Market Summary

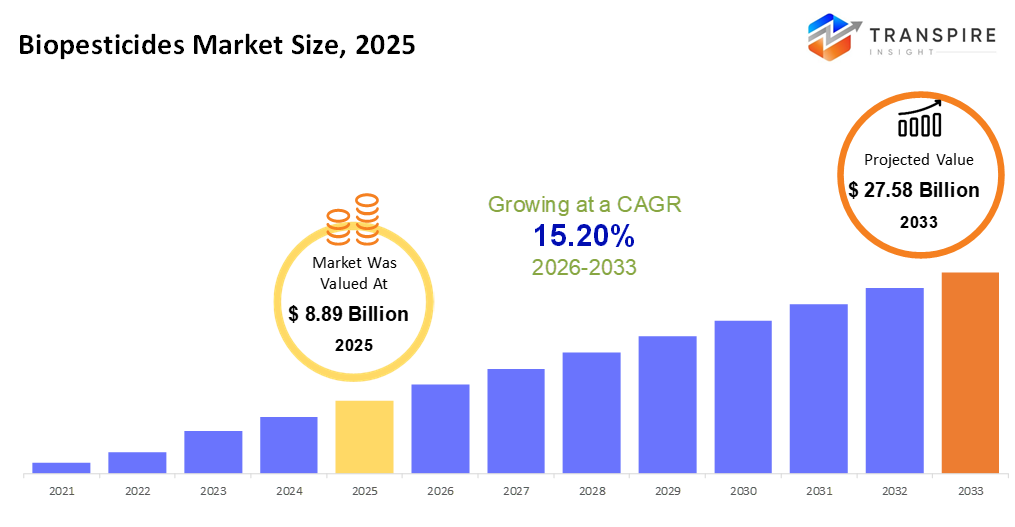

The global Biopesticides market size was valued at USD 8.89 billion in 2025 and is projected to reach USD 27.58 billion by 2033, growing at a CAGR of 15.20% from 2026 to 2033. Fresh concerns about chemical leftovers push more farmers toward natural options, sparking a jump in sales of bug-fighting products made from living stuff or plants. Not long ago, few considered microbes useful; now they’re central players. Rules from officials that back smarter spraying habits add steady pressure on companies to innovate. What once seemed like niche science now spreads through fields worldwide, helped along by tighter food safety rules and clearer labels that shoppers actually read.

Market Size & Forecast

- 2025 Market Size: USD 8.89 Billion

- 2033 Projected Market Size: USD 27.58 Billion

- CAGR (2026-2033): 15.20%

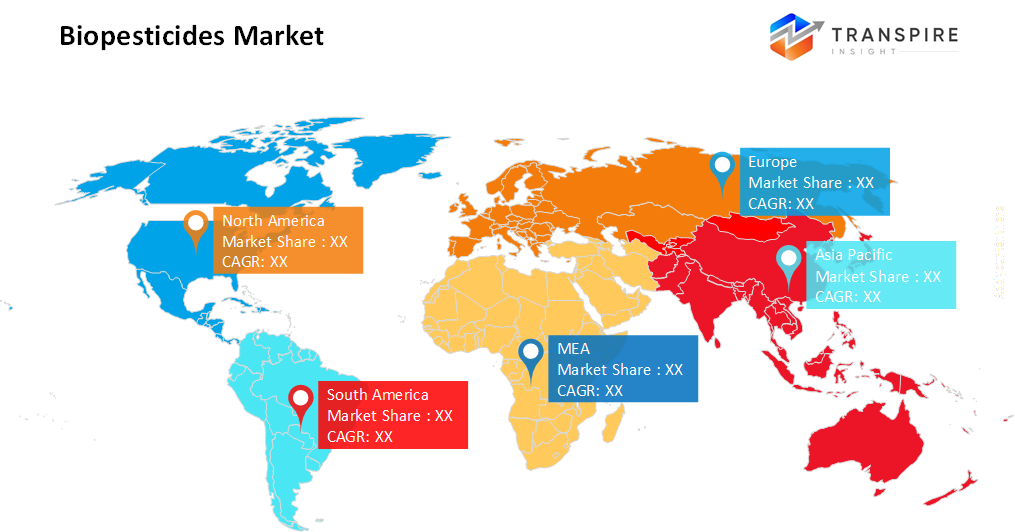

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 37% in 2026. Fueled by steady rules favoring eco-friendly pest methods, North America sees expansion. Widespread use of natural crop safeguards adds momentum across the region.

- Farming in the United States leans heavily on certain inputs, especially where valuable harvests are at stake. Still, rules that back eco-friendly practices help shape how widely these are used across regions.

- Across the Asia Pacific, growth is picking up fast. Awareness around safe food practices keeps growing. Governments are stepping in with support measures. In places like India, China, and parts of Southeast Asia, more people now rely on these methods. Change is visible, steady, unfolding differently in each region.

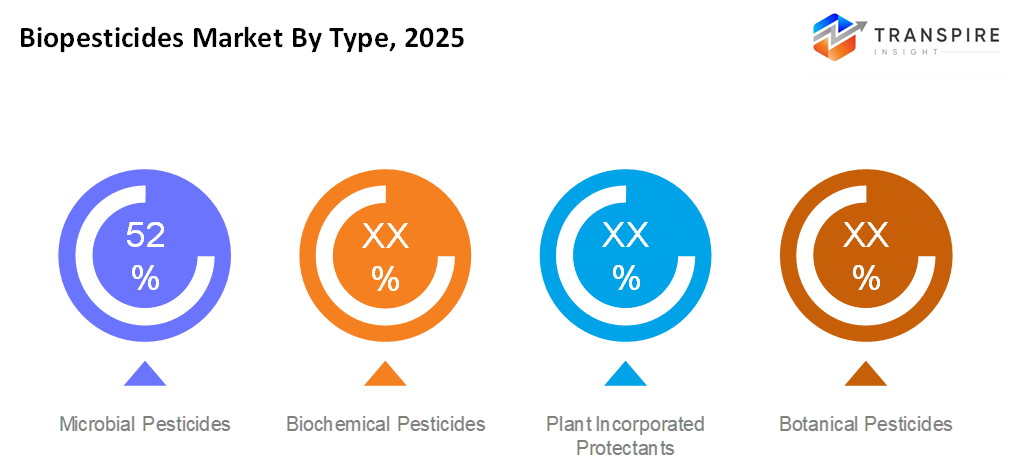

- Microbial Pesticides share approximately 54% in 2026. Besides their strong performance, microbial pesticides are gaining ground because they’re safer for nature. Their widespread use follows naturally from these benefits. Still, effectiveness remains a key reason farmers choose them. On top of that, ecosystems tend to recover faster when these tools replace older chemicals. Over time, trust in these methods has built steadily.

- Bacteria take the lead here. Bacillus types thrive when applied to soil or leaves. Growth peaks where these microbes go.

- Fresh fruits and vegetables see quick gains because rules on leftovers grow tougher, yet people want cleaner options. Though safety pushes matter, shopper habits pull just as hard.

- Farmers still go to retail stores first because they like getting help face-to-face when choosing what to buy.

Farmers are turning more toward natural options instead of synthetic sprays when protecting their plants. From bacteria to botanicals, these solutions come from nature itself - working against pests without leaving behind harmful traces. Instead of broad damage, they aim precisely where needed. Crops like wheat, tomatoes, almonds, and grapes see growing use of such treatments. Even specialty greens benefit quietly under this shift. Soil stays cleaner. Yields stay strong. Quality rises without loud claims. One thing becomes clear: less poison in fields leads to better results down the line.

Fresh breakthroughs in science are widening markets, as better microbes, plant-based mixes, and signal chemicals boost performance, shelf life, or how simply they work. Because these tools now fit real farm needs, growers handle insect threats well without leaning so hard on synthetic sprays. On top of that, simpler packaging and smarter delivery systems help big operations and family-run fields alike bring them into daily use.

Rules help boost demand, since nations back eco-friendly crops while limiting dangerous substances. Support grows as officials offer cash aid, education campaigns, and easier rules so growers switch to natural pesticides. Pressure rises alongside wider moves toward balanced bug control methods, shaping conditions where biological options thrive worldwide.

More people want fruits and vegetables without chemical traces, so they choose organic options. This shift helps bio-pesticides find their way into wider use. Growers now mix these natural solutions into how they handle pests, aiming to pass safety checks and match buyer habits. Driven by care for nature's balance, a stronger push for healthier harvests, and steady improvements in science, this sector keeps expanding. Growth shows no sign of slowing, especially across North America, Europe, and parts of Asia, where farming methods evolve fast.

Biopesticides Market Segmentation

By Type

- Microbial Pesticides

Bugs fighting bugs, tiny life forms help block garden invaders. These natural sprays rely on helpful microbes instead of chemicals. A different kind of shield grows where pests try to spread. Living ingredients do the work quietly, without harsh traces. Not poison, just precise pressure from nature's own balance.

- Biochemical Pesticides

From nature, these pesticides mess with how pests act or grow.

- Plant-Incorporated Protectants

Pest defense is built into plants through genetic changes. These traits show up as natural shields while the crop grows. Protection comes alive inside the plant itself. Not sprayed on, but grown in place where it is needed.

- Botanical Pesticides

Plant‑derived pest control agents are extracted from botanical sources.

To learn more about this report, Download Free Sample Report

By Source

- Bacteria-Based

Pest control agents derived from beneficial bacterial strains.

- Fungi‑Based

Bio‑pesticides sourced from entomopathogenic fungi for insect suppression.

- Virus‑Based

Insect‑specific viral formulations for targeted pest control.

- Plant Extracts

Active pest‑control compounds derived from plant metabolites.

- Semiochemicals

Pheromones and other signaling molecules are used for pest disruption.

By Crop Type

- Cereals & Grains

Farmers grow wheat, rice, and maize using natural pest controls instead of chemicals. These grains stay safer when treated with plant-based sprays. Protection comes from microbes that stop bugs without harming the soil. Each season, more fields rely on these methods. Crop safety improves without synthetic residues. Even large harvests now include eco-friendly options. Nature-inspired solutions are changing how staples are grown.

- Fruits & Vegetables

Bio‑pesticide adoption in high‑value horticultural crops.

- Oilseed & Pulses

Pests show up in soybeans, then mustard fights them too. Crops such as pulses face bugs that slow growth down. Farmers watch closely when plants start to flower. Insects arrive most often at warm stages of growth. Some seeds resist pests before they sprout. Others rely on timing to escape damage. Each season brings different pressure from beetles or worms. Control methods shift with weather patterns across regions.

- Turf & Ornamentals

Pest management for ornamental landscapes and sports turf.

- Others

Bio‑pesticide utilization in specialty and minor crops.

By Distribution Channel

- Direct Sales

Farmers buy straight from the maker, cutting out middle players. Sometimes it skips several steps at once. This route often changes how prices are set down the line.

- Retail Stores

Traditional agro stores sell branded bio‑pesticide products.

- Online Stores

E‑commerce platforms offering bio‑pesticides to farmers.

- Agri Service Providers

Farm support comes through consultants who guide planting choices, while separate companies handle pest control treatments. Some experts recommend certain products based on field conditions, while others apply solutions directly across growing seasons.

Regional Insights

The North American Biopesticides market leads worldwide. This comes down to the United States (tier-1), where key biologic patents are ending, rules from the FDA make approvals smoother, and medical systems can handle new treatments well. Meanwhile, Canada (tier-2) helps push expansion forward because hospitals are using more Biopesticides and insurance plans cover them better now. A lot of people here deal with long-term or immune-related conditions, so demand stays high; doctors and insurers trust these drugs, making it easier for similar versions of cancer antibodies to spread quickly.

Europe’s a big market too; Germany, France, and the United Kingdom take the lead because rules and budget pressures push cheaper copycat drugs. Meanwhile, nations like Spain, Italy, or the Netherlands see rising use since hospitals swap costly treatments for affordable options. Backed by early approval paths, doctors trust these alternatives more; bidding setups in clinics boost their spread, especially for cancer, immune issues, and blood conditions.

The Asia Pacific area is changing fast. Japan, China, and South Korea (top-tier) lead because more people face long-term health issues, hospitals are spreading, and patients find care easier to reach. In second-level spots like India, Australia, plus Southeast Asian regions, growth comes from making products locally, getting state support, while knowledge about cheaper options instead of biologic drugs goes up. On the flip side, Latin America, along with the Middle East & Africa stay minor player yet hints at room to grow, especially in leading nations such as Brazil, Mexico, the United Arab Emirates, and South Africa, thanks to better medical systems, looser rules for approvals, spending on health services, and pushing interest in similar biological treatments.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 29, 2025 – Indovinya unveils new formulation platform to accelerate biopesticides adoption

- August 1, 2025 – Kan Biosys launched ROFA™ specialty fertilizers & need-based crop protection products for a healthier, profitable farming future.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 8.89 Billion |

|

Market size value in 2026 |

USD 10.25 Billion |

|

Revenue forecast in 2033 |

USD 27.58 Billion |

|

Growth rate |

CAGR of 15.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Bayer CropScience, Syngenta AG, BASF SE, UPL Limited, ADAMA Ltd., Valent BioSciences LLC, Certis USA LLC, Marrone Bio Innovations, Andermatt Biocontrol AG, Valagro SpA, Isagro SpA, Sumitomo Chemical Co., Ltd., Koppert Biological Systems, Arysta LifeScience (now part of UPL), Tessenderlo Group, and Bioworks Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Microbial Pesticides, Biochemical Pesticides, Plant-Incorporated Protectants, Botanical Pesticides) By Source(Bacteria-Based, Fungi-Based, Virus-Based, Plant Extracts, Semiochemicals) By Crop Type (Cererals & Grains, Fruits & vegetables, Oilseed & Pulses, Turf & Ornamentals, Others) By Distribution Channel (Direct Sales, Retail Stores, Online Stores, Agri Service Providers) |

Key Biopesticides Company Insights

Beyond fields and farms, one name stands out in natural pest control: Bayer CropScience shapes how growers guard their plants without harsh chemicals. Moving through gardens and grain belts alike, it brings tools made from living microbes, plant extracts, and nature-based compounds. Not every big firm looks beyond synthetic sprays, yet here effort flows into greener ways to shield harvests. Year after year, labs hum with tests meant to boost performance, shelf life, and even handling simplicity for these biological shields. From Europe to Asia, North America to Africa, supply lines stretch far, touching soil where corn rises, vines climb, orchards bloom, and specialty crops thrive. What sets motion forward is not just reach but mindset: blend tactics, respect ecosystems, and favor balance over brute force when pests appear.

Key Biopesticides Companies:

- Bayer CropScience

- Syngenta AG

- BASF SE

- UPL Limited

- ADAMA Ltd.

- Valent BioSciences LLC

- Certis USA LLC

- Marrone Bio Innovations

- Andermatt Biocontrol AG

- Valagro SpA

- Isagro SpA

- Sumitomo Chemical Co., Ltd.

- Koppert Biological Systems

- Arysta LifeScience (now part of UPL)

- Tessenderlo Group

- Bioworks Inc

Global Biopesticides Market Report Segmentation

By Type

- Microbial Pesticides

- Biochemical Pesticides

- Plant-Incorporated Protectants

- Botanical Pesticides

By Source

- Bacteria-Based

- Fungi-Based

- Virus-Based

- Plant Extracts

- Semiochemicals

By Crop Type

- Cererals & Grains

- Fruits & vegetables

- Oilseed & Pulses

- Turf & Ornamentals

- Others

By Distribution Channel

- Direct Sales

- Retail Stores

- Online Stores

- Agri Service Providers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636