Market Summary

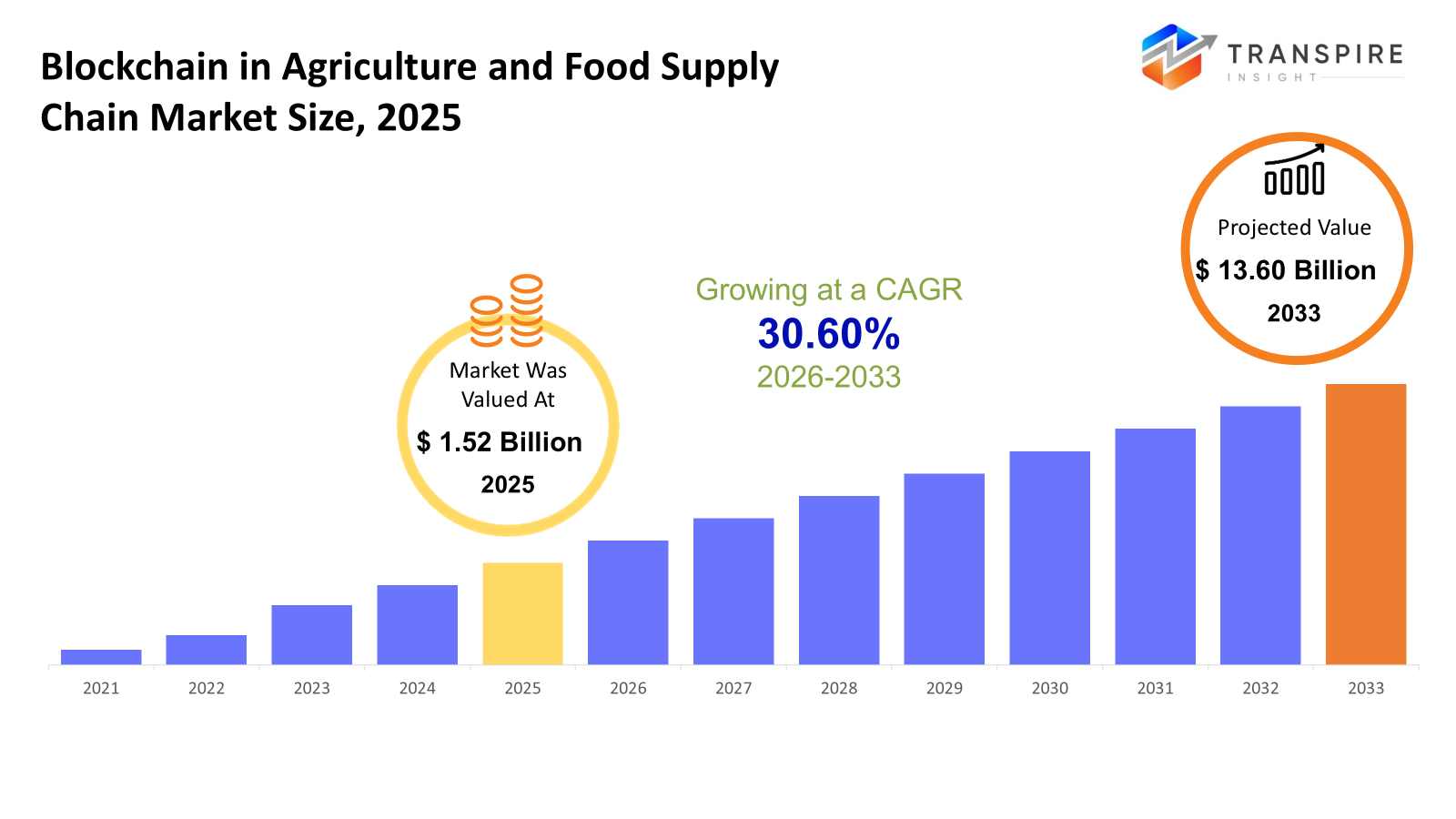

The global Blockchain in Agriculture and Food Supply Chain market size was valued at USD 1.52 billion in 2025 and is projected to reach USD 13.60 billion by 2033, growing at a CAGR of 30.60% from 2026 to 2033. Food companies now track every step from farm to table because supply networks span the globe. Pressure builds as rules tighten around safety, eco impact, and proof of where items come from. Shoppers want the truth about what they buy, pushing firms toward clearer records. Tech like blockchain steps in when trust gets shaky.

Market Size & Forecast

- 2025 Market Size: USD 1.52 Billion

- 2033 Projected Market Size: USD 13.60 Billion

- CAGR (2026-2033): 30.60%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 38% in 2026. North America is ahead of the pack; this area pushes forward with widespread use thanks to clear rules that shape progress, big investments in farm technology, and companies team up with a sharp eye on honesty and cleaner food chains.

- Fueled by quick growth, the United States market sees blockchain tested across many areas, with tracking food origins standing out, while businesses scan QR codes to show supply details directly to buyers. Alongside, automated contracts are finding a place in payment systems and rule-following software, slowly becoming part of daily operations.

- China and India are pushing change across Asia-Pacific, where demand grows fast for better export checks and tracking systems. Government backing plays a role here, along with a stronger focus on safe food practices, shaping how things move forward

- Private Blockchain shares approximately 52% in 2026. Businesses stick with Private Blockchain because it guards information better. One reason stands out: control over sensitive details stays in-house. Security tightens when access is limited. Supply chains need that kind of setup. Fewer entry points mean fewer risks. That shapes how companies adopt the tech. Not every blockchain works the same way here.

- Fueled by real-world needs, software builders set the pace, rolling out systems that track every step while meeting strict rules. Their tools quietly become the standard, pulling others along simply by working.

- Traceability is pushed by rules that require proof of where food comes from and whether it is safe.

- Right now, food makers take up the biggest chunk because tracking stuff through many suppliers matters a lot. Their systems must follow every step just to stay within the rules.

Nowhere else has tech made such quiet waves as on farms where ledgers once lived in notebooks, now replaced by digital trails. Instead of relying on paper that tears or fades, every tomato picked or cow moved gets logged permanently online. Because records can not be altered after entry, buyers question less when claims about origin appear. When one farmer shares harvest dates, everyone down the line sees it without asking twice. Even inspectors find mismatches faster since each step connects as puzzle pieces snapped together. Trust builds slowly here, not through promises but proof stored block by block. What used to vanish in paperwork shadows now stays visible from soil to shelf.

Clear tracking at every step of how goods move. From farms to stores, each player adds key details like when crops were picked or if refrigeration stayed steady to a secure digital log. That log stays unchanged, open to everyone involved. When problems pop up, finding affected items takes less time because everything shows clearly. Companies gain credibility too, showing real proof of where things come from and how they’re treated. People today want honest answers about what they eat and who made it. A system like blockchain helps meet that need without guesswork.

Growth in smart contracts, along with automatic settlements. When business logic lives inside blockchain code, players rely less on middlemen while smoothing out tasks, payments happen faster, agreements hold firm, and reporting stays clear. Conditions written in code run as promised, visible to all, shrinking errors plus lowering conflict chances. Efficiency climbs. Expenses drop. Trust builds through consistency. New ways of operating emerge notably, selling straight from maker to buyer or rewarding eco-friendly actions via coded incentives.

Now things shift because farms and food makers move faster into digital ways, while rules start matching up across regions. More attention goes to clean food practices, watching environmental harm, who’s responsible when something breaks blockchain locks records so they cannot change, which fits well here. With tools like smart sensors and number-crunching software working alongside, it strengthens how goods travel from field to table. Surprises hit less hard now. People want different things every season, laws adjust often the system bends but does not snap. This is not only machines talking to each other; it’s rebuilding trust through clear trails of truth in an age where knowing matters more than guessing.

Blockchain in Agriculture and Food Supply Chain Market Segmentation

By Blockchain Type

- Public Blockchain

A fresh look at how data moves through food systems begins here, open networks run by no single authority, just shared access for everyone involved. These digital tracks stay visible to all participants, making changes obvious if they happen. Trust builds because records cannot be quietly altered once logged. From farm to plate, every step finds a permanent home on this kind of ledger.

- Private Blockchain

Built for businesses, private blockchains restrict access to boost control over information. These networks prioritize safety through limited entry points. Supply chains often choose them to handle growth without sacrificing speed. Control stays tight because only approved users join. Security improves when outsiders cannot view transactions.

- Hybrid Blockchain

A mix of blockchains uses open visibility where needed, yet keeps entry restricted in sensitive areas. This setup holds privacy close while still showing a clear trail when required.

To learn more about this report, Download Free Sample Report

By Provider

- Application & Solution Providers

Some companies build full blockchain systems that track goods, manage rules, and handle money transfers, while also showing every step across global supply routes. These tools help organizations see what happens at each point without gaps or guesswork. Platforms come ready to use, linking verification, movement records, and financial steps into one view. They work where trust matters, especially when many parties share data but need proof. Each system adapts to different industries needing clear, unchangeable logs of actions taken.

- Middleware Providers

Out in the mix, companies link blockchains to old-school supply networks, hooking up sensors and enterprise software without breaking stride. Some quietly bridge modern ledgers with factory-floor machines while others sync real-time data flows across outdated databases. Behind the scenes, tools adapt transaction records for warehouse scanners, shipping logs, and even temperature monitors on trucks. These layers let factories talk to decentralized apps without rewriting everything from scratch.

- Infrastructure & Protocol Providers

Fundamental systems and rule enforcers lay down the backbone - block by block - for farm-to-fork digital tracking. One layer handles agreement methods, another guards trust through structure. These pieces form silent foundations beneath food networks running on shared ledgers.

By Application

- Traceability

From soil to shelf, knowing where food comes from helps keep it safe. Movement through each step can be seen instantly. This clear path builds trust with people who eat it. Details stay visible at every point along the way.

- Product Provenance & Anti-Fraud

From soil to shelf, checks confirm where items really come from. Tampering gets spotted fast through traceable records. Realness is confirmed without relying on guesswork. Hidden fakes are caught before they reach buyers.

- Smart Contracts

When conditions are met, deals run themselves; no middlemen needed. Payments go through only when goods arrive safely. Insurance kicks in if something breaks during shipping. Checks happen without someone watching every step. Rules lock in place once everyone agrees.

- Payment & Settlement

Farmers, suppliers, and buyers' transactions move quicker now, clearer too, held together by trust and visibility. Security comes through steady links between each party involved.

- GRC

When it comes to food supply chains, handling rules, and staying ready for audits, solid oversight lowers risks across operations.

- ESG & Sustainability Tracking

Farms leave marks on nature. This tool watches those effects closely. It checks where materials come from, making sure they meet fair standards. Growth is not just yield; it includes long-term earth balance too. What gets measured here shapes how fields are managed day by day.

By End-Users

- Farmers & Growers

Out in the fields, trust grows when records show exactly what happened. Money moves more easily when lenders see clear proof of harvests and sales. Prices feel right when everyone checks the same unchangeable ledger. A system that tracks every step helps small farms stand tall. Truth sticks around when it's written, where no one can erase it.

- Food Manufacturers & Processors

Starting with food makers, tracking every step becomes clearer when using blockchain. Not only does it help meet rules, but it also supports better checks on product standards. Instead of guessing where ingredients come from, companies see the full journey. This kind of system sharpens how goods move from source to shelf. Accuracy improves while errors drop over time. Behind the scenes, trust builds without extra paperwork.

- Retailers & Grocers

Start by using blockchain. This helps stores show where products come from. Shoppers feel more sure about what they buy. Trust grows when origins are clear. Some brands already prove quality this way. Truth in sourcing makes a difference. People notice when companies stay open about supply chains.

- Consumers

People can check where products come from and how good they are because of systems built on blockchain. These tools show proof about materials, making choices clearer without extra steps.

- Government & Regulatory Bodies

Beyond just oversight, officials find blockchain helpful when tracking where food comes from. Tracking each step becomes easier for those setting rules. Instead of guessing, authorities see exactly how products move. Following safety laws feels more doable with clear records. When problems arise, responses get faster thanks to transparent data.

Regional Insights

Ahead of others, North America leads due to solid tech foundations, early business uptake, and clear public interest in safer, more transparent food. Firms across the United States and Canada, big growers, stores, plus agriculture tech players are turning to blockchain for better tracking, proof of standards, and smoother logistics. Because rules here push traceability and digital tools, countless trials and live systems have taken root, setting an example others follow when applying blockchain to farming and food networks.

Food safety rules push Europe to use blockchain in farming and food tracking. Not just rules, sustainability targets matter too. Digital records help meet laws, especially where transparency counts. Across Western and Northern regions, farms and brands log organic labels using shared ledgers. Fraud slips less often when every step gets recorded. Eco-conscious buying gains ground because systems show proof. Groups team up: regulators, tech firms, farmers, all feeding progress. Innovation moves faster with joint efforts in play. Even if North America spends more, Europe shapes global habits through strict checks. Ethical choices drive its path forward. Influence grows quietly, behind solid structures.

Down south of Asia, farming powers like China and India push new tech into fields faster than elsewhere. Not just them, Australia, plus nations across Southeast Asia, test blockchains to track goods better, meet global rules, and leave fewer errors behind. These trials grow because governments team up with companies, laying digital ground so farms can join in without falling behind. People want safer food now, that much is clear. Their choices pull entire networks forward, making sure each mango or sack of rice tells a story. Even far beyond, from African coasts to desert hubs in the Middle East, efforts spark up, export checks tighten, scams drop, shipments move more smoothly. Yet those places still trail, their steps small when set beside giants such as Europe or North America, where systems run deeper, longer tested.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 5, 2025 – Justoken launched a traceability & sustainability explorer platform integrating blockchain, AI, and Satellite Data for Global Agri-Supply Chains

(Source: Generic and Blockchain in Agriculture and Food Supply Chain initiatives https://www.gabionline.net/pharma-news/new-denosumab-and-ustekinumab-Blockchain in Agriculture and Food Supply Chain-launches-in-us-canada-and-japan)

- December 9, 2025 – Mahaseel Technologies partners with Egyptian Food Bank to launch digital traceability

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.52 Billion |

|

Market size value in 2026 |

USD 2.10 Billion |

|

Revenue forecast in 2033 |

USD 13.60 Billion |

|

Growth rate |

CAGR of 30.60% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

IBM, Microsoft, SAP SE, Oracle Corporation, TE‑FOOD International GmbH, Ambrosus, Provenance, ScienceSoft, OriginTrail, Ripe.io, AgriDigital, ACR‑NET, VeChain Foundation, Bext360, GrainChain, Walmart, and FoodLogiQ |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Blockchain Type (Public Blockchain, Private Blockchain, Hybrid Blockchain), By Provider(Application & Solution Providers, Middleware providers, Infrastructure & Protocol Providers), By Application (Traceability, Product Provenance & Anti-Fraud, Smart Contracts, Payment & Settlement, GRC, ESG &Sustainability Tracking), By End-Users (Farmers & Growers, Food Manufacturers & Processors, Retailers & Grocers, Consumers, Government & Regulatory Bodies) |

Key Blockchain in Agriculture and Food Supply Chain Company Insights

IBM offers strong digital tools built on blockchain. Their system, called Food Trust, lets everyone see what happens at every step: growers, makers, stores, trucking teams, all sharing updates live. Because it uses smart tracking plus sensors and artificial intelligence, problems get found faster. Safety goes up when each item can be followed from start to shelf. Mistakes drop. Cheating drops, too. Work flows better overall. Well-known companies around the world rely on this path to check where things come from and meet tough rules everywhere goods travel.

Key Blockchain in Agriculture and Food Supply Chain Companies:

- IBM

- Microsoft

- SAP SE

- Oracle Corporation

- TE‑FOOD International GmbH

- Ambrosus

- Provenance

- ScienceSoft

- OriginTrail

- io

- AgriDigital

- ACR‑NET

- VeChain Foundation

- Bext360

- GrainChain

- Walmart

- FoodLogiQ

Global Blockchain in Agriculture and Food Supply Chain Market Report Segmentation

By Blockchain Type

- Public Blockchain

- Private Blockchain

- Hybrid Blockchain

By Provider

- Application & Solution Providers

- Middleware providers

- Infrastructure & Protocol Providers

By Application

- Traceability

- Product Provenance & Anti-Fraud

- Smart Contracts

- Payment & Settlement

- GRC

- ESG &Sustainability Tracking

By End-Users

- Farmers & Growers

- Food Manufacturers & Processors

- Retailers & Grocers

- Consumers

- Government & Regulatory Bodies

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636