arket Summary

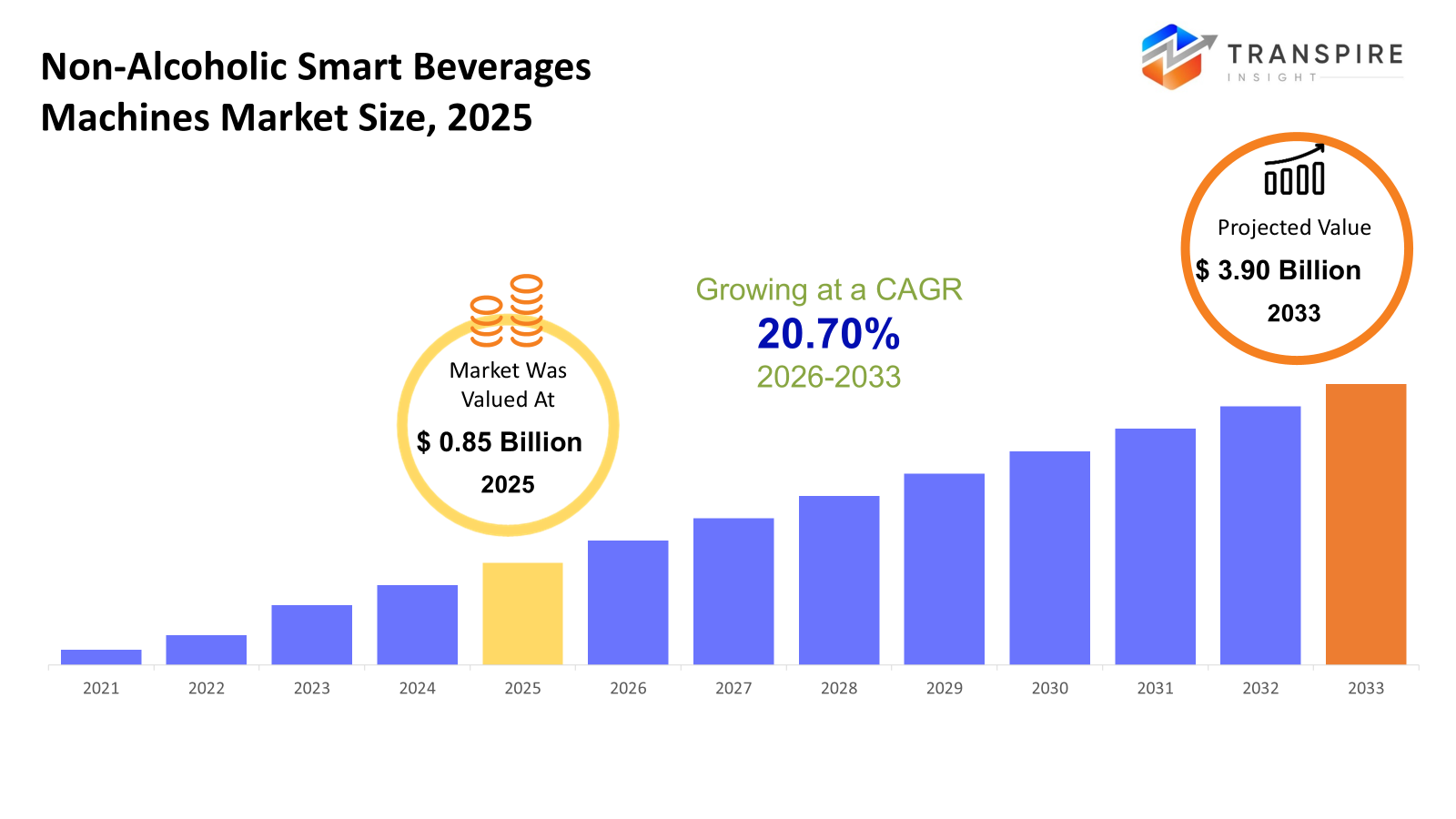

The global Non-Alcoholic Smart Beverages Machines market size was valued at USD 0.85 billion in 2025 and is projected to reach USD 3.90 billion by 2033, growing at a CAGR of 20.70% from 2026 to 2033. Home setups now see more non-alcoholic smart drink machines because people want quick choices they can tweak themselves. Health focus climbs, pulling interest toward better drinks without effort. Gadgets that connect online shape how places pick new equipment. Choices shift as tech blends into daily routines quietly. What once felt rare now fits inside offices and kitchens alike.

Market Size & Forecast

- 2025 Market Size: USD 0.85 Billion

- 2033 Projected Market Size: USD 3.90 Billion

- CAGR (2026-2033): 20.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. People now grab smart gadgets for their homes more than ever. A fresh wave comes from living healthier, choosing better habits shapes spending too. Custom drinks play a role, as tastes shift toward personal picks instead of one-size options.

- The United States is out ahead because drink dispensers got smart sooner here. Online shopping is already common across the area. People have cash left after bills to spend on new things.

- Urban areas are expanding quickly across parts of Asia. China sees more people buying high-tech home gear. Rising pay lets households spend on modern comforts. India's market heats up with demand for smarter kitchens. New habits shape how people live day to day. Japan blends tradition with digital upgrades at home. More cities mean more change in daily routines.

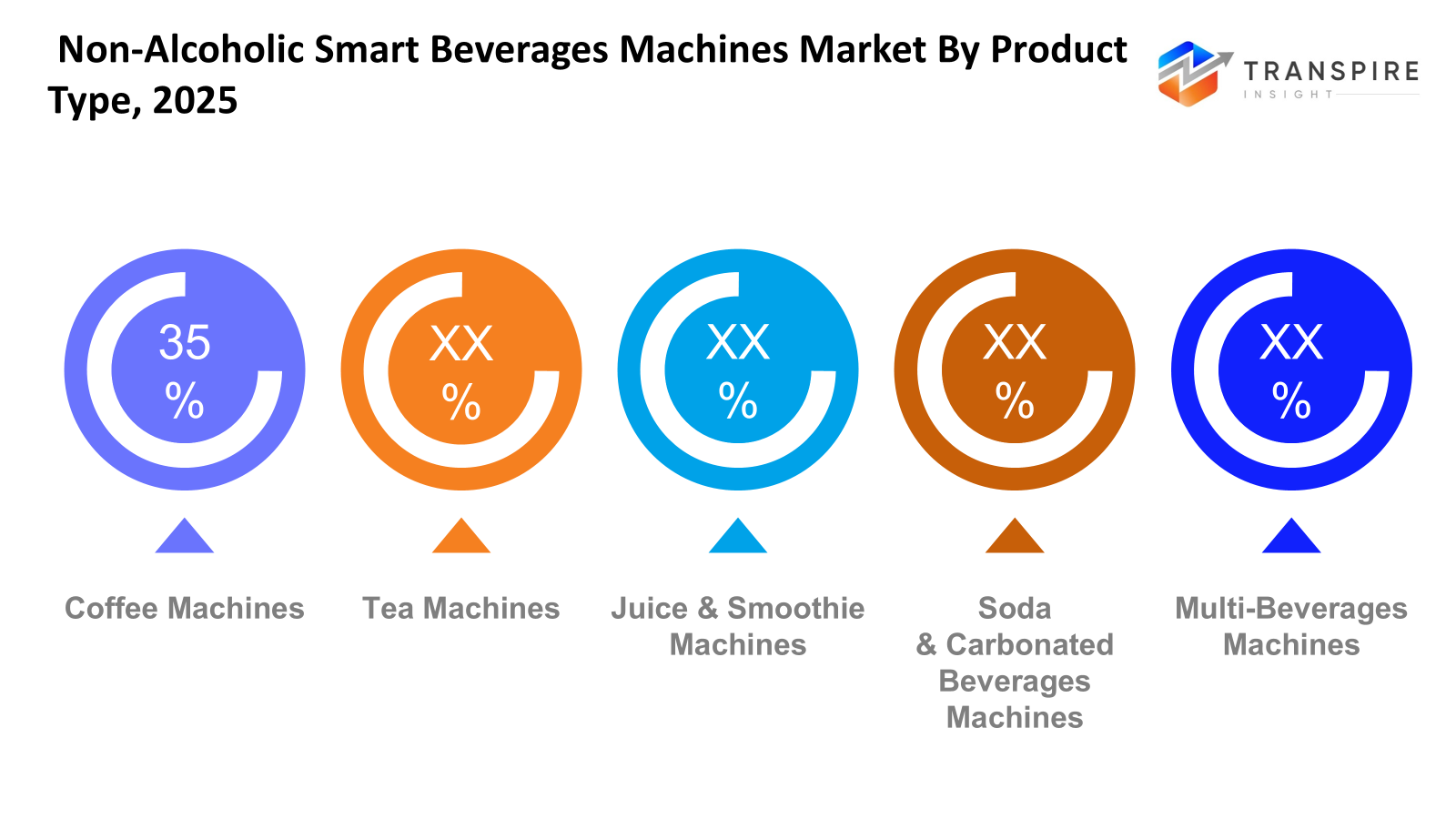

- Coffee Machines share approximately 35% in 2026. Home and business spots alike lean on coffee machines; these gadgets win favor thanks to ease and personal taste control. Popularity climbs as more people choose quick, tailored cups without stepping outside.

- Since people want things easier, they tap apps instead of buttons. Remote access fits right into how homes work these day connected, quick, always on. Smart setups love them because they link without fuss. What once felt rare is now part of daily life. Control shifts happen quietly, behind screens. New habits grow around touch-free choices. Seamless blends with other gadgets keep pulling interest forward.

- Faster growth shows up online, where shopping clicks because getting things at home feels simple. Delivery to your door pairs well with plans that renew automatically, pulling more people in. What stands out is how smooth it feels - no lines, just orders arriving. Subscriptions stick around since they trim down the effort each month.

- At home, people are using more smart drink devices because they fit easily into everyday routines while offering choices that feel made just for them.

Right now, more consumers are choosing beverages that align with their wellness goals, which is accelerating growth in the non-alcoholic smart beverages machines market. These machines make it easy to prepare coffee, tea, juice, or functional health blends with minimal effort. As lifestyles become faster and more convenience-driven, tapping a screen to customize a drink feels natural and efficient. Many devices now adjust flavor intensity, temperature, and strength through connected mobile apps or voice-enabled controls. What truly differentiates these systems is not just the technology itself, but how seamlessly they deliver personalized beverages exactly when needed.

Tech progress, clearly. Features such as linking to apps, self-serving portions, and using artificial intelligence to tailor drinks now matter more than before. Because of these upgrades, people at home or businesses like restaurants can make drinks faster, toss less away, yet keep each batch tasting just right. Not stuck to kitchens only, these clever devices show up where you might not expect them, at workplaces, guest houses, coffee spots, and even in homes.

Now more than ever, makers shape new versions of coffee gear to match how people actually use them at home. Not just one-size-fits-all models, machines now pour single cups or brew several drinks in a row, depending on what someone wants. With green choices mattering more to buyers, companies tweak materials and power use behind the scenes. Machines that sip less electricity and create less waste slowly become standard rather than rare.

Shifting shopping habits push how drinks get sold. Now, corner shops, big stores, and online sites make these machines easier to find. Teams build confidence by working with known names, promoting clearly, and standing behind support once bought. Each piece adds up to a wider presence, stronger interest, and steady rise through different areas where people live, work, and drink.

Non-Alcoholic Smart Beverages Machines Market Segmentation

By Product Type

- Coffee Machines

Starting strong, these machines brew coffee fast - found everywhere from kitchens to cafes. Settings change easily, making each cup match personal taste. Not stuck on one style, they adapt whether you want bold or mild. Their reach goes beyond homes into busy shops where speed matters too.

- Tea Machines

From loose leaves to green blends, machines handle steeping without fuss. One press delivers steady results every time. Built for daily use, they simplify ritual into a single step. These gadgets keep flavor reliable, cup after cup.

- Juice & Smoothie Machines

Fresh drinks flow fast when machines blend fruits just right. Health fans love how these tools turn produce into sips without fuss. Some models crush ice while others slowly extract liquid gold from greens. Each glass holds more than flavor - think energy, color, life. Taste stays bright, close to nature.

- Soda & Carbonated Beverages Machines

Home or office settings find fizz anytime through soda and carbonated drink machines. These units deliver instant bubbly refreshments without needing store trips. Bubbles come ready whenever wanted, thanks to built-in carbonation. Easy access shapes how people enjoy soft drinks daily. Fizzy options appear fast, changing usual drinking routines. Machines stand quietly until someone wants a chilled, sparkling pour. Refreshment shifts from waiting to immediate, just by pressing a button.

- Multi-Beverages Machines

This machine handles it without needing extra gadgets. Not limited to just coffee, it shifts easily into other modes when needed. One device, several options, no swapping appliances each time. Flexibility shows up right where you’d least expect it. Making different beverages feels less like work, more like routine.

To learn more about this report, Download Free Sample Report

By Technology

- App-Enabled Machines

From your phone, tweak settings on machines that connect via apps. These gadgets respond to commands sent far away. Custom options appear right in the palm of your hand. Control shifts easily when screens guide adjustments. Functions change without touching the device itself.

- Touchscreen Machines

With a tap here or a swipe there, touchscreen machines guide users through steps using live feedback on screen. Some find it natural right away because choices appear as they go. Each move feels like flipping pages - smooth, without pause.

- AI-Enabled Machines

AI-Enabled Machines: Provide personalized beverage recommendations and automated

customization.

- IoT Integrated Machines

Connected devices talk to household systems, sending live updates. These machines share data while checking conditions as they happen. A network link keeps them active alongside the apps people use daily.

By Distribution Channel

- Supermarket/Hypermarket

Provides wide product availability for everyday consumers.

- Specialty Stores

Enthusiasts often land here when chasing advanced drink gadgets. Premium models take center stage across these shelves. Machines with smart features show up more than basic versions. A narrow selection rules the space; only top-tier gear makes the cut.

- Online

Folks shop more online these days because it fits their routine. Delivery right to the door plays a big part. Some stick with automatic renewals that charge each month. What keeps people coming back is how little effort it takes.

- Direct Sales

Brand shops and company-run paths serve business buyers directly. What you get is a straight route without middle steps in between.

By End-Users

- Residential

Folks at home mix drinks they like every day using these. Devices sit quietly in kitchens, ready when needed. Some tweak flavors just how they want. Morning routines often start here. Each cup is shaped by habit, preference, and small choices.

- Commercial

Offices, hotels, cafes - these spots often choose it when drinks are needed fast, again and again. Where crowds gather, you’ll find this setup pulling through each busy rush without pause.

Regional Insights

Most people in North America grab onto smart kitchen gadgets fast. Health awareness keeps rising across the region, which pushes interest in tailored drinks. What helps even more is how much folks there like options that fit their personal habits. The United States pulls ahead because homes, workplaces, and businesses plug into digital tools daily.

Steady growth marks the scene across Europe, where cafes, eateries, and lodging spots seek more advanced drink dispensing gear. Germany, France, and the United Kingdom. lead shifts fueled by smart upgrades, lower power needs, along with a stronger interest in alcohol-free, purpose-driven beverages. Behind this push lies evolving taste, paired with tools that save resources while delivering quality on demand.

Jumping ahead, Asia Pacific leads global growth thanks to more spending power and city expansion, especially where tech-savvy homes take off, places like China, India, and Japan come to mind. Meanwhile, far beyond those borders, parts of Latin America, along with Middle Eastern and African markets, quietly gain momentum, step by step, as digital storefronts spread and curiosity about intelligent drink-making tools grows among shops and households alike.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 18, 2025 – Coca-Cola & Coco-Cola Europacific partners launched AI-powered Coke & GO coolers across New Zealand.

- October 10, 2025 – Xcoffee launched the region’s first AI-powered smart robotic beverages.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 0.85 Billion |

|

Market size value in 2026 |

USD 1.05 Billion |

|

Revenue forecast in 2033 |

USD 3.90 Billion |

|

Growth rate |

CAGR of 20.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Terra Universal, Clean Air Products, Azbil Corporation, Getinge AB, Abtech, SKAN Group, Germfree Laboratories, Klenzaid, Bühler Group, Enbio, Heal Force, Nuaire, Air Techniques International, G-CON Manufacturing, Cleanroom Technology, AES Clean Technology, and PortaFab Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Coffee Machines, Tea Machines, Juice & Smoothie Machines, Soda & Carbonated Beverages Machines, Multi-Beverages Machines), By Technology (App-Enabled, Touchscreen, AI-Enabled, IoT-Integrated Machines), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Online, Direct Sales), By End-Users (Residential, Commercial) |

Key Non-Alcoholic Smart Beverages Machines Company Insights

One of the top names in non-alcoholic smart drink machines is Nestlé, famous for brewing systems such as Nespresso. Instead of just selling devices, it pairs sleek hardware with specially designed pods for better taste and ease. Because these setups offer personalization along with reliability, many users stick around long after their first cup. While physical stores still matter, digital channels now help move more units worldwide each year. On top of that, eco-conscious designs and built-in tech features keep buyers paying attention - even when rivals try harder.

Key Non-Alcoholic Smart Beverages Machines Companies:

- Nestlé

- Keurig Dr. Pepper

- Philips

- Breville

- Nespresso

- Hamilton Beach

- De’Longhi

- Jura

- Krups

- Bosch

- Saeco

- Cuisinart

- Lavazza

- Bunn

- Electrolu

- Xiaomi,

- LG Electronics.

Global Non-Alcoholic Smart Beverages Machines Market Report Segmentation

By Product Type

- Coffee Machines

- Tea Machines

- Juice & Smoothie Machines

- Soda & Carbonated Beverages Machines

- Multi-Beverages Machines

By Technology

- App-Enabled

- Touchscreen

- AI-Enabled

- IoT-Integrated Machines

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Online

- Direct Sales

By End-Users

- Residential

- Commercial

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636