Market Summary

The global Long-Duration Energy Storage market size was valued at USD 3.35 billion in 2025 and is projected to reach USD 19.35 billion by 2033, growing at a CAGR of 23.10% from 2026 to 2033. Power from sun and wind grows fast, pushing demand for ways to store it longer. Because that power comes and goes, systems must even out supply over days, not just hours. Now grids use heavy-duty batteries to avoid blackouts when usage spikes. These setups help keep lights on during lulls when turbines sit still, or skies turn gray. Better tech makes them work more efficiently than before. Prices drop as materials get cheaper and designs evolve slowly. Rules made in capitals favor clean upgrades, nudging companies to act.

Market Size & Forecast

- 2025 Market Size: USD 3.35 Billion

- 2033 Projected Market Size: USD 19.35 Billion

- CAGR (2026-2033): 23.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 35% in 2026. North America's big solar and wind projects are coming online. Rules that back clean energy play a part, too. Utilities putting money into water-powered storage helps. New ways to store power for many hours are also catching on.

- Out front, United States federal support gives momentum. State rules pushing cleaner power add fuel to the fire. Long-lasting batteries are showing up more often where they’re needed most - helping cities handle surges and keep lights on when demand spikes.

- Asia Pacific fueled by city growth, higher electricity needs, and more green energy, storage solutions spread fast, pumped water systems and new flow batteries take root in parts of China, India, and Southeast Asia.

- Pumped Hydro Storage shares approximately 86% in 2026. Flooded valleys spin power when demand peaks. Old dams keep going decade after decade. Trusted performance locks it into big networks. Built-out systems give it a head start on scale.

- Half a day to three days stands out now. Power networks are leaning on longer backups more often because sunshine and wind come and go unpredictably.

- Utilities now back grid energy storage to handle surges, ease bottlenecks, and keep supply steady through shifts. Stability takes center stage when managing heavy loads across networks. Long-haul performance matters just as much as immediate response during peak strain.

- Fueled by utility investment, these systems keep leading the pack - long-duration storage fits neatly into clean energy targets. Power providers back them heavily while chasing reliability and lower emissions.

Power systems now see longer-term battery tech as essential, since nations push faster into renewables. Storing electric power over many hours helps balance how much sun and wind feed into the network at any time. When supply wavers, these setups keep electricity flowing without hiccups. Cutting down on gas-powered backup stations means cleaner operations take hold more easily. Stability grows stronger across transmission lines because reserves stand ready when demand spikes. Fossil-free targets become reachable thanks to steady output from stored energy sources.

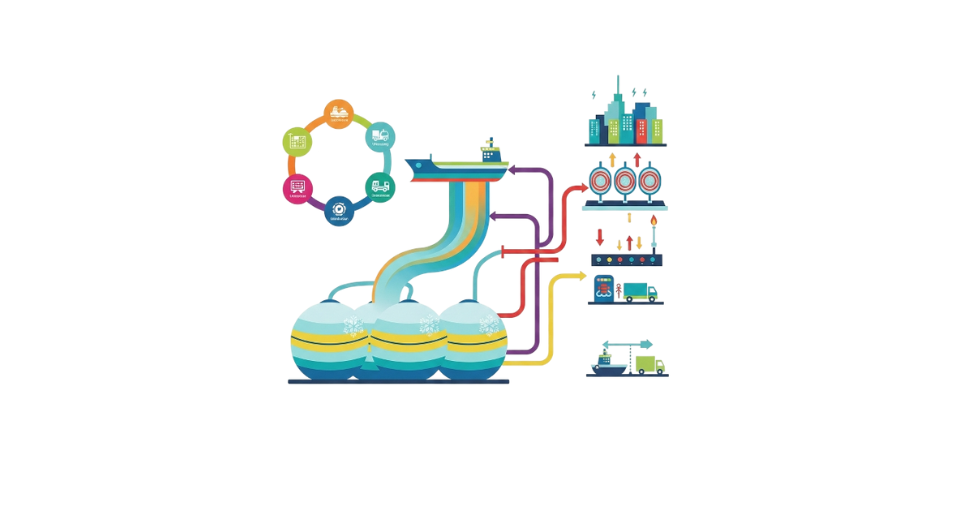

Apart from pumped hydro, options like compressed air, liquid air setups, flow batteries, heat-focused storage, and hydrogen methods fill out the field. Still dominant is pumping water uphill - long track record, big output, lasts decades. Even so, fresh approaches begin to catch on since location limits shrink while size adjustments grow easier. These modern alternatives also link up well with power networks and factory-level energy needs.

Lately, longer-lasting batteries show up more often where power networks need stability. When wind or sunlight produces extra electricity, these setups save it for later use. Think about times when usage spikes, energy gets pulled from storage instead of overloading the system. During storms or blackouts, they act like quiet helpers, keeping things running. Even if solar panels sleep or turbines stop, the lights stay on. Utilities now lean on them not just for daily shifts but for surprise failures too. With climate swings growing wilder, having reserves ready makes a difference. Not every solution fits all spots, yet their role keeps expanding quietly.

Utilities still lead big projects, though private firms teaming up with governments now help more often. Backed by steady rules and clear green goals, plus upgrades to power grids, these efforts spread faster. With how energy works changing, storing power for longer stretches will matter most for stable, adaptable, cleaner electric systems across the globe.

Long-Duration Energy Storage Market Segmentation

By Technology Type

- Pumped Hydro Storage

Hills hold back water until power is needed. When demand rises, gravity sends it rushing down through turbines below. This movement turns potential into electricity on a massive scale. Height makes the system work without constant fuel. Stored uphill, energy waits quietly for its moment to act.

- Compressed Air Energy Storage

When electricity is plentiful, air gets squeezed into big holes under the ground. This trapped air waits until more power is needed. Then, it's let out to help run generators when usage spikes. The release turns pressure back into usable energy. Underground spaces hold everything steady until required. Power comes back online just by letting the air expand again.

- Liquid Air Energy Storage

A switch flips, turning power into chilled air that pools in tanks, waiting. Stored cold sits ready, able to send energy back when needed. Place does not matter, hours pass without loss, and release happens on demand.

- Flow Batteries

Liquid inside big containers powers flow batteries. These systems hold plenty of energy because storage space can grow. Long-lasting performance comes from how they work. Their design keeps them running many cycles without wearing out.

- Thermal Energy Storage

Sometimes it keeps warmth, sometimes it's chill; either way, it saves thermal power for later. Useful when factories need steady temperatures or when the electricity network needs to smooth out supply.

- Hydrogen Energy Storage

Storing power using hydrogen means turning electric current into a gas that sits tight until needed across different parts of the energy system. This method holds onto energy for months, even years, feeding it back when demand rises later on.

To learn more about this report, Download Free Sample Report

By Duration

- 8-12 Hours

Beyond eight hours, energy storage handles everyday shifts in supply. Around midday, it smooths out solar dips. When the wind slows briefly, this range keeps grids stable. Duration fits regular cycling needs. Power gaps up to half a day fall within its reach.

- 24-72 Hours

After two or three days, systems can move power across longer stretches of time. This helps balance supply when usage stays high. The whole network handles stress better because stored energy fills gaps.

- More than 72 Hours

When it lasts over three days, the system helps store energy for different times of year while keeping power steady if supplies run short for a while. It handles gaps that stretch beyond seventy two hours by balancing what's needed across seasons.

By Application

- Grid Energy Storage

Storing energy on a large scale helps keep power grids stable. When needs shift throughout the day, it smooths out mismatches between production and usage. Over time, this balance becomes easier to maintain. Supply stays aligned with changing demands. Performance improves without sudden drops. Long-term fluctuations are managed more effectively.

- Renewable Energy Integration

Sunlight fades, yet energy flows captured earlier, held back like breath, then released slowly through dim hours. When wind stalls and panels sleep, stored power stirs awake, stepping forward without warning.

- Peak Shaving & Load Shifting

Using power when rates are lower helps avoid high costs during busy times. Energy gets moved around, so heavy use happens later. This means less strain when everyone else is drawing power. Bills drop because the system runs smarter, not harder.

- Backup Power & Resilience

Power stays on when storms hit. Even if the grid fails, backup systems keep lights running. When blackouts strike, energy flow continues without a hitch. During heavy snow or high winds, electricity remains steady. Outages lose their grip when resilience kicks in.

- Microgrids

A small-scale grid can run on its own, separate from the main network. Power keeps flowing even when the larger system fails. Local generation supports a consistent supply where big infrastructure is less easily accessible. Independence grows when communities manage their own electricity sources.

By End-Users

- Utility-Owned

A single utility might install extended batteries just to keep power flowing smoothly. These systems help balance sudden jumps in wind or solar supply across wide areas.

- Third-Party Owned

Out there, some companies run their own storage systems. These players earn money by selling into power and grid availability exchanges. Their operations stand apart from bigger utilities.

- Public Private Partnership

When officials team up with businesses, big storage systems get built faster. Sometimes cities join forces with companies to move things along. Working together helps speed up massive storage efforts across regions.

Regional Insights

Out west, power rules push longer-lasting batteries into play. Across the United States, green targets spark big solar-wind hookups needing steady backup. Projects pop up where laws pay extra for clean shifts. Old-school water-powered storage still runs alongside new setups using lithium or hydrogen stacks. Up north, rivers help Canada stockpile juice when sun and wind fade. Heavy-duty reserves grow where blackouts scare planners most.

Fueled by strict climate goals across Europe, the movement grows stronger, especially where wind and solar plans run deep. Driven not just by old methods that think water lifted uphill for power later, but by fresh ideas like liquid-based cells and heat locked in materials. Rules shaped in Brussels, alongside country-by-country blueprints, pull neighboring grids closer through shared battery ventures. Support rises quietly, woven into laws that nudge better storage tech forward while aging systems slowly get updates.

A wave of change sweeps across the Asia Pacific, where rising power needs shape fresh thinking on energy grids. Electricity hunger grows fast as cities swell and wind plus solar farms multiply. China now leads by storing massive amounts of green energy for days at a time using new methods beyond lithium batteries. Interest there also builds around futuristic options like hydrogen and next-gen storage cells. Farther south, India and its neighbors begin testing extended-run systems to avoid blackouts during high-use hours. Stability matters more every year when storms or heat waves strain infrastructure. Not far behind, parts of Latin America look to mountain rivers spinning turbines after heavy rains fill reservoirs above. Desert regions in the Middle East study ways to lock up sunlight for nights that stretch long and hot. In Africa, small test sites pop up near villages cut off from central networks, aiming to deliver steady juice despite weak connections. Seasonal droughts push innovators toward water-based storage tricks and backup setups powered by sunbeams. Each corner adapts tools fit for local hurdles without copying blueprints from abroad.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 15, 2025 – Hithium unveils new long-duration energy storage innovation at annual Eco-Day.

- November 20, 2025 – CALB unveiled two high-capacity cells aiming at long-duration energy storage.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.35 Billion |

|

Market size value in 2026 |

USD 4.50 Billion |

|

Revenue forecast in 2033 |

USD 19.35 Billion |

|

Growth rate |

CAGR of 23.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Form Energy, Highview Power, Energy Vault, Energy Dome, ESS Inc., VFlow Tech, Vionx Energy, Invinity Energy Systems, Fluence Energy, Siemens Energy, Linde, Air Liquide, Wärtsilä, Tesla Energy, CATL, Hydrostor, and BASF |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology Type (Pumped Hydro Storage, Air Energy, Liquid Air Energy Storage, Flow Batteries, Thermal Energy Storage, Hydrogen Energy Storage) By Duration(8-12 Hours, 24-72 Hours, More Than 72 Hours) By Application (Grid Energy Storage, Renewable Energy Integration, Peak Shaving & Load Shifting, Backup Power & Resilience, Microgrids ) By End-Users (Utility-Own, Third Party Owned, Public-Private Partnerships |

Key Long-Duration Energy Storage Company Insights

One thing stands out about Form Energy: it builds batteries using iron and air, aiming at storing power for days, not hours. A clear focus on affordability and dependability when sunlight and wind go quiet. Instead of just chasing speed, they stretch capacity far past what typical lithium-ion systems offer. Working hand-in-hand with electricity providers shapes much of their real-world impact. Long gaps without sun or wind become easier to manage because of these efforts.

Key Long-Duration Energy Storage Companies:

- Form Energy

- Highview Power

- Energy Vault

- Energy Dome

- ESS Inc.

- VFlow Tech

- Vionx Energy

- Invinity Energy Systems

- Fluence Energy

- Siemens Energy

- Linde

- Air Liquide

- Wärtsilä

- Tesla Energy

- CATL

- Hydrostor

- BASF

Global Long-Duration Energy Storage Market Report Segmentation

By Technology Type

- Pumped Hydro Storage Air Energy

- Liquid Air Energy Storage

- Flow Batteries

- Thermal Energy Storage

- Hydrogen Energy Storage

By Duration

- 8-12 Hours

- 24-72 Hours

- More Than 72 Hours

By Application

- Grid Energy Storage

- Renewable Energy Integration

- Peak Shaving & Load Shifting

- Backup Power & Resilience

- Microgrids

By End-Users

- Utility-Own

- Third Party Owned

- Public-Private Partnerships

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636