Market Summary

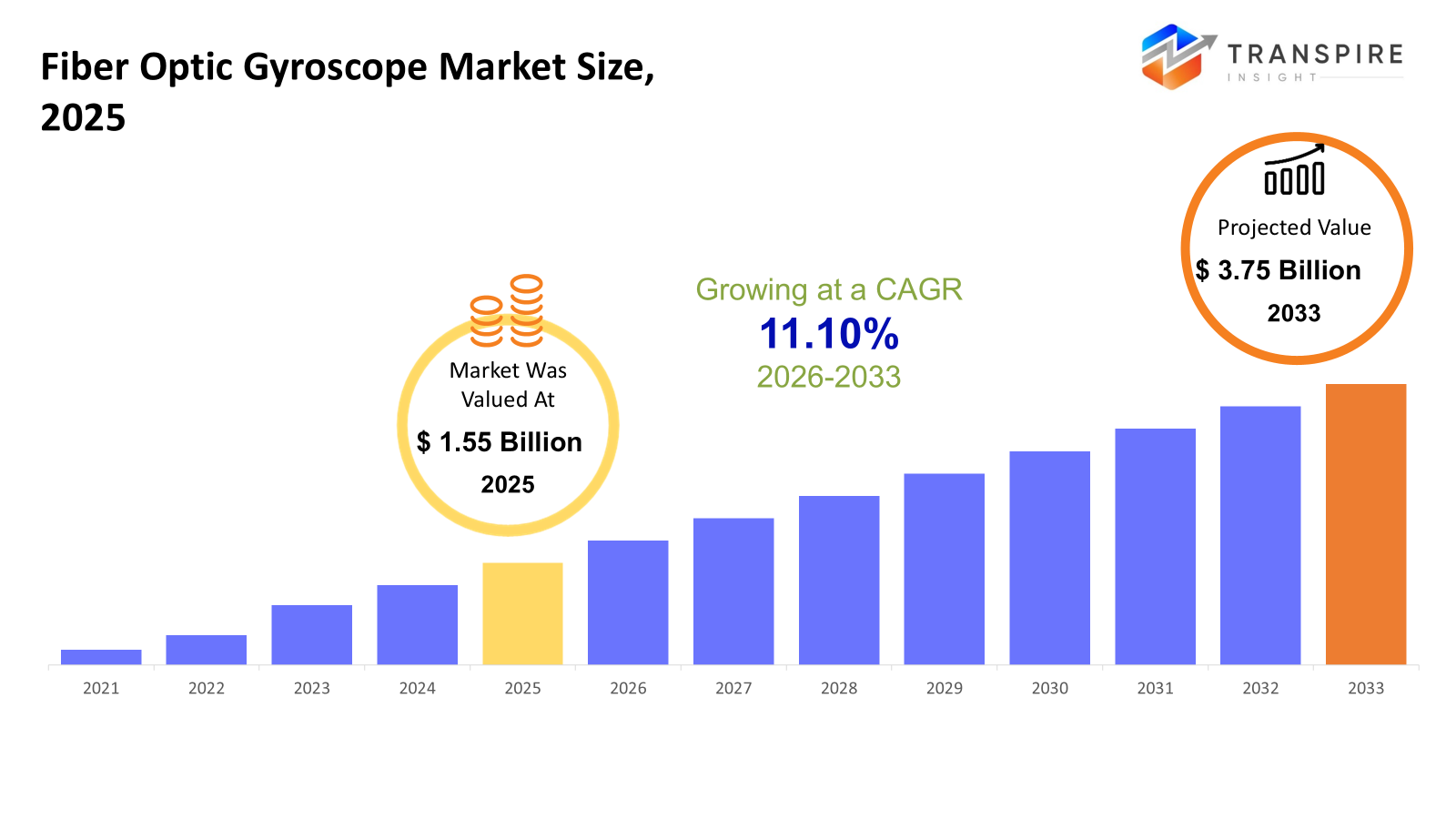

The global Fiber Optic Gyroscope market size was valued at USD 1.55 billion in 2025 and is projected to reach USD 3.75 billion by 2033, growing at a CAGR of 11.10% from 2026 to 2033. The Fiber optic Gyroscope market is increasing due to the need for accurate navigation systems by aerospace, defense, and drone sectors. The trend is to use an increasing number of drones, satellites, and inertial navigation systems, requiring a high level of accuracy, thus fueling the market growth. Fiber optic gyros are favored due to their accuracy, strength, and lack of susceptibility to electromagnetic interference. Defense modernization and future mobility developments are adding to the steady CAGR development of the market.

Market Size & Forecast

- 2025 Market Size: USD 1.55 Billion

- 2033 Projected Market Size: USD 3.75 Billion

- CAGR (2026-2033): 11.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is still a place for growth. This is because they are always working on defense systems and lots of people use advanced navigation and there are many aerospace and defense companies in North America. These companies in North America keep needing fiber gyroscopes so the demand for fiber optic gyroscopes, in North America stays strong.

- The Asia Pacific region is growing fast. This is happening because the countries in the Asia Pacific region are spending money on defense. They also have space programs now. Many things are being made locally in the Asia Pacific region. The Asia Pacific region is also using navigation systems often in the military in aerospace and, in self-driving cars. The Asia Pacific region is using these navigation systems a lot.

- Fiber optic gyroscopes that use interferometry are popular now. These fiber optic gyroscopes are very accurate. They stay that way overtime. Fiber optic gyroscopes are also very dependable. That is why people like to use fiber optic gyroscopes for navigation, in aerospace and defense systems when they need to be precise. Fiber optic gyroscopes are the choice.

- The aerospace/defense industry is the major application segment. Demand is driven by the continued acquisition of inertial navigation systems, the rise in the use of UAVs, and modernization in air force, navy, and missiles.

- Multi-axis fiber optic gyroscopes are seeing more growth. This is because there's a rising need for complete navigation solutions that can measure tricky movements, especially in aircraft, unmanned vehicles, missiles, and space vehicles that need better awareness of their surroundings.

The fiber optic gyroscope (FOG) market is a specific part of the navigation and inertial sensing business. It deals with tools that use light to measure angular speed accurately. FOGs are better than older mechanical gyroscopes because they're more accurate, dependable, and can resist electromagnetic problems. This makes them great for important jobs in aerospace, defense, marine, and factory systems where correct navigation and stability is a must. The market is growing because of the need for better navigation in planes, satellites, unmanned vehicles, and self-driving platforms, especially in areas where they're spending lots on defense and space projects.

Tech improvements are a big reason why the market is getting bigger. Interferometric and resonant fiber optic gyroscopes are the main types of techs being used. Multi-axis gyroscopes are becoming more popular for all-in-one navigation systems that can follow complicated movements in 3D. When you put together inertial measurement units and inertial navigation systems with FOG technology you get navigation platforms that're small and work very well. These navigation platforms are also very accurate. The fact that more self-driving vehicles and unmanned aerial vehicles and factory robots are using FOG technology opens possibilities for FOG technology and helps the market for FOG technology grow. Asia Pacific is becoming an area for FOG technology because they are spending more money on defense and making more aerospace products and launching more satellites. This means FOG technology is being used increasingly in Asia Pacific. North America is still on top because of its strong defense setup and use of new tech.

The market also wants GPS-free navigation, especially in defense, aerospace, and sea travel, where losing a signal can mess up a mission. Fiber optic gyroscopes work steadily and dependably in tough places, so they're preferred over older mechanical or MEMS gyroscopes. Constant spending on research and development, along with more unmanned systems and accurately guided tech being sold, should keep the market growing strong. All in all, the fiber optic gyroscope market is set to keep growing because of fresh tech, key defense plans, and more use in high-accuracy navigation across the world.

Fiber Optic Gyroscope Market Segmentation

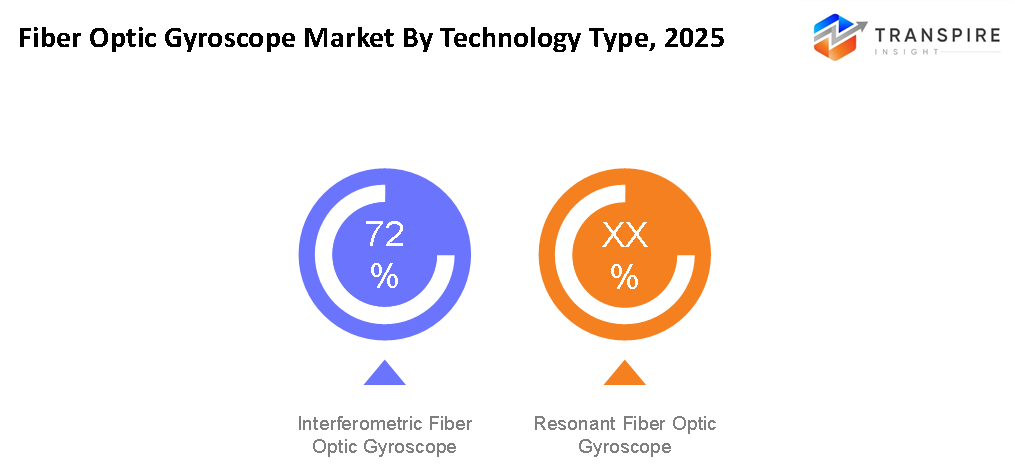

By Technology Type

- Interferometric FOG

The interference FOG is the most preferred because it is more accurate, stable, and reliable compared to all other FOG technologies.

- Resonant FOG

Resonant FOG is gaining traction for cost-effective solutions where moderate precision suffices, supporting broader industrial and navigation adoption.

To learn more about this report, Download Free Sample Report

By Axis Type

- Multi-Axis (2-Axis, 3-Axis)

Multi-Axis Gyroscopes drive market growth as they facilitate full-motion analysis within complex platforms such as aircraft, UAVs, and satellites.

- Single-Axis

Single-axis devices remain relevant for simpler systems but contribute less to revenue due to limited measurement capabilities.

By Device Type

- Inertial Measurement Units [IMU]

IMUs are preferred for compact, integrated navigation solutions offering high accuracy and ease of deployment across multiple platforms

- Inertial Navigation Systems (INS)

INS adoption remains strong in high-precision military and aerospace applications, ensuring reliability where GPS-independent navigation is critical.

By Application

- Navigation

Navigation is the primary driver, especially in defense and aerospace sectors requiring accurate positioning in GPS-denied environments.

- Guidance & Control

Guidance and control systems benefit from precise angular measurement.

- Stabilization

while stabilization applications leverage FOGs for platform balance and operational efficiency.

End-Use Industry

- Aerospace & Defense

Aerospace & defense dominates due to continuous modernization programs, satellite deployments, and unmanned platform usage.

- Automotive, Marine, Industrial

Automotive and industrial sectors are emerging markets as autonomous vehicles, robotics, and precision machinery increasingly adopt fiber optic gyroscopes.

Regional Insights

The Fiber Optic Gyroscope Market changes across the globe because of tech use, defense spending, and factory work. North America is a leader because of its strong defense setup, plane making, and quick use of new navigation systems. The United States has most of the demand because it keeps buying inertial navigation systems and working on satellite programs. Canada and Mexico add to this with factory uses and new defense plans.

Europe is growing slowly but surely. Germany, the UK, and France are in charge because they have big defense budgets, good plane businesses, and spend money on satellites and navigation tech. Spain and Italy are using it some, mostly for ships and planes. The rest of Europe gets a boost from defense teamwork and machines in factories.

The Asia Pacific area is growing the fastest. This is driven by higher defense costs, bigger plane programs, and more self-driving platforms in China, Japan, India, and South Korea. Australia and New Zealand are new markets that care about space and defense navigation systems. The rest of Asia Pacific is taking more interest in factory and ship navigation uses.

South America is seeing some growth. Brazil and Argentina are pushing use in the plane and defense areas, with factories in the rest of South America playing a role. The Middle East and Africa are seeing higher demand, led by Saudi Arabia, the UAE, and South Africa. They want to modernize their defenses, start space programs, and improve factory navigation. The rest of the area is slowly putting money into new navigation solutions.

To learn more about this report, Download Free Sample Report

Recent Development News

- March 2025, Exail selected by VTU to equip Czech land defense forces with Advans inertial navigation systems - Exail Technologies announced it was awarded a contract by the Czech Republic’s Vojensky technicky ustav (VTU) to supply its Advans Series INS, based on fiber‑optic gyroscope technology, for artillery and reconnaissance vehicles, enhancing GNSS‑denied navigation capabilities.

- February 2025, Safran signs an agreement with Finnish Defence Forces for Inertial Navigation Systems - Safran Electronics & Defense officially announced a significant agreement to supply its Geonyx INS, leveraging advanced gyroscope technology, to the Finnish Defence Forces for artillery systems through 2031, strengthening long‑term military navigation capabilities.

(Source: https://www.safran-group.com

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.55 Billion |

|

Market size value in 2026 |

USD 1.80 Billion |

|

Revenue forecast in 2033 |

USD 3.75 Billion |

|

Growth rate |

CAGR of 11.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Northrop Grumman Corporation, Honeywell International Inc., KVH Industries, Inc., EMCORE Corporation, Exail Technologies, Safran Electronics & Defense, Fizoptika Corp., Optolink LLC, Nedaero Technology Types, Advanced Navigation Pty Ltd, Cielo Inertial Solutions Ltd., Al Cielo Inertial Solutions Ltd., Fibernetics LLC, SkyMEMS, Tamam Division (Elbit Systems Ltd.) |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Axis Type type (interferometric fiber optic gyroscope, resonant fiber optic gyroscope), by axis type (single-axis, multi-axis [2-axis, 3-axis]), by device type (inertial measurement units [IMU], inertial navigation systems [INS]), by application (navigation, guidance & control, stabilization), by end-use industry (aerospace & defense, automotive, marine, industrial) |

Key Fiber Optic Gyroscope Company Insights

Northrop Grumman is a major participant and beneficiary of this global fiber optic gyroscope market industry. Its experience and knowledge base of several decades around defense and aerospace-based navigation systems help it deliver high-performance and reliable FOG inertial navigation systems to its valued customers. Its continuous R&D investments also help it integrate mini and multi-axis gyroscopic systems into its high-performance inertial measurement units to support their GPS denied applications. Its major contracts and joint ventures with other players, with their strong defense reach and influence at the current global scenario, help this company emerge as a leader of this high-tech industry of navigation systems.

Key Fiber Optic Gyroscope Companies:

- Northrop Grumman Corporation

- Exail Technologies (formerly iXblue)

- Safran Electronics & Defense

- Honeywell International Inc.

- KVH Industries, Inc.

- EMCORE Corporation

- Fizoptika Corp.

- Optolink LLC

- Nedaero Technology Types

- Advanced Navigation Pty Ltd

- Cielo Inertial Solutions Ltd.

- Al Cielo Inertial Solutions Ltd.

- Fibernetics LLC

- SkyMEMS

- Tamam Division (Elbit Systems Ltd.)

Global Fiber Optic Gyroscope Market Report Segmentation

By Technology Type

- Interferometric Fiber Optic Gyroscope

- Resonant Fiber Optic Gyroscope

By Axis Type

- Single-Axis

- Multi-Axis (2-Axis, 3-Axis)

By Device Type

- Inertial Measurement Units (IMU)

- Inertial Navigation Systems (INS)

By Application

- Navigation

- Guidance & Control

- Stabilization

By End-Use Industry

- Aerospace & Defense

- Automotive

- Marine

- Industrial

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636