Market Summary

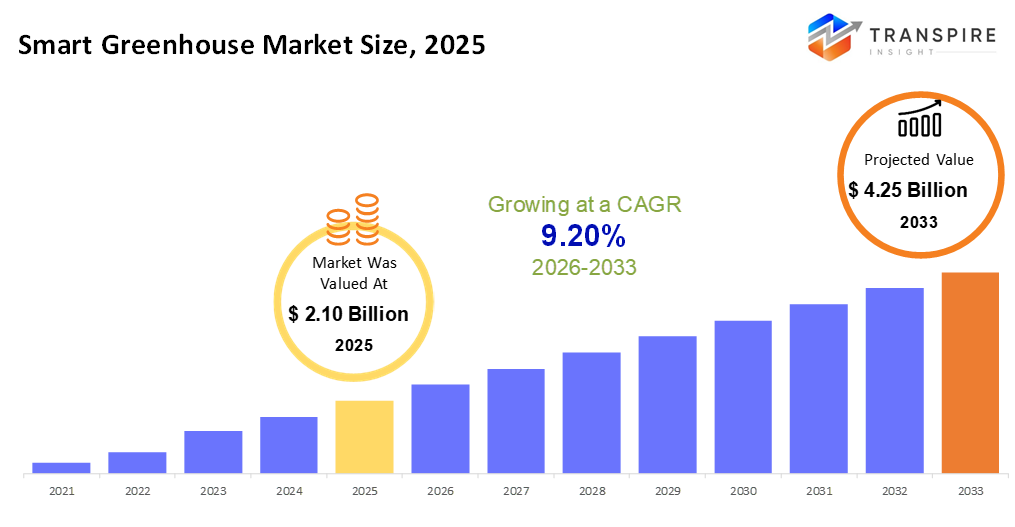

The global Smart Greenhouse market size was valued at USD 2.10 billion in 2025 and is projected to reach USD 4.25 billion by 2033, growing at a CAGR of 9.20% from 2026 to 2033. Fresh food without pesticides pushes new farm tech into greenhouses. Efficiency climbs when sensors plus climate tools work together quietly behind glass walls. Growth does not stop at one place; cities begin growing more inside controlled spaces. Money moves toward these farms as rules favor smarter ways to use water and energy. Year-round harvests become normal where old fields once slept in the winter months.

Market Size & Forecast

- 2025 Market Size: USD 2.10 Billion

- 2033 Projected Market Size: USD 4.25 Billion

- CAGR (2026-2033): 9.20%

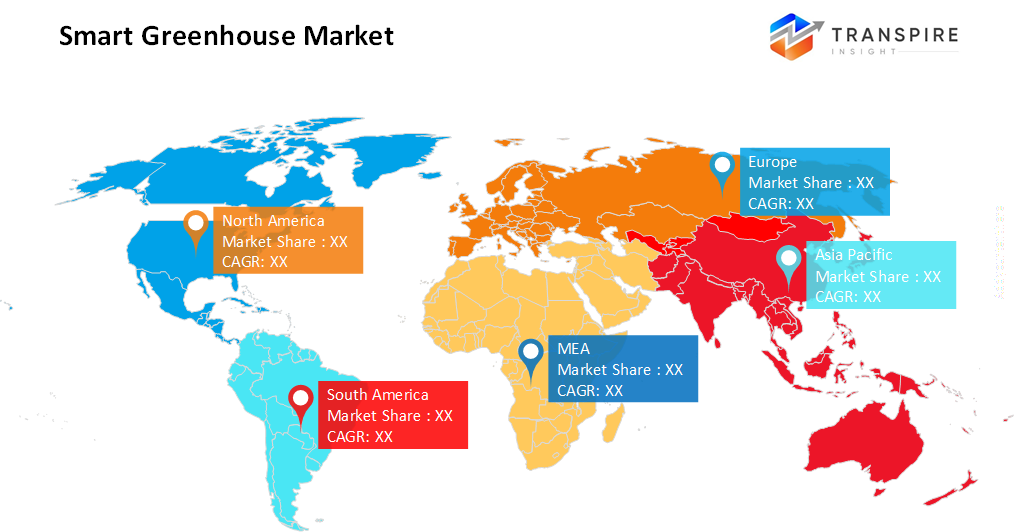

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 39% in 2026. Across North America, farms are turning toward smarter greenhouses because new sensors work well. High-tech tools that monitor conditions closely. These gadgets help growers adjust quickly. As a result, more buildings now use automated systems. Progress happens fast where technology fits easily into daily routines.

- Farming at scale helps drive innovation across the United States greenhouses. Technology blends into daily operations, setting a pace others follow. What stands out is how machinery and data work together under one roof. This mix shapes modern growing methods nationwide.

- Farmers across Latin America are turning to covered growing methods more often. Because weather shifts make outdoor farming harder, shelters help plants thrive. These structures shield crops from extreme conditions. With rising temperatures affecting harvests, protection becomes a practical choice.

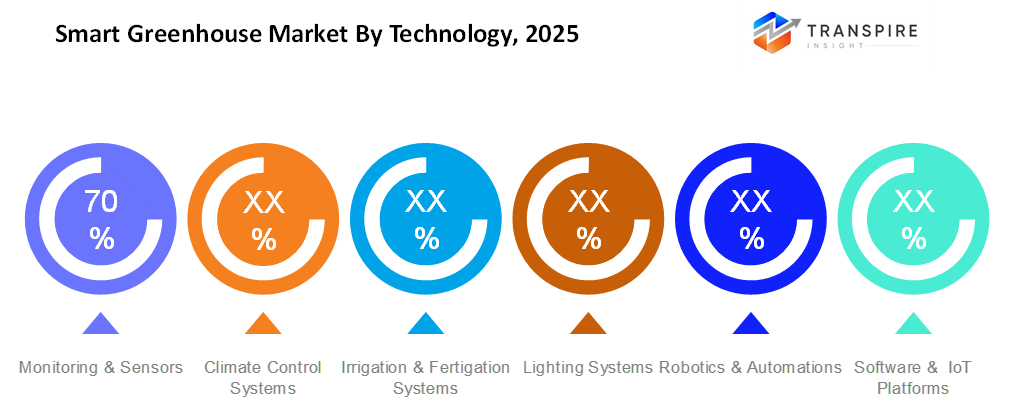

- Monitoring & Sensors share approximately 73% in 2026. Monitoring & sensors lead as the most adopted technology, enhancing precision farming with real-time environmental data to boost yields and reduce resource use.

- Fresh sunlight pours through glass houses, making them top choices where steady growing matters. Their strength over time seals the deal for reliable harvests across seasons.

- Year after year, glass greenhouses stay popular because they let in plenty of sunlight while standing up to wear. Their strength makes them a go-to choice when growth never stops.

- Freshness pulls people toward vegetables and fruits, which make up the biggest share of sales. Profit plays a role, too, since these items often bring better returns than others on shelves.

- Farms selling crops drive adoption more than any other group. Growing large volumes while keeping operations lean. Profit matters most when decisions are made.

Fresh food needs grow while farmland shrinks this pushes more growers to use tech-heavy growing spaces. Year-round harvests now depend less on weather, more on sensors that track moisture, light, and heat. Machines adjust settings without waiting for human input, thanks to live feedback loops built into the system. Cities start seeing these setups pop up where traditional fields cannot fit. Labs also adopt them to test plant behavior under exact conditions. Climate swings make old methods unreliable, nudging even cautious farmers toward digital upgrades.

Right now, sensors and monitors sit at the heart of farming tech, sending live updates on weather, water needs, and how crops are doing. Because of this flow of information, things like automatic watering, nutrient delivery, smart lights, and management software can respond quickly and accurately. What stands out is that sensing tools are expanding faster than any other part here - growers everywhere rely on them more each year. They help plants grow better while using less energy and fewer supplies.

Not many realize how much fresh produce shapes the way smart greenhouses are used today. What stands out is that veggies and fruits take up most of the space due to steady buyers, good returns, and growing them all year long. Think about lettuce or basil; they fit well because they grow fast, and city folks want them daily. Big farming outfits still lead the pack when it comes to using these tech-powered spaces at scale. On another note, places like science labs, garden rooftops, and plant schools now turn to smart setups not just to test ideas but also feed neighborhoods and cut environmental impact.

North America sits ahead when it comes to market share, thanks mainly to heavy funding, solid systems already in place, while automated setups linked to internet-connected devices spread fast across the United States farms. Moving south, parts like Brazil and Mexico show rising interest, as growers there slowly shift toward intelligent greenhouse methods that help boost output and handle unpredictable weather better. Technology keeps moving forward, cities keep expanding, and people want smarter ways to grow food without wasting resources. These forces together point to steady expansion for high-tech greenhouses worldwide in the time ahead.

Smart Greenhouse Market Segmentation

By Technology

- Climate Control System

Besides warmth, what crops really respond to is steady air flow plus balanced dampness in their surroundings. A setup managing these elements keeps plants thriving through changing seasons. Not just heat matters; fresh air movement plays a big role, too. Consistent conditions shaped by careful tuning of environment inputs.

- Irrigation & Fertigation Systems

Pouring just enough water into crops gets easier when nutrients move through the same path. Machines handle timing so roots drink what they need, exactly when needed. Tubes snake across fields, pushing mixtures that match growth stages. This way, plants grow without guesswork behind their meals.

- Lighting Systems

Plants grow better when they get steady light. Bright LEDs help them make food indoors. Extra lamps kick in if natural sunshine falls short. These setups keep crops happy all year round.

- Monitoring & Sensors

Sensors keep an eye on crops plus their surroundings, feeding live updates. Data flows continuously, showing how plants are doing. Conditions out in the field get recorded the moment they shift. What grows is watched closely through these quiet electronic watchers.

- Robotics & Automation

Machines handle planting tasks, while robotics takes over picking crops. Greenhouse work gets done without manual labor. Equipment runs on its own, streamlining farm routines. Tasks once done by hand now finish faster.

- Software & IoT Platforms

A fresh digital setup helps greenhouses stay connected. One part crunches numbers while another links devices smoothly. Tools inside keep things running without hiccups. Management gets easier when tech handles routine tasks.

To learn more about this report, Download Free Sample Report

By Greenhouse Type

- Venlo Greenhouse

These greenhouses come in sections, built to connect across wide spans. Common in large-scale farming setups. One piece fits next to another, making expansion straightforward. Found often where crops grow under glass at a professional level.

- Glass Greenhouse

Sunlight slips through these clear glass shelters, brightening what is inside. Their see-through walls let brightness flow deep into growing spaces.

- Polycarbonate Greenhouse

These greenhouses stand strong through tough weather. Built to lock in warmth, they work where seasons swing hard. Tough plastic walls hold up when storms hit. Temperature stays steady inside, even when outside changes fast. Gardeners trust them across hot and cold zones alike.

- Plastic Greenhouse

Farmers often pick plastic greenhouses because they cost less. These lightweight builds bend to fit different spaces. Polyethylene covers keep crops safe on modest plots. They work well where budgets stay tight.

- Hybrid Greenhouse

A mix of glass and plastic shapes today’s hybrid greenhouses. These structures balance strength with affordability. Materials work together, each handling different demands. Performance improves without raising expenses too much. Some parts rely on clarity of glass, others on lightness of plastic. Together, they respond well to changing conditions. Cost stays reasonable because both materials play a role.

By Crop Type

- Vegetables & Fruits

Tomatoes, cucumbers, and strawberries grow well when cared for closely. What matters most is steady attention in the rows. Not every plant thrives under the same conditions, yet timing makes a difference. Fresh produce like this often sells fast if quality stays consistent. Growing them takes space, yes, but also patience through changing weather.

- Leafy Greens & Herbs

Lettuce, basil, spinach, these greens move quickly because they grow fast. Harvest cycles stay short, so supply keeps up without delay. Think leafy plants that renew themselves on tight schedules. Freshness matters most when turnover runs high week after week.

- Flowers & Ornamentals

Beautiful blooms and decorative plants need steady environments to look their best. Growing them well means managing temperature, light, and humidity carefully. These crops are worth more when appearance meets high standards. Success depends on precise care throughout development.

- Others

Some grow unusual types of plants, medicinal ones, rare species, or crops meant for testing. These fall outside regular farming categories.

By End-Users

- Commercial Agriculture

Large‑scale growers use smart greenhouse technologies for high yields.

- Research & Educational Institutes

Institutions exploring controlled environment agriculture research.

- Rooftop Farms

Urban agriculture setups on rooftops serve local markets.

- Nurseries & Horticulture Centers

Baby plants find a home where green thumbs craft beauty. These spots nurture flowers and shrubs made for patting gardens into shape. Some focus on rare greens, others on bold colors that catch light differently. Each place runs its own way, quiet backyards or wide-open fields humming with life.

Regional Insights

The biggest smart greenhouse markets sit in North America and parts of Europe. The United States pushes forward through heavy backing of automated setups and internet-connected tools, because indoor farming tech helps growers boost output while keeping crops consistent. Dutch operations set the pace across the region, Germany follows close behind, alongside Britain, where new methods meet eco-conscious growing, especially inside city limits. Public funding flows into these efforts due to rising interest in fresh food without chemical sprays.

A surge in demand marks parts of the Asia Pacific, where crowded cities push farming innovation. Technology steps in across Japan, China, and Singapore, sensors watch crops, water flows on schedule, and lights tune to plant needs. Elsewhere, India and South Korea move forward, joining Southeast nations in testing intelligent greenhouses. Better harvests drive interest, and efficiency gains pull more attention. Farms for profit grow smarter; rooftops turn into gardens; labs explore new methods nearby.

Out beyond Europe and Asia, farming with smart greenhouses is still finding its footing. Brazil and Mexico are slowly bringing in digital systems to grow more food despite shifting weather patterns. Places such as the United Arab Emirates, Saudi Arabia, and South Africa are putting money into controlled-environment growing because fresh water runs low and imported meals fill too many shelves. Meanwhile, lesser-known regions test small-scale setups right inside cities, just trying things out. Progress moves unevenly, yet signs point forward.

To learn more about this report, Download Free Sample Report

Recent Development News

- July 12, 2025 – Mongolia launched a USD 3.4 million smart greenhouse project to boost food security.

- February 2, 2025 – MECO launched Iran’s first IoT-Enabled Smart Greenhouse.

(Source: https://mapnagroup.com/46717/meco-launches-irans-first-iot-enabled-smart-greenhouse/?lang=en

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.10 Billion |

|

Market size value in 2026 |

USD 2.29 Billion |

|

Revenue forecast in 2033 |

USD 4.25 Billion |

|

Growth rate |

CAGR of 9.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Priva, Argus Controls, Heliospectra, Hortimax, Netafim, Certhon, Nexus Greenhouse Systems, Ridder, Dalsem, Van der Hoeven, Signify (Philips Lighting), OSRAM, Growlink, Hoogendoorn Growth Management, Urban Crop Solutions, and Illumitex. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Climate Control Systems, Irrigation & Fertigation Systems, Lighting Systems, Monitoring & Sensors, Robotics & Automations, Software & IoT Platforms), By Greenhouse Type(Venlo Greenhouses, Glass Greenhouses, Polycarbonate Greenhouses, Plastic Greenhouses, Hybrid Greenhouses), By Crop Type (Vegetables & fruits, Leafy Green & Herbs, Flower & Ornamentals, Others), By End-Users (Commercial Agriculture, Research & Educational Institutes, Rooftop Farms, Nurseries & Horticulture Centers) |

Key Smart Greenhouse Company Insights

One step beyond ordinary, Priva shapes how greenhouses work across the planet by fine-tuning air conditions, watering routines, and light patterns through automated tools. Instead of guesswork, farms rely on their connected tech to manage heat, dampness, brightness, and feeding schedules, each adjusted precisely where needed. Though often unseen, these systems quietly power vast indoor gardens and city-based growing sites, turning real-time insights into steady harvests. Behind every update stands years of testing, fresh ideas, and teams spread around continents, making sure things run without waste. Not flashy, yet trusted everywhere, it sets what others aim for when building tomorrow's controlled-environment agriculture.

Key Smart Greenhouse Companies:

- Priva

- Argus Controls

- Heliospectra

- Hortimax

- Netafim

- Certhon

- Nexus Greenhouse Systems

- Ridder

- Dalsem

- Van der Hoeven

- Signify (Philips Lighting)

- OSRAM

- Growlink

- Hoogendoorn Growth Management

- Urban Crop Solutions

Global Smart Greenhouse Market Report Segmentation

By Technology

- Climate Control Systems

- Irrigation & Fertigation Systems

- Lighting Systems

- Monitoring & Sensors

- Robotics & Automations

- Software & IoT Platforms

By Greenhouse Type

- Venlo Greenhouses

- Glass Greenhouses

- Polycarbonate Greenhouses

- Plastic Greenhouses

- Hybrid Greenhouses

By Crop Type

- Vegetables & fruits

- Leafy Green & Herbs

- Flower & Ornamentals

- Others

By End-Users

- Commercial Agriculture

- Research & Educational Institutes

- Rooftop Farms

- Nurseries & Horticulture Centers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636