Market Summary

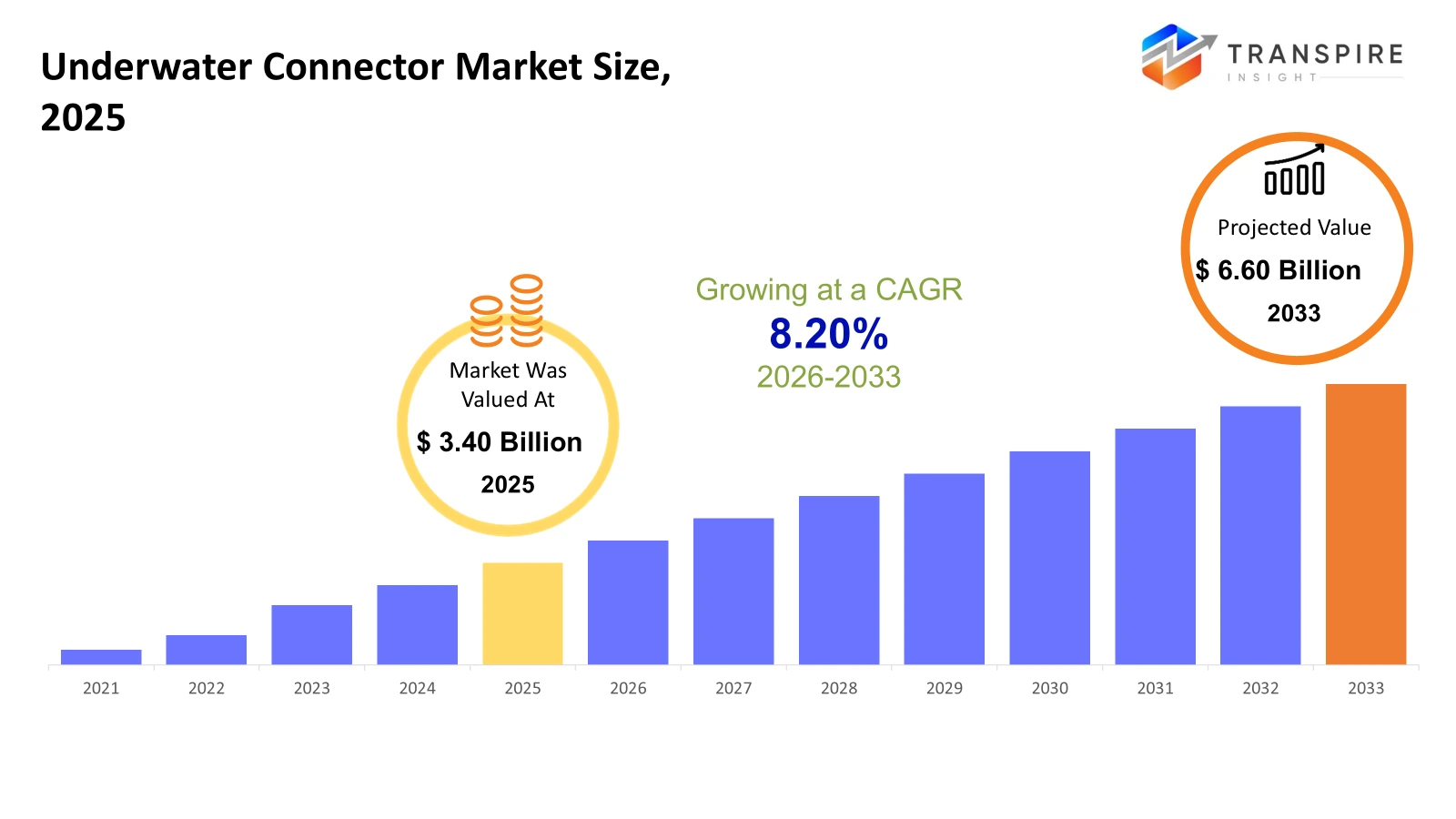

The global Underwater Connectors market size was valued at USD 3.40 billion in 2025 and is projected to reach USD 6.60 billion by 2033, growing at a CAGR of 8.20% from 2026 to 2033. Not far off, underwater connectors see a steady climb as needs rise in ocean-based oil work, deep-sea research, plus clean energy setups. Equipment used below the surface gains ground - not just for signals but also for electricity flow and linking sensors into systems. New materials that fight rust, better seals under crushing depths, smarter plug shapes, all these push momentum forward past earlier limits. Growth keeps pace, backed by tech shifts expected to hold firm until 2033.

Market Size & Forecast

- 2025 Market Size: USD 3.40 Billion

- 2033 Projected Market Size: USD 6.60 Billion

- CAGR (2026-2033): 8.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 38% in 2026. From coast to coast, fresh ideas shape how connectors are built, checked, and tested, using new substances. Power plants lean on these updates, so do military setups, and factories rely on them too.

- Fueled by deepwater drilling, America's demand grows. Subsea innovations push progress forward. Tough jobs need tough parts. Dependability matters most out there. Performance can not slip under pressure.

- Fueled by rising offshore digs, undersea buildouts, and renewables push, Asia Pacific pulls ahead in making things and using them. While others lag, its mix of new energy plans plus industrial muscle keeps it out front - quietly setting pace.

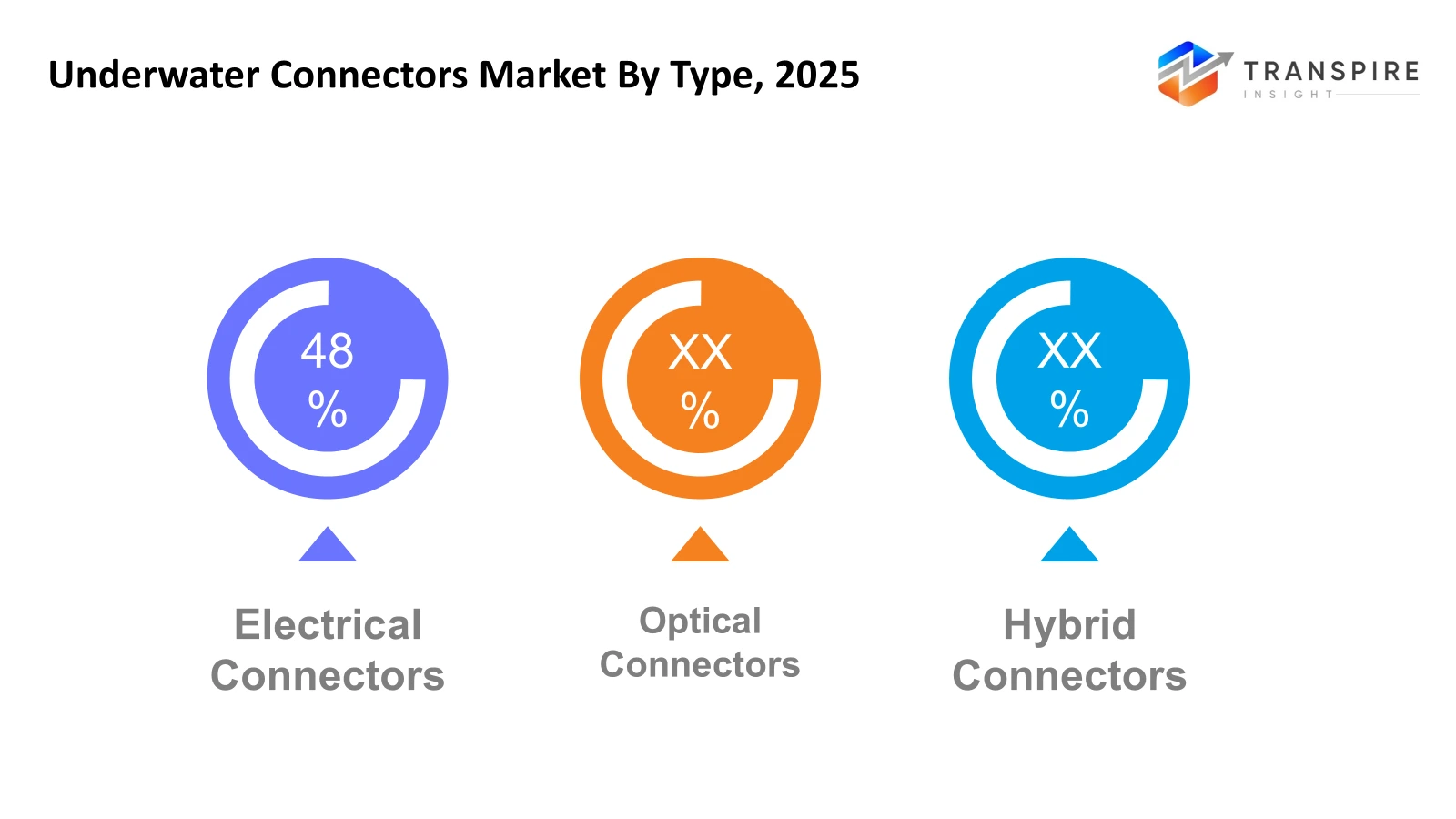

- Electrical Connectors share approximately 50% in 2026. Out at sea, electrical connectors show up most they carry power underwater. Not just that, these links handle basic signals too. Think oil rigs, think ships: both rely on them heavily. Even where things move slowly, like data pulses under waves, they stay in play. Their reach stretches far because industries trust what they do.

- Offshore work pushes into deeper zones, and performance under pressure matters more now. High-stakes environments demand parts that hold firm, without fail. Reliability becomes non-negotiable when systems run below the surface, far from reach. Tough conditions favor designs built to last, tested beyond standard runs. Projects stretch further out; only robust links keep operations steady. Deepwater settings reshape what strong means in hardware terms.

- When saltwater and tough conditions mix, certain metals hold up better over time. These materials resist rust, lasting longer than others that fail. Undersea settings often call for such strength. Durability matters most when the surroundings eat away at everything else.

- Heavy-duty connectors matter most when drilling deep below the sea floor. Because underwater work demands reliability, pipeline networks depend on them just as much as exploration does. Equipment built to handle pressure keeps operations moving - without it, progress stalls. Tough conditions call for precision engineering every single time.

Beneath the waves, more advanced systems now rely on durable connectivity to remain powered and operational fueling steady growth in the underwater connectors market. In environments where saltwater pressure intensifies and corrosion spreads quickly, ordinary connectors simply cannot perform. From remotely operated vehicles and subsea robotics to offshore oil and gas platforms, equipment must maintain uninterrupted communication and power transmission.

As operations move deeper and extend over longer durations, components must withstand extreme pressure and harsh marine conditions without maintenance access. Reinforced housings, advanced sealing technologies, and corrosion-resistant materials ensure signal integrity where failure is not an option. Pressure exposes structural weaknesses, and even minor design flaws can cause significant disruptions far below the surface. Because underwater equipment often operates continuously, connectors must deliver long-term reliability without interruption.

New tech is changing how the market works. Because materials resist rust better, the gear lasts longer underwater. Seals have gotten tighter, which helps devices handle extreme pressure below the surface. Smart parts now include built-in sensors that track performance without extra wiring. Instead of fixed units, companies use pieces that fit together like blocks, making repairs easier. Thanks to faster attachment methods, swapping components takes less time during deep-sea tasks. With these changes, work underwater runs more smoothly, and costs go down. Fewer breakdowns happen when systems must perform in tough conditions far beneath the waves.

Offshore renewables keep gaining ground, pushing subsea wind projects into faster development. Power must travel from turbines to shore that job falls to underwater connectors linking everything together. Monitoring systems rely on those same links, making them vital for upkeep and oversight. Machines move below the surface more often now, driven by AUVs and ROVs working in science, security, or industry. Sensors down there multiply too, expanding what these networks can do. As uses shift and grow, makers adjust their designs accordingly. Each task brings new demands, met with tailored connection hardware built for real conditions. Progress is not just about scale anymore; it’s shaped by purpose.

New ideas keep surfacing as firms push ahead through fresh approaches, team up in smart ways, or lock into lasting deals. What drives top makers forward is not just funding labs but sharpening how materials behave, refining build accuracy, and meeting tough safety bars. Working alongside ocean drillers, military branches, and wind developers brings custom answers shaped by real-world demands. With more tasks unfolding beneath waves - whether fuel runs deep, nations guard coasts, or scientists explore the need holds steady for gear that works when it must, built sharp, wired clever, ready for what comes next.

Underwater Connectors Market Segmentation

By Type

- Electrical Connectors

Power links under the sea handle energy flow plus basic signal tasks. These pieces join parts so the machines below stay connected without fuss. They work where water pressure is high, keeping connections safe and steady.

- Optical Connectors

Fiber links run deep below the seas using light-guided plugs that pass signals fast. These glass-tipped joints carry streams of info where cables stretch under waves. Light moves without wires thanks to tiny channels sealed inside durable housings. Speed stays high even across long distances under saltwater pressure. Such fittings link faraway points by guiding beams through flexible strands.

- Hybrid Connectors

A mix of pathways lets energy move alongside light signals in one setup. What you get is both electricity and information flowing at once. Power travels through metal parts while data rides on beams inside glass threads. This blend fits systems needing speed plus supply without separate lines. Each unit links everything neatly into a single frame.

To learn more about this report, Download Free Sample Report

By Pressure Rating

- Shallow Water Connectors

These connectors work in shallow zones along coasts where pressure stays low. Built for short-range underwater tasks close to shorelines. Handle mild conditions found just off the coastline. Fit jobs that don’t need heavy-duty sealing. Made light, yet strong enough for gentle environments.

- Deepwater Connectors

Under heavy loads, deepwater connectors hold firm during offshore work below the surface. Tough by design, these pieces manage extreme conditions found under the sea. Pressure means little when each joint is made to resist crushing depths. Submerged setups rely on their strength day after day. Not every part can handle such stress, but these do.

- Ultra-Deepwater Connectors

Engineered for extreme-depth operations in harsh subsea environments.

By Material

- Corrosion-Resistant Alloys

Underwater, salt water can eat away at most metals - except these alloys stand up to it well. Tough by design, they last long where ocean currents never stop pushing. Not all materials handle seawater; yet corrosion-resistant types thrive despite constant soak. When submerged gear must endure, such alloys answer without failing.

- Stainless Steel

Often it is stainless steel. This material works when you need some strength, yet not extreme. Corrosion does not win easily here. Not the toughest option out there. Still, for everyday jobs beneath the waves, many pick this metal. It resists rust well enough. Strength stays decent. Nothing fancy, just reliable.

- Composite Materials

Lightweight composites bring strength where it matters most. Their design fits tough ocean tasks without adding bulk. Built for pressure, they perform deep below the surface.

By End-Users

- Oil & Gas

Floating platforms tap deep-sea resources, relying on sturdy links to send energy and data ashore. Wires snake through saltwater, feeding information while handling heavy loads below waves. Machines drill into rock beneath the ocean floor, powered by connections that resist pressure and rust.

- Renewable Energy

Suddenly, renewable energy powers machines beneath the waves. Wind turbines stand tall on ocean floors, catching flow instead of breeze. Tidal generators hum along coastlines, turning push and pull into electricity. Wires stretch below the surface, moving power from deep sources to land. This network runs day and night without stopping.

- Marine & Defense

Underwater drones, autonomous subs, warships - each relies on these systems below the surface. Equipment lives where saltwater presses hard, mission after mission.

- Industrial & Research

Out at sea, tools used in science and industry gather information through underwater systems. These devices work deep below, watching changes and sending details back. From research teams to factory sites, they rely on smart gear that stays down long term. Monitoring happens quietly beneath waves, feeding facts to those who need them.

Regional Insights

Offshore work speeds up across the Asia Pacific, pushing growth in underwater tech markets. Deepwater drilling gets big backing from nations such as China and Japan, because reliable power links matter more now. Subsea networks spread further thanks to rising energy needs below the waves. Advanced connectors see higher demand not just for oil but also for green projects under the sea. Australia joins the push, building systems that handle tough ocean conditions.

Offshore rigs dot the coastline, due to steady progress in underwater tech across the United States, driven by North America. Growth ticks forward not from flashiness but reliability seen in rugged connectors built for tough energy and military uses. Progress hums quietly here, powered more by testing labs than bold claims. Innovation does not shout; it runs deep beneath waves and wires.

Offshore wind gives Europe a boost; meanwhile, subsea energy work keeps momentum going. In the Middle East and across Africa, money flows into oil and gas systems, slowly building scale. Down in Latin America, new deepwater hunts push the need higher, as tough underwater links become essential. Growth ticks up there, too.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 20, 2026 – Leading underwater connector manufacturer advances marine technology with specialized solutions.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.40 Billion |

|

Market size value in 2026 |

USD 3.80 Billion |

|

Revenue forecast in 2033 |

USD 6.60 Billion |

|

Growth rate |

CAGR of 8.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

E Connectivity, Amphenol Corporation, MacArtney Underwater Technology, SEACON Products, Inc., Oceaneering International, SubConn (by Curtiss‑Wright), JDR Cable Systems, Trelleborg Marine & Offshore, Hydralics International, Fugro, Kongsberg Maritime, Eaton Corporation, HUBER+SUHNER, LEMO SA, Smiths Connectors, Axon Cables, and Allectra Systems |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Electrical Connectors, Optical Connectors, Hybrid Connectors), By Pressure Rating (Shallow Water Connectors, Deepwater Connectors, Ultra-Deepwater Connectors), By Material (Corrosion-Resistant Alloys, Stainless Steel, Composite Materials), By End-Users (Oil & Gas, Renewable Energy, Marine & Defense, Industrial & Research) |

Key Underwater Connectors Company Insights

Out at sea, where conditions turn tough, one name stands out: TE Connectivity. Their gear keeps signals strong under crushing depths. Built to last, these connectors laugh off rust thanks to smart material choices. Pressure that would wreck ordinary parts means nothing here. Each piece undergoes brutal checks before ever touching water. Engineers sweat every tiny detail so performance never slips. Power flows steady, data moves clean - even miles below the surface. Deep ocean jobs demand precision; they deliver without fuss. Innovation is not just claimed; it shows up in every seal, fit, and finish.

Key Underwater Connectors Companies:

- E Connectivity

- Amphenol Corporation

- MacArtne

- Underwater Technology

- SEACON Products, Inc.

- Oceaneering International

- SubConn (by Curtiss‑Wright)

- JDR Cable Systems

- Trelleborg Marine & Offshore

- Hydralics International

- Fugro

- Kongsberg Maritime

- Eaton Corporation

- HUBER+SUHNER

- LEMO SA

- Smiths Connectors

- Axon Cables

- Allectra Systems

Global Underwater Connectors Market Report Segmentation

By Type

- Electrical Connectors

- Optical Connectors

- Hybrid Connectors

By Pressure Rating

- Shallow Water Connectors

- Deepwater Connectors

- Ultra-Deepwater Connectors

By Material

- Corrosion-Resistant Alloys

- Stainless Steel

- Composite Materials

By End-Users

- Oil & Gas

- Renewable Energy

- Marine & Defense

- Industrial & Research

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636