Market Summary

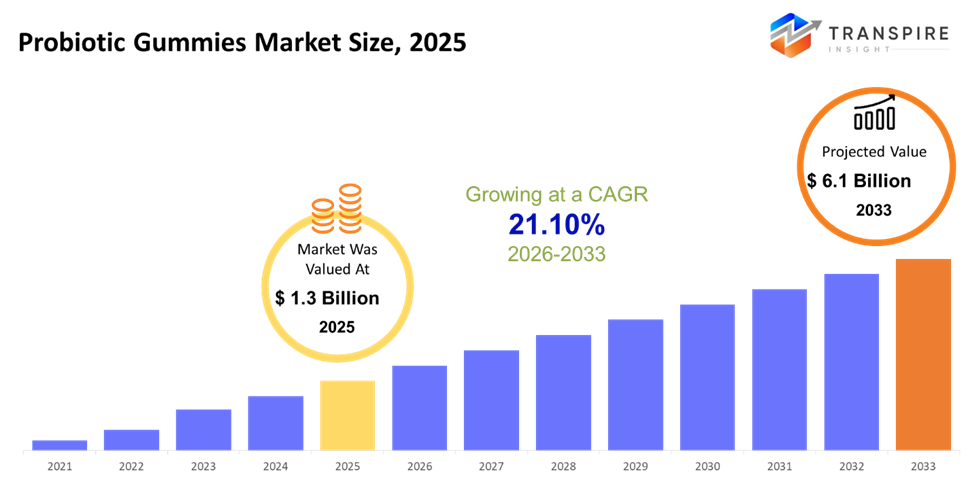

The global Probiotic Gummies market size was valued at USD 1.3 billion in 2025 and is projected to reach USD 6.1 billion by 2033, growing at a CAGR of 21.10% from 2026 to 2033. The pro-biotic gummies market is growing steadily because consumers increasingly prefer easy-to-consume and tasteful dietary supplements over capsules. Increasing awareness about the gut-immunity connection, preventive healthcare expenditure, and acceptance in the pediatric as well as geriatric demographic are some key factors supporting the CAGR growth in the pro-biotics gummies market.

Market Size & Forecast

- 2025 Market Size: USD 1.3 Billion

- 2033 Projected Market Size: USD 6.1 Billion

- CAGR (2026-2033): 21.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The adoption of probiotics gummies, particularly in North America, is quite prominent due to intense health awareness and penetration of dietary supplements, creating opportunities for premium probiotics with clean-label, reduced sugars, and scientifically validated formulas on online health platforms.

- The United States continues to be the most impactful growth driver in North America, which has been driven by active innovation in products, influencer-based education of consumers, and growing subscription-based e-commerce sales in digestive and immune health gummies targeting adults and kids.

- The Asia Pacific market has grown at an enhanced pace owing to the increasing number of middle-class consumers, changing lifestyles in cities, and the long-standing acceptability of probiotics in Asia, especially in India, China, and Japan.

- Digestive health is presently the most prominent application type, given the fact that probiotics have traditionally been known for balancing digestive systems and relieving conditions like bloating and enhancing nutrient absorption. This indicates that this is the entry point of new users.

- In terms of end-use, adult consumption leads, primarily because of work-related stress, irregular dietary patterns, and adoption within the wellness demographic, whereas the pediatric and elderly populations experience increased growth rates with gummies, which can be taken without much hassle owing to age-related factors.

- Online distribution channels become prominent because of the increasing product range and benefit of subscription services as well as digital health marketing channels. Meanwhile, offline channels remain important for trust purchases, especially in the senior generation and new regions.

So, The probiotic gummies market indicates an emerging and fast-paced segment in the global dietary supplements industry which offers advantageous microorganisms through chewable and flavored gummies. They are produced for promoting digestive, immune, and overall wellness capabilities while boosting consumer compliance with respect to conventional capsules and powders.The growth of the market is directly associated with the change in lifestyles of consumers. Convenience, taste, and preventative measures in health are factors that form a major part of the market. The primary benefit of probiotic gummies is that they can be consumed by a wide range of people in varying age groups. Dosage hassle is eliminated in the case of probiotic gummies.

In addition, the market gets benefitted by increasing e-commerce trends, wellness-oriented positioning, and rising awareness about healthcare in developing nations. The regulatory approval of probiotics as dietary supplements for major geographical areas also promotes their commercialization. As more research emerges on microbiome wellness, probiotic gummies would soon venture into targeted products, thus ensuring continued market growth.

Probiotic Gummies Market Segmentation

By Application

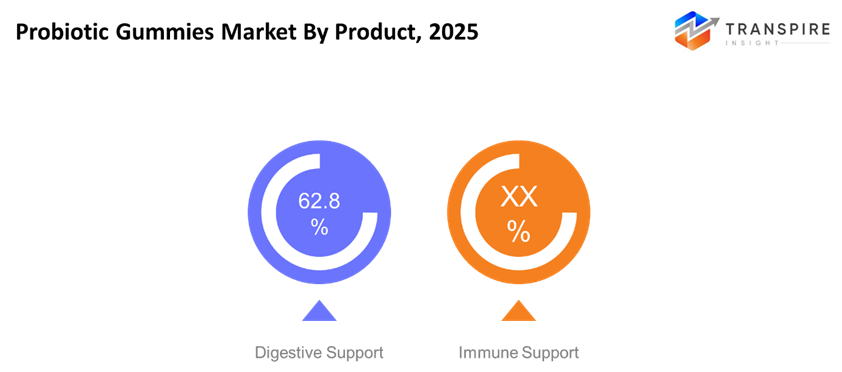

- Digestive Support

Supporting digestive health remains the fundamental reason for consumers purchasing and using these products because it has a direct correlation in their minds between these products and digestive comfort. The convenience of consuming them and tasting good further enhances this usage.

- Immune Support

Immune system gummies have recently seen an upswing as more and more consumers understand and link gut care with immunity care. Such products can be viewed as daily vitality promoters, targeted more at family audiences for preventing rather than just treating seasonal conditions.

To learn more about this report, Download Free Sample Report

By End Use

- Adults

The adult population constitutes the largest market for consumers, and this can be attributed by increasing awareness about digestive well-being and related stomach issues caused by stress. One can smoothly integrate probiotic gummies into their busy lifestyle as they can become a great alternative for people consuming tablets on a daily basis.

- Men

Men have slowly begun incorporating probiotics in gummy form as an adjunct of their performance and wellness activities. Formulations related to digestion, energy, and immune function have struck a chord with targeted consumers.

- Women

The preference for probiotic gummies can be observed in women, mainly because of their benefits related to digestion, immunities, and well-being. The clean label and different flavors also play an important role in making these products more desirable and contribute towards developing good practices for their consumption.

- Pregnant Women

The use of probiotic gummies has become more prominent among pregnant women who are opting to take them to aid digestive comfort during pregnancy. This demand is influenced by perceptions of their safety, endorsement by doctors, and their positioning to market them as physiologically beneficial for pregnant women.

- Geriatric

The geriatric segment is attracted to probiotic gummies because of the ease of chewing and digestion. This is because probiotic gummies are designed to aid digestion and relieve digestive sensitivities that affect older people, without requiring complicated daily intake as some supplements do.

- Kids

Kids’ probiotic gummies are meant to be enjoyable and delicious while also being kid-friendly and parent-approved options. The colorful packaging and fruity tastes go a long way in ensuring they are fun and exciting enough for consumption on a daily basis.

By Distribution Channel

- Offline

Offline channels are still relevant for trusted purchases, particularly via pharmacies and supermarkets. Customer preference is especially with offline purchase guidance and availability, especially for first-time probiotic gummy consumers.

- Online

Online distribution channels are increasingly diversifying due to the factor of convenience and the rise of subscription models. Digital or online platforms help customers find customized probiotic solutions and facilitate reorder purchasing through home delivery.

Regional Insights

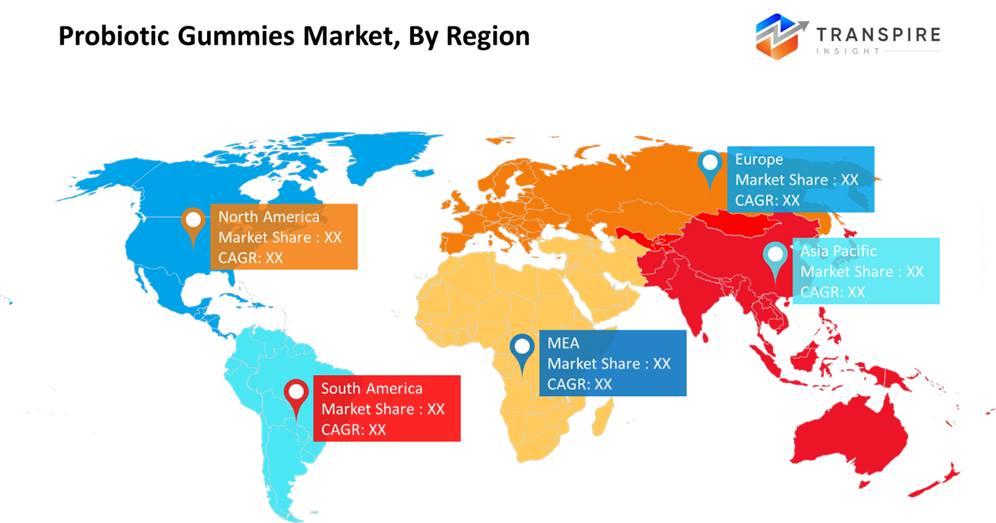

North America is a mature and high-value market, and the US is a tier-1 country because of the high usage levels and the developed retail infrastructure and innovation-driven launches. Canada is a tier-2 market with stable demand, and Mexico has emerging marketing because of the growing health awareness. The market in the global region of Europe displays stable growth, with tier-1 markets in the region comprised of countries such as Germany, the United Kingdom, France, Italy, and Spain, driven by the preventive healthcare movement and government frameworks. The remaining regions of Europe are tier-2, having an impact through an increase in functional nutrition in lifestyle.

The Asia Pacific market is the fastest-growing market because of tier-1 countries like China, Japan, India, South Korea, Australia, and New Zealand. The factor of increased disposable incomes, size of the population, and acceptance of digestive health products and services creates a positive environment for growth, and Rest of Asia Pacific is termed to be tier-2 with enhanced accessibility.

South America, driven by Brazil and Argentina as tier-1 markets, is growing moderately on the back of increasing child-focused supplements, while the Rest of South America remains price-sensitive. Middle East & Africa emerge as a nascent market, led by Saudi Arabia, the UAE, and South Africa as tier-1 markets on the back of premium wellness adoption, while the rest form tier-2 markets with gradual uptake.

To learn more about this report, Download Free Sample Report

Recent Development News

- May 2025, Nature Made, a leading national vitamin and supplement broadline brand with more than 50 years of excellence in offering high-quality supplements with ingredients supported by science, proudly announces the launch of the innovative and newest offerings of its Digestive line, which provide a wide assortment of probiotics, prebiotics, and fiber supplements based on different needs.

- In September 2024, SIRIO Pharma (SIRIO), the global nutraceutical Contract Development and Manufacturing Organisation, will showcase its innovative product, GummiBiotics, for prominent nutraceutical and pharmaceutical companies. This new product range consists of gummies made from branded and scientifically endorsed macrobiotic strains, aiming at different health advantages.

(Source:https://sirio-europe.com/news/sirio-launches-gummibiotic-range-at-cphi-milan/)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.3 Billion |

|

Market size value in 2026 |

USD 1.6 Billion |

|

Revenue forecast in 2033 |

USD 6.1 Billion |

|

Growth rate |

CAGR of 21.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Church & Dwight Co., Inc., Nature’s Way Products, LLC, SmartyPants Vitamins, Olly Public Benefit Corporation, The Clorox Company (Renew Life), Garden of Life (Nestlé Health Science), Life Extension, BioGaia AB, Nature’s Bounty Co., Jarrow Formulas, Inc., Nordic Naturals, Inc., Pharmavite LLC (Nature Made), Goli Nutrition Inc., Herbaland Naturals Inc., Rainbow Light Nutritional Systems, Inc |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Digestive Support, Immune Support), By Distribution Channel (Adults, Men, Women, Pregnant Women, Geriatric, Kids), By Distribution Channel (Offline, Online) |

Key Probiotic Gummies Company Insights

Church & Dwight Co., Inc. is a major player in the probiotic gummy market with its flagship brand Vitafusion, utilizing robust consumer penetration and recognition of its brand. The company's market strategy is focused on innovation with a fusion of effectiveness and taste and convenience for a wide demographic spanning adults and children. Vitafusion probiotic gummies are distributed extensively across premier pharmacies, grocery stores, and mass market retailers, establishing a stronghold of market share dominance over North America. Church & Dwight's focus on research and marketing differentiates its products with an increasing trend of a clean label and wellness elements, establishing its market differentiation amidst intense competition worldwide of probiotic gummies.

Key Probiotic Gummies Companies:

- Church & Dwight Co., Inc.

- Nature’s Way Products, LLC

- SmartyPants Vitamins

- Olly Public Benefit Corporation

- The Clorox Company (Renew Life)

- Garden of Life (Nestlé Health Science)

- Life Extension

- BioGaia AB

- Nature’s Bounty Co.

- Jarrow Formulas, Inc.

- Nordic Naturals, Inc.

- Pharmavite LLC (Nature Made)

- Goli Nutrition Inc.

- Herbaland Naturals Inc.

- Rainbow Light Nutritional Systems, Inc

Global Probiotic Gummies Market Report Segmentation

By Application

- Digestive Support

- Immune Support

By End Use

- Adults

- Men

- Women

- Pregnant Women

- Geriatric

- Kids

By Distribution Channel

- Offline

- Online

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636