Market Summary

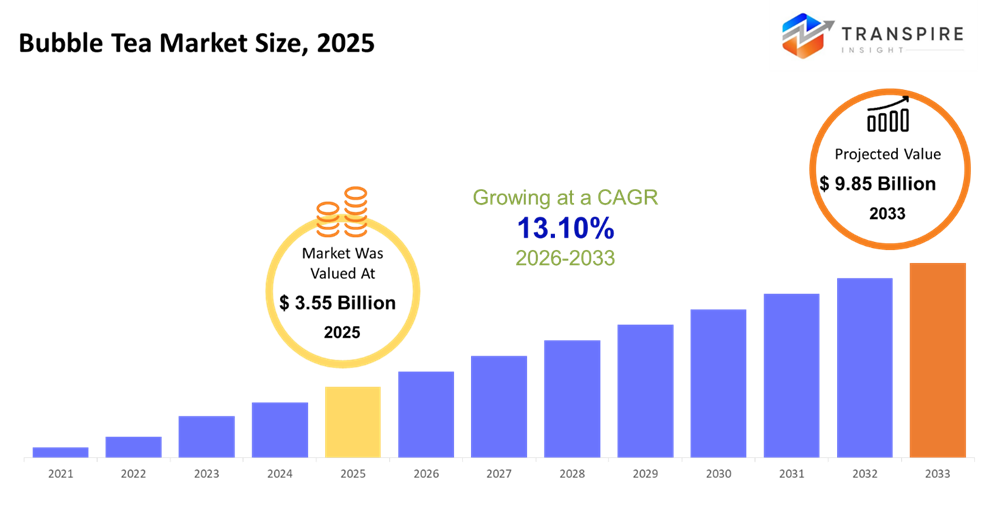

The global Bubble Tea market size was valued at USD 3.55 billion in 2025 and is projected to reach USD 9.85 billion by 2033, growing at a CAGR of 13.10% from 2026 to 2033 The market is expected to register steady growth driven by the rising preference for experiential drinks in the market. The market has been driven by the expansion of café chains, youth population, and premiumization. Health drinks and innovative flavors in the tea market further boost the overall market.

Market Size & Forecast

- 2025 Market Size: USD 3.55 Billion

- 2033 Projected Market Size: USD 9.85 Billion

- CAGR (2026-2033): 13.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America boasts high growth rate because of the penetration of premium café chains, high disposable incomes, and the increasing acceptance of specialty tea drinks. The United States leads the popularity of tea consumption in the North American market because of innovation in brand and flavors and the combination of tea and coffee in the same package to meet the demands of the urban population

- Asia Pacific is the fastest-growing market due to a tradition of drinking tea as well as rising income levels. China, Japan, India, and South Korea are major markets because of domestic brands, urbanization, and the rising middle class.

- Black Tea remains the leading base tea because of factors such as its robust flavor, compatibility with milk, and its appeal based on caffeine content. The wide acceptability in the mass market helps assure demand scalability, be it premium or economy drinks.

- Fruit flavors top the list in the flavor segment. This popularity is attributed to the versatility in accommodating seasonal concepts and customization trends, which makes fruit-flavored products the choice of the youth across North America and the Asia Pacific.

So, The global tea-based specialty drinks market includes tea-based drinks that are processed with the aid of the most common tea varieties like black tea, green tea, oolong tea, and white tea, and other flavors and processing methods. These are the most common tea drinks that are sold in tea shops or the specialty tea chains or packaged in ready-to-drink format based on the trending lifestyle demands of the consumers to create an experiential value out of the consumed tea drinks. Market demands are mainly owing to urbanization, the rising coffee shop culture, as well as consumer trends towards customization and premium quality. Youngest segments are major contributors to demands, including innovative flavor, audacity of looks, as well as personalization. However, health-conscious consumers have shown increased demand towards tea-based products that are lighter compared to carbonated drinks, resulting in acceptance of green as well as lower sugar formulas. In terms of competition, the market is driven by product innovation, franchising, and online engagement, while brands also focus on supply chain optimization, sustainable procurement, and flavor differentiation. The global awareness of specialty tea has led to the growth of this market, contributing to the expansion of consumption beyond conventional norms.

Bubble Tea Market Segmentation

By Type

- Black Tea

Black Teas are already dominating the market owing to strong flavor, high caffeine content, and ease of being consumed with milk-based preparation. Socio-culturally accepted and economical, this is the prime choice to be used as the base material in commercial drink services.

- Green Tea

Green Tea is motivated by healthy consumption trends and growing attention to antioxidants. Its less astringent taste segment stimulates innovation in the development of low-calorie drink products.

- Oolong Tea

Oolong Tea is marketed towards upscale and niche consumers who want complexity in flavor. Because it is traditionally based and considered complex, it creates a niche product market.

- White Tea

White Tea has been positioned as a premium, lightly processed variety that appeals to clean label customers as well as those seeking low-caffeine content. Its relative scarcity, as well as a subtle taste, work to add to the premium position of the offering.

To learn more about this report, Download Free Sample Report

By Flavor

- Fruit

Fruit flavors are the most preferred due to their cooling taste and universal appeal. Fruit flavors are adaptable and can be suited to local tastes and can be launched according to the seasons.

- Taro

The taro flavor has good cultural fit within the Asia Pacific market and also benefits from international interest. The texture enhances indulgence from an SBD product offering position.

- Strawberry

Strawberry is still an universally accepted flavor because of its balanced sweetness and commonality. This flavor works well in all regions and demographics, which helps create steady demand.

- Classic

Conventional tastes are relevant because of nostalgia. They create a steady sales volume. They ensure brand trust throughout developed and developing markets. Both are basic psychological factors. They can affect any target audience. No advertising campaign is needed to make consumers concerned. They

- Coffee

Caffeinated variants tend to attract more consumers with their potential to provide higher caffeine content and experience fusion. This segment enjoys better integration with the coffee culture, mostly in the West.

- Other

Other types of flavors facilitate endless innovations. Seasonal, limited, and regional flavors assist the brand in tapping into niches.

Regional Insights

North America is an established and innovation-forcing market, led by the US, Canada, and Mexico. Tier 1 markets are characterized by premiumization, and Tier 2 by affordability and café formats. Europe is a steadily moving market, led by Germany, the UK, and France as Tier 1 markets due to health-related trends, and the southern and Eastern regions of Europe as Tier 2 markets. The Asia Pacific leads by global volume, with China, Japan, India, and South Korea classed as Tier 1 markets due to increasing consumer volume and home brands. The Tier 2 regions include Australia, New Zealand, and Southeast Asia, while penetration of premium units and coffee shops is increasing. The emerging countries include those in South America, mainly Brazil and Argentina, where younger people and fruits drive sales. The MEA (Middle East and Africa region) is slowly expanding, led by Saudi Arabia, UAE, and South Africa, which are classified in Tier 1, primarily driven by their café culture and preference for premium drinks. The Tier 2 geography is highlighted by the movement towards urbanization and awareness of global drinks trends.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, CHAGEE published the 2025 Year-End Tea Friends Review. The review covers the development of the company over the past year, as their stores’ networks have been extended over two continents, covering a total of eight countries, with an accumulated annual tea-sourcing volume over 10,000 tons, involving six prominent tea varieties as well as the prime Pu’er tea-producing region, as a result of collaboration with over 100 tea factories.

- In February 2025, Gong cha, the global leader in bubble tea with almost 2,200 stores in 32 international markets and over 240 locations in the US operating in 23 states, as well as Washington D.C. and Puerto Rico, continues to accelerate expansion across the Americas.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.55 Billion |

|

Market size value in 2026 |

USD 4.2 Billion |

|

Revenue forecast in 2033 |

USD 9.85 Billion |

|

Growth rate |

CAGR of 13.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Lipton Teas and Infusions B.V., Tata Global Beverages,Twinings (Associated British Foods), Dilmah Ceylon Tea Company PLC, Celestial Seasonings (Hain Celestial Group), Bigelow Tea Company, The Republic of Tea, Yorkshire Tea (Bettys & Taylors of Harrogate), Ahmad Tea Ltd. ITO EN, Ltd., The Coca-Cola Company, PepsiCo, Inc.,Starbucks Corporation, AriZona Beverage Company LLC, Chatime International Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Black Tea, Green Tea, Oolong Tea, White Tea), By Flavor (Fruit, Taro, Strawberry, Classic, Coffee, Other) |

Key Bubble Tea Company Insights

Key players operating in the global Bubble Tea Market include Onnit Labs, Reckitt Benckiser Group plc, Glanbia plc, Mind Lab Pro, TruBrain, Thorne HealthTech, HVMN Inc., Natural Factors Nutritional Products Ltd., AlternaScript LLC, Neurohacker Collective, Purelife Bioscience Co., Ltd., NOW Health Group, Inc., Gaia Herbs, Opti-Nutra Ltd., and Peak Bubble Tea, collectively shaping market growth through innovation, strong branding, and expanding regional presence.

Key Bubble Tea Companies:

- Lipton Teas and Infusions B.V.

- Tata Global Beverages

- Twinings (Associated British Foods)

- Dilmah Ceylon Tea Company PLC

- Celestial Seasonings (Hain Celestial Group)

- Bigelow Tea Company

- The Republic of Tea

- Yorkshire Tea (Bettys & Taylors of Harrogate)

- Ahmad Tea Ltd.

- ITO EN, Ltd.

- The Coca-Cola Company

- PepsiCo, Inc.

- Starbucks Corporation

- AriZona Beverage Company LLC

- Chatime International Ltd.

Global Bubble Tea market Report Segmentation

By Type

- Capsules/Tablets

- Powder

- Drinks

- Others

By Flavor

- Offline

- Online

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636