Market Summary

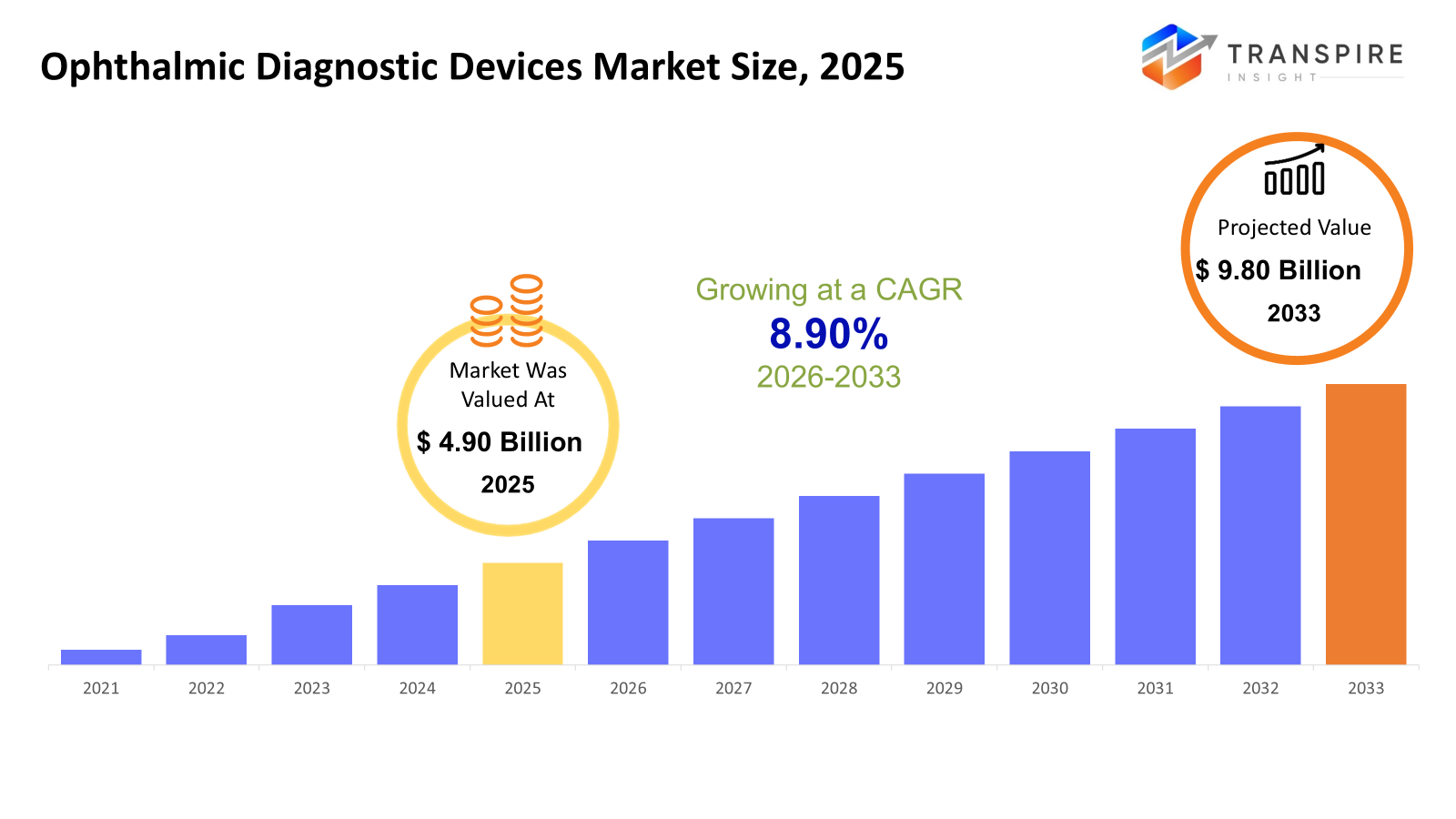

The global Ophthalmic Diagnostic Devices market size was valued at USD 4.90 billion in 2025 and is projected to reach USD 9.80 billion by 2033, growing at a CAGR of 8.90% from 2026 to 2033. The market for ophthalmic diagnostic devices is increasing with an increasing incidence of age-related vision disorders, diabetes-related vision problems, and other vision problems worldwide. The increasing trend of advanced imaging techniques and AI-based diagnostic systems is also driving the market. In addition, increasing awareness of preventive measures for eye problems and development of ophthalmology infrastructure in emerging markets is also driving the market.

Market Size & Forecast

- 2025 Market Size: USD 4.90 Billion

- 2033 Projected Market Size: USD 9.80 Billion

- CAGR (2026-2033): 8.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America continues to show steady growth trends with support from highly developed reimbursement systems, widespread screening activities, and high penetration rates of premium ophthalmic imaging technologies, with digital health technologies and established positions of key industry players driving continued technology updates.

- The U.S. is driving regional momentum with its adoption of AI-enabled ophthalmology diagnostics, its growth in outpatient surgical volumes, and its investments in clinical research, with private ophthalmology networks driving procurement of high-resolution imaging systems.

- Asia Pacific possesses the fastest growth rate due to the increasing diabetic and elderly populations, development in the healthcare sector, and awareness initiatives, as the Chinese, Indian, and Japanese governments seek to undertake retinal screening programs at an affordable cost.

- Optical coherence tomography scanners hold the top spot in the product segment due to the accuracy in imaging, increasing scope in the treatment of glaucoma and retinal diseases, and the development of new technology in the field.

- The technology landscape is dominated by optical-based diagnostics, owing to non-invasive capabilities, high-resolution visualization, and strong clinical validation, with digital imaging software and artificial intelligence adding value to the workflow efficiency of hospitals and clinics.

- The application of cataract diagnosis is the major driving force for the growth of the market, fueled by the increasing global surgical procedures, the expanding geriatric population, and the need for precise biometric analysis for the choice of intraocular lenses.

- The ophthalmic clinics segment is the largest end-user segment, driven by the expansion of outpatient services, the growth in private eye care facilities and the need for compact high-performance diagnostic solutions in routine and special vision examinations.

So, The ophthalmic diagnostic devices market refers to the medical devices used to identify, monitor, and manage different eye problems by employing the latest technologies in medical imaging and measurement techniques. These medical devices are of great importance in the early detection of different eye problems, especially chronic diseases like glaucoma, diabetic retinopathy, cataracts and age-related macular degeneration. The increased need for precise diagnostic tools has largely affected the innovation of technology in this market segment. Market growth is highly correlated with demographic factors, especially with the rise in the aging population and the incidence of lifestyle-related diseases, particularly those affecting vision. Technological advancements, including optical coherence tomography, AI-based image analysis and digital imaging platforms, have helped increase accuracy and workflow efficiency. These advancements are encouraging healthcare facilities to upgrade their diagnostic equipment.

In addition to that the scope of screening programs and awareness about the need for preventive eye care are helping the ophthalmic diagnostic devices market grow. New economies are investing in the modernization of their healthcare systems and improving ophthalmology facilities.

Ophthalmic Diagnostic Devices Market Segmentation

By Product Type

- Optical Coherence Tomography (OCT) Scanners

OCT scanners stand as a cornerstone for retinal diagnostics, enabling high-resolution cross-sectional visualization of various structures. The drivers for its adoption come from rising incidence rates for glaucoma, AMD, and diabetic retinopathy. Various technological advances, including swept-source OCT and AI analytics, are also hastening replacement cycles in developed countries.

- Fundus Cameras

Fundus cameras are used in retinal photography and screening programs, especially for diabetic retinopathy. The growth of this segment is fueled by the expansion of teleophthalmology and portable, non-mydriatic devices. The need is growing in primary care and new countries in emerging economies, focusing on early disease detection.

- Perimeters / Visual Field Analyzers

Perimeters are very important in the diagnosis and monitoring of glaucoma, where there is an assessment of functional vision loss. The increasing incidence rates of glaucoma, coupled with the need for routine screening, are driving the demand for perimeters. New automated and computerized perimeters are improving diagnostic efficiency

- Autorefractors and Keratometers

These devices are generally used for the assessment of refractive errors and pre-surgical evaluations. The market growth is related to the increased rates of myopia and elective refractive surgery cases. Portable and combination devices are becoming popular in outpatient clinics.

- Optical Biometers

The optical biometers play an important role in the planning of cataract surgery, allowing for precise intraocular lens power calculation. The increasing rate of cataract surgeries worldwide is a major factor for the growth of the market. The emphasis on speed and accuracy is also contributing to the growth of the market.

- Ophthalmic Ultrasound Imaging Systems

Ultrasound systems find their applications when there is a reduction in optical clarity, such as dense cataract or vitreous hemorrhages. They continue to play a role in trauma and posterior segment examinations. There is a steady market requirement for ultrasound systems in both developed and resource-constrained environments.

- Corneal Topography Systems

Corneal topography systems are used to chart the curvature of the cornea, thereby facilitating refractive surgery planning and the diagnosis of keratoconus. Growing numbers of LASIK procedures and increased awareness of corneal diseases are likely to boost the market. It can be coupled with advanced imaging software to

- Specular Microscopes

Specular microscopes are used for the evaluation of the health of the endothelial cells of the cornea, especially for pre- and post-surgical assessments. This growth is driven by the increase in the number of corneal transplant surgeries and intricate cataract surgeries.

- Others

This segment includes pachymeters and tonometers. These devices are crucial in supporting comprehensive eye care. Increasing screening activities and ophthalmic evaluations maintain moderate and steady product demand. Innovation in this product segment is centered on portability and digital technology.

By Technology

- Optical-Based Diagnostics

Optical-based systems are predominant because of their non-invasive nature and the capability of high-resolution images. Innovation in depth and speed of imaging continues to improve diagnostic confidence. Uptake of the technology continues to be strong in tertiary care facilities and advanced ophthalmic clinics.

- Ultrasound-Based Diagnostics

The use of ultrasound diagnostics offers supplementary imaging where other optical techniques may be limited. These are especially useful where opaque media conditions apply. The market is steadily increasing, driven by its versatility and cost-effectiveness.

- Imaging-Based Diagnostics

Imaging technologies, like fundus photographs and OCT, are the cornerstone of disease monitoring. Digital health record integration is helping to drive the trend further. Screening programs and telemedicine are also driving the demand for imaging technologies.

- AI-Enabled Diagnostic Systems

AI-assisted systems are revolutionizing ophthalmic diagnostics with automated detection and predictive analytics capabilities. The technology is increasingly being adopted for screening programs for diabetic retinopathy and glaucoma. Regulatory approvals are also speeding up the commercialization of the technology worldwide.

To learn more about this report, Download Free Sample Report

By Application

- Cataract Diagnosis

Cataract diagnosis offers a major application area, driven by the high surgical volumes globally. Aging populations and surgical access are major factors for the demand of cataract diagnoses. Pre-operative biometric accuracy is important for a good outcome.

- Glaucoma Diagnosis

Glaucoma diagnostic equipment includes OCT and perimetry systems. Increasing cases of the disease and the importance of early detection are driving the market forward. Long-term monitoring of the disease ensures continued usage of the equipment.

- Age-Related Macular Degeneration (AMD)

AMD diagnosis relies on retinal imaging at a high resolution. OCT is the key imaging technique. The elderly population in North America, Europe, and Japan is increasing. Early-stage AMD helps in better therapeutic management.

- Diabetic Retinopathy

Screening for diabetic retinopathy is increasing in scope due to the rise in the global incidence of diabetes. Fundus cameras and artificial intelligence-based systems are at the core. There is an increasing investment in mass screening facilities in the emerging economies.

- Refractive Error Diagnosis

The increasing rates of myopia, especially in Asia Pacific, are driving high demand for autorefractors and keratometers. Awareness and vision screening are also boosting the market, which is recording steady growth. Optical retail chains are also contributing to the expansion of the market segment.

- Others

This segment comprises uveitis and corneal disease diagnostics. The growth is moderate, driven by developments in the field of multimodal imaging. Ophthalmic specialty sites are the primary adopters of this segment.

By End User

- Hospitals

Hospitals contribute substantially to the revenue stream, given their diagnostic capabilities and high patient volumes. Investment in diagnostic imaging technologies helps in the management of complex cases. Expansion in the hospital industry in emerging markets, particularly in public and private sectors, drives demand.

- Ophthalmic Clinics

Specialized clinics are important growth drivers, especially for outpatient diagnostics and refractive surgery. The use of compact and integrated devices has the advantage of improving workflow efficiency. Expansion of private ophthalmology networks is driving steady upgrades of equipment.

- Ambulatory Surgical Centers (ASCs)

ASCs are helped by the growing demand for minimally invasive cataract and refractive surgeries. Demand for pre- and post-operative diagnostic accuracy drives the market. Cost-effectiveness and space-saving are key considerations.

- Diagnostic Centers

Standalone diagnostic centers are used to support screening programs and referrals. The growth of the market is attributed to urbanization and preventive healthcare programs. The integration of tele ophthalmology adds scalability to the operations of the market.

- Academic and Research Institutes

These institutes make use of the latest imaging technologies for research and innovations. Funds for ophthalmic research help in purchasing state-of-the-art technology. Collaborations with device companies help in technology validation and development.

Regional Insights

North America, comprising the United States, Canada, and Mexico, forms a mature market with a high level of adoption of advanced diagnostic technologies and a well-developed structure of ophthalmology services. The country with the highest level of demand for AI-enabled diagnostics in the region is the United States, followed by steady growth in Canada and Mexico, driven by increased access to eye care services. The region comprises countries such as Germany, the United Kingdom, France, Spain, Italy and the rest of Europe. The market is steadily increasing with a strong growth rate due to aging populations and robust public healthcare systems. The Tier 1 countries, namely Germany and the United Kingdom, are leaders in technology adoption, while other countries such as those in Southern and Eastern Europe are increasing their ophthalmic diagnostic systems through healthcare modernization. Asia Pacific, which includes countries like Japan, China, Australia, and New Zealand, along with South Korea, India, and the rest of Asia Pacific, is the fastest-growing market. Countries like Japan and South Korea have high levels of penetration of advanced image-based devices, while countries like China and India have high volume growth due to increased screening programs and investments in healthcare. South America, which includes countries like Brazil and Argentina, has a gradual growth pattern due to growth in private healthcare, while countries like Saudi Arabia, United Arab Emirates, South Africa and the rest of Middle East and Africa have growth due to investments in healthcare and adoption of advanced ophthalmic devices.

To learn more about this report, Download Free Sample Report

Recent Development News

- July 2025, Topcon Healthcare has made an investment in and partnered with OKKO Health to advance vision monitoring solutions in the home environment. The partnership has aimed at empowering patients to monitor their vision at home by utilizing smartphone-based technology, thereby facilitating the early detection of changes in eye health. The move has reflected the integration of digital health technologies with ophthalmic diagnostic systems, thereby enhancing the diagnostic capabilities of the healthcare system and the preventive eye care system.

- In December 2024, In recent news, ZEISS reported advancements in ophthalmic diagnostic technologies, focusing on digital workflow integration and AI-assisted image technologies to enhance clinical workflow and diagnostic accuracy. These advancements are aimed at improving disease detection, decision making, and data-driven ophthalmology. These advancements are part of a trend towards automation and precision diagnostics in ophthalmology, particularly in managing chronic diseases like glaucoma and retinal diseases.

(Source:https://www.zeiss.com/meditec-ag/en/media-news/press-releases/2024/zeiss-at-aao.html)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 4.90 Billion |

|

Market size value in 2026 |

USD 5.40 Billion |

|

Revenue forecast in 2033 |

USD 9.80 Billion |

|

Growth rate |

CAGR of 8.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Carl Zeiss Meditec AG, Topcon Corporation, NIDEK Co., Ltd., Heidelberg Engineering GmbH, Canon Medical Systems Corporation, Haag-Streit Group, Optovue, Inc., Tomey Corporation, Optopol Technology Sp. z o.o., Ziemer Ophthalmic Systems AG, Lumedica Inc., Visionix (Luneau Technology Group), EssilorLuxottica SA, Bausch + Lomb Corporation, and Alcon Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Optical Coherence Tomography (OCT) Scanners, Fundus Cameras, Perimeters / Visual Field Analyzers, Autorefractors and Keratometers, Optical Biometers, Ophthalmic Ultrasound Imaging Systems, Corneal Topography Systems, Specular Microscopes, Others), By Technology (Optical-Based Diagnostics, Ultrasound-Based Diagnostics, Imaging-Based Diagnostics, AI-Enabled Diagnostic Systems), By Application (Cataract Diagnosis, Glaucoma Diagnosis, Age-Related Macular Degeneration (AMD), Diabetic Retinopathy, Refractive Error Diagnosis, Others) and By End User (Hospitals, Ophthalmic Clinics, Ambulatory Surgical Centers (ASCs), Diagnostic Centers, Academic and Research Institutes) |

Key Ophthalmic Diagnostic Devices Company Insights

The company has a strong competitive edge with its comprehensive product portfolio for ophthalmic diagnostics and surgery, backed by continuous technological advancement and strong distribution power. The company is also gaining from strong market adoption of its optical coherence tomography systems, advanced imaging systems, and digital workflow solutions. The company is also focusing on precise diagnostics, AI analysis, and connectivity, which is improving its market position. The company has a strong footprint in key markets such as North America, Europe, and Asia Pacific, with strategic partnerships and product updates, which is helping the company maintain its market leadership. The company is also focusing on continuous R&D activities, which is strengthening its position to cater to emerging ophthalmic diagnostic needs.

Key Ophthalmic Diagnostic Devices Companies:

- Carl Zeiss Meditec AG

- Topcon Corporation

- NIDEK Co., Ltd.

- Heidelberg Engineering GmbH

- Canon Medical Systems Corporation

- Haag-Streit Group

- Optovue, Inc.

- Tomey Corporation

- Optopol Technology Sp. z o.o.

- Ziemer Ophthalmic Systems AG

- Lumedica Inc.

- Visionix (Luneau Technology Group)

- EssilorLuxottica SA

- Bausch + Lomb Corporation

- Alcon Inc.

Global Ophthalmic Diagnostic Devices Market Report Segmentation

By Product Type

- Optical Coherence Tomography (OCT) Scanners

- Fundus Cameras

- Perimeters / Visual Field Analyzers

- Autorefractors and Keratometers

- Optical Biometers

- Ophthalmic Ultrasound Imaging Systems

- Corneal Topography Systems

- Specular Microscopes

- Others

By Technology

- Optical-Based Diagnostics

- Ultrasound-Based Diagnostics

- Imaging-Based Diagnostics

- AI-Enabled Diagnostic Systems

By Application

- Cataract Diagnosis

- Glaucoma Diagnosis

- Age-Related Macular Degeneration (AMD)

- Diabetic Retinopathy

- Refractive Error Diagnosis

- Others

By End User

- Hospitals

- Ophthalmic Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Academic and Research Institutes

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636