Market Summary

The global Real-Time Payments market size was valued at USD 34.16 billion in 2025 and is projected to reach USD 385.11 billion by 2033, growing at a CAGR of 35.37% from 2026 to 2033. The rapid growth of the Real-Time Payments market is driven by increasing demand for instant, 24/7 payment processing, rising digital commerce, and widespread adoption of mobile and P2P payment platforms. Additionally, government-backed payment infrastructures, growing fintech participation, and the shift toward cashless economies are accelerating real-time payment adoption globally.

Market Size & Forecast

- 2025 Market Size: USD 34.16 Billion

- 2033 Projected Market Size: USD 385.11 Billion

- CAGR (2026-2033): 35.37%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. Across North America, fast payment systems thrive thanks to solid tech foundations. Digital transactions happen at scale here, fueled by widespread use of immediate transfer networks. What stands out is how deeply embedded these quick-pay methods have become in everyday commerce.

- Across the United States, momentum builds as fresh funding flows into instant payment systems. Open banking takes root, backed by steady progress in financial tech development. One region at a time, change unfolds where infrastructure meets new ideas. Progress shows most clearly where support runs deep.

- Mobile payments are spreading fast across the Asia Pacific. Growth here outpaces other regions thanks to live retail transactions. Financial access programs help fuel this shift. Peer-to-peer transfers now happen instantly in many areas. Speed and reach keep increasing. Real-world usage drives adoption more than policy alone. Progress feels steady when you watch daily habits change.

- Solutions share approximately 75% in 2026. One part stands out: solutions drive momentum because organizations are putting money into systems that handle payments right away. These platforms clear and finalize transactions without delay, shaping how quickly things move behind the scenes.

- Around the world, people are sending money more often through phones. Mobile wallets help move cash directly between users. This shift makes person-to-person transfers grow quicker than others. Growth comes as apps simplify how funds travel from one individual to another.

- Cloud-based deployment grows fastest. Its reach expands easily, cost stays low, and integration through APIs fits modern needs well. Speed comes from flexibility, not just technology.

- Fintech firms and payment service providers see the sharpest rise in digital wallets push quick payments forward. Instant transactions climb because app-based tools spread fast. These companies grow quickest where mobile money gains ground. Speed wins trust when people pay daily tasks get done smoothly. Growth sticks where ease meets real needs.

Right now, more people want money moves that happen instantly. When banks offer quick transfers, cash flow gets easier, waiting times shrink, and one thing becomes clear: users like it when funds show up right away. Phones hold wallets made of apps these days, not leather. As those tools grow popular, pressure builds on old methods to keep pace, no lag allowed. From person to person, company to client, every type of payment feels the push toward speed. What once took hours, even days, now must finish in moments. This shift is not just happening; it is shaping how finance works today.

Core platforms, software, and tools form the backbone because they make instant clearing possible while showing every move clearly. Alongside them come help like setup guidance, tech linking, advice, ongoing management, all working behind the scenes so systems run smoothly, meet rules, and connect without hiccups to current banking setups. Now more firms pick cloud hosting - not just for room to grow but also for smoother tool connections, giving banks and payment operators faster ways to launch live-payment networks.

Payments between people and businesses are catching on fast, thanks to more online activity and a push for quicker money movement. Faster access to funds helps companies manage day-to-day finances better and also settle bills sooner. People find it easier to send money whenever they need, without delays holding them back. When used for paying employees, returning money, sending invoices, or handling customer purchases, immediate transfer systems become harder to ignore. This shift is turning rapid payment tech into a key focus for many organizations.

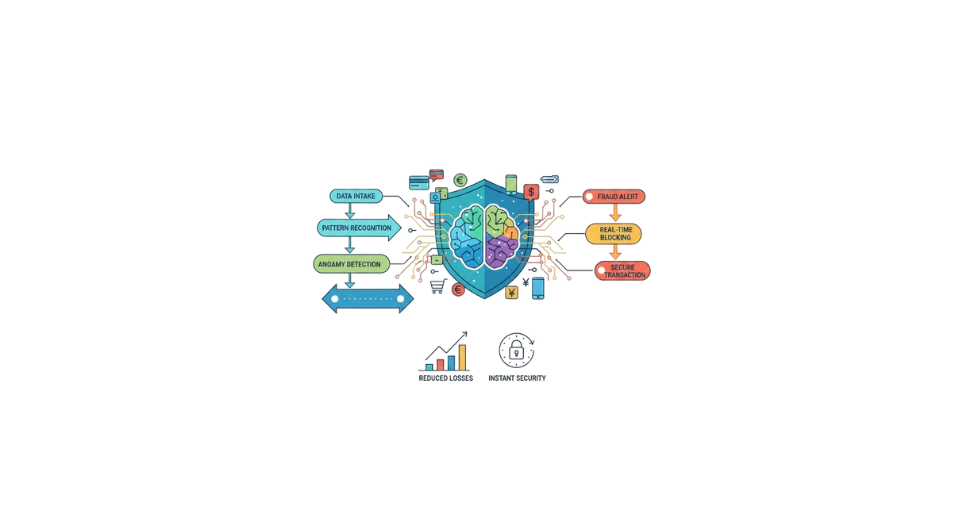

Out of nowhere, AI and machine learning are changing how real-time payments work. Blockchain slips in alongside advanced data tools, making fraud spotting sharper, tracking transactions smoother, one step at a time. Instead of waiting, banks and tech firms now speed up operations while offering smarter features people actually use. Personal touches appear more often, tucked into everyday money moves. With digital shifts becoming routine, immediate transfers gain ground - no fanfare, just steady progress ahead.

Real-Time Payments Market Segmentation

By Component

- Solutions

Instant payments happen through specialized software designed to move money quickly. These platforms handle transactions right away instead of delaying them. Speed comes from built-in rules that clear and finalize transfers in seconds. Systems stay active all day, every day, so funds shift without waiting. Processing works straight through, no pauses, no batches. Settlement finishes within moments after a transfer starts. Technology runs behind the scenes to verify and lock in each movement securely.

- Services

Running smooth payments takes more than software. Expert setup guides the process from the start. Ongoing assistance keeps systems up to date. Specialists consult on ways to improve speed and reliability. Teams monitor performance day and night. Each piece fits together without forced connections. Real results come from steady attention, not promises.

To learn more about this report, Download Free Sample Report

By Transaction Type

- Person-to-Person

Money moves directly from one person to another, fast. These are quick swaps of cash between people who know each other. Speed matters here, no delays. Transfers happen right away, straight from sender to receiver.

- Business-to-Business

Companies pay each other instantly when buying goods or services. Money moves fast between businesses during supply deals. Instant transfers help firms settle accounts without delays. Payments happen right away instead of waiting days. Firms handle invoices quickly using live transaction systems.

- Consumer-to-Business

A single tap, money moves instantly from buyer to seller. Whether swiping a card in-store or clicking checkout online, cash flows without delay. This is how people now send funds directly to companies. Speed matters most when shopping happens fast.

- Business-to-Business

Payouts land fast when companies send money straight to people. Refunds show up now, not later. Workers get paid on time, every time. Money moves without waiting, changing how quickly things settle.

By Deployment Mode

- Cloud-Based

Hosted online, this setup grows as needed. It links quickly through APIs. Built for smooth connections right away.

- On-Premises

Housed within your own space, these setups let you shape how things work while keeping information close. Running on local hardware means decisions stay in-house instead of drifting elsewhere.

By End-Users

- Banks & Financial Institutions

Some banks, both old-school and online, now use instant payment systems so people can move money faster. While they used to wait days, transfers happen in moments these days. Not every bank moved at the same pace, yet most are on board now. Because speed matters more than before, updating tech has become necessary. Even smaller credit unions started exploring similar tools. As customers expect quicker access, pressure builds across the sector.

- Fintech Provider & Payment Service Providers

Built on speed, these firms handle quick transfers through digital tools. Instant access shapes how money moves today.

- Corporate & Retailers

Funds move fast when companies collect or send them through real-time systems. Some stores use these methods to get paid more quickly by customers. Large firms also pay suppliers without waiting days for clearance. Speed helps manage cash better across departments and locations.

- Government & Public Sectors

Moving money fast is now routine inside government offices. Where payments used to drag on, they now arrive as soon as approved. Workers get paid without waiting days. Benefits reach people who need them right away. Grants shift from slow paper trails to instant transfers. Speed replaces delays across departments.

Regional Insights

Across the Asia Pacific, top spots held by China, India, Japan, Australia; others, including Indonesia, Malaysia, Thailand, do not take much time before money moves digitally. Mobile payment networks run deep here, backed strongly by state-built systems that keep things moving fast. Take India’s UPI: it pushes huge numbers of transactions, pulls more people into banking reach. Meanwhile, Chinese digital wallets thrive under unified national plans, boosting everyday spending plus international flows. Expansion never stops; building bigger, faster digital pathways remains a priority. Because of this push, the region holds the biggest slice of global payment activity by far.

Even though it is already well developed, money movement tech keeps growing fast in North America, especially in the United States and Canada, plus Mexico, making steady moves too. Right now, more banks and tech firms are jumping on instant payments thanks to new systems like FedNow® and the continued rollout of The Clearing House RTP network. Down south, Mexico is steadily linking up its own real-time networks as people want speedier transfers. People using online banking often means institutions adapt quicker, one reason these countries hold such a large piece of the global scene. Rules that back fresh ideas also play a part in keeping things moving forward here.

Fresh across Europe, think the United Kingdom, Germany, France, and slower but moving in southern and eastern pockets. Payment speed picks up where rules push it, especially through SEPA's instant network, pulling countries into sync. Over in Latin lands, Brazil lights the way with PIX lighting transactions fast, and others like Mexico, Peru, and Colombia are catching pace without hurry. Not far behind, parts of the Middle East and Africa jump early into now-pay systems, nudged by state tech pushes and phones becoming bank fronts. As local networks stretch wider, small hubs start humming with new potential. Speed changes quietly, unevenly, nowhere all at once.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 11, 2025 – India and Bahrain launched a real-time cross-border payment system linking UPI

(Source: https://ddnews.gov.in/en/india-and-bahrain-launch-real-time-cross-border-payment-system-linking-upi/

- September 9, 2025 – Thunes launched real-time payments in Morocco.

(Source: https://fintech.global/2025/09/09/thunes-launches-real-time-payments-to-morocco/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 34.16 Billion |

|

Market size value in 2026 |

USD 46.24 Billion |

|

Revenue forecast in 2033 |

USD 385.11 Billion |

|

Growth rate |

CAGR of 35.37% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

ACI Worldwide, FIS, Fiserv, Mastercard, Visa, PayPal, Worldline, Temenos, Tata Consultancy Services, Capgemini, Oracle, Volante Technologies, AliPay, Adyen, and Square. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Services, Solutions), By Transaction Type(Person-to-Person, Business-to-Business, Consumer-to-Consumer, Business-to-Consumer), By Deployment Mode (Cloud-Based, On-Premises), By End-Users (Banks & Financial Institutions, FinTech Providers & Payment Service Providers, Corporate & Retailers, Government & Public Sectors) |

Key Real-Time Payments Company Insights

ACI Worldwide is a leading global provider of real-time payment solutions, offering end-to-end software and platforms for banks, payment service providers, and enterprises. Its RTP systems enable instant clearing and settlement for P2P, B2B, C2B, and B2C transactions across multiple channels. The company focuses on scalable, cloud-based, and API-enabled solutions, allowing financial institutions to modernize payment infrastructure while ensuring security and compliance. With a strong global presence and partnerships with major banks and fintechs, ACI Worldwide is a key driver of innovation in the real-time payments market.

Key Real-Time Payments Companies:

- ACI Worldwide

- FIS

- Fiserv

- Mastercard

- Visa

- PayPal

- Worldline

- Temenos

- Tata Consultancy Services

- Capgemini

- Oracle

- Volante Technologies

- AliPay

- Adyen

Global Real-Time Payments Market Report Segmentation

By Component

- Services

- Solutions

By Transaction Type

- Person-to-Person

- Business-to-Business

- Consumer-to-Consumer

- Business-to-Consumer

By Deployment Mode

- Cloud-Based

- On-Premises

By End-Users

- Banks & Financial Institutions

- FinTech Providers & Payment Service Providers

- Corporate & Retailers

- Government & Public Sectors

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

_Market,_Forecast_to_2033.png)

-market-pr.png)

-market-pr.png)

APAC:+91 7666513636

APAC:+91 7666513636