Market Summary

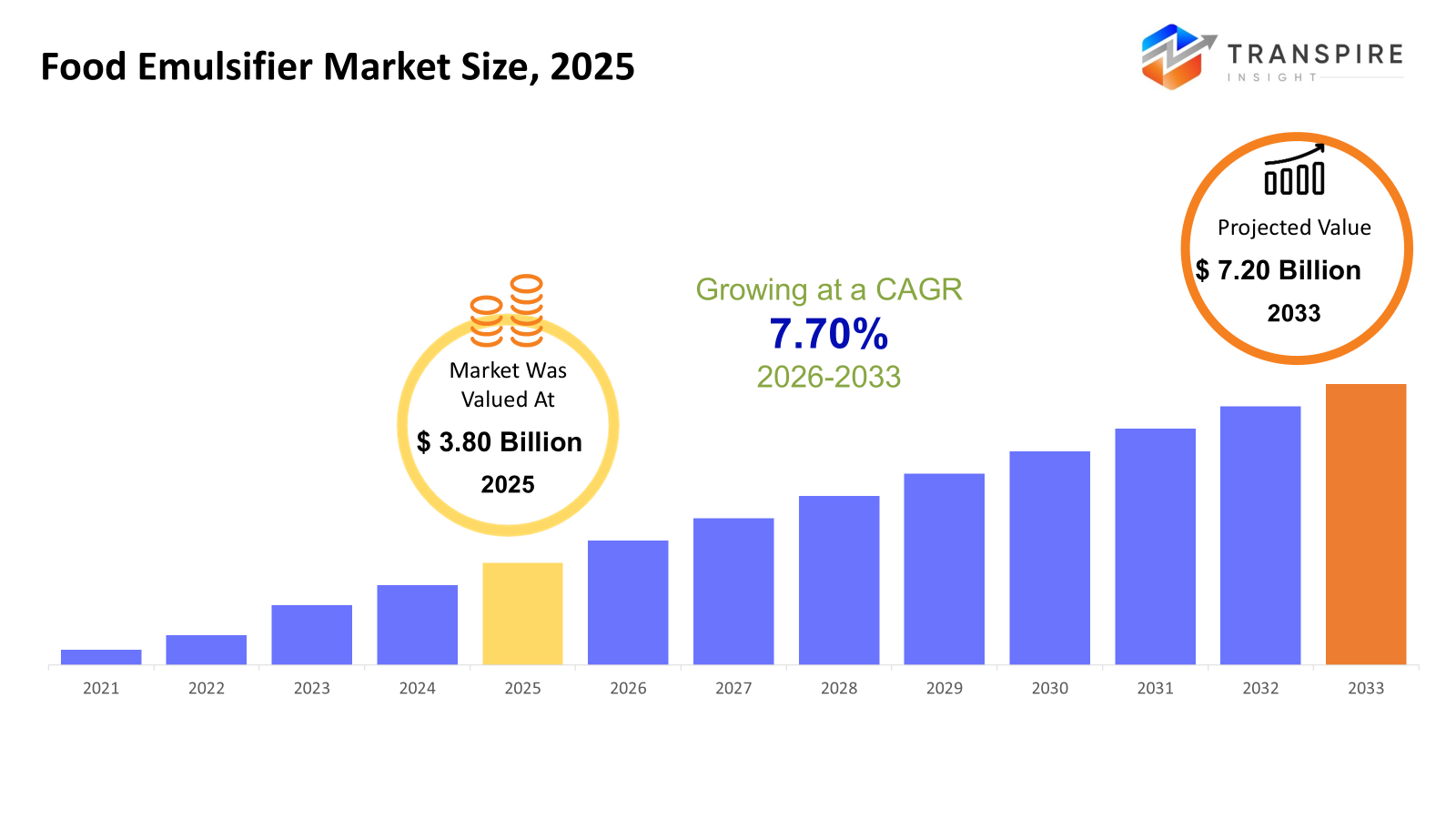

The global Food Emulsifier market size was valued at USD 3.80 billion in 2025 and is projected to reach USD 7.20 billion by 2033, growing at a CAGR of 7.70% from 2026 to 2033. Foods that stay fresh longer often rely on emulsifiers, helping them keep a smooth feel and consistent quality. Because more people buy ready-to-eat meals, these additives find wider use in everyday items. Lecithin and similar natural options now draw greater interest, shifting choices toward simpler ingredient names. Baked goods, sweets, and milk-based products use more of these substances, especially where new factories open in fast-growing regions. New methods in mixing and refining allow makers to fit specific needs across different drinks and dishes.

Market Size & Forecast

- 2025 Market Size: USD 3.80 Billion

- 2033 Projected Market Size: USD 7.20 Billion

- CAGR (2026-2033): 7.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 35% in 2026. Across North America, tastes shift toward simpler ingredients. Bakeries, candy makers, and quick-meal producers lead the push. Preference grows for emulsifiers that sound familiar, not chemical. Markets respond slowly but steadily to what people now expect on labels.

- Big appetite here comes from massive food production. A liking for clean labels helps drive demand. Long-standing distribution networks keep things moving smoothly.

- Bakery output climbs across Asia Pacific, pushing demand higher. Growth rides on more people joining the middle class. Food texture matters now more than before. Processed items fill shelves faster. Awareness spreads about what goes into daily meals. Expansion unfolds quietly but steadily.

- Lecithin shares approximately 38% in 2026. Lecithin takes the lead simply because it comes from nature. Its wide range of uses keeps it popular across many recipes. Clean-label trends give it an edge lately. Function meets demand, quietly shaping choices in everyday foods.

- From soy comes a top pick for blending ingredients, used everywhere in baked goods, milk-based treats, plus sweets across the world.

- Sitting on shelves much longer without going bad powder form usually wins inside factories. Handling stays simpler when it is not wet or squishy. Stability matters too, especially under hot lights or bumpy transport. Many choose powder simply because machines work better with dust than drips.

- Bakery and confectionery operations make up the biggest group, needing better texture and smoother dough handling, because freshness lasts longer. Though small, their need shapes much of what gets developed. What stands out is how often they rely on certain additives just to keep things consistent. Because textures matter so much, changes spread fast across similar producers. Their choices push supply trends more than most realize.

Food emulsifiers work behind the scenes, keeping mixtures smooth and textures even across drinks and dishes. These additives hold their ground especially well in baked goods, milk-based items, sweets, dressings, or ready-to-eat meals, places where uniformity matters. Instead of splitting apart, such products stay blended thanks to these compounds. Quality expectations in packaged foods keep climbing, so manufacturers rely more heavily on emulsifiers just to meet basic performance. That often traces back to one of these quiet helpers doing its job out of sight.

Nowadays, people lean toward natural options like lecithin pulled from soy, sunflower, or rapeseed, as labels matter more and wellness trends rise. Industrial makers still rely on lab-made helpers such as mono- and diglycerides, polyglycerol esters, or sodium stearoyl lactylates when they need steady results without spending much. What works best shifts based on how it's used, what effect is needed, and which rules apply locally.

Starting off, it is clear that businesses making baked goods or sweets rely heavily on emulsifiers to get a better texture and smoother mixing. Instead of just one form, these additives come as powders or liquids, giving makers options depending on how they run their lines. Think about yogurt or frozen treats; here, the stuff helps create rich mouthfeel and stable blends without breaking down. Even in ready-to-eat meals or drinks, similar benefits show up when blending ingredients that normally would not stay mixed. With people wanting new flavors and textures all the time, companies keep turning to these helpers to deliver steady results across batches.

North America and Europe lead in emulsifier use, thanks to long-standing food production systems and a shift toward natural, specialized components. On the flip side, demand surges in the Asia Pacific, where factories multiply alongside city growth and sharper attention to how food feels and tastes. Fresh trends in less mature economies, paired with changing buyer habits, open room for new ideas across the worldwide emulsifier landscape.

Food Emulsifier Market Segmentation

By Type

- Lecithin

Found in nature, lecithin helps mix ingredients that usually separate, commonly seen in baked goods, milk-based products, or candy bars, where a smooth texture matters most. It comes from sources like soy or sunflower, doing quiet work behind the scenes without changing taste. Bakers rely on it subtly; chocolatiers depend on its touch even more.

- Mono- and Diglycerides

From time to time, spot mono- and diglycerides tucked into ingredient lists. These helpers keep bread soft a bit longer. Baked items hold their shape better when these are added. Processed meals stay consistent through changes in temperature. They arrive with a quiet role - slowing breakdown over days. Not flashy, just steady. Their presence means less crumbling and fewer separation issues. A small nudge toward reliability without drawing attention.

- Sorbitan Esters

These helpers keep textures smooth in candies plus similar rich treats. Found commonly where fats need control think creamy fillings or chocolate coatings. Their role blends quietly into products you likely eat already.

- Polyglycerol Esters

Foam rises better when these ingredients step in. Emulsions hold together thanks to their stabilizing effect. Baked goods feel smoother on the tongue because of how they reshape structure. Sweets gain consistency not by chance but through precise interaction. Air stays trapped where it should, making each bite lighter than expected.

- Sodium Stearoyl Lactylates

Found in bakery items, Sodium Stearoyl Lactylates make dough tougher while also boosting tenderness. With time, these additives help keep bread feeling fresh longer than usual. Texture shifts become smoother thanks to their presence during baking.

- Others

Enzyme-driven types show up alongside special-purpose emulsifiers, mostly found in very specific drink and food uses.

To learn more about this report, Download Free Sample Report

By Source

- Soy

Lecithin usually comes from soy, found in plenty of everyday foods. Emulsifiers made this way mix easily into products people eat daily. Food makers rely on these ingredients more than you might think.

- Sunflower

Now showing up more in snacks and sweets, sunflower steps in where soy once ruled. Not built in a lab, it slides into cookies and chocolate bars instead. This yellow plant swaps out processed picks without fuss. Bakers find it handy when avoiding genetic tweaks matters. From pastry crusts to cocoa blends, its role grows quietly but steadily.

- Rapeseed

Sunflower fields often get the job done where rapeseed grows close by. Lecithin pulled from these plants works just fine when transport is not needed. Freshness matters less than proximity here. Fields nearby cut down travel, nothing more.

- Others

Other options come from palm or corn, and microbes make unique emulsifiers. These sources add variety beyond common types. Palm brings one kind of trait, corn another, while tiny life forms offer something different entirely.

By Form

- Liquid

Smoother work. Measuring them out lands closer to the target each time.

- Powder

Stability often leans toward powder; its shelf life stretches further compared to others. When moisture stays out of the mix, powders hold form without shifting shape. Less risk of breakdown shows up over time, especially in dry blends where change slows down.

By End-Users

- Food & Beverages Manufacturer

Besides making processed foods, those who create sauces often mix in emulsifiers. Drinks get them too, especially when texture matters. While some stick to old methods, others blend these additives right into beverages. Even if it's not obvious, many manufactured food items rely on such mixing agents. Though taste stays a priority, stability sometimes depends on what goes inside.

- Bakery & Confectionery Units

From smoother dough to richer textures, bakery setups help baked items last longer while enhancing how they feel and taste. Chocolates gain better structure, staying fresh with a more consistent bite over time.

- Dairy & Ice Cream Producer

From milky blends to frozen treats, smoothness gets a boost. Stability holds up when temperatures shift. Texture turns richer without extra effort. Creamy results come through quietly. Each bite feels just right.

- Processed Food Manufacturers

Food makers add emulsifiers so meals stay smooth, even, and steady on shelves. These helpers keep ingredients from separating during storage. They ensure each bite feels the same as the last. Factories rely on them in snacks, sauces, and frozen dishes. Without these substances, textures might turn grainy or lumpy. Emulsifiers make sure everything holds together well.

Regional Insights

Food emulsifier use runs deep across North America, fueled by steady activity in processed foods along with solid appetite from bakeries, dairies, and candy makers. Leading the way, the United States pulls ahead due to massive production volumes, growing interest in cleaner labels and plant-based components, while dependable networks keep premium-grade additives flowing without pause.

Across Europe, demand stays strong because well-established food industries meet shifting tastes for clean-label additives. Instead of synthetic options, buyers in nations like Germany, France, and the United Kingdom lean toward nature-based solutions. Tough rules on safety push makers to choose eco-conscious emulsifiers more often. New methods pop up regularly, helping refine how these substances work. Specialty types show up frequently in products ranging from cakes to cheese. Progress does not slow, especially where texture and shelf life matter most.

From the east to the far corners of the south, new markets are gaining speed. China, India, and Japan push ahead, pulling the Asia Pacific lead with factories humming more each year. Urban life spreads fast there, while wallets grow heavier. In Latin America, meals come increasingly sealed and ready, a shift feeding demand across shelves. Bakeries swell alongside dairies, their output climbing quietly but surely. People pay closer attention now to what they eat and how it feels on the tongue. Growth moves at its own pace in Africa and the Middle East, yet still it climbs. Rising habits around convenience shape choices one meal at a time.

To learn more about this report, Download Free Sample Report

Recent Development News

- May 23, 2025 – Indorama Ventures strengthens food-grade emulsifier offering.

(Source:https://indovinya.indoramaventures.com/indorama-ventures-launches-food-grade-emulsifier/

- August 23, 2023 – Vantage Food launched a new Simply KAKE™ emulsifier formulated to complement food industry cleaner label initiatives.

(Source:https://www.vantagegrp.com/en/News/2023-0831-PR-VANTAGE-FOOD-LAUNCHES-SIMPLY-KAKE-EMULSIFIER

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.80 Billion |

|

Market size value in 2026 |

USD 4.30 Billion |

|

Revenue forecast in 2033 |

USD 7.20 Billion |

|

Growth rate |

CAGR of 7.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Cargill, Archer Daniels Midland Company (ADM), BASF SE, Kerry Group, Ingredion Incorporated, AAK AB, Associated British Foods (ABF), SunOpta Inc., CHS Inc., Fuji Oil Holdings Inc., CH Biotech Co., Ltd., Lipoid GmbH, Lecico GmbH, Kerry Group, Croda Industrial Specialities, Neos Global, and Chemvera. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Lecithin, Mono- and Diglycerides, Sorbitan Esters, Polyglycerol Esters, Sodium Stearoyl Lactylates, Others), By Source (Soy, Sunflower, Rapeseed, Others), By Form (Liquid, Powder), By End-Users (Food & Beverages Manufacturers, Bakery and Confectionery Units, Dairy & Ice Cream Producers, Processed Food Manufacturers) |

Key Food Emulsifier Company Insights

Food textures stay smoother when Cargill steps in with its specialty lecithin, among other natural helpers. From bakeries to candy makers, their touch shows up across dairy and ready-made meals too. Texture holds better. Products last longer. Stability climbs without flashy chemicals. Clean labels drive choices now; people want what feels close to nature. This push shapes how Cargill builds each solution, keeping earth-friendly methods at the forefront of mind. Operations stretch through North America, dig deep into European networks, and reach across Pacific shores. Custom blends come alive where science teams join forces with factory planners. Supply lines hum steadily, built wide enough to handle demands anywhere they rise.

Key Food Emulsifier Companies:

- Cargill

- Archer Daniels Midland Company (ADM)

- BASF SE

- Kerry Group

- Ingredion Incorporated

- AAK AB

- Associated British Foods (ABF)

- SunOpta Inc.

- CHS Inc.

- Fuji Oil Holdings Inc.

- CH Biotech Co., Ltd.

- Lipoid GmbH

- Lecico GmbH

- Kerry Group

- Croda Industrial Specialties

- Neos Global

Global Food Emulsifier Market Report Segmentation

By Type

- Lecithin

- Mono- and Diglycerides

- Sorbitan Esters

- Polyglycerol Esters

- Sodium Stearoyl Lactylates

- Others

By Source

- Soy

- Sunflower

- Rapeseed

- Others

By Form

- Liquid

- Powder

By End-Users

- Food & Beverages Manufacturers

- Bakery and Confectionery Units

- Dairy & Ice Cream Producers

- Processed Food Manufacturers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions

Find quick answers to common questions.

The approximate Food Emulsifier Market size for the market will be USD 7.20 billion in 2033.

Key segments for the Food Emulsifier Market are By Type (Lecithin, Mono- and Diglycerides, Sorbitan Esters, Polyglycerol Esters, Sodium Stearoyl Lactylates, Others), By Source (Soy, Sunflower, Rapeseed, Others), By Form (Liquid, Powder), By End-Users (Food & Beverages Manufacturers, Bakery and Confectionery Units, Dairy & Ice Cream Producers, Processed Food Manufacturers).

Major Food Emulsifier Market players are Cargill, Archer Daniels Midland Company (ADM), BASF SE, Kerry Group, Ingredion Incorporated, AAK AB, and Associated British Foods (ABF).

The North America region is leading the Food Emulsifier Market.

The Food Emulsifier Market CAGR is 7.70%.

- Cargill

- Archer Daniels Midland Company (ADM)

- BASF SE

- Kerry Group

- Ingredion Incorporated

- AAK AB

- Associated British Foods (ABF)

- SunOpta Inc.

- CHS Inc.

- Fuji Oil Holdings Inc.

- CH Biotech Co., Ltd.

- Lipoid GmbH

- Lecico GmbH

- Kerry Group

- Croda Industrial Specialties

- Neos Global

Recently Published Reports

-

Dec 2024

Baby Infant Formula Market

Baby Infant Formula Market Size, Share & Analysis Report By ype (Infant Milk, Follow On Milk, Specialty Baby Milk, Growing-Up Milk), By Ingredient (Carbohydrate, Fat, Protein, Minerals, Vitamins, and Others), By Product Form (Powder, Liquid, and Ready-to-feed), By Distribution Channels (Supermarket/Hypermarket, Specialty Store, Pharmacies, Online Retail, and Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

Edible Insects for Animal Feed Market

Edible Insects for Animal Feed Market Size, Share & Analysis Report By Type (Insect Powder, Insect Meal, Insect Bar, Insect Paste, Insect Oil, and Others), By Insect Type (Beetles, Cricket, Caterpillar, Hymenoptera, Orthoptera, Tree Bugs, and Others), By Application (Livestock, Pet Food, and Aquaculture), By Livestock Type (Poultry, Swine, and Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

Food Industry Disinfection and Bacterial Control Market

Food Industry Disinfection and Bacterial Control Market Size, Share & Analysis Report By Type (Chemical Disinfectants, Physical Disinfectants, and Biocides and Antimicrobials), By Application (Food Processing Equipment Surface Disinfection, Food Preparation Areas Surface Disinfection, Storage Areas Surface Disinfection, Anti-microbial Coatings Food Preservation, and Preservative Solutions Food Preservation), By End User (Meat and Poultry Processing, Dairy Processing, Seafood Processing, Bakery and Confectionery, Restaurants and Commercial Kitchens, and Food Service Providers), By Sales Channel (Online, Offline), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031

-

Jan 2025

Freeze Dried Food Market

Freeze Dried Food Market Size, Share & Analysis Report By Product Type (Fruits, Vegetables, Freeze-Dried Dairy Products, Freeze-Dried Meat and Seafood, Freeze-Dried Pet Food, and Prepared Meal), By Nature (Organic, and Conventional), By Form (Powdered, Granules, and Diced), By End Use (Breakfast Cereals, Dairy Products, Bakery & Confectionery, Nutritional Bars & Supplements, Powdered Beverages, Snacks, and Retail (Household)), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America), 2021 - 2031