Market Summary

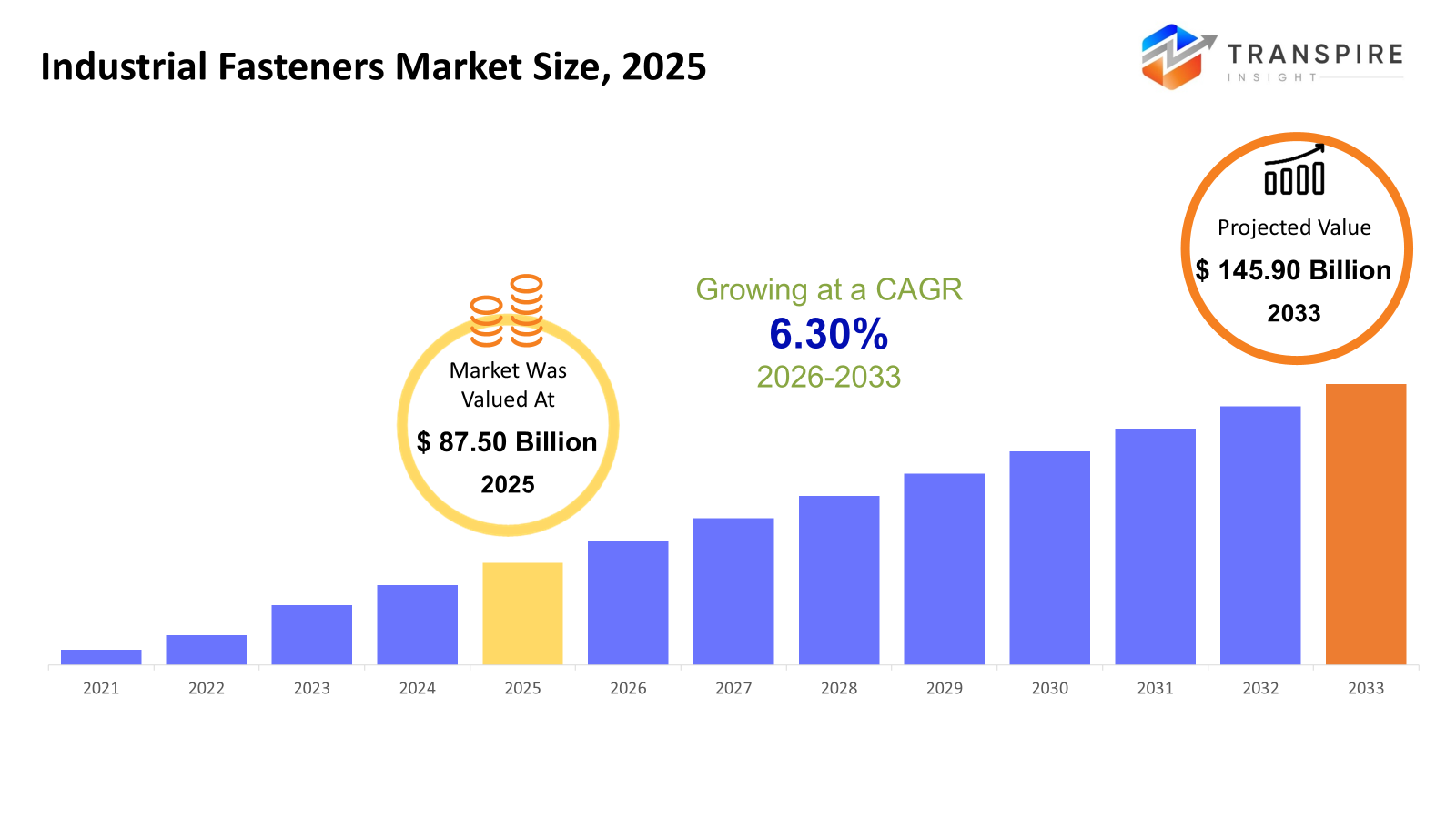

The global Industrial Fasteners market size was valued at USD 87.50 billion in 2025 and is projected to reach USD 145.90 billion by 2033, growing at a CAGR of 6.30% from 2026 to 2033. More pressure to keep drug, biotech, and medical product spaces free from germs. As biologic drugs, shots that prevent disease, and new kinds of treatments get made more often, companies turn to adaptable, tightly managed rooms you can build like puzzle pieces. Rules about safety and consistency have gotten tougher. Factories now spend more on smarter room designs just to stay within limits.

Market Size & Forecast

- 2025 Market Size: USD 87.50 Billion

- 2033 Projected Market Size: USD 145.90 Billion

- CAGR (2026-2033): 6.30%

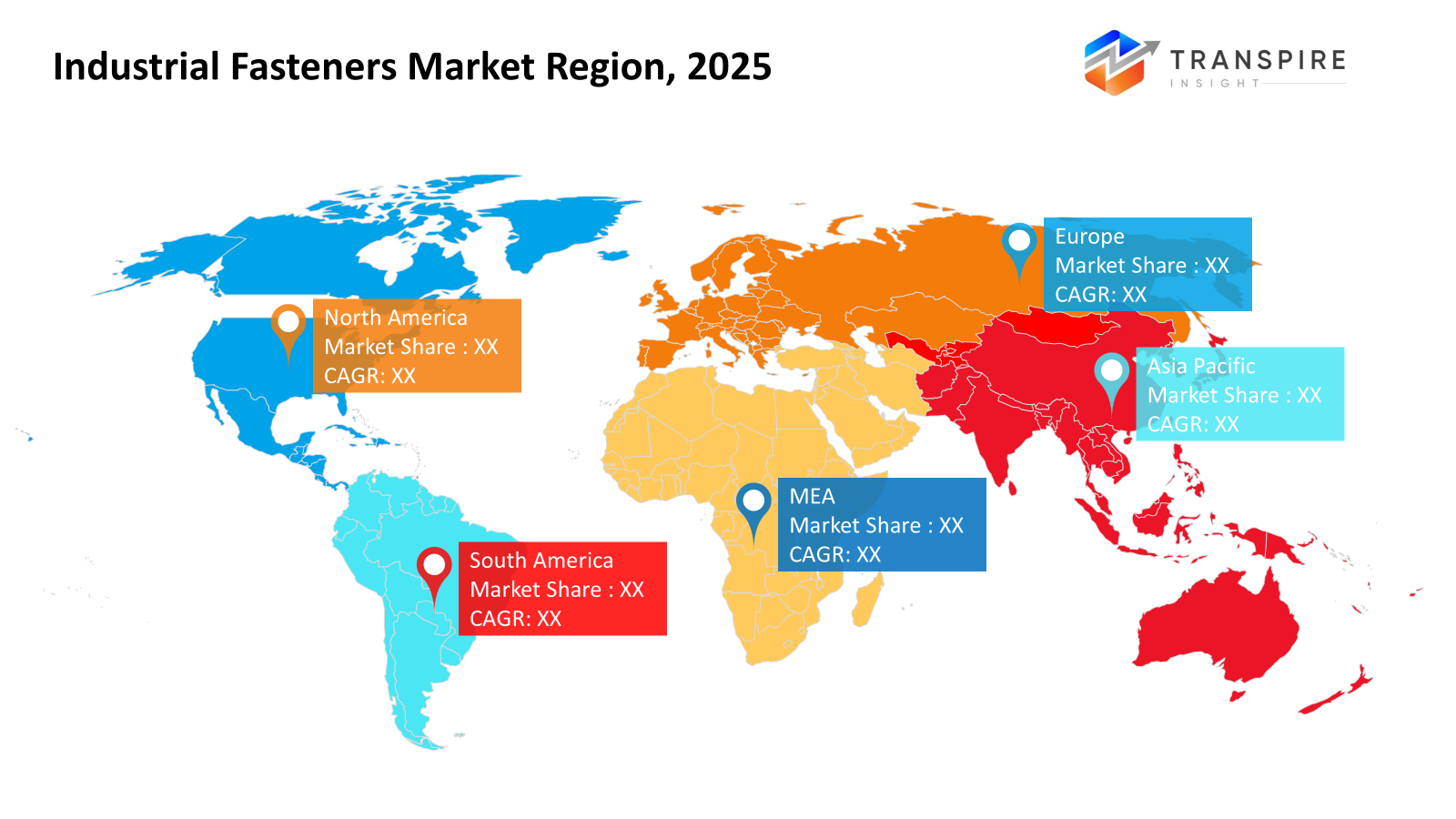

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 40% in 2026. Fueled by a push toward bringing production back home, North America holds steady. Metal types take hold where strength matters most. Threaded designs on the outside edge gain ground just as quickly. Growth hums along, tied closely to smarter factory setups rising across the landscape.

- Fueled by car manufacturing, electric models were included in the United States. The fastener industry sees steady growth. Aerospace initiatives push demand higher at the same time. Upgraded roads, bridges, and buildings also play their part in lifting output.

- Starting strong, Asia Pacific grabs the biggest slice of global market activity. Fastest gains here come on the back of building booms, a rise in car production, alongside cheaper factory operations. Growth pulses through the region, fed by heavy investment in physical frameworks plus expanding industrial zones. Cost edges sharpen its position against other regions. Momentum builds quietly but steadily.

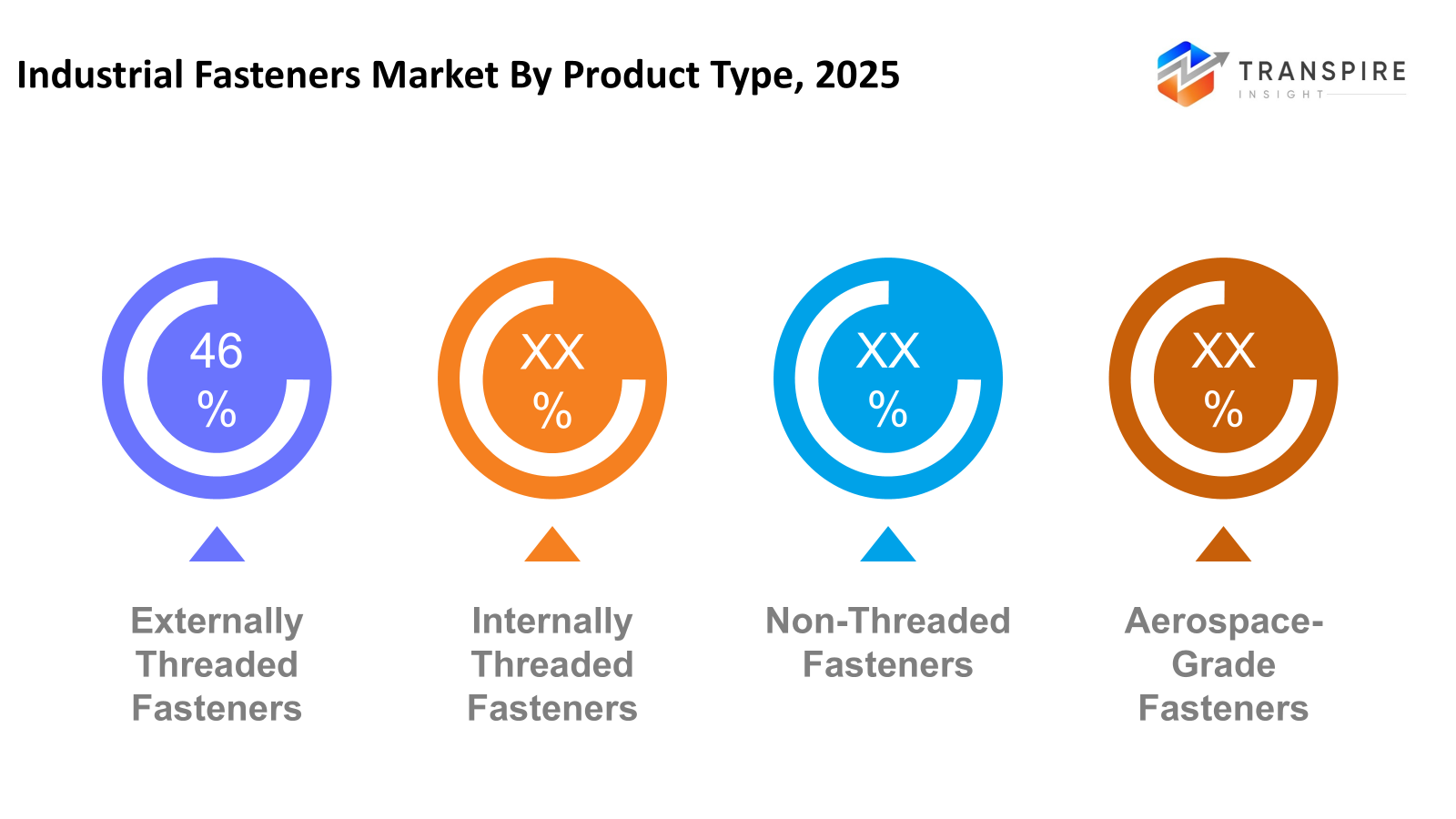

- Externally Threaded Fasteners share approximately 44% in 2026. What holds things together outside keeps leading the pack. Growth hangs on a strong need from car makers and big machines building stuff. Fasteners that screw from the outside see consistent push forward.

- Firmness and wide jobsite demand keep metal fixings ahead of others. Their ongoing top spot ties to toughness above most materials.

- Fasteners for cars still lead the pack when it comes to usage, driven not just by how many vehicles are made worldwide but also by the shift toward electric models.

- Direct sales take top spot because manufacturers often want large orders of tailored, reliable fasteners straight from the market

Strong factories across this market keep the fastener industry moving, pulling need from car makers, plane builders, heavy equipment plants, and construction work. Bolts and similar outer-threaded pieces lead because they fit many jobs, hold tight, yet come apart when needed. Inside-threaded and thread-free types fill gaps where regular ones will not do, especially in places needing precision. High-stress areas like aircraft rely on specialty parts built for extreme reliability and strict safety rules.

Though metal holds top spot here, its edge comes from toughness and long life, especially where jobs get tough. Where steel rules, stainless joins close behind; both handle stress well. Lightweight needs open doors for plastic, even if only in small corners of use. Corrosion worries help plastic grow, slowly but steadily. What a job demands shapes what gets picked - no surprise there. Precision matters most when vehicles take shape or planes come together. Quality cannot slip where safety rides on every piece.

Nowhere else do we see such clear splits in how products move. Direct lines go straight to big factories needing truckloads plus tailored setups. Meanwhile, middlemen like local stockists, resale hubs, or web shops keep small workshops running smoothly. Two paths, one goal: steady supply, whether you run a plant or fix machines on the side.

North America stands out thanks to strong factories, steady upgrades to roads and buildings, while pushing new tech in cars and aircraft. Led by the United States, the need runs high here, fueled heavily through car assembly, military work, and factory updates. Elsewhere, activity rises too in parts of Canada and Mexico - adding layers that strengthen overall demand. This mix turns the area into a long-standing center where industrial bolts remain consistently needed.

Industrial Fasteners Market Segmentation

By Product Type

- Externally Threaded Fasteners

Threaded rods, bolts, and screws are common in heavy-duty setups where parts need frequent disassembly. These fasteners grip tight, last long, and fit into machinery needing reliable connections. Used widely when strength matters most, yet access remains key. Joint integrity stays solid even under shifting loads.

- Internally Threaded Fasteners

Inside these fasteners, threads catch onto bolts or screws, holding parts together tightly. A nut of this type fits right where a bolt spins in, joining pieces without slipping loose. Threads within grip the rod-like shaft, keeping everything locked as pressure builds. This connection stays firm even when things shift or vibrate nearby. Each twist pulls the joint closer, making the bond stronger over time.

- Non-Threaded Fasteners

Rivets hold things together without threads, doing their job once hammered or pressed into place. Washers spread out pressure under bolts, protecting surfaces below them. Pins slide through holes to lock parts in alignment, stopping unwanted movement. Clips snap on securely, keeping components firmly attached where needed.

- Aerospace-Grade Fasteners

Engineered for extreme conditions, these fasteners deliver strength without adding weight. Built to match demanding defense requirements, they maintain precision under pressure. Meeting exacting aerospace benchmarks, each piece ensures reliable performance. Toughness combines with accuracy where failure is not an option. Precision shaping allows them to fit perfectly in critical systems.

To learn more about this report, Download Free Sample Report

By Raw Material

- Metal Fasteners

From strong steel to tough stainless blends, these small parts hold things tight under heavy loads. Built to last, they handle heat without weakening. Some mix metals for extra strength when needed most. Titanium ones stay light yet resist extreme conditions just as well.

- Plastic Fasteners

- Not too heavy, these plastic clips hold things without rusting. Where metal is not needed, they work just fine. Electricity passes near them safely. Some jobs simply need something that will not corrode. Light-duty tasks fit their strength well.

By Application

- Automotive

Fittings hold parts together when building cars. These bits show up under the hood where motors live. They join pieces that form the base frame of machines on wheels. Inside cabins, small clips keep panels locked in place.

- Aerospace

Flying machines need strong little parts that hold pieces together tightly. These tiny helpers go inside wings, power units, and key spots where failure is not an option. Each piece must work exactly right under extreme pressure. Safety depends on their precise fit and reliable performance.

- Construction & Infrastructure

Steel pins hold up towers, link bridge parts, fix road surfaces, and join big construction jobs together. Fastening bits anchor foundations, connect support beams, secure concrete forms, and tie infrastructure networks into place. Bolts clamp structural frames, attach metal joints, mount utility supports, and lock down public works elements.

- Industrial Machinery & Equipment

Firm anchors hold together machines built for tough work. Where big tools run day after day, strong bolts stay tight. Factories rely on these parts when things move nonstop. Rugged hardware keeps operations steady under pressure.

- Motor & Pumps

Spinning machines stay tight because special bolts handle constant shaking. These connections hold firm where movement never stops. Built tough, they lock parts together without loosening over time.

- Plumbing & Fixtures Products

Fasteners made to resist rust go inside plumbing parts like valves, pipe sections, and fixtures for bathrooms. These small pieces hold things together where water flows through. They last longer when exposed to moisture over time. Fittings and connections rely on them daily. Water systems in homes use such hardware without frequent replacement.

By Distribution Channel

- Direct Sales

Faster deliveries happen when makers send fasteners straight to big buyers who need lots at once. Instead of going through middlemen, factories ship right where they are needed most. Large manufacturers often prefer this route because it cuts delays. Orders move more quickly without extra stops along the way. Bulk needs get met faster when supply lines stay short.

- Indirect Sales

Faster access to customers happens when fasteners move through middle players like stores, supply hubs, web shops, or local sellers. These paths stretch into more areas than direct selling can easily touch.

Regional Insights

Out there in the Asia Pacific, heavy demand for industrial fasteners sets the pace worldwide. Fast-paced factory growth keeps things moving, while car production and building booms add steady pressure on supply. China, India, and Japan stand out not just in buying tons of bolts and clips but in making them at scale too. Factories hum with activity, assembling vehicles, crafting machines, and bolting down big civil works. Labor pools that run deep, workshops ready to produce, prices that stay low. This mix pushes the region ahead of no close rivals when it comes to output. Strength builds where tools turn raw material into working parts every single day.

Steady progress defines North America, where established industries keep things moving - automotive plants hum in the United States, shaping the need for precise metal parts. Precision is not just preferred there; it's built into how machines are made. Across borders, Canadian efforts lean on heavy equipment and power systems, calling for tough fastening solutions. Not far behind, Mexican industry adds its weight via building work and mechanical assembly, relying on strong components that hold up under stress. Aerospace activity threads through the region too, tying upgrades in defense tech to factory output. Modernizing structures keeps demand ticking, not with bursts but consistency. High-strength performance matters most when failure is not an option.

Growth moves at a steady pace across Europe, Latin America, and parts of the Middle East and Africa - each shaped by what happens locally in factories and building projects. High-end manufacturing and work tied to flight technology steer activity in Europe. In contrast, fresh momentum comes through rising needs in homebuilding and vehicle production in Latin America. Meanwhile, regions across the Middle East and into Africa are seeing more need for tough hardware that fights rust, mostly brought in from outside because local output can not yet cover demands from oil operations, big builds, and equipment makers.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 21, 2025 – Huyett launched an extensive new line of industrial threaded fasteners.

- March 05, 2025 – Alligo launched a new product brand in fasteners.

(Source:https://www.alligo.com/en/stories/alligo-l-aunches-a-new-product-brand-in-fasteners-inno/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 87.50 Billion |

|

Market size value in 2026 |

USD 95.00 Billion |

|

Revenue forecast in 2033 |

USD 145.90 Billion |

|

Growth rate |

CAGR of 6.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Illinois Tool Works Inc. (ITW), Stanley Black & Decker, Würth Group, Hilti Corporation, LISI Group Link Solutions, Nifco Inc., MW Industries Inc., Birmingham Fastener and Supply Inc., SESCO Industries Inc., Elgin Fastener Group LLC, Slidematic Precision Components, Acument Global Technologies Inc., ATF Inc., Penn Engineering & Manufacturing Corp., Nucor Fastener, and KAMAX GmbH |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Externally Threaded Fasteners, Internally Threaded Fasteners, Non-Threaded Fasteners, Aerospace-Grade Fasteners), By Raw Material (Metal Fasteners, Plastic Fasteners), By Application (Automotive, Aerospace, Construction & Infrastructure, Industrial Machinery & Equipment, Motor & Pumps, Plumbing & Fixture Products), By Distribution Channel (Direct Sales, Indirect Sales), |

Key Industrial Fasteners Company Insights

A giant in industrial gear, Illinois Tool Works Inc., or ITW, builds tough parts that hold things together across heavy-duty fields. From cars to buildings to factory lines, its grip comes in many forms, such as clips, bolts, and anchors, all designed with precision. Instead of just selling hardware, the firm delivers full setups: tools that install them quickly, systems that fit exact needs. Innovation shows up in smarter alloys, robotic placement tricks, and tight tolerances nobody skips. With labs pushing limits and offices spanning continents, it stays deep inside complex supply chains. Performance is not claimed; it is baked into every thread, tested long before shipping. Across noisy plants and blueprint meetings, one fact sticks: reliability shapes each decision. Markets shift, yet this name holds ground through stubborn consistency. Not flash, but function, that’s what echoes in every facility using their tech.

Key Industrial Fasteners Companies:

- Illinois Tool Works Inc. (ITW)

- Stanley Black & Decker

- Würth Group

- Hilti Corporation

- LISI Group Link Solutions

- Nifco Inc

- MW Industries Inc.

- Birmingham Fastener and Supply Inc.

- SESCO Industries Inc.

- Elgin Fastener Group LLC

- Slidematic Precision Components

- Acument Global Technologies Inc.

- ATF Inc.

- Penn Engineering & Manufacturing Corp.

- Nucor Fastener

- KAMAX GmbH

Global Industrial Fasteners Market Report Segmentation

By Product Type

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-Threaded Fasteners

- Aerospace-Grade Fasteners

By Raw Material

- Metal Fasteners

- Plastic Fasteners

By Application

- Automotive

- Aerospace

- Construction & Infrastructure

- Industrial Machinery & Equipment

- Motor & Pumps

- Plumbing & Fixture Products

By Distribution Channel

- Direct Sales

- Indirect Sales

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions

Find quick answers to common questions.

The approximate Industrial Fasteners Market size for the market will be USD 145.90 billion in 2033.

Key segments for the Industrial Fasteners Market are By Product Type (Externally Threaded Fasteners, Internally Threaded Fasteners, Non-Threaded Fasteners, Aerospace-Grade Fasteners), By Raw Material (Metal Fasteners, Plastic Fasteners), By Application (Automotive, Aerospace, Construction & Infrastructure, Industrial Machinery & Equipment, Motor & Pumps, Plumbing & Fixture Products), By Distribution Channel (Direct Sales, Indirect Sales).

Major Industrial Fasteners Market players are Illinois Tool Works Inc. (ITW), Stanley Black & Decker, Würth Group, Hilti Corporation, and LISI Group Link Solutions.

The North America region is leading the Industrial Fasteners Market.

The Industrial Fasteners Market CAGR is 6.30%.

- Illinois Tool Works Inc. (ITW)

- Stanley Black & Decker

- Würth Group

- Hilti Corporation

- LISI Group Link Solutions

- Nifco Inc

- MW Industries Inc.

- Birmingham Fastener and Supply Inc.

- SESCO Industries Inc.

- Elgin Fastener Group LLC

- Slidematic Precision Components

- Acument Global Technologies Inc.

- ATF Inc.

- Penn Engineering & Manufacturing Corp.

- Nucor Fastener

- KAMAX GmbH

Recently Published Reports

-

Dec 2024

Healthcare Polymer Packaging Market

Healthcare Polymer Packaging Market Size, Share & Analysis Report By Packaging Type (Syringes, IV Bottles and Pouches, Clamshells, Blisters, Bottles & Jars, Containers, Tubes, IV Parental Packaging, Others), By Type (Regulated, Non-regulated), By Polymer Type (LDPE (Low-Density Polyethylene), HDPE (High-Density Polyethylene), Homo-polymer (Homo), Random Copolymer (Random), Block Copolymer (Block), PET, Polystyrene, Polyvinyl Chloride, Polyamide/EVOH, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

Hydrophilic Tape (Waterstop) Market

Hydrophilic Tape (Waterstop) Market Size, Share & Analysis Report By Type (Bentonite-Based Hydrophilic Tape, Rubber-Based Hydrophilic Tape), By Application (Residential Buildings, Commercial Buildings, Infrastructure Projects), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

Metalens Market

Metalens Market Size, Share & Analysis Report By Type (Visible Light Metalens, and Infrared Metalens), By Application (Consumer Electronics, Automotive Electronics, Industrial, Medical, and Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

PBT Resin Market

PBT Resin Market Size, Share & Analysis Report By Type (Reinforced PBT Resin, Unreinforced PBT Resin), By Processing Method (Injection Molding, Extrusion, Blow Molding, Others), By End-User (Automotive, Electrical & Electronics, Consumer Appliances, Industrial Machinery, Medical Devices, Packaging, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031