Market Summary

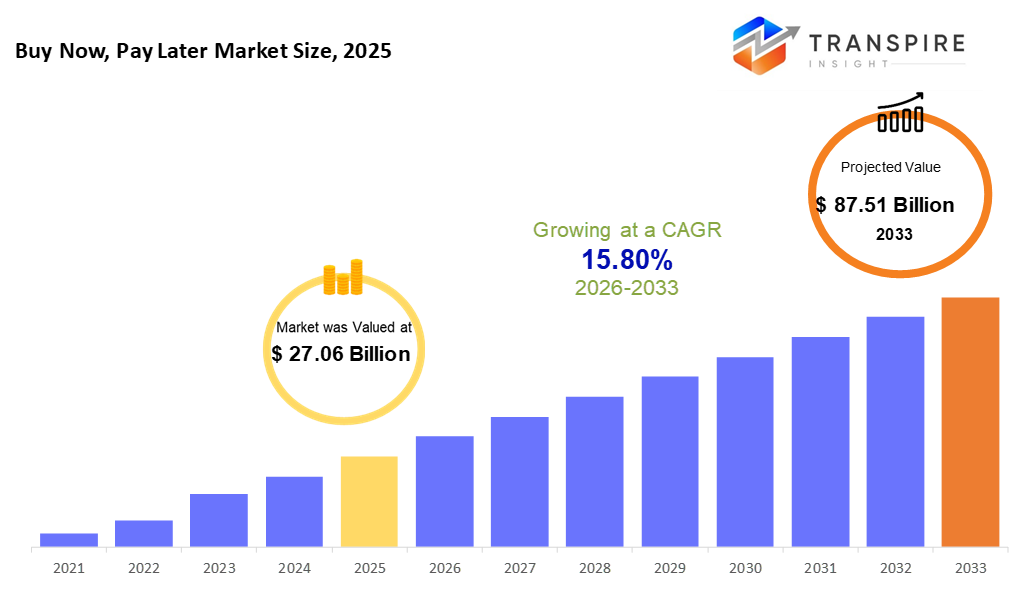

The global Buy Now, Pay Later (BNPL) market size was valued at USD 27.06 billion in 2025 and is projected to reach USD 87.51 billion by 2033, growing at a CAGR of 15.80% from 2026 to 2033. A mix of faster e-commerce adoption plus shifting buyer habits around openness and flexibility in payments. Retailers lean on it because blending into digital and physical stores lifts conversion rates, sometimes even spending per sale. Growth stays steady thanks to real-world fit, not just trends.

Market Size & Forecast

- 2025 Market Size: USD 27.06 Billion

- 2033 Projected Market Size: USD 87.51 Billion

- CAGR (2026-2033): 15.80%

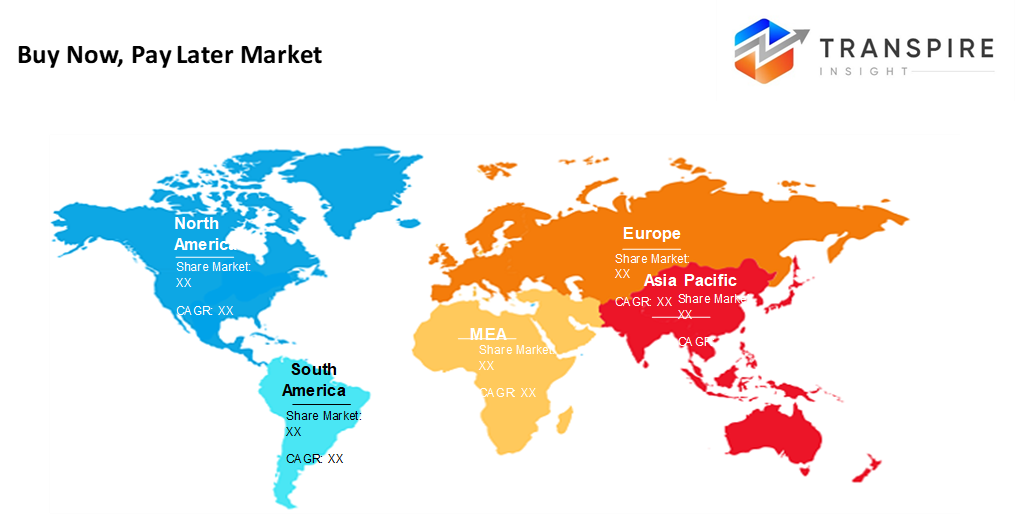

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 37% in 2026. Built right into checkout lines across cities and websites, North America leads the world in buy-now-pay-later usage. Shoppers there tap these plans often, especially when buying online. Stores on main streets, plus digital marketplaces, have made space for it smoothly. This region holds the biggest share simply because people use it more than anywhere else.

- Fueled by surging online shopping, young consumers in the United States lean heavily toward installment plans with no added fees. Tech finance firms team up with big stores across the region, giving them an edge. This trend pushes the country ahead of others nearby. Growth does not slow down; instead, it sets the pace for North America.

- Out here in the Asia Pacific region, digital payments are already deep-rooted. Strong rules back up how people pay online, making things feel safer. Because of this setup, buy-now-pay-later options spread faster than before. Places like China show clear shifts toward these methods. India's move follows close behind with similar patterns taking shape.

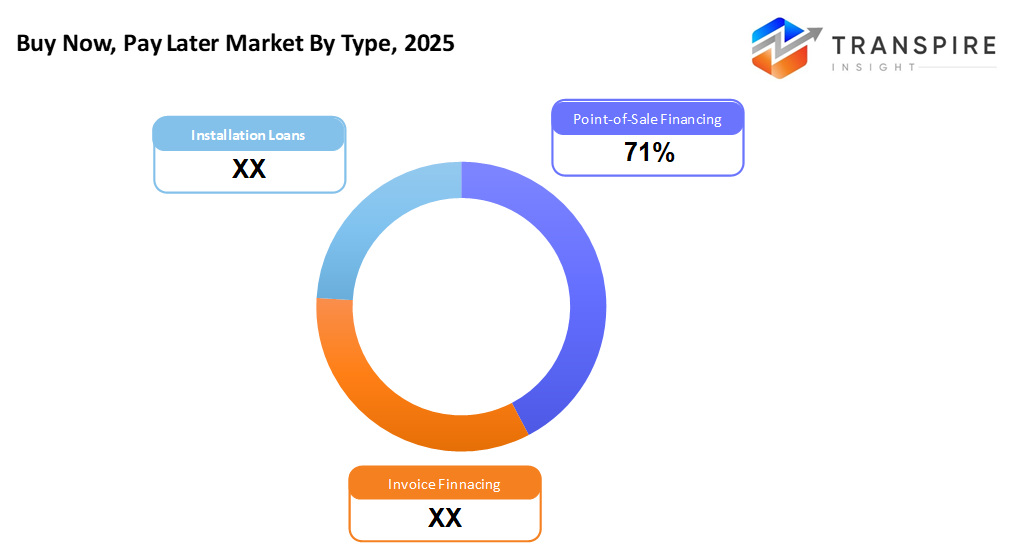

- Point-of-Sale Financing shares approximately 75% in 2026. Even though other options exist, point-of-sale financing keeps gaining ground because it fits smoothly into checkout processes. Shoppers now use it more often, whether they are buying online or walking through store aisles. Growth continues as real-world usage rises across shopping channels.

- Online shops top the list these days because more people buy things online now. Digital payments fit right into that shift without much resistance. Buying stuff through websites feels normal to most folks lately.

- Shoppers online drive most buy now pay later activity. Stores on the internet see it used more than anywhere else because people are buying things every day.

The Buy Now, Pay Later (BNPL) market includes medicines made from living cells, closely matching existing biologic drugs in how safe, effective, and reliable they are, yet usually cheaper. Because these treatments come from biological sources, their production is complicated, needing strict oversight so there’s no real difference in performance versus the original. They are commonly prescribed for illnesses like cancer, rheumatoid arthritis, diabetes, or clotting problems, helping patients access care without high costs. As key biologic drug patents run out across countries, more companies jump in, pushing steady growth in this sector.

Demand for Buy Now, Pay Later (BNPL) is going up because medical expenses keep climbing, serious illnesses are spreading, yet cheaper treatments are needed now more than ever. Since biological drugs usually cost a lot and must be taken for years, hospitals, along with insurers, are pushing similar medicines to save money without losing effectiveness. In cancer care or managing immune system disorders - areas where such advanced meds matter most - the push grows even stronger.

Patent expirations on major biologic meds have opened doors for cheaper copies, giving Buy Now, Pay Later (BNPL) makers a clear shot at the market. On top of that, clearer rules in places like Europe and the US help doctors and patients trust these options more. Because medical staff are getting more familiar with them, acceptance is growing, especially where insurance covers the cost easily.

The market’s getting a boost from better biomanufacturing tools, smarter testing ways, while drug makers team up more often - fueling longer Buy Now, Pay Later (BNPL) lineups. In developing regions, strong potential is opening up as state leaders push cheaper options to get biologics into more hands. Step by step, copycat versions that can swap freely plus steady rule-maker backing should heat up rivalry, widen reach, and keep the Buy Now, Pay Later (BNPL) sector growing down the road.

Buy Now, Pay Later (BNPL) Market Segmentation

By Type

- Point-of-Sale Financing

Right there, when paying online or in person can split what you owe right away. Some stores let you take that route straight at the register. It’s built into how you finish buying things today.

- Invoice Financing

Bills get paid later when companies offer invoice financing. Buyers in business deals can delay payments like a BNPL plan. This setup works behind the scenes for B2B transactions. Payment shifts to future dates with this method. It changes how firms handle outgoing cash.

- Installation Loans

Funds borrowed by shoppers get paid back slowly, split into chunks over set dates. One payment follows another until the amount owed is nothing more.

To learn more about this report, Download Free Sample Report

By Merchant Type

- Online Merchants

Folks running online shops add BNPL options so buyers complete purchases more often. Payment flexibility shows up right when customers decide to pay.

- Offline Merchants

Brick-and-mortar shops where customers can pay later, right when buying. Some retailers let shoppers split payments face-to-face using special checkout devices. Places visited in person now accept buy-now-pay-later through their payment systems. Real-world locations are adding installment options during transactions at registers.

- Installment Loans

Some stores offer buy now, pay later, whether you shop on a website or walk into a physical location. These businesses blend digital and in‑person shopping with flexible payment options available everywhere they sell.

By End-Users

- Retail & E-Commerce

People buying clothes or gadgets online often pay in parts instead of one full amount.

- Travel & Hospitality

Booking trips gets easier when people pay later for plane tickets, stays at lodges, or full holiday plans. Splitting costs helps some manage big expenses without upfront cash. Getting away does not always mean payment follows instead.

- Healthcare

Bills can stretch across time, medicine, teeth fixes, and even check-ups. Money moves slowly sometimes. This way, getting better does not have to wait. Each step taken counts. Peace comes in small payments.

- Automotive

Paying later when customers buy a car or its parts. Sometimes the cost waits while you drive off.

- Others

- Now, schools, power companies, and even repair shops start offering pay-later plans. Some find it easier than upfront costs. Not everyone agrees on whether that helps long-term. Still, the trend keeps growing across daily life needs.

Regional Insights

Growth in North America’s buy-now-pay-later scene looks solid ahead, due to more people using digital money tools, shopping online often, and liking payment plans that bend without breaking. Leading the charge, the United States powers a lively tech-savvy finance network where split-payment options slip neatly into web stores, physical shop registers, and blended shopping setups. Shoppers now lean toward these services instead of old-style credit accounts, pulled by zero-interest splits, clear payback rules, plus quick taps when buying, which keeps demand climbing.

Surprisingly, North America holds the biggest slice of the BNPL world pie. A flood of shoppers there choose buy-now-pay-later options instead of traditional payments. Online shopping keeps rising, giving the model fresh fuel every season. Behind it all sits a web of solid tech systems, making transactions smooth. In that mix, the United States stands out, no question. Countless stores now offer split payment plans at checkout. Digital storefronts often build them right into their flow. One thing remains clear: momentum grows where access meets ease.

Over in Europe, after North America, buy-now-pay-later is gaining real ground. The United Kingdom leads, then Germany, along with several Western European nations embracing it fast. Rules that guard buyers and demand clear terms help people believe in these payment options more. Because of this clarity, usage spreads further across daily shopping habits.

A fresh wave of digital trade sweeps across the Asia-Pacific, fueling shifts in how people pay. Mobile phones now reach nearly every pocket, pushing financial tools into daily hands. In places such as India, China, and much of Southeast Asia, buying online is not new, but paying later is catching on fast. As fintech grows, so does the habit of delaying payments. Underbanked groups find relief in flexibility, gravitating toward services that adapt to them. What was once rare now feels ordinary in bustling urban centers and quiet towns alike.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 21, 2025 – MoneyLash partners with Tabby to launch BNPL for MEA merchants.

(Source: https://intlbm.com/2025/10/21/moneyhash-partners-with-tabby-to-launch-bnpl-for-mea-merchants/

- March 19, 2024 – Galileo launched BNPL post-purchase for credit & debit.

(Source: https://www.galileo-ft.com/news/galileo-launches-bnpl-post-purchase-for-credit-and-debit/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 27.06 Billion |

|

Market size value in 2026 |

USD 31.34 Billion |

|

Revenue forecast in 2033 |

USD 87.51 Billion |

|

Growth rate |

CAGR of 15.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Affirm Holding, Afterpay, Klarna, PayPal, Sezzle, Zip, Splitit, ViaBill, PayU Payment, Clearpay, Apple Pay, Mastercard, ZestMoney, Latitude Group, Visa, and Tabby. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Point-of-Sale Financing, Invoice Financing, Installment Loans), By Merchant Type (Online Merchants, Offline, Omni-Channel Merchants), By End-Users (Retail & E-Commerce, Travel & Hospitality, Healthcare, Automotive, Others) |

Key Buy Now, Pay Later (BNPL) Company Insights

A fresh take on shopping payments started with Klarna, now a top name in buy-now-pay-later services around the world. Instead of upfront costs, buyers get options split over time, thanks to early moves by the company at online checkouts. Big stores and digital marketplaces link up with them so people pay in chunks without extra charges. This ease comes through smooth tech that hooks into websites, shaping choices based on user habits. Decisions about who qualifies rely on careful checks, balancing access with safety behind the scenes. From European roots, it stretched wide, landing firmly in North America too, growing fast wherever shoppers click or walk in-store.

Key Buy Now, Pay Later (BNPL) Companies:

- Affirm Holding

- Afterpay

- Klarna

- PayPal

- Sezzle

- Zip

- Splitit

- ViaBill

- PayU Payment

- Clearpay

- Apple Pay

- Mastercard

- ZestMoney

- Latitude Group

- Visa

- Tabby

Global Buy Now, Pay Later (BNPL) Market Report Segmentation

By Type

- Point-of-Sale Financing

- Invoice Financing

- Installment Loans

By Merchant Type

- Online Merchants

- Offline

- Omni-Channel Merchants

By End-Users

- Retail & E-Commerce

- Travel & Hospitality

- Healthcare

- Automotive

- Others

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

APAC:+91 7666513636

APAC:+91 7666513636