MARKET OVERVIEW:

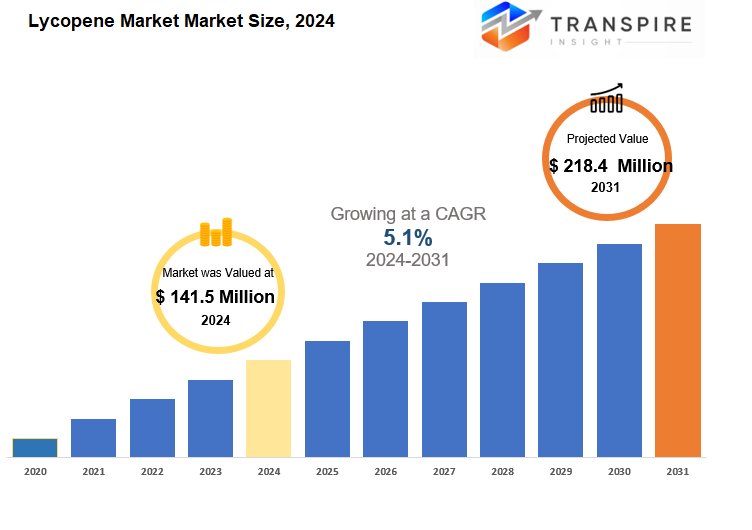

Global Lycopene market is estimated to reach $218.4 Million by 2031; growing at a CAGR of 5.1% from 2023 to 2031.

The Global Lycopene Market is growing due to factors like consumer trends, technological advancements, and agricultural practices. Lycopene, found in tomatoes and red fruits, is in high demand for its health benefits and natural antioxidants.

The market caters to consumers looking for nutritional value and potential health benefits. It is also expanding into pharmaceuticals and cosmetics, with research on its medicinal properties and skin-friendly attributes. Agriculture plays a vital role, influencing cultivation practices and supply chain intricacies. Sustainability and organic farming practices are becoming more important, reflecting a global shift towards eco-conscious choices.

The market is a diverse tapestry of health consciousness, technological innovation, and agricultural dynamics, going beyond traditional commodity markets. The future of the market is seen as adaptable and evolving, reflecting the dynamic forces shaping our world.

GROWTH FACTORS

The Global Lycopene Market is expanding due to various factors. People are increasingly aware of the health benefits of consuming lycopene, which is found in tomatoes and other red fruits. The food and beverage industry's interest in natural colorants boosts the demand for lycopene to enhance product appearance. Consumers favor natural and organic ingredients, aligning with the trend towards healthier lifestyles.

Lycopene's antioxidant properties make it popular in skincare and cosmetics as it protects against UV radiation and pollutants. Ongoing research is exploring new applications for lycopene in pharmaceuticals, nutraceuticals, and functional foods.

The market is also growing globally as lycopene is incorporated into traditional cuisines and products worldwide. Overall, the market's growth is driven by evolving consumer preferences, health awareness, and the food, beauty, and pharmaceutical industries' dynamics.

MARKET SEGMENTATION

By Source

The Global Lycopene Market is divided into two segments: Synthetic and Natural. The Synthetic segment, valued at 82. 5 USD Million in 2022, involves lycopene produced through artificial processes, ensuring a consistent supply that is cost-effective. Industries prefer synthetic lycopene for its reliability.

On the other hand, the Natural segment, valued at 51. 8 USD Million in 2022, includes lycopene sourced from natural sources like tomatoes and watermelons. Natural lycopene is popular due to its perceived health benefits and the preference for natural ingredients in consumer products. The distinction between synthetic and natural lycopene caters to different industry preferences and consumer trends, providing stakeholders with choices that suit their specific requirements.

By Form

The Global Lycopene Market offers a variety of forms like Beadlets, Oil Suspension, Powder, and Emulsion. Each form has its unique characteristics and advantages that cater to different industries and consumer preferences. Beadlets are small, stable spheres that can be easily incorporated into products. Oil Suspension provides a versatile solution for oil-based applications. Powdered lycopene is convenient and flexible, making it popular in various industries. Emulsion, a mixture of lycopene in water and oil, is compatible in different formulations like food and beverages.

The choice of lycopene form depends on specific product requirements. Beadlets are suitable for supplements. Oil Suspension is used in cosmetics. Powdered lycopene is common in the food industry for color and nutrition. Emulsion is ideal for beverages and pharmaceuticals. The various forms of lycopene allow for its widespread use in different industries, from supplements to food products. As global demand increases, the availability and adaptability of lycopene forms continue to expand, driving the growth of the lycopene market.

By Property

The Global Lycopene Market is complex, with various properties contributing to its versatility. One key aspect is its role as a Health Ingredient, valued at 72. 6 USD Million in 2022, showing its importance in the health and wellness sector. Another significant property is its use as a Coloring Agent, valued at 61. 7 USD Million, highlighting its role in food and cosmetic industries for natural coloring.

Both Health Ingredient and Coloring Agent aspects showcase the market's flexibility in meeting consumer demands. The Health Ingredient segment aligns with the trend towards healthier lifestyles, driving the demand for nutritional supplements and functional foods. On the other hand, the Coloring Agent segment reflects the consumer preference for natural and sustainable ingredients in products.

Lycopene, derived from fruits like tomatoes, is widely used for its health benefits and vibrant color properties. Its versatility in catering to both health-conscious consumers and those seeking natural ingredients demonstrates its importance in various industries. The Global Lycopene Market adapts to changing consumer needs and industry trends, making lycopene a sought-after component in different sectors.

By Application

The global Lycopene Market is versatile and finds applications in various sectors such as dietary supplements, food & beverages, personal care products, and pharmaceuticals. Dietary supplements contain Lycopene, providing consumers with a concentrated source of the compound for nutritional benefits. In the food & beverages sector, Lycopene is added to products like sauces and juices due to the growing awareness of its health benefits as a natural antioxidant.

Lycopene is increasingly used in personal care products like creams and lotions due to its antioxidant properties, aligning with the trend for natural ingredients in skincare. In the pharmaceutical industry, Lycopene is recognized for its antioxidant and anti-inflammatory properties and is included in medications and supplements for specific health purposes.

The diverse applications of Lycopene reflect its versatility and impact on consumer choices and industry trends, highlighting its journey from a natural antioxidant to a valuable component in products that promote health and well-being.

REGIONAL ANALYSIS

The Global Lycopene Market is influenced by various regional factors, each contributing to its overall growth and dynamics. Understanding these nuances is essential for grasping the market’s development.

- Europe: The Lycopene Market is flourishing due to greater awareness of lycopene's health benefits. The focus on preventive healthcare and the rise of natural supplements significantly boost this growth. A strong presence of major companies in the region also supports market expansion.

- North America: This market is growing as health-conscious consumers seek natural antioxidants like lycopene. The rise in chronic diseases and a focus on nutrition drive demand, while advancements in food processing help incorporate lycopene into various products.

- Asia-Pacific: With its large population and diverse diets, this region plays a crucial role in the Lycopene Market. Rising health awareness and the adoption of Western dietary trends encourage demand for functional foods rich in lycopene. Additionally, local agricultural production supports this growth.

- Latin America: Growth is steady, fueled by a growing middle class and a focus on preventive health. Traditional diets rich in tomatoes help increase demand for lycopene-fortified products.

- Middle East and Africa: Though currently smaller, this market shows potential for growth due to rising health awareness. Economic stability and market access are key to its development.

KEY INDUSTRY PLAYERS

In the Global Lycopene Market, key players like Allied Biotech Corporation and Divi's Laboratories Limited are instrumental in shaping the industry. Allied Biotech Corporation brings experience and expertise to drive market growth, highlighting the importance of strategic players. Similarly, Divi's Laboratories Limited sets benchmarks for quality and innovation, meeting market demands effectively. Both companies play a vital role in driving advancements and fostering competitiveness within the lycopene market.

Their contributions go beyond individual success, influencing the overall progress of the industry on a global scale. By leading in innovation, quality, and market trends, Allied Biotech Corporation and Divi's Laboratories Limited significantly impact the dynamics and vibrancy of the lycopene sector.

REPORT SCOPE AND SEGMENTATION

|

Attributes |

Details |

|

Market Size By 2031 |

USD 218.4 Million |

|

Growth Rate |

CAGR of 5.1% |

|

Forecast period |

2024 - 2031 |

|

Report Pages |

250+ |

|

By Source |

|

|

By Form |

|

|

By Property |

|

|

By Application |

|

|

By Region |

|

|

Key Market Players |

|

APAC:+91 7666513636

APAC:+91 7666513636