Market Summary

The global Dual-energy X-ray Absorptiometry market size was valued at USD 1.65 billion in 2025 and is projected to reach USD 3.55 billion by 2033, growing at a CAGR of 9.40% from 2026 to 2033. The increasing prevalence of osteoporosis, an aging population worldwide, and the increased consideration of diagnostics for prevention will continue to drive the growth of the market for Dual-energy X-ray Absorptiometry at a steady CAGR. Improvement in the speed and accuracy of scans and expansion in their clinical and wellness applications are other factors contributing to long-term market growth.

Market Size & Forecast

- 2025 Market Size: USD 1.65 Billion

- 2033 Projected Market Size: USD 3.55 Billion

- CAGR (2026-2033): 9.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America still maintains dominance due to superior diagnostic equipment, high screening rates, and appropriate reimbursement procedures. A good level of knowledge and utilization of DEXA technology by physicians for routine bone health care aids continued equipment upgrade and replacement needs.

- The US continues to be the major growth driver in North America, bolstered by sound osteoporosis diagnostic rates, a robust infrastructure of outpatient imaging services, and progress in technological uptake. Preventive healthcare trends and demographic trends support steady DEXA system usage.

- Asia Pacific appears to be the growth hotspot, driven by growing geriatric populations, access to healthcare facilities, and awareness about bone disorders. Rapid infrastructure growth in China and India for diagnosis has a major effect on the growth rate for the installation of new systems.

- Central DEXA systems currently hold top position in DEXA-based axial bone density measurements. The reliability of Central DEXA, their reimbursement status, and their suitability for high-volume hospital markets all contribute to increased demand for central DEXA despite their significant capital investment costs.

- The choice of fan beam technology will continue, as it allows for quicker image scans, coupled with better image resolutions. The overriding need for speed in image scans, coupled with clarity, will continue to make this technology extremely popular worldwide.

- Osteoporosis diagnosis, as well as bone density measurements, still remain to be the core applications, driven by increasing risks of fractures, particularly with increasing age. Screening recommendations through guidelines generate consistent clinical demands, including long-term DEXA technology utilization.

- Hospitals are the largest end-users who can enjoy an integrated approach to diagnostics and care. Hospitalization results in large volumes, providing economies of scale, and access to capital budgets for installations and regular upgrades of the system.

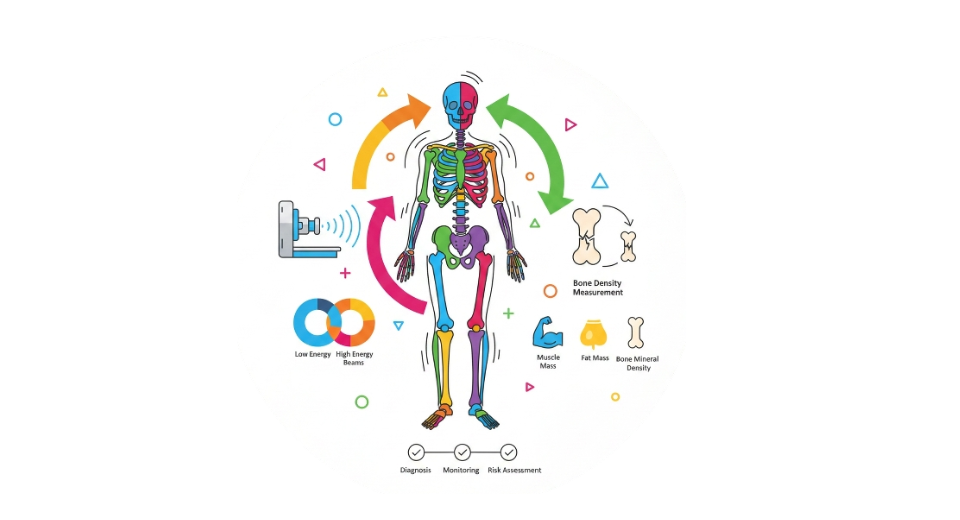

So, On the other hand, the dual-energy X-ray absorptiometry market is primarily focused on diagnostic equipment for bone density and skeletal health. It is accepted that the dual-energy X-ray absorptiometry test for osteoporosis is the most reliable test, with minimal exposure to harmful rays to promote bone health, thereby reducing the risk of fractures in troublesome areas such as the spine and the hip. Moving beyond bone health, the market has further extended to include body composition analysis, thereby entering into supports for the management of obesity, sports medicine, and metabolism. This has helped diversify the market, thereby providing it an entry into wider end-users such as hospitals, diagnostic imaging facilities, clinics, and educational institutions. Further, technology, which includes better software for images and faster scanning, keeps on supporting the market. The increasing demand for these systems in the global DEXA industry also gets a boost due to the awareness regarding preventive healthcare, early diagnosis, and maintenance regarding the detection and treatment of long-term health conditions. With the progression towards value-based care, the DEXA systems have found a greater application in the long-term care and diagnosis, as opposed to the traditional approach to diagnosis.

Dual-energy X-ray Absorptiometry Market Segmentation

By Product Type

- Central DEXA Systems

These are the central DEXA systems, and they are the gold standard choice for the evaluation of bone density due to their accuracy and the capability of the systems to scan the axial skeleton. There are widespread uses of the DEXA systems due to their use in the hospitals, support for reimbursement, and expansion of osteoporosis screening.

- Peripheral DEXA Systems

Peripheral systems for performing DEXA scans have, however, gained popularity due to their cost-effectiveness and transportability, especially for outpatient clinics and community screening programs. This is mainly due to their ease of use and decreased installation costs.

To learn more about this report, Download Free Sample Report

By Technology

- Fan Beam Technology

The segment of fan beam technology dominates this market due to faster scan times and better image resolution. These factors favor this form of scanning within large-volume clinical settings.

- Pencil Beam Technology

Pencil Beam technology still has an application in cost-sensitive environments, particularly when precision constraints are less than stringent. This technology takes more time to scan, but it offers less dose and simplicity to accommodate it in smaller facilities.

By Application

- Osteoporosis diagnosis/ Bone Density Measurement

This segment represents the largest application segment to date, with the incidence of osteoporosis being directly related to the aging global population. Growing trends for preventive screening programs will drive demand for devices that incorporate bone density scanners.

- Body Composition Analysis

DEXA is now widely used for precise analysis of body composition in sports medicine and obese patient treatment. The increasing need for maintaining and providing personal health monitoring and clinical nutrition also fuels DEXA scanner use.

- Fracture Risk Assessment / Vertebral Fracture Assessment

This application is enlarging with clinicians focusing more and more on early fracture prediction, as well as skeletal risk profilers. With the integration of vertebral fracture assessment with conventional DEXA scans, there is enhancement in diagnostic utility.

- Others

The other applications include the monitoring of metabolic bone disease, pediatric bone health, and longitudinal research. The niche contribution also has its incremental addition, especially to the world of academia and medicine.

By End-User

- Hospitals

A majority of the segment can be attributed to hospitals with their availability of technological imaging equipment and the number of patients. Routine diagnostics with the inclusion of DEXA systems ensure their consistent utilization and replacement.

- Diagnostic Imaging Centers

Diagnostic imaging centers are experiencing a steady growth rate with the rise in the trend of using outpatient imaging and efficient service practices. These centers are leading to a growing need for high-throughput DEXA.

- Specialty Clinics

Orthopedic, endocrinology, and rheumatology clinics also show increased dependence on DEXA for targeted bone health assessments. The progressive specialization in managing chronic diseases would provide continued traction for this segment.

- Research & Academic Institutions

Research institutions use DEXA equipment for clinical trials, community-based studies, and body-composition research. The demand for DEXA from this segment will be secured with increased government grants for medical research and innovation.

- Others

Other end users could include gyms and wellness clinics utilizing DEXA scans for wellness evaluations. This end-user segment remains relatively untapped and represents the continued expansion of the use of medical imaging technologies.

Regional Insights

North America currently dominates the Dual-energy X-ray absorptiometry market, with the highest market share across countries, including the United States, Canada, and Mexico, due to awareness of osteoporosis, strong reimbursement policies, and established imaging infrastructures that demonstrate strong demand for these systems. Europe comprises a developed and stable market consisting of Germany, the United Kingdom, France, Spain, Italy, and the rest of Europe. The region enjoys population growth due to an aging population, universal clinical practice guidelines, and public healthcare infrastructure for routine population screening for bone density and overall preventive diagnostics. The Asia Pacific is growing significantly, and this includes Japan, China, Australia & New Zealand, South Korea, India, and the rest of Asia Pacific. There has been rapid urbanization, increasing expenditure, and growing awareness regarding diseases of the bones, which have increased demand for diagnostic products, especially in China and India.

The same occurs in South America, where countries such as Brazil, Argentina, and the rest of South America are witnessing moderate growth in terms of investment in private healthcare services, diagnostics, etc. The Middle East & Africa, including countries such as Saudi Arabia, UAE, South Africa, and others, are witnessing steady progress in terms of investments in healthcare services.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 2025, Hologic announced the release of its compact-design "portable" bone health screening solution, the Horizon DXA, in the period ranging from April to May in the year 2025. The solution came with the key intention of decentralizing bone health screening beyond traditional settings.

(Source:https://www.hologic.com/horizondxa)

- In October 2024, Siemens Healthineers launched a strategic collaboration with Osteosys, with emphasis placed on next-generation DXA imaging systems with AI-enhanced functionalities and improvements to market penetration in Asia.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.65 Billion |

|

Market size value in 2026 |

USD 1.9 Billion |

|

Revenue forecast in 2033 |

USD 3.55 Billion |

|

Growth rate |

CAGR of 9.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Hologic, Inc., GE Healthcare, OSTEOSYS Co., Ltd., DMS Imaging (Diagnostic Medical Systems Group), Swissray International, Inc., BeamMed Ltd., Medilink International, Fujifilm Holdings Corporation, Furuno Electric Co., Ltd., Medonica Co., Ltd., Scanflex Healthcare AB, Shenzhen XRAY Electric Co., Ltd., Osteometer Meditech Inc., Xingaoyi Medical Equipment Co., Ltd., Trivitron Healthcare |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Central DEXA Systems, Peripheral DEXA Systems), By Technology (Fan Beam Technology, Pencil Beam Technology), Recycling & Recovery Technologies), By Application (Osteoporosis Diagnosis / Bone Density Measurement, Body Composition Analysis, Fracture Risk Assessment / Vertebral Fracture Assessment, Others) and By End-User (Hospitals, Diagnostic Imaging Centers, Specialty Clinics, Research & Academic Institutions, Others) |

Key Dual-energy X-ray Absorptiometry Company Insights

Hologic, Inc. can be easily classified as a key player or market leader in manufacturing products that aid in dual-energy X-ray absorptiometry, especially in relation to technologies used for discerning bone densitometry. The company’s product portfolio seems to rely mainly on products like Horizon or Discovery DXA systems. These products have been designed to ensure accurate diagnostic outcomes while reducing clinical workflow. Its emphasis on innovation through technologies like artificial intelligence-based software or clinical support aids in widening its leadership gap. The company’s extensive involvement in initiatives for advancing healthcare for women and building associations across healthcare providers worldwide have also enabled increased product availability. The leadership role that Hologic plays in manufacturing DXA diagnostic equipment globally, owing to long-standing service relationships and brand reputation.

Key Dual-energy X-ray Absorptiometry Companies:

- Hologic, Inc.

- GE Healthcare

- OSTEOSYS Co., Ltd.

- DMS Imaging (Diagnostic Medical Systems Group)

- Swissray International, Inc.

- BeamMed Ltd.

- Medilink International

- Fujifilm Holdings Corporation

- Furuno Electric Co., Ltd.

- Medonica Co., Ltd.

- Scanflex Healthcare AB

- Shenzhen XRAY Electric Co., Ltd.

- Osteometer Meditech Inc.

- Xingaoyi Medical Equipment Co., Ltd.

- Trivitron Healthcare

Global Dual-energy X-ray Absorptiometry Market Report Segmentation

By Product Type

- Central DEXA Systems

- Peripheral DEXA Systems

By Technology

- Fan Beam Technology

- Pencil Beam Technology

By Application

- Osteoporosis Diagnosis / Bone Density Measurement

- Body Composition Analysis

- Fracture Risk Assessment / Vertebral Fracture Assessment

- Others

By End-User

- Hospitals

- Diagnostic Imaging Centers

- Specialty Clinics

- Research & Academic Institutions

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636