Market Summary

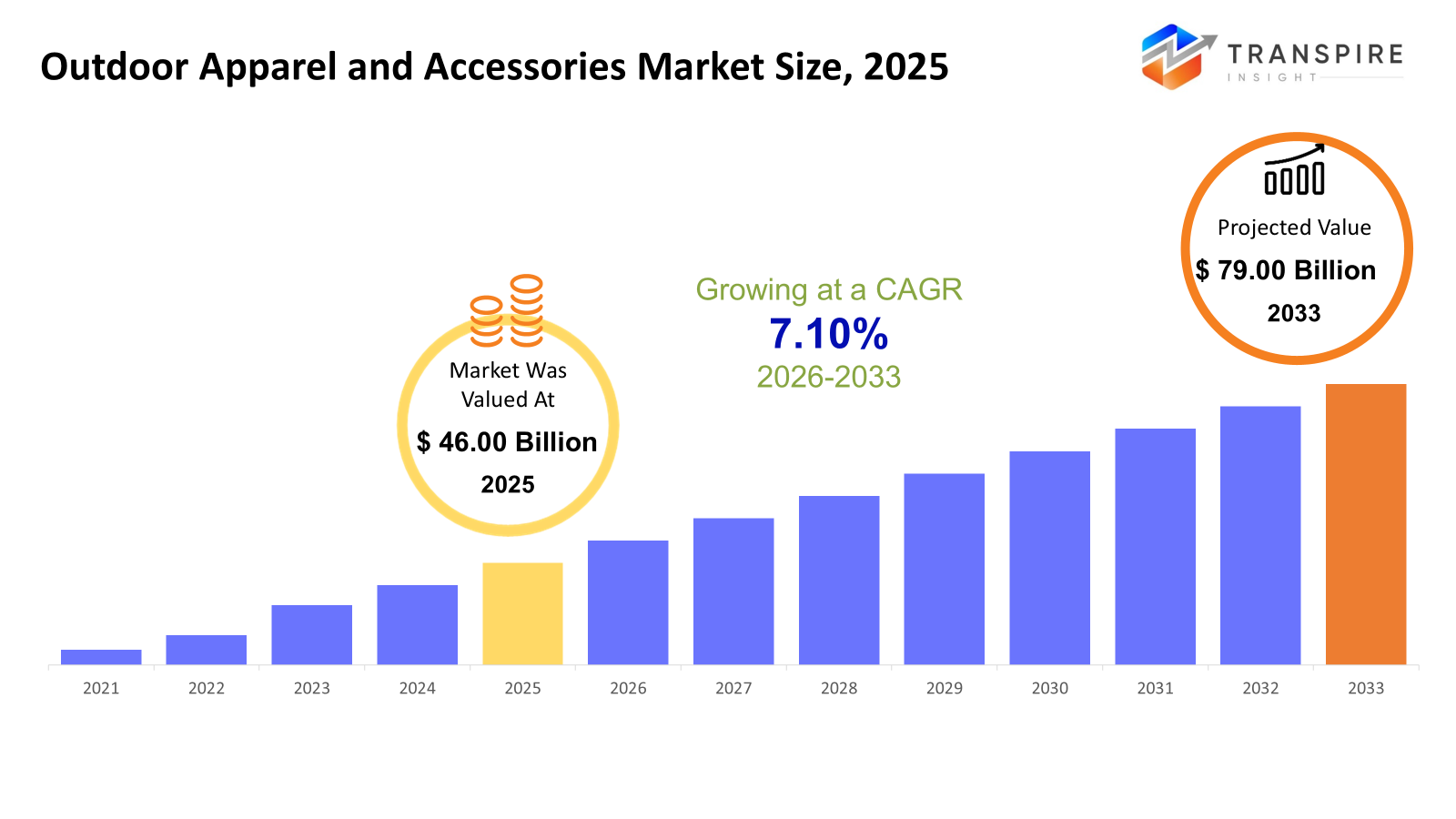

The global Outdoor Apparel and Accessories market size was valued at USD 46.00 billion in 2025 and is projected to reach USD 79.00 billion by 2033, growing at a CAGR of 7.10% from 2026 to 2033. The global outdoor apparel and accessories market is growing at a steady compound annual growth rate (CAGR). The growth in the global outdoor apparel and accessories market is largely driven by the increasing trend of participating in adventure tourism, hiking, and trekking activities. The rising awareness among consumers regarding health, fitness, and outdoor activities also contributes to the growth in the global outdoor apparel and accessories market.

Market Size & Forecast

- 2025 Market Size: USD 46.00 Billion

- 2033 Projected Market Size: USD 79.00 Billion

- CAGR (2026-2033): 7.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America has a mature outdoor apparel market with high consumer spending, a focus on premium performance apparel, and well-established e-commerce markets, resulting in a high adoption rate for outdoor apparel, including jackets, footwear, and backpacks.

- United States has a high adoption rate for synthetic and blended fabrics for jackets, footwear, and base layers, primarily because of weather conditions and a high number of outdoor enthusiasts, and direct-to-consumers and online channels are key growth channels.

- Asia Pacific has a rapidly growing market for outdoor apparel, primarily because of increasing disposable incomes, urbanization, and adventure tourism. Jackets, backpacks, and footwear are key segments, supported by innovations in fabrics and increasing penetration of online retailing in China, India and Japan.

- Jackets and coats remain at the forefront of product demand based on adaptability to climate, improvements in insulation, and the development of lightweight waterproof materials, which improve the usability of the products in trekking, skiing, and urban outdoor activities.

- Synthetic materials remain the primary material trend based on durability, moisture management, and the ability to work well with advanced technology, while the increasing use of recycled synthetic materials is a reflection of the influence of sustainability on the differentiation strategy of the leading brands.

- Hiking and trekking continue to be the most influential end-use trend, given the importance of functional, breathable, and lightweight apparel, which has been driving the demand for jackets, footwear, backpacks, and layered apparel systems around the globe.

- The evolution of online retail continues to influence the dynamics of the global market in terms of increasing product accessibility, price transparency, and direct brand engagement, thus driving the penetration of the market and increasing access to diversified product portfolios.

So, The outdoor apparel and accessories market refers to a wide range of clothing, shoes, and accessories, primarily designed for outdoor activities like hiking, camping, climbing, skiing, fishing, and urban lifestyle. The key factors associated with outdoor apparel and accessories, which remain constant, include performance, durability, and comfort. The global outdoor apparel and accessories market is witnessing a surge in demand for multifunctional and eco-friendly products, as consumers increasingly seek sustainable and performance-oriented apparel. The global outdoor apparel and accessories market is also witnessing a surge in adventure tourism, outdoor, and lifestyle activities, thereby fueling adoption in major global markets. The global outdoor apparel and accessories market is witnessing a change in distribution channels, with online retail and direct-to-consumer stores becoming major channels for product distribution, along with specialty and sports retailers. The premiumization trend is also notable, especially in North America and Europe, as consumers seek technologically advanced materials and clothing that combines fashion and performance. Furthermore, there are growth opportunities in emerging markets in Asia Pacific, as increasing disposable income levels and outdoor lifestyles encourage people to participate in outdoor sports and recreational activities, creating a positive outlook for jackets, footwear, backpacks, and base layers. Overall, the market has a positive outlook as it combines performance, fashion, and sustainability, with technology innovations creating competition and supporting CAGR growth.

Outdoor Apparel and Accessories Market Segmentation

By Product Type

- Jackets & Coats

Jackets and coats are leading in market demand, given their significance in providing protection against extreme weather conditions. Technological innovations are propelling the market for jackets and coats, especially for hikers, climbers, and adventure enthusiasts.

- Pants & Shorts

Pants and shorts are witnessing increasing market share in hiking, trekking, and climbing, as comfort plays a vital role. Technological innovations in fabrics are propelling the market for adventure enthusiasts, as well as for those seeking comfort during outdoor activities.

- Base Layers & T-Shirts:

Base layers and t-shirts are a crucial part of performance clothing, providing essential comfort. Growing awareness about performance clothing for outdoor enthusiasts is propelling market growth.

- Footwear

Outdoor footwear, including hiking boots, is a major segment, as comfort plays a vital role. Growing adventure sports activities are propelling market growth.

- Hats, Gloves & Accessories

These products are designed for specific purposes and are often sold as complementary products. The seasonal demand and multiple-feature products (such as UV protection and insulation) contribute to the consistent growth of demand for this type of equipment.

- Backpacks & Bags

Backpacks and bags are essential equipment for outdoor activities, be it for recreation or professional purposes. The rise of adventure tourism and hiking activities has led to the increasing demand for this type of equipment

To learn more about this report, Download Free Sample Report

By Material

- Synthetic

Synthetic fabrics like polyester and nylon are leading the market because of their durability, water-resistant properties, and lightweight characteristics. Advances in technology have enabled the addition of features like moisture-wicking and quick-dry properties to these fabrics, making synthetic fibers the preferred choice for high-performance outdoor apparel.

- Natural

Natural fibers like cotton, wool, and down are popular among environmentally-conscious consumers and provide the comfort and breathability that is required from these types of fibers. The use of natural fibers is increasing in high-end outdoor apparel.

- Blended Fabrics

Blended fabrics are those that are made from a combination of synthetic and natural fibers. These are becoming increasingly popular for use in multifunctional apparel that caters to the needs of the urban and outdoor lifestyle.

By End-Use

- Hiking & Trekking

This segment creates significant demand for performance apparel like jackets, pants, and shoes. The focus of consumers on light, durable, and moisture-wicking apparel helps drive the growth of the hiking and trekking segment.

- Camping

Apparel and gear used by camping enthusiasts are comfortable, flexible, and resistant to harsh weather conditions. Accessories like backpacks and hats play a critical role in the purchase of apparel and gear by these enthusiasts.

- Climbing & Mountaineering

Apparel and gear used by climbing and mountaineering enthusiasts are highly performance-oriented and technically engineered. Critical factors like durability, insulation, and flexibility of the apparel and gear are highly valued and command premium prices for the products.

- Skiing & Snowboarding

Apparel and gear used by skiing and snowboarding enthusiasts are insulated and waterproof, and the growth of skiing and snowboarding tourism and the number of enthusiasts engaging in these winter sports drive the purchase of apparel like jackets, pants, and gloves.

- Fishing & Hunting

Durability, camouflage, and weather protection are the key factors in this segment. Apparel in this segment often incorporates water-resistant, UV-resistant, and scent-controlling technology.

- Casual/Urban Outdoor

Casual outdoor wear combines functionality and fashion, targeting the lifestyle-oriented consumer. Jackets, tees, and footwear for the urban outdoorsman are witnessing a high growth rate.

By Distribution Channel

- Online Retail

Electronic commerce channels are increasingly expanding, driven by the ease of shopping, wider product offerings, and direct-to-consumer models of brands. Better return policies and fitting options are also aiding the cause.

- Specialty Stores

Specialty stores for the outdoors are geared towards performance-oriented consumers, who are often assisted by experts and offered access to niche brands. These stores enjoy strong influence for premium and technical products.

- Sports & Outdoor Retailers

These are stores like sporting goods stores, which offer performance-oriented and casual outdoor apparel. They enjoy a large physical presence and seasonal selling, thus driving sales.

- Department Stores

Department stores are geared towards the urban outdoor consumer, who wants casual and lifestyle apparel. These stores enjoy moderate growth, driven by the urban consumer and seasonal selling.

- Direct-to-Consumer

These are stores operated by brands, and the focus here is premium positioning with the entire product portfolio being offered. Trust, consumer loyalty, and the personal touch are what drive the sales for these stores.

Regional Insights

North America, which includes countries like the United States, Canada, and Mexico, is a mature market with a high level of awareness of outdoor activities, a focus on premium products, and a developed retail and e-commerce infrastructure. The United States is a leader in terms of innovation adoption, Canada focuses on winter and adventure sports, and Mexico is a developing market with a growing trend of outdoor activities in urban areas. Europe, which includes countries like Germany, the United Kingdom, France, Spain, Italy, and Rest of Europe, is a promising market with a high level of demand for technical and sustainable apparel. Western Europe focuses on premiumization, hiking, and skiing, while Eastern Europe is witnessing a trend of increasing interest in recreational trekking and casual wear. Asia Pacific, which includes countries like Japan, China, Australia & New Zealand, South Korea, India, and Rest of Asia Pacific, is a promising region with a high level of growth potential due to increasing disposable income, adventure tourism, and urban outdoor trends. Japan, China, and India are the key growth markets in terms of performance fabric adoption and penetration of online retail. South America, which includes countries like Brazil, Argentina, and Rest of South America, has a moderate growth rate driven by trekking, adventure tourism, and fitness awareness. Middle East & Africa includes countries like Saudi Arabia, UAE, South Africa, and Rest of the Middle East & Africa, which has a demand for special and rugged outdoor apparel to tackle extreme weather conditions and the increasing urban outdoor culture. Premiumization, technological innovations, and online retail remain key growth drivers across all the regions.

To learn more about this report, Download Free Sample Report

Recent Development News

- February 2026, Columbia Sportswear Company reported its financial results for Q4 and fiscal year 2025, recording a minor increase in net sales, as well as an expansion of gross margins. The press release also included the company’s financial outlook for 2026, highlighting strategic initiatives across global markets, international growth, and new differentiated collections of products under the Engineered for Whatever brand, reinforcing its position in the outdoor apparel and accessories space.

- In July 2025, Columbia Sportswear Company has published its 2024 Impact Report, which details the company’s progress in various pillars of sustainability and corporate responsibility, such as accelerated access to clean water, reduced energy consumption in key facilities, and “increased workplace sustainability initiatives.” The report covers the company’s progress in various pillars of sustainability and corporate responsibility under its main brands: Columbia, Sorel, Mountain Hardwear, and prAna. The report reflects the company’s continued commitment to various environmental and social objectives as part of its global outdoor apparel business strategy.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 46.00 Billion |

|

Market size value in 2026 |

USD 49.00 Billion |

|

Revenue forecast in 2033 |

USD 79.00 Billion |

|

Growth rate |

CAGR of 7.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

The North Face, Patagonia, Columbia Sportswear Company, Arc’teryx Equipment Inc., REI Co‑op, Salomon S.A., Black Diamond Equipment Ltd., Helly Hansen AS, Marmot, Outdoor Research, Mountain Hardwear, Fjällräven, Jack Wolfskin, Vaude, and Icebreaker |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Jackets & Coats, Pants & Shorts, Base Layers & T-Shirts, Footwear, Hats, Gloves & Accessories, Backpacks & Bags), By Material (Synthetic, Natural, Blended Fabrics), By End-Use (Hiking & Trekking, Camping, Climbing & Mountaineering, Skiing & Snowboarding, Fishing & Hunting, Casual/Urban Outdoor) and By Distribution Channel (Online Retail, Specialty Stores, Sports & Outdoor Retailers, Department Stores, Direct-to-Consumer) |

Key Outdoor Apparel and Accessories Company Insights

The North Face has become a leading company within the global outdoor clothing and outerwear segment by continually developing and introducing new technology-based clothing products that provide wearing comfort, as well as protect from various types of subsequent weather conditions. Their ability to lead in high-performance materials (including proprietary waterproof/breathable technologies) has resulted in the brand being preferred by not only serious adventurers, but also many everyday outdoor enthusiasts. What also contributes to their global success is their extensive distribution network throughout the world to include specialty retailers, selling directly to consumers, and having a solid online presence. The North Face has a strong focus on producing products with performance-based designs, and by providing an authentic brand identity (supporting the reader's voice), enables them to maintain a competitive advantage, which separately helps them to sustain their ability to continue to be relevant in a very fractured marketplace.

Key Outdoor Apparel and Accessories Companies:

- The North Face

- Patagonia

- Columbia Sportswear Company

- Arc’teryx Equipment Inc.

- REI Co‑op

- Salomon S.A.

- Black Diamond Equipment Ltd.

- Helly Hansen AS

- Marmot

- Outdoor Research

- Mountain Hardwear

- Fjällräven

- Jack Wolfskin

- Vaude

- Icebreaker

Global Outdoor Apparel and Accessories Market Report Segmentation

By Product Type

- Jackets & Coats

- Pants & Shorts

- Base Layers & T-Shirts

- Footwear

- Hats, Gloves & Accessories

- Backpacks & Bags

By Material

- Synthetic

- Natural

- Blended Fabrics

By End-Use

- Hiking & Trekking

- Camping

- Climbing & Mountaineering

- Skiing & Snowboarding

- Fishing & Hunting

- Casual/Urban Outdoor

By Distribution Channel

- Online Retail

- Specialty Stores

- Sports & Outdoor Retailers

- Department Stores

- Direct-to-Consumer

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636