Market Summary

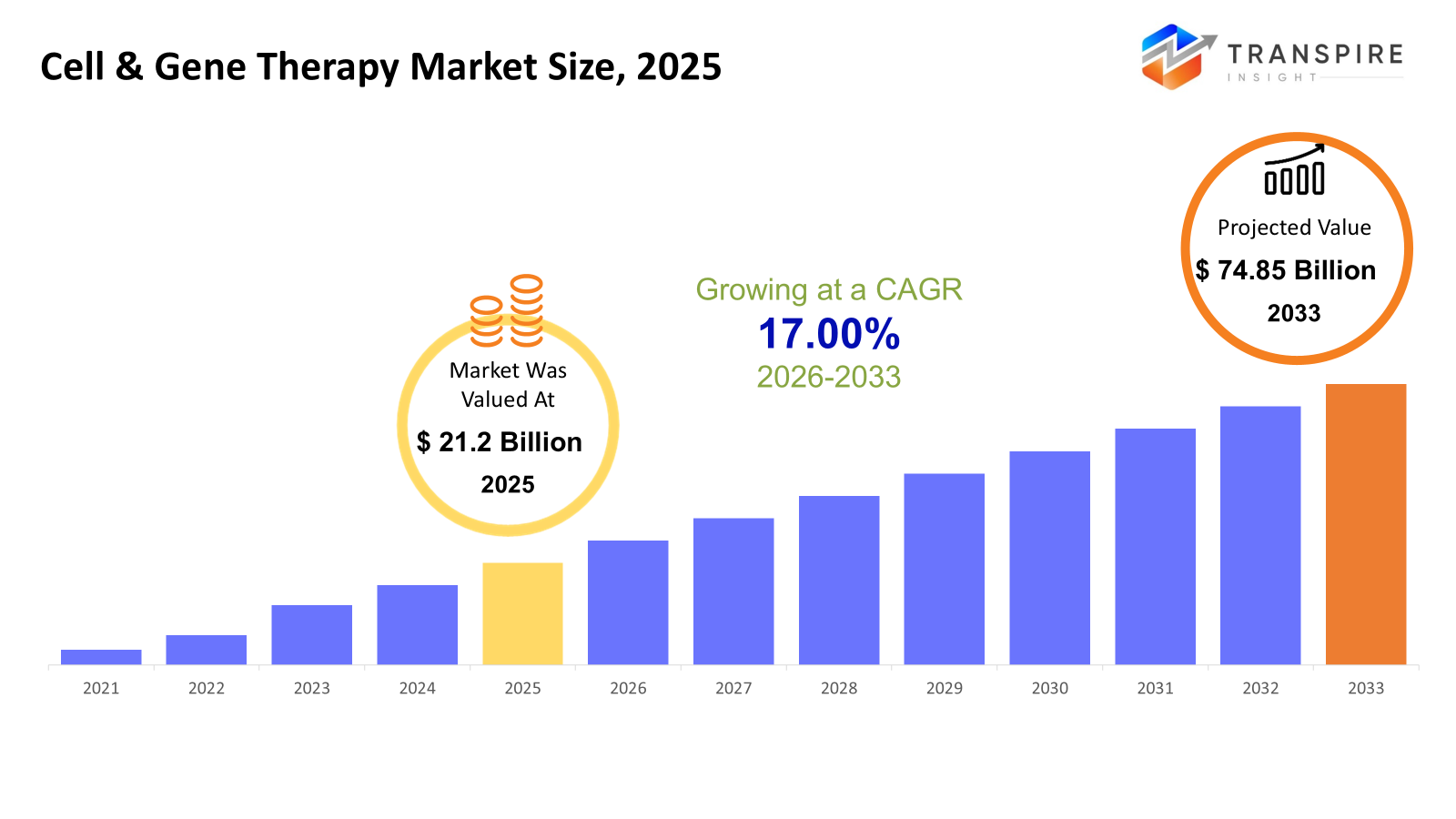

The global Cell & Gene Therapy market size was valued at USD 21.2 billion in 2025 and is projected to reach USD 74.85 billion by 2033, growing at a CAGR of 17.00% from 2026 to 2033. The Cell & Gene Therapy market is reporting strong growth with the help of the growing prevalence of cancer, rare genetic conditions, and chronic illnesses with no definitive cures. Fast-tracked clinical success, regulatory approvals, growing pipelines with investments, and new initiatives in vectorization & cell processing technologies are propelling commercialization.

Market Size & Forecast

- 2025 Market Size: USD 21.2 Billion

- 2033 Projected Market Size: USD 74.85 Billion

- CAGR (2026-2033): 17.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America shows robust momentum because of well-developed regulatory environments, high density of clinical trials, and quick acceptance of advanced therapies by tertiary care centers because of robust reimbursement systems and continuous investment by leading biopharmaceutical innovators.

- The United States is at the forefront of market expansion due to early approvals, a broad CAR-T and gene therapy pipeline, and the concentration of specialized treatment centers, thus facilitating faster patient access and solidifying its position as the global commercialization hub.

- The Asia Pacific market has the fastest growth rate due to the presence of a large patient base, an improving healthcare infrastructure, government-supported biotech programs and the ability to manufacture domestically especially in China, Japan, South Korea, and India.

- Cell therapy continues to be the leading therapy type, thanks to the success of CAR-T and stem cell therapies, the expanding use of these therapies in oncology, and the growing confidence in long-term efficacy based on the expanding real-world evidence.

- Oncology is the most prominent application area, as the highest level of unmet need, significant survival benefits, and rapid innovation in the area of immune-oncology therapies continue to drive support and adoption in this area.

- The market is dominated by hospitals in end-user adoption because of their advanced infrastructure, multidisciplinary expertise, and ability to handle complex administration and post-therapy monitoring, making them the key access points for high-cost and high-complexity therapies.

So, the Cell and Gene Therapy market includes advanced therapeutic modalities that involve modifying or replacing cells and genetic material to prevent, treat, or potentially cure diseases at their root cause. Such therapies are a paradigm shift from treating symptoms to providing long-term therapeutic solutions. The market is marked by high innovation intensity, ranging from oncology to rare genetic disorders, immunology, neurology, and regenerative medicine. Breakthroughs in viral vectors, genome editing tools, and cell expansion technologies are enhancing safety, scalability, and efficacy, paving the way for mainstream adoption. The market is driven by high innovation intensity and investment by biopharmaceutical companies, research institutes, and governments. Although high treatment costs, complex manufacturing processes, and reimbursement issues have remained major challenges, innovations in manufacturing, vector optimization, and supply chain optimization are improving accessibility. The commercialization process is accelerating due to the introduction of fast-track approval procedures by the regulatory bodies, as well as the availability of orphan drug programs. Nevertheless, the high cost of production, logistics, and the issue of reimbursement are still influencing the competitive environment.

Cell & Gene Therapy Market Segmentation

By Therapy Type

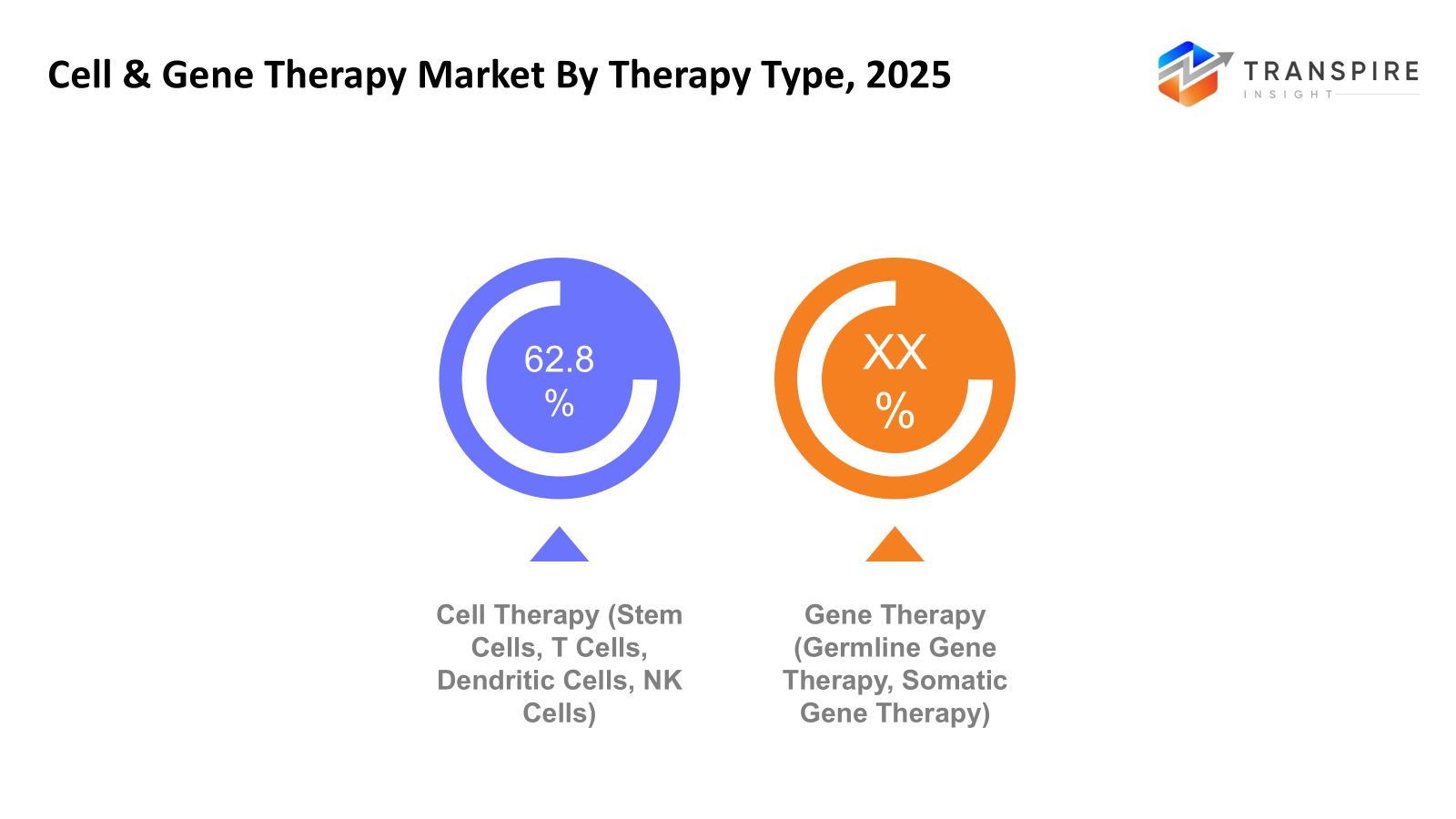

- Cell Therapy (Stem Cells, T Cells, Dendritic Cells, NK Cells)

The cell therapy segment leads the market because of the popularity of CAR-T cell therapies in cancer treatment and the growing use of stem cell therapies in regenerative medicine. The segment is also driven by the high efficacy of these therapies, the rising number of hospital-based administrations, and the expanding product pipelines in hematology and solid tumors.

- Gene Therapy (Germline Gene Therapy, Somatic Gene Therapy)

Gene therapy is rapidly gaining traction as one-time, potentially curative therapies receive regulatory approvals, especially for rare genetic and neurological disorders. Advances in viral vector targeting, gene editing, and long-term safety profiles are increasing physician confidence. Increasing reimbursement policies and fast-track regulatory approvals are helping gene therapy penetrate the market faster.

To learn more about this report, Download Free Sample Report

By Application

- Dermatology

Cell and gene therapies are being investigated for chronic skin diseases and wound healing. The growing need for regenerative dermatology and cosmetic repair, along with the benefits of localized delivery, drive interest in these therapies.

- Musculoskeletal

Applications in cartilage repair, osteoarthritis, and spinal injuries are increasing. The growing need for long-term functional restoration, sports injuries, and aging populations are driving the demand for regenerative applications beyond traditional orthopedic care.

- Oncology

Oncology leads as the largest application area, driven by CAR-T and gene-based immunotherapies. The high unmet need, significant survival benefit, and fast-track approvals continue to fuel significant investment and clinical trial activity.

- Immunology

Cell and gene therapies are finding their place in autoimmune and inflammatory disorders. The precision of immune modulation and the long-term efficacy of treatment are encouraging their use, especially with the growing realization of the limitations of biologic therapies.

- Cardiology & Neurology

These applications are increasing with developments in neurodegenerative and ischemic diseases. The high disease burden and the lack of curative approaches make gene and cell therapies revolutionary, although challenging, long-term approaches.

- Others

Niche applications such as ophthalmic, retinal, infectious, and urological diseases are growing steadily. The possibility of targeted delivery and orphan drug programs are encouraging clinical development and selective commercialization.

By End User

- Hospitals

The market is dominated by hospitals because of their advanced infrastructure and access to specialized clinical staff. The role of hospitals in the administration of complex therapies, management of adverse events, and clinical trials further cements their position in the market.

- Clinics

Specialty clinics are being drawn into the fold, especially in cancer and dermatology. Better outpatient strategies are making way for selective adoption, although high treatment costs are restricting penetration.

- Others

Research and academic institutions continue to play an important role in innovation and early-stage development. Strong engagement in translational research, clinical trials, and public-private partnerships is an important factor in supporting pipeline sustainability.

Regional Insights

North America currently has the largest market share, thanks to the well-organized healthcare infrastructure and regulatory environment. The United States is the main contributor to the dominance of the region, followed by the increasing number of research participants in Canada and Mexico. Europe is a mature but constantly expanding market, with innovation hotspots in Germany, the UK, and France. Spain, Italy, and the remaining countries in Europe enjoy public funding for healthcare, strong research at universities, and rising international collaboration in the clinical sector. The Asia Pacific region is the fastest-growing, driven by China and Japan because of the strong support of their governments and the scale of their manufacturing. South Korea, India, Australia, and New Zealand are also growing in terms of clinical capacity, while the remaining Asia Pacific region is seeing improvements in healthcare access. South America has a moderate growth rate, with Brazil and Argentina at the forefront of adoption due to better regulatory conditions. The Middle East and Africa are still emerging markets, with investment in Saudi Arabia and the UAE, while South Africa provides a foundation for clinical research in the region.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Novo Nordisk (NOVOb.CO), opens new tab and Canada-based private firm Aspect Biosystems announced on Tuesday that they have formed a collaboration to create cell-based therapies for diabetes. Aspect will drive the development and manufacturing of the therapies and will commercialize them, while Novo Nordisk will retain some options and rights to expand its role in the future

- January 2026, Last month, December 2025, the CGTLive team was actively monitoring the activities of the FDA regarding the development of cell and gene therapies for the treatment of rare, complex, and difficult diseases and disorders. The agency has continued to increase its work on these products as more of them move through the pipeline. This past month was no exception as the FDA approved lisocabtagene maraleucel (liso-cel, branded as Breyanzi) for the treatment of relapsed/refractory (r/r) marginal zone lymphoma (MZL) and approved etuvetidigene autotemcel (Waskyra; Fondazione Telethon ETS) as the first cell-based gene therapy approved for the treatment of Wiskott-Aldrich syndrome (WAS).

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 21.2 Billion |

|

Market size value in 2026 |

USD 25 Billion |

|

Revenue forecast in 2033 |

USD 74.85 Billion |

|

Growth rate |

CAGR of 17.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Novartis AG, Gilead Sciences, Inc., Bristol-Myers Squibb Company, bluebird bio, Inc., Kite Pharma, Inc., Sangamo Therapeutics, Moderna, Inc., Editas Medicine, Inc., Cellectis,Orchard Therapeutics, UniQure, Regenxbio, Spark Therapeutics, Fosun Pharma, MeiraGTx Holdings plc |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Therapy Type (Cell Therapy (Stem Cells, T Cells, Dendritic Cells, NK Cells), Gene Therapy (Germline Gene Therapy, Somatic Gene Therapy)), By Therapy Type (Dermatology, Musculoskeletal, Oncology, Immunology, Cardiology & Neurology, Others (Urinary Problems, Infectious Disease, Ophthalmic, Diseases, Retinal Diseases, And Others)), By Application (Hospitals, Clinics, Others (Research Institutes, Academic Institutes, etc.)) |

Key Cell & Gene Therapy Company Insights

Novartis AG has created an unparallelled presence in the cell and gene therapy market with its innovative CAR-T therapy, Kymriah, the first-approved CAR-T cell therapy in the market, thus reiterating its strong hold on oncology innovation. The vast global infrastructure and production base created by the company enables the speedy integration of innovative therapies in the markets across North America, Europe, and Asia Pacific, thus outlining strong potential for growth for Novartis. Ventures into innovative gene editing and cell therapy platforms further add to its strong competitive positions.

Key Cell & Gene Therapy Companies:

- Novartis AG

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- bluebird bio, Inc.

- Kite Pharma, Inc.

- Sangamo Therapeutics

- Moderna, Inc.

- Editas Medicine, Inc.

- Cellectis

- Orchard Therapeutics

- UniQure

- Regenxbio

- Spark Therapeutics

- Fosun Pharma

- MeiraGTx Holdings plc

Global Cell & Gene Therapy Market Report Segmentation

By Therapy Type

- Cell Therapy (Stem Cells, T Cells, Dendritic Cells, NK Cells)

- Gene Therapy (Germline Gene Therapy, Somatic Gene Therapy)

By Application

- Dermatology

- Musculoskeletal

- Oncology

- Immunology

- Cardiology & Neurology

- Others (Urinary Problems, Infectious Disease, Ophthalmic, Diseases, Retinal Diseases, And Others)

By End User

- Hospitals

- Clinics

- Others (Research Institutes, Academic Institutes, etc.)

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636