Market Summary

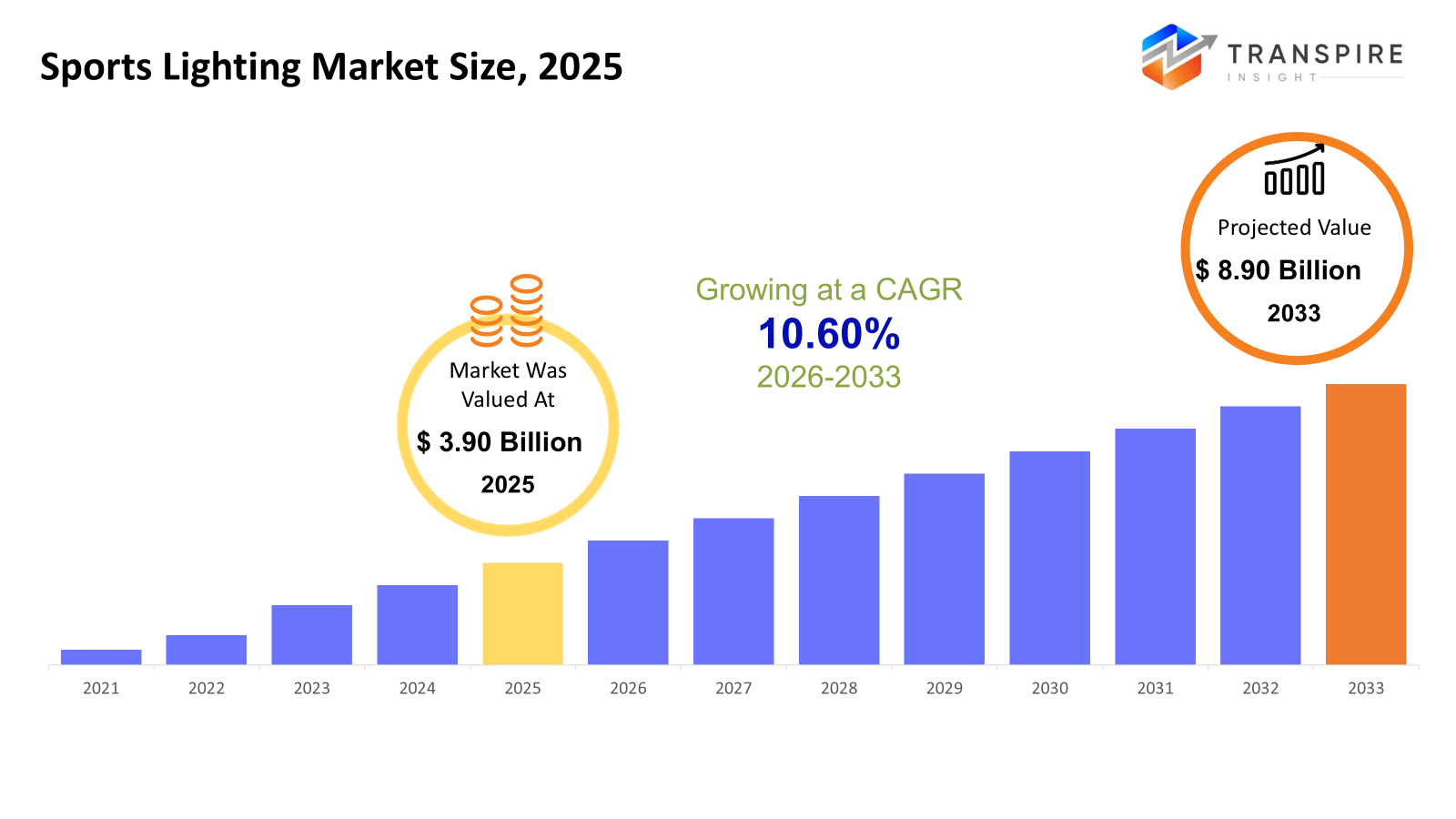

The global Sports Lighting market size was valued at USD 3.90 billion in 2025 and is projected to reach USD 8.90 billion by 2033, growing at a CAGR of 10.60% from 2026 to 2033. Brighter lights powered by LEDs now lead the field, thanks to lower power needs, sharper visibility, and stronger durability. Big venues keep upgrading, fueled by fresh funding for courts, tracks, and halls. Still, steep initial bills plus complications when updating older sites slow things down.

Market Size & Forecast

- 2025 Market Size: USD 3.90 Billion

- 2033 Projected Market Size: USD 8.90 Billion

- CAGR (2026-2033): 10.60%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 49% in 2026. Fueled by modern facilities, North America holds a leading edge. Smart lighting spreads fast across college and pro sports arenas here. Progress rides on high-performance setups. Energy-saving tech finds steady ground in stadiums. Demand stays firm thanks to upgraded systems. Growth links closely with reliable networks. Adoption climbs where technology meets sport.

- Still leading across North America, the United States pumps heavy funding into modernizing stadiums while quickly rolling out LED setups paired with smart controls for lights.

- Fastest gains happen across the Asia Pacific. Growth rides on new sports facilities going up fast there. Government efforts help move things forward. Big spending on updated lights for major games adds momentum, too.

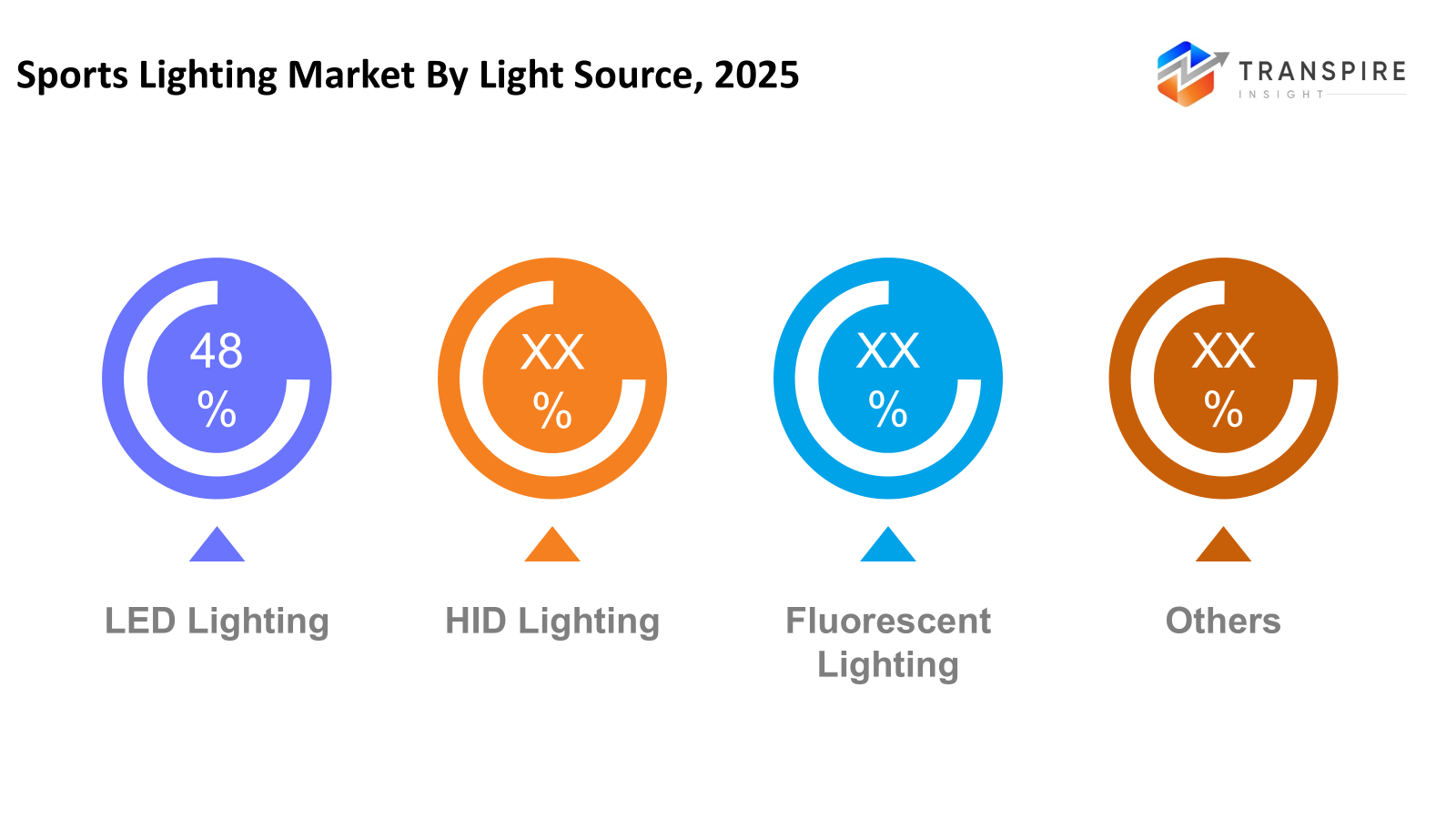

- LED Lighting shares approximately 49% in 2026. Light pours through LEDs more often these days because they sip power while lasting years beyond older bulbs. Venues keep choosing them because efficiency pulls weight here. Longer life means fewer changes, less hassle over time. Their rise is not sudden; it builds on steady performance, quiet savings. Older forms of light fade where brightness meets endurance.

- Flood lights keep leading the pack when it comes to stadium brightness. Their strong, even glow fits massive outdoor arenas just right. Because they shine so widely and consistently, these fixtures handle big spaces without trouble.

- Fans see better when lights shine bright at big sports spots. This need pushes stadiums and arenas ahead of others. A rising push for sharp, clear lighting like what TV crews use.

- Starting strong, pro teams push ahead because better lights mean sharper TV shots plus reliable field visibility. Their spending sets the pace others follow when upgrading venues.

Lights on fields now change slowly but surely, since venues want better vision for athletes, fans, and cameras. Brightness spreads evenly when new setups go in, cutting harsh shine while directing light exactly where needed. These upgrades follow strict rules meant for professional play. As a result, the sports lighting market is evolving with smarter fixtures transforming both outdoor arenas and indoor stadiums. Outdoors or under a roof, brighter spaces begin feeling different as advanced lighting solutions take over.

Brighter days for stadiums started when lights began lasting years longer. Because they need fewer repairs, teams now switch less often during busy seasons. Instant start times help games move faster after delays. Older bulbs fade fast, but these stay strong under pressure. Facilities notice savings piling up quietly over time. With each upgrade, carbon output drops without slowing performance down. Tough conditions do not scare them; they keep shining through rain or heat. Long-term thinking fits better when gear does more with less energy.

Flickering into view, tech upgrades push the market forward. Smart lighting hooks up with automated systems. Because lights can now dim themselves, be watched from afar, or shift brightness depending on what’s happening, those running venues save power without slowing down. When practice drills kick off, the system knows how to adjust; during live games or TV shoots, it switches mode just right.

Fueled by fresh funding, sports venues are upgrading their setups, lighting, and gaining traction as a key upgrade when new safety rules kick in. When brightness and clarity matter during play, operators lean on steady, adaptable fixtures that will not falter mid-game. With sturdiness now non-negotiable, top-tier lights stick around longer, feeding consistent demand across stadiums and fields alike.

Sports Lighting Market Segmentation

By Light Source

- LED Lighting

Lights that last longer while using less power can change how courts and fields are lit. What matters most shows up clearly under these bright setups. Control gets easier when adjustments respond exactly where needed. Long-term savings come through fewer replacements over time.

- HID Lighting

Lights that shine really bright are often found lighting up big open-air sports fields from way above. They have been around a while, doing one job well without much fuss.

- Fluorescent Lighting

Flickering tubes often hang above gym floors where steady light matters without draining budgets. Bright rows fill low ceilings, spreading even glow across courts where games unfold quietly at night.

- Others

Football fields lit by drone swarms. Ice rinks glowing under magnetic induction strips. Hover courts powered by motion-sensitive LEDs. Underwater arenas brightened with submersible laser arrays. Desert tracks illuminated through solar-charged fiber nodes.

To learn more about this report, Download Free Sample Report

By Lighting Type

- Flood Lights

Flood lights pour a strong light across big open spaces. Where games happen outside, they brighten every corner. Stadiums rely on them when daylight fades. Brightness spreads evenly, reaching edges and stands alike.

- High-Bay Lights

Floodlit spaces rise above where ceilings soar, built for courts under vast roofs. Lighting reaches far upward, meant for stadiums with tall walls stretching skyward.

- Area Lights

Flooded zones get lit by area lights, mainly seen across fields where games happen, along with nearby spaces needing visibility. These fixtures spread broad illumination, handling large outdoor sections without relying on multiple smaller sources. Their placement often follows the shape of courts or tracks, ensuring even coverage beyond just the main play zone.

- Linear Lights

Along straight paths, light spreads evenly across practice areas and indoor playing zones. Where space stretches out, brightness stays consistent without dark spots between fixtures.

By Application

- Stadium & Arenas

Floodlights blaze above playing fields, ensuring every move stays visible on screen. Brightness must match strict rules for pro games, so shadows never interfere. Where athletes compete under watchful cameras, light quality cannot slip. Clarity matters most when millions are watching frame by frame.

- Training Grounds

Built for drills, the space uses practical lights that save power during daily workouts. Lighting stays sharp yet efficient, matching the rhythm of routine training. Every fixture works hard without wasting energy, keeping sessions smooth. Efficiency drives the setup, supporting repetition and skill building. The glow stays steady, designed around movement and flow.

- Recreational Sports Facilities

Adopt cost-effective lighting solutions for community and leisure sports.

- Educational Institutions

Buildings where learning happens need long-lasting light solutions for playing fields. Strong lamps work better outdoors at high schools. College stadiums benefit when fixtures handle the weather well. Lasting brightness helps night games stay clear. Tough bulbs cut maintenance needs across campuses.

By End-Users

- Professional Sports Clubs

Lights matter when games are on the line. High-level teams choose stronger setups so matches stay clear under cameras. Brightness shifts happen without warning during night events. Some stadiums upgrade quietly, others make announcements. Visibility needs to change fast when rules shift. Broadcast crews demand steady output across fields. Clubs adjust because shadows can hide key moments. Technology moves ahead whether clubs follow or not.

- Educational Institutions

Deploy lighting solutions to support student sports and physical education programs.

- Municipal Authorities

Install sports lighting for public stadiums and community sports facilities.

- Sports Associations

Light spills onto fields when associations install new lamps. Tournaments stretch into evening hours due to steady beams overhead. Practice drills continue past sunset because power reaches every corner of the grounds. Events unfold without delay under bright, reliable coverage.

Regional Insights

Most stadiums across North America have updated their lights recently. Energy savings matter a lot there, so brighter LEDs now replace older types. Renovations happen often thanks to active pro leagues pushing upgrades. Safety rules also push teams toward better illumination. In Europe, regulations shape how courts and fields are lit. Smart controls link into lighting setups more frequently than before. Performance demands grow alongside tech improvements. Older facilities get modern gear during refits. High expectations drive choices in both places.

Out here, more people are joining team games. New fields pop up where old ones stood before. Across cities, lights switch on smarter than ever seen prior. Nations aim higher when hosting big matches now. Brighter setups follow fresh construction waves. Progress marches forward without needing loud announcements. Standards shift as tech moves in quietly. Stadiums transform while attention grows stronger.

Fueled by rising sports programs, parts of Latin America see more lights going up in neighborhoods. Where schools and stadiums grow, so does the need for steady, affordable lighting. Across Africa and the Middle East, new construction quietly pushes similar demands. Progress in cities brings longer-term chances for simpler technologies to take root. Modern builds keep opening doors where basic needs still shape choices.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 27, 2025 – Access fixtures launched the Best LED sports light for 2026.

- June 10, 2025 – Bajaj redefines sports lighting at MCA Pune stadium.

(Source:https://www.manufacturingtodayindia.com/bajaj-redefines-sports-lighting)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.90 Billion |

|

Market size value in 2026 |

USD 4.40 Billion |

|

Revenue forecast in 2033 |

USD 8.90 Billion |

|

Growth rate |

CAGR of 10.60% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Signify Holding, Musco Sports Lighting LLC, Acuity Brands Lighting Inc., Eaton Corporation (Ephesus Lighting), Hubbell Incorporated, GE Current (GE Lighting), Cree Lighting (Cree, Inc.), Zumtobel Group AG, OSRAM Licht AG, LEDVANCE GmbH, Qualite Sports Lighting LLC, Techline Sports Lighting, AAA-LUX B.V., Valmont Industries, Abacus Lighting Ltd, AEON LED LLC, and Canara Lighting Industries Pvt. Ltd |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Light Source (LED Lighting, HID Lighting, Fluorescent Lighting, Others), By Lighting Type (Flood Lights, High-Bay Lights, Area Lights, Linear Lights), By Application (Stadium & Arenas, Training Grounds, Recreational Sports Facilities, Educational Institutions), By End-Users (Professional Sports Clubs, Educational Institutions, Municipal Authorities, Sports Associations), |

Key Sports Lighting Company Insights

One name stands out when talking about lights for big games: Signify Holding. Lights that brighten huge fields and indoor courts come from this firm, built using modern LED tech. Quality shines through every beam they produce, while saving power remains a top priority. Because TV crews need perfect visibility, these systems follow strict performance rules. Smart features let managers adjust brightness based on real-time needs. New ideas drive their progress, especially those lowering environmental impact. Trust grows slowly, yet many global teams now rely on it. Stadium owners pick them again, not because of flashy ads, but steady results. Long-lasting bonds form when gear works night after night. Across continents, facilities run smoother under their glow.

Key Sports Lighting Companies:

- Signify Holding

- Musco Sports Lighting LLC

- Acuity Brands Lighting Inc.

- Eaton Corporation (Ephesus Lighting)

- Hubbell Incorporated

- GE Current (GE Lighting)

- Cree Lighting (Cree, Inc.)

- Zumtobel Group AG

- OSRAM Licht AG

- LEDVANCE GmbH

- Qualite Sports Lighting LLC

- Techline Sports Lighting

- AAA-LUX B.V.

- Valmont Industries

- Abacus Lighting Ltd

- AEON LED LLC

- Canara Lighting Industries Pvt. Ltd

Global Sports Lighting Market Report Segmentation

By Light Source

- LED Lighting

- HID Lighting

- Fluorescent Lighting

- Others

By Lighting Type

- Flood Lights

- High-Bay Lights

- Area Lights

- Linear Lights

By Application

- Stadium & Arenas

- Training Grounds

- Recreational Sports Facilities

- Educational Institutions

By End-Users

- Professional Sports Clubs

- Educational Institutions

- Municipal Authorities

- Sports Associations

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636