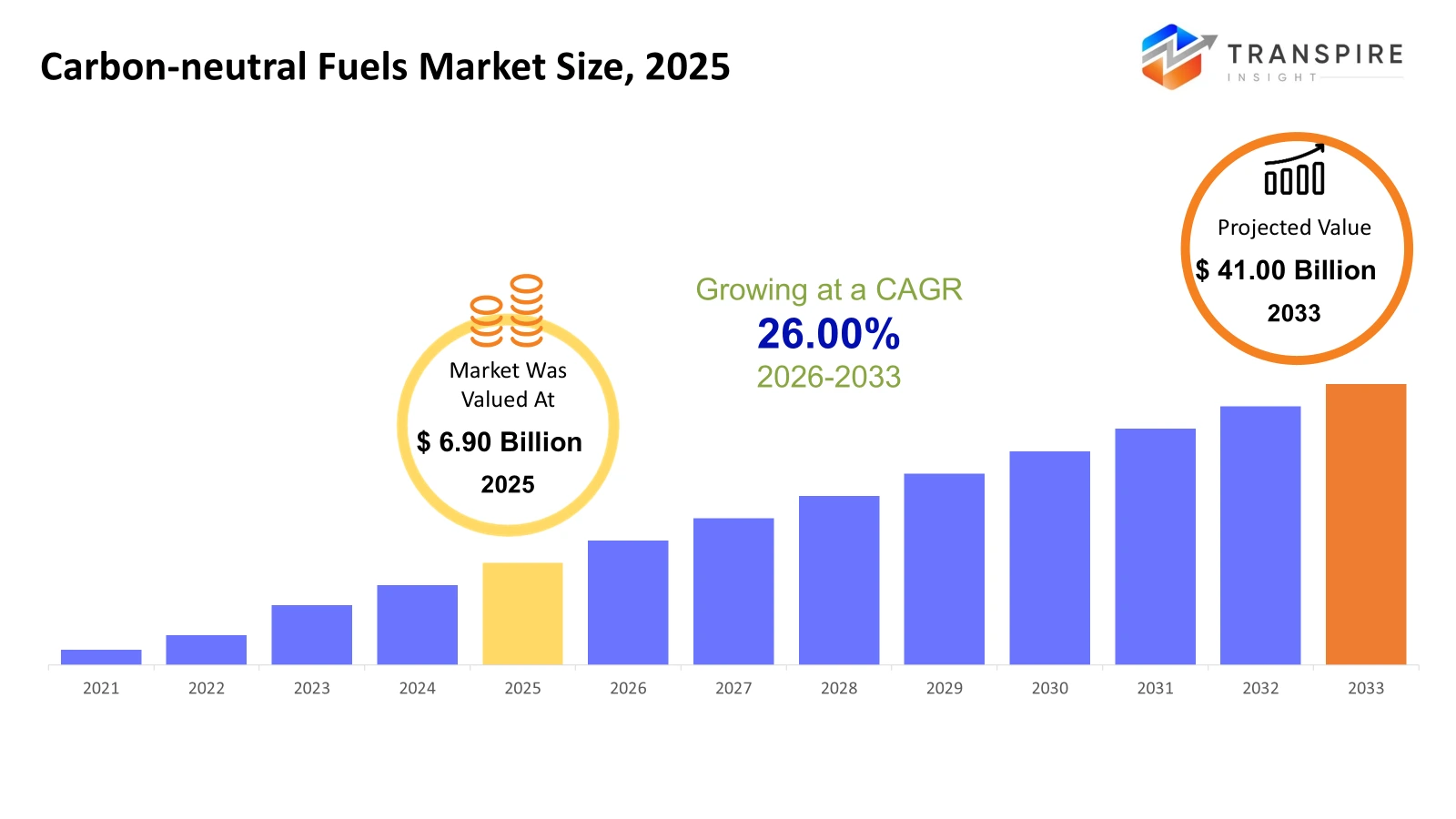

The global Carbon-neutral Fuels market size was valued at USD 6.90 billion in 2025 and is projected to reach USD 41.00 billion by 2033, growing at a CAGR of 26.00% from 2026 to 2033. Due to stricter global decarbonization requirements and net-zero commitments in both the transport and industrial sectors, carbon-neutral fuel markets are anticipated to develop significantly at a high compound annual growth rate (CAGR). Demand visibility is being enhanced by growing carbon pricing systems and renewable fuel mandates. Ongoing technological innovations in both electrolysis and synthetic fuels are decreasing cost obstacles.

Market Size & Forecast

- 2025 Market Size: USD 6.90 Billion

- 2033 Projected Market Size: USD 41.00 Billion

- CAGR (2026-2033): 26.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is experiencing an accelerated deployment of carbon-neutral fuels, aided by renewable fuel standards, tax credits, and funding of infrastructure projects. The presence of clearly defined policies and greater involvement from industry will allow greater scalability, with a particular focus on advanced biofuels and hydrogen production.

- The U.S. leads the regional growth through the federal subsidy program and state-level low-carbon fuel standard, as well as through the growing investment in sustainable aviation fuels. Strong capital flow and shifting refinery assets are continuously creating increasing U.S. capacity for renewable diesel and biofuels.

- In Asia Pacific, the demand for hydrogen and biofuel blending is expected to increase significantly due to rapid industrial development and the implementation of "hydrogen roadmaps" by many nations, which are expected to stimulate demand for hydrogen imports.

- Sustainable Aviation Fuel is currently the largest category of aviation fuels due to airline decarbonization commitments and regulatory blending mandates; despite the current price premium, the limited alternatives available for electrifying aviation support an overall long-term structural demand for this fuel category.

- As the predominant production process, electrolysis is vital as the primary means by which green hydrogen is created. Falling prices for renewable electricity, as well as scaling up electrolyzer production, are creating more commercial opportunities in both industrial and mobility applications.

- Agricultural waste is continuing to be the major feedstock segment due to both its availability and lower lifecycle emissions compared to other feedstocks, as well as being aligned with circular economy models. This use of non-food biomass helps remove sustainability issues and will create stronger policy enabling incentives.

- Transportation continues to be the largest application area due to government blending mandates and emissions standards for heavy-duty on-road transport and passenger vehicles. The heavy-duty mobility sectors are leading the adoption of renewable diesel and biodiesel.

So, the marketplace for carbon-neutral fuels consists of fuels made from renewable feedstocks or processes that result in zero net lifecycle greenhouse gas emissions. These fuels can include bio-based fuels, hydrogen generated from renewable electricity, or synthetic fuels produced utilizing carbon capture and renewable energy integration. Decarbonization targets across transportation, aviation, marine, and industrial sectors are the main drivers of market growth. Governments are using several tools to drive production and consumption, such as carbon pricing mechanisms, renewable blending mandates, and fiscal incentives. Private investment is increasingly being directed toward scalable technologies to support decarbonization, such as electrolysis and the power-to-liquid pathway. As climate commitments strengthen worldwide, the carbon-neutral fuels market is expanding steadily, supported by policy frameworks, technological innovation, and rising demand for sustainable energy alternatives across multiple end-use industries.

Cost competitiveness continues to be a major factor influencing adoption trajectories. Currently, production costs for carbon-neutral fuels exceed those of fossil-fuel alternatives; however, technological advancements and economies of scale are reducing that differential. Strategic collaborations, long-term supply contracts, and investments in infrastructure are anticipated to contribute to market maturity over the forecast horizon.

Carbon-neutral Fuels Market Segmentation

By Fuel Type

- Bioethanol

Due to blending mandates for road transport, bioethanol is still the most widely used type of carbon-neutral fuel. Government policies that promote low-carbon fuels, as well as the availability of abundant feedstocks such as corn and sugarcane will drive growth in bioethanol. However, in regulatory dynamics, issues of land use and food security will have an effect.

- Biodiesel

Biodiesel provides important contributions to the decarbonisation of heavy-duty transport and agricultural equipment. Biodiesel is largely produced from vegetable oils and waste fats and is subject to feedstock price volatility. The market for biodiesel continues to grow steadily due to government policies/myriad incentives supporting biodiesel production and renewable fuel standards.

- Renewable Diesel (HVO)

Renewable diesel is a drop-in fuel and can replace traditional diesel in existing diesel engines and infrastructure, facilitating its uptake in the market. Renewable diesel has superior energy density than traditional diesel and performs significantly better in colder temperatures compared to traditional diesel, positioning it competitively in the market. However, due to the capital-intensive nature of renewable diesel production facilities, the rate of capacity expansions is limited.

- Sustainable Aviation Fuel (SAF)

Sustainable aviation fuel (SAF) is a growing area of interest as a result of decarbonisation targets for the aviation sector and the carbon offset requirements associated with these targets. Long-term offtake contracts with airlines are facilitating investments in SAF, but the limited amount of SAF produced and the high cost of production remain critical barriers to the growth of the SAF market.

- Green Hydrogen

Emerging as a key fuel for deep decarbonization in transport and industry, green hydrogen's lifecycle emissions are low because they are produced by electrolysis using renewable energy. However, it is difficult to fully commercialize green hydrogen as it can currently face high costs to produce and gaps in the necessary infrastructure to allow for widespread usage.

- E-Methanol

E-methanol is becoming widely used in shipping and chemicals due to having lower carbon emissions than conventional fuels. E-methanol is produced using renewable energy and captured CO2 in its production process, making it a more sustainable fuel to be used. E-methanol also faces production cost competitiveness negatively impacted by the challenge of scaling production, as well as being reliant on renewable power for its production.

- Biogas / Biomethane

Biogas and upgraded biomethane can be used in various applications (e.g., to fuel transport and to supply the gas grid) and provide an opportunity to create circular economy models as they enable the use of organic waste. The growth of these products will depend on waste management policy, as well as the efficiency of feedstock collection.

- Synthetic Fuels (E-fuels)

Synthetic fuels (or e-fuels) have the same characteristics as conventional fuels and can therefore be used in existing engines. E-fuels are produced using renewable energy sources and captured carbon and offer the potential for long-term decarbonization. However, the cost to produce e-fuels is high due to the energy consumption required to produce them.

By Production Technology

- Biomass Gasification

Biomass gasification converts biomass (solid) into syngas for producing the fuel. Biomass gasification allows the use of a wide variety of feedstocks (biomass) and integration with Fischer-Tropsch processes. The complexity of the technology and amount of capital required make it difficult to scale.

- Anaerobic Digestion

Anaerobic digestion plays a key role in producing biogas (gas) from organic waste. Anaerobic digestion allows for decentralized energy systems and waste reduction goals. The variability of feedstock and the management of methane emissions both effect the efficiency of anaerobic digestion (AD) operations.

- Fischer-Tropsch Synthesis

The Fischer-Tropsch synthesis converts syngas into liquid hydrocarbons for transportation fuels (diesel and aviation fuels). The Fischer-Tropsch synthesis is important for producing sustainable aviation fuel (SAF) and synthetic diesel fuels. The amount of capital invested in Fischer-Tropsch synthesis and the challenges in optimizing the process add to the competitiveness of Fischer-Tropsch products.

- Power-to-Liquid (PtL)

Power-to-Liquid (PtL) converts renewable electrical energy into liquid fuels (by using hydrogen and captured CO2). Power-to-Liquid (PtL) will play a strategic role in helping to decarbonise aviation and shipping. The economic feasibility of PtL is closely tied to the cost of electricity from renewable sources.

- Power-to-Gas (PtG

Power-to-Gas (PtG) technology converts excess energy from renewable sources into gaseous fuel such as hydrogen or methane. It improves the ability to balance the grid and create energy storage options, but readiness of the infrastructure and energy losses limits its availability on a large scale.

- Electrolysis

Electrolysis plays a vital role in producing green hydrogen from renewable sources of electricity. Advances in technology are reducing production costs through improved efficiency, and to meet projected demand, capacity for producing equipment will need to be expanded.

By Feedstock

- Agricultural Residuals

Residuals like straw and husks provide inexpensive biomass that isn’t food. These residuals can also help generate a secondary economy where income can be created for rural communities through waste valorization. Supplies can vary in consistency based on collection logistics and the season.

- Energy Crops

Energy crops provide a steady source of biomass to sustain biofuel production. The viability of these markets is determined by optimizing yield from plants as well as land allocation policies. As land-use change issues continue to grow, sustainability will become an even larger concern.

- Municipal Solid Waste

Municipal Solid Waste (MSW) creates a sustainable source of biomass for waste-to-fuel conversion. It simultaneously helps to reduce both landfill disposal and greenhouse gas emissions through one solution. Processing economics are affected by effectiveness of sorting and the level of contamination.

- Algae

Algae-based fuel has the potential to be a high-volume biomass source that requires minimal land area to produce. Current research is focused on increasing harvesting and conversion efficiencies to improve commercial viability, as this industry is still in early development stages.

- Industrial Waste Gases

By using industrial emissions, carbon recycling methods can be maximized. Integration with the chemical and steel industries can lead to circular production models. Technology adaptation and efficiency of carbon capture processes will be important factors.

- Water (for electrolysis)

Hydrogen from electrolysis of water depends on the availability of good quality water. Water needs to be available at a low price to keep costs down. Regions with a high quantity of renewable energy sources and fresh water will have a competitive advantage.

- CO₂ Capture

The ability to capture CO₂ is a significant factor in producing synthetic fuels. If carbon is captured from industrial facilities, it is possible to achieve carbon neutrality through the use of synthetic fuels. Developing low-cost carbon capture and storage technologies will continue to be a key strategic goal.

By Application

- Transportation

Road transport has a vast share of carbon-neutral fuel including those that are supported via blending mandates and emission regulations. The trends of electrification may also have long-term implications on fuel mixes.

- Aviation

Aviation is a high-growth end market with limited options in electrification. The use of SAF is supported by regulatory and airline commitments. Premium prices remain a temporary barrier.

- Marine

Maritime regulations supporting decarbonization are increasing the demand for e-methanol and biofuels. International regulations on sulfur and carbon emissions are strengthening the momentum to transit to more carbon-neutral fuels. Infrastructure developments continue to progress.

- Power Generation

Carbon-neutral fuels support the integration of renewable backup and peak load generation. Hydrogen and biomethane are being used more frequently in gas turbines. The cost competitiveness of carbon-neutral fuels versus conventional fuels will have an effect on the rate of adoption.

- Industrial Heating

Hydrogen and biofuels will be increasingly used to provide the high temperature heat necessary for heavy industries. There is increasing pressure from regulations on industrial emissions, which will improve the overall outlook for demand for carbon-neutral fuels. The cost of retrofitting industrial plants will determine timelines for conversion.

- Residential/Commercial Heating

The blending of biomethane into natural gas networks will help to reduce emissions from buildings. The use of policy incentives and carbon pricing mechanisms will encourage the penetration of carbon-neutral fuels. Electrification trends will provide competitive alternatives.

To learn more about this report, Download Free Sample Report

Regional Insights

The three countries of North America (the U.S., Canada, and Mexico) are at the forefront of new technologies due to the strong government support they have received for developing innovative energy resources. The United States leads the continent with its programs that promote the use of biofuels and hydrogen as clean energy sources. Canada is steadily moving towards adopting more clean fuels, while Mexico is a developing nation making an effort to transition its energy system and create a market for renewable energy. In Europe, Germany, the United Kingdom, France, Spain, Italy, and the rest of Europe have developed extensive regulatory frameworks focused on achieving carbon neutrality. Germany, France, and the United Kingdom are considered "Tier 1" countries based on their commitment to investing in hydrogen and sustainable aviation fuels (SAF). Southern and Eastern European countries represent opportunities for Tier 2 growth through the use of funds provided by the EU.

Japan, China, Australia, and New Zealand, South Korea, and India will make up the Asia-Pacific region. China, Japan, and South Korea will contribute to the development of renewable energy technologies as "Tier 1" countries focused on developing hydrogen and biofuels. India and Australia will serve as "Tier 2" high-growth countries supported by the blended mandate for hydrogen and SAF, as well as the strong market for hydrogen-based exports. In South America, Brazil, Argentina, and Others, there is a prominent inclusion of biofuels. Brazil is the global leader in the production of Bioethanol and Biodiesel, while Argentina and surrounding nations are gaining traction through the use of agricultural feedstock for expansion. In the Middle East and Africa, including Saudi Arabia, the United Arab Emirates, South Africa, and the Rest of the Middle East and Africa, there is potential for a major production centre. Saudi Arabia and the United Arab Emirates display significant activity in terms of green hydrogen export and represent Tier 1 investing countries, while South Africa and others are gradually achieving business cases for development of infrastructure as Tier 2 countries.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 2024, Saudi Aramco, TotalEnergies, and the Saudi Investment Recycling Company (SIRC) have agreed to collaborate on a project that will create a Sustainable Aviation Fuel (SAF) production unit in Saudi Arabia. They will be utilizing locally generated feedstocks, such as used cooking oil and animal fat, to produce SAF. This project will aid in reducing aviation emissions through increased production of SAF in Saudi Arabia.

- In November 2023, Neste Corporation announced partnerships with two new distributors (Altens and Bolloré Energy) for the sale and distribution of Neste MY Renewable Diesel™ in France, with planned launch in January 2024. The new partnerships will increase availability of low-carbon fuel solutions and support the reduction of transportation-related emissions through use of high-quality, high-performing renewable diesel fuel in existing fleets.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 6.90 Billion |

|

Market size value in 2026 |

USD 8.20 Billion |

|

Revenue forecast in 2033 |

USD 41.00 Billion |

|

Growth rate |

CAGR of 26.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Neste Corporation, BP plc, Shell plc, and TotalEnergies SE, which are major energy producers diversifying into renewable fuels. Chevron Corporation, Valero Energy Corporation, and Archer Daniels Midland (ADM) |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Fuel Type (Bioethanol, Biodiesel, Renewable Diesel (HVO), Sustainable Aviation Fuel (SAF), Green Hydrogen, E-Methanol, Biogas / Biomethane, Synthetic Fuels (E-fuels)), By Production Technology (Biomass Gasification, Anaerobic Digestion, Fischer–Tropsch Synthesis, Power-to-Liquid (PtL), Power-to-Gas (PtG), Electrolysis), By Feedstock (Agricultural Residues, Energy Crops, Municipal Solid Waste, Algae, Industrial Waste Gases, Water (for electrolysis), CO₂ Capture) and By Application (Transportation, Aviation, Marine, Power Generation, Industrial Heating, Residential & Commercial Heating)

Key Carbon-neutral Fuels Company Insights

Neste Corporation is an established carbon-neutral fuel producer for both Renewable Diesel and Sustainable Aviation Fuel (SAF) through their proprietary NEXBTL technology, which allows for flexible feedstocks such as waste oils and residues. The large production facilities that Neste has established throughout Europe, along with their increasing production capacity of SAF, position Neste at the forefront of meeting global reduction of emissions and transition energy targets. Furthermore, Neste’s global distribution network and the decarbonization requirements set by major transportation and aviation companies allow the company to establish long-term supply contracts with its customers. In addition, ongoing investments in advanced renewable feedstocks and power-to-liquid technologies will help to create a competitive advantage for the company as they further prove to be a leading producer and economist for both near-term and long-term availability of low-carbon fuels.

Key Carbon-neutral Fuels Companies:

- Neste Corporation

- BP plc

- Shell plc

- TotalEnergies SE

- Chevron Corporation

- Valero Energy Corporation

- Archer Daniels Midland (ADM)

- Renewable Energy Group, Inc.

- Gevo, Inc.

- World Energy, LLC

- LanzaJet LLC

- Cargill, Incorporated

- Carbon Recycling International Inc.

- SkyNRG B.V.

- UPM Ltd.

Global Carbon-neutral Fuels Market Report Segmentation

By Fuel Type

- Bioethanol

- Biodiesel

- Renewable Diesel (HVO)

- Sustainable Aviation Fuel (SAF)

- Green Hydrogen

- E-Methanol

- Biogas / Biomethane

- Synthetic Fuels (E-fuels)

By Production Technology

- Biomass Gasification

- Anaerobic Digestion

- Fischer–Tropsch Synthesis

- Power-to-Liquid (PtL)

- Power-to-Gas (PtG)

- Electrolysis

By Feedstock

- Agricultural Residues

- Energy Crops

- Municipal Solid Waste

- Algae

- Industrial Waste Gases

- Water (for electrolysis)

- CO₂ Capture

By Application

- Transportation

- Aviation

- Marine

- Power Generation

- Industrial Heating

- Residential & Commercial Heating

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636