Market Summary

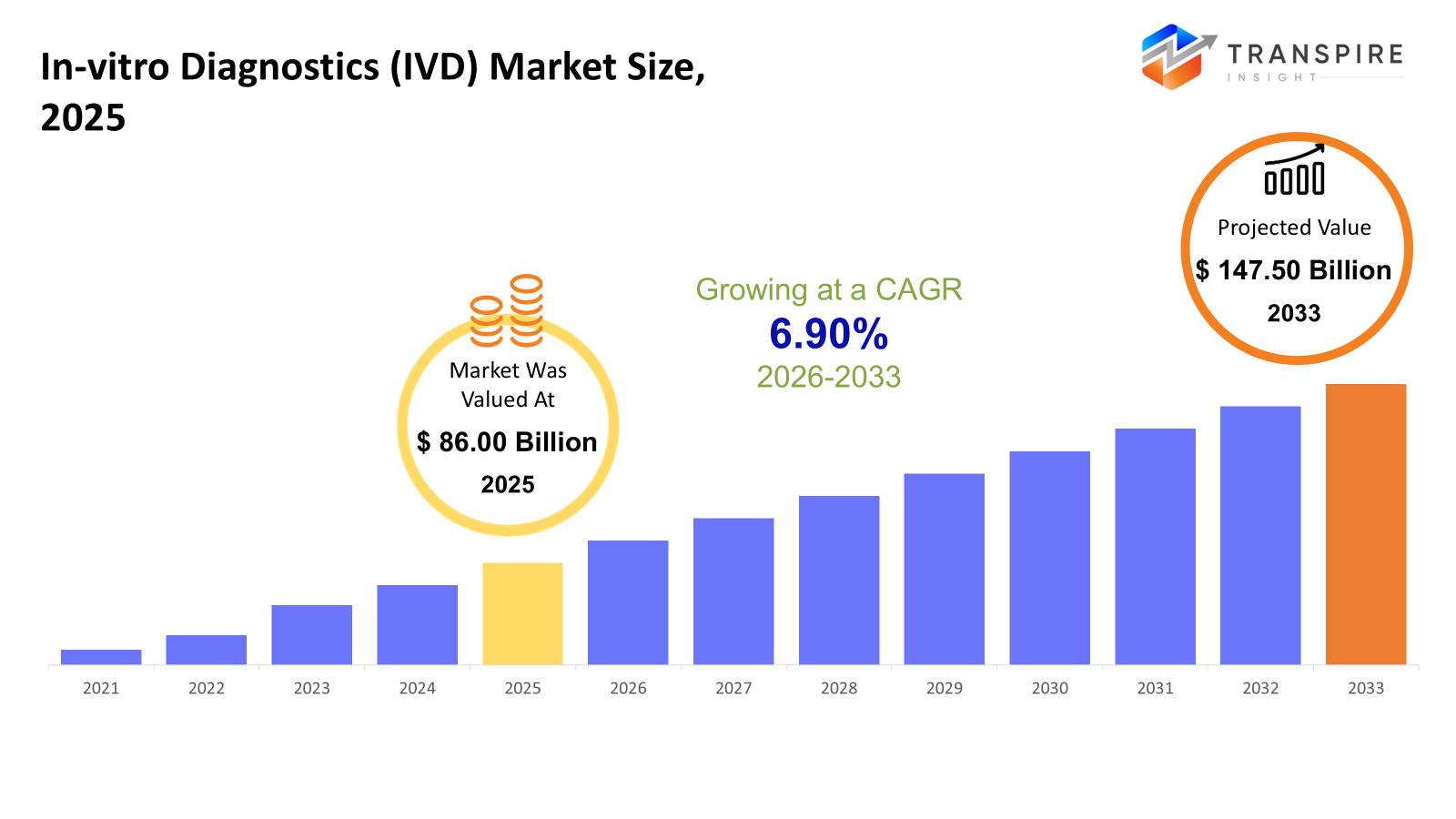

The global In-vitro Diagnostics (IVD) market size was valued at USD 86.00 billion in 2025 and is projected to reach USD 147.50 billion by 2033, growing at a CAGR of 6.90% from 2026 to 2033. The global IVD market is growing at a CAGR due to the rising number of Chronic & Infectious Diseases worldwide, growing demands for accurate diagnostic capabilities, along with increased awareness among patients for Preventative Healthcare. Advances in Technology & Automation, as well as Point-of-Care Testing Platforms, boost the market.

Market Size & Forecast

- 2025 Market Size: USD 86.00 Billion

- 2033 Projected Market Size: USD 147.50 Billion

- CAGR (2026-2033): 6.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- In North America, increasing incidence of chronic as well as infectious diseases has market growth prospects for early diagnostics, and the healthcare segments like hospitals and diagnostic labs are witnessing the usage of automated instruments as well as reagents for testing.

- In United States, Point-of-care testing instruments and automated diagnostic instruments are seeing increasing acceptance in hospitals and labs because of their usability in early intervention, precision medicine, and handling a large number of patients, and their ability to provide a quick and accurate diagnosis.

- In Asia-Pacific, the expanding need for healthcare infrastructure, increased populations, and the rising trend of chronic as well as infectious diseases are fostering the use of reagents, kits, and molecular diagnostics in urban and tier-2 regions, especially in China, India, Japan, and South Korea.

- Reagents and kits remain dominant in the market because they are user-friendly, accurate, and processed quickly, and instruments are experiencing growth in the market owing to automation, high throughput, and connectivity with digital lab systems that improve efficiency.

- The preponderant position in routine analysis is occupied by clinical chemistry, but molecular and immunochemical analysis is increasingly being used owing to high sensitivity and specificity, facilitating early diagnosis and development of therapeutic approaches for diseases in accordance with biological markers.

- Infectious disease diagnostic testing is increasing due to increased outbreaks and government-championed screening initiatives, whereas cancer and cardiology diagnostic testing is increasing steadily with the expanding need for early detection, treatment management, and the adoption of precision medicine.

- Hospitals and diagnostic laboratories consume the highest quantity due to the large patient base with complicated testing needs, while research institutions are the innovation hotbed for the adoption of sophisticated diagnostic technology with increased accuracy and faster turnaround time for testing.

So, The In-vitro Diagnostics (IVD) market consists of products and solutions for the detection of diseases and infections caused by biological samples like blood, urine, and tissues. It is a booming market driven by the increasing number of chronic and infectious diseases, along with growing awareness for patient preventive healthcare. Advancements in molecular diagnostic solutions for point-of-care testing and automation in the laboratory sector are increasing its efficacy and turnaround time for testing. This emerging trend is a significant boost for the In-vitro diagnostic market. These diagnostic solutions help test patient samples for various types of infections caused by bacteria or other diseases diagnosed with biological samples. The rising usage of personalized medicine and biomarkers in diagnostics has further accelerated the need for specialized testing, especially in oncology, cardiology, and autoimmune diseases. The trend towards remote testing and home-based blood collection has changed market forces in a favorable way for the industry by offering greater convenience. Moreover, the initiative by governments in emerging countries for early detection, increased healthcare spending, and the development of healthcare infrastructure in emerging countries are stimulating growth in the industry. Collaboration between IVD companies, research organizations, and healthcare centers has also accelerated the development of new, sophisticated assays and automated testing platforms in diagnostics.

The market for IVD, in general is observing strong growth driven by advancements in technology, an increasing burden of diseases, along with an emphasis on early intervention and precision medicine

In-vitro Diagnostics (IVD) Market Segmentation

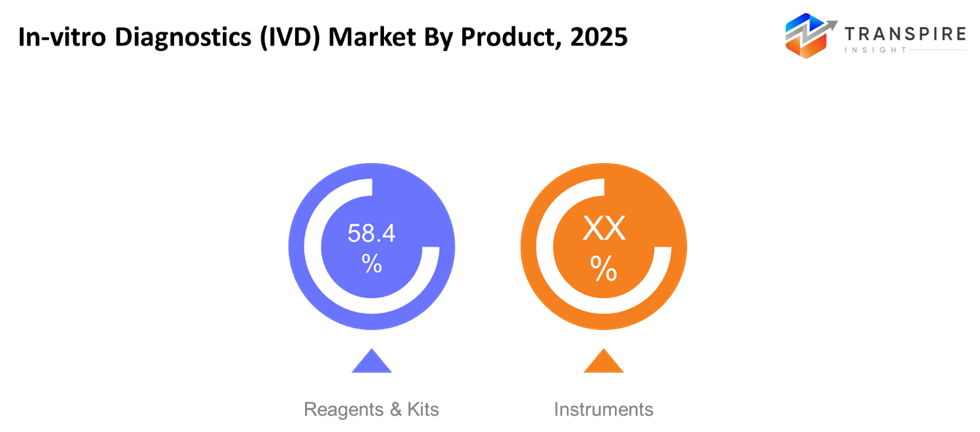

By Product

- Reagents & Kits

Reagents & kits hold a larger market share in the IVD industry due to their importance in diagnostic testing. An increased incidence of chronic & infectious diseases boosts demand for good-quality diagnostic kits.

- Instruments

The diagnostic instruments, though being cost-intensive, are very useful in hospitals and labs for large-scale testing. Technological development and automation and miniaturization are being aided by automation and have thus increased their use.

To learn more about this report, Download Free Sample Report

By Test Type

- Clinical Biochemistry

Clinical chemistry analysis has remained core, as the analysis involves fluids in the body that indicate the presence of a disease. An increase in lifestyle diseases ensures that there is a steady market. This will benefit patients as lab results will be fast, hence ensuring that patients are able to check the effectiveness of medications.

- Immunoassay

Immunoassays are extremely sensitive as well as very important in the detection of hormones, proteins, and infectious agents. An immunoassay is used in making life-saving decisions on a daily basis.

- Hematology

Hematology analysis is used in testing for diseases related to blood conditions, and it is an important activity in general medical examinations as well as in medical examinations for particular diseases. The blood count gives information about the general health of the patient and serves to reassure both the patient and the doctor in this

- Molecular Diagnostics

Molecular diagnosis is increasing in popularity because it provides precision in detecting genetic and infectious diseases in their early stage. Early detection gives patients enough time to embark on interventions since they are aware that the disease is treatable.

- Microbiology

Microbiological tests isolate bacteria, viruses, and fungi; such tests are critical in managing infectious diseases. Microbial identification techniques enable a physician to prescribe antibiotics correctly.

- Coagulation

Coagulation tests check the level of blood coagulation, which is of utmost importance in the event of surgery or in the case of patients suffering from hemophilia. This is because these tests help ensure the safety of the patient before any surgical procedure

- Others

Other specialized tests such as metabolic and enzymatic tests are designed to fulfill dedicated requirements for analysis. Such tests enable customized understanding to help realize appropriate treatment plans.

By Application

- Infectious Diseases

It breeds a high prevalence of infectious diseases worldwide, resulting in strong demand for diagnosis tests in this segment. Timely detection saves many lives and helps in controlling outbreaks effectively.

- Diabetes

Diabetes testing is on the rise as it is faced with an increasing global burden of both type 1 and type 2 diabetes. Patients are able to manage their blood sugar levels better and avoid complications.

- Oncology

Cancer diagnostics are expanding due to developments in molecular and biomarker-based analysis techniques. Early diagnosis and monitoring offer patients their greatest hope of successful treatment.

- Cardiology

Testing for cardiovascular disease concentrates on determinants for heart ailments, making it possible for preventive care to be delivered. This helps patients understand their situation enough for lifestyle changes and medications to have a positive effect.

- Nephrology

Renal function tests in nephrology provide advantages in the detection and management of kidney diseases. People suffering from kidney disorders are helped by early treatment and efficient health management.

- Autoimmune Disorders

Autoimmune disorder testing is on the rise with increased awareness and better diagnostic facilities. Correct diagnosis helps in administering appropriate treatment to the patient.

- Others

Other uses include metabolic, endocrine, or rare disease panels. This test provides a needed tool for diagnosing rare diseases. In other respects, a genetic test is a kind of PCR test.

By End User

- Hospitals & Clinics

The hospital and medical clinics sector remains one of the top consumers as a result of the high patient turnout and demand for overall diagnostic services. Patients benefit from faster diagnosis and commencement of treatment.

- Diagnostic Laboratories

These labs, such as stand-alone labs, are engaged in specialized and high-volume test procedures. These labs fill a gap between highly specialized and hard-to-access tests and patients.

- Academic & Research Institutes

These institutes propel R&D, and the innovations of new diagnostic techniques are validated. The findings of research lead to enhanced diagnostic solutions for patients.

- Others

Other types of end-users are point of care centers and specialized clinics that focus on niche analysis services. Such centers offer patients convenience and easy access to appropriate treatment by having the analysis done close to patients’ locations.

Regional Insights

North America currently holds the leading position in the IVD industry because of the established presence of diagnostic firms, advanced healthcare facilities, and higher patient literacy. The United States possesses a dominant share of this market because of large-scale implementations of automated instruments, molecular diagnostics, and immunoassays. Canada and Mexico are slowly increasing their diagnostic capacities because of government programs and advancements in their respective healthcare sectors. Europe is a mature market with strong regulations in place, established hospital infrastructure, and mature usage of advanced instruments. Major countries contributing to the market growth in Europe include Germany, the UK, France, Italy, and Spain, driven by a growing emphasis on oncology and infectious disease testing. A growing emphasis on laboratory modernization is being noticed in emerging markets in Europe. The Asia Pacific is experiencing the most growth in the global market because of the steadily increasing pool of people, as well as the presence of a mounting number of infectious and chronic illnesses in countries such as China, India, Japan, South Korea, and Australia. Point-of-care testing is presently experiencing immense growth in the Asian markets. The markets in South America and the Middle East & Africa regions are presently experiencing a steady growth rate due to the development of healthcare facilities in countries such as Brazil, Argentina, Saudi Arabia, UAE, & South Africa.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 2025, Roche achieved CE mark certification in April 2025 for its Chest Pain Triage algorithm, a novel digital IVD medical device developed with University Heidelberg that enables improved emergency department triage for Acute Coronary Syndrome, allowing for quicker decision-making and differentiation of cardiac versus non-cardiac chest pain by leveraging high-sensitivity cardiac troponin data.

(Source:https://www.roche.com/media/releases/med-cor-2025-04-23)

- In March 2025, Thermo Fisher Scientific introduced the Applied Biosystems SeqStudio Flex Dx, an IVDR‑compliant capillary electrophoresis system that streamlines genomic testing workflows, enhances regulatory compliance, and supports flexible sequencing and fragment analysis operations in clinical and research laboratories.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 86.00 Billion |

|

Market size value in 2026 |

USD 92.00 Billion |

|

Revenue forecast in 2033 |

USD 147.50 Billion |

|

Growth rate |

CAGR of 6.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

F. Hoffmann‑La Roche Ltd.,Abbott Laboratories, Thermo Fisher Scientific Inc, Danaher Corporation, Siemens Healthineers AG, Becton, Dickinson and Company, bioMérieux S.A, Bio‑Rad Laboratories, Inc, Sysmex Corporation, Johnson & Johnson, Hologic, Inc, Qiagen N.V, DiaSorin S.p.A, Agilent Technologies, Inc, Ortho‑Clinical Diagnostics Inc |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product (Reagents & Kits, Instruments), By Test Type (Clinical Chemistry, Immunoassay, Hematology, Molecular Diagnostics, Microbiology, Coagulation, Others), By Application (Infectious Diseases, Diabetes, Oncology, Cardiology, Nephrology, Autoimmune Disorders, Others) and By End User (Hospitals & Clinics, Diagnostic Laboratories, Academic & Research Institutes, Others) |

Key In-vitro Diagnostics (IVD) Company Insights

Hoffmann-La Roche Ltd is one of the world leaders in the IVD industry, and it provides strong portfolios in the fields of molecular diagnostics, immunoassays, and clinical chemistry systems to tackle cancer, infectious diseases, and cardiovascular conditions. Roche’s cobas systems and high-throughput analyzers from Roche are used extensively in the biggest health networks to facilitate early detection of diseases and complete patient management. Roche’s success is its strong focus on innovations and its presence in almost all parts of the world along with its integration of digital diagnostics, which improves the efficiency of laboratory work and the accuracy of test results.

Key In-vitro Diagnostics (IVD) Companies:

- Hoffmann‑La Roche Ltd

- Abbott Laboratories

- Thermo Fisher Scientific Inc

- Danaher Corporation

- Siemens Healthineers AG

- Becton, Dickinson and Company

- bioMérieux S.A

- Bio‑Rad Laboratories, Inc

- Sysmex Corporation

- Johnson & Johnson

- Hologic, Inc

- Qiagen N.V

- DiaSorin S.p.A

- Agilent Technologies, Inc

- Ortho‑Clinical Diagnostics Inc

Global In-vitro Diagnostics (IVD) Market Report Segmentation

By Product

- Reagents & Kits

- Instruments

By Test Type

- Clinical Chemistry

- Immunoassay

- Hematology

- Molecular Diagnostics

- Microbiology

- Coagulation

- Others

By Application

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Disorders

- Others

By End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Academic & Research Institutes

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636