Market Summary

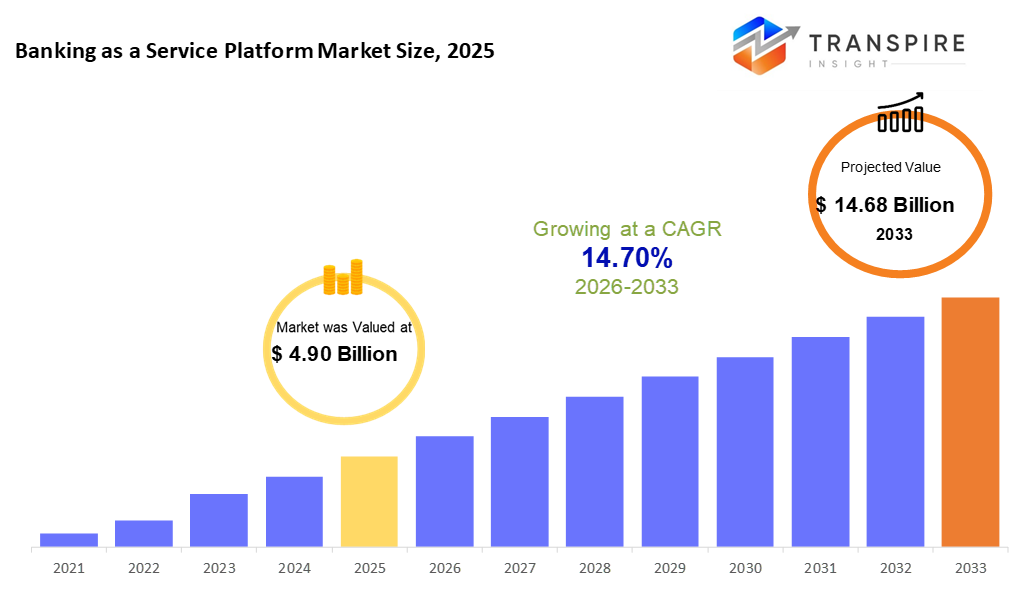

The global Banking as a Service Platform market size was valued at USD 4.90 billion in 2025 and is projected to reach USD 14.68 billion by 2033, growing at a CAGR of 14.70% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 4.90 Billion

- 2033 Projected Market Size: USD 14.68 Billion

- CAGR (2026-2033): 14.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 52% in 2026. North of the continent sees the biggest numbers. That happens because tech in finance started there long ago. APIs came into play sooner than elsewhere. Rules around them help instead of blocking progress.

- Payment Services share approximately 35% in 2026. Payment services lead because more people want instant online transfers and new cards, while relying on tech interfaces that link systems together.

- Setup moves fast. It cuts hardware expenses. Banks see it first. Fintech firms follow close behind.

- They are updating old tech setups while rolling out digital services that handle many tasks at once. Growth here is strongest because outdated systems are being replaced step by step. Multiple tools get bundled into single platforms, which helps streamline operations behind the scenes.

- Fueled by the rising use of smartphones, digital wallets are seeing rapid growth. Mobile payment habits push this trend forward. Contactless methods now play a big role here. This area moves faster than others in the field.

- Banks and financial firms take up most of the space here, using BaaS to get better at online services while smoothing out daily work. Though seen as traditional, they adapt by folding new tech into what they already do.

Right now, banks, tech startups, and big companies are turning fast toward API-powered tools that let them offer money services without setting up old-style banking systems. Because of this shift, a sector called Banking-as-a-Service, known as BaaS, is expanding quickly around the world. Instead of building everything themselves, businesses plug into ready-made functions like payments, accounts, loans, or rules tracking through smooth software links. This setup helps lower day-to-day expenses while getting new finance features out faster. Another push comes from more brands wanting to weave banking into their own platforms - think shopping sites, stores, or ride-hailing apps so users never have to leave. That trend, often called embedded finance, plays a major role in why the whole space keeps gaining speed.

Right now, payment services sit at the front of the BaaS field because more people are using phones to pay, tapping cards instead of swiping, plus sending money instantly. Instead of building everything themselves, fintech companies and traditional banks turn to BaaS tools that handle payments safely while growing easily. These platforms support things like virtual cards, apps that store cash digitally, and moving funds across borders without delays. As shopping online keeps rising, so does the pressure for systems that settle payments quickly and work every time, pushing even wider use of BaaS built mainly around moving money.

Out in the open world of finance, new tools keep shifting how things work. Running systems through internet clouds has become common because it grows easily, adapts fast, yet stays affordable. Big firms and small ones alike lean on these setups more each year. Smarter software like AI, self-learning algorithms, or secure digital ledgers now plug into banking services. They help spot scams, handle risks, and move money across borders without hiccups. With these upgrades, financial providers improve service quality while still following strict rules laid down by regulators.

North America leads in market size because of its well-established fintech scene, solid rules backing open banking, alongside widespread comfort with digital tools. Growth there does not slow easily. Europe keeps pace thanks to PSD2 pushing transparency and smoother international money handling. In another direction entirely, Asia Pacific surges ahead faster than others as phones dominate daily transactions and public policies bring more people into the financial fold. Underlying it all: steady spending on tech foundations, more appetite for finance woven into non-financial apps, along with joint efforts linking traditional lenders and new fintech players, it is this mix that should keep the BaaS sector expanding through the coming years.

Banking as a Service Platform Market Segmentation

By Service Type

- Monoclonal Antibodies

Monoclonal antibodies lead in value boosted by cancer treatments, along with immune-related conditions, thanks to key drug patents running out.

- Recombinant Hormones

Recombinant hormones are on the rise, like insulin or similar versions of growth hormone, that help handle long-term health issues.

- Erythropoietin

Erythropoietin (EPO) helps manage low red blood cell counts - common when kidneys don't work well or during cancer care. Use is growing, even as expenses tighten.

- G-CSF

Granulocyte Colony-Stimulating Factor (G-CSF) helps handle low white blood cell counts during cancer care, often used in hospitals because it works well.

- Others

Other types cover fusion proteins, enzymes, or specialized biologics growing slowly when fresh Banking as a Service Platform moves into specific treatment zones.

To learn more about this report, Download Free Sample Report

By Deployment Mode

- Oncology

Oncology takes the lead - growing quicker than others because biologics are widely used, while cutting costs becomes essential.

- Autoimmune Diseases

Growing use of illnesses such as rheumatoid arthritis or psoriasis, mainly because treatment lasts for years. People stick with it since symptoms need constant control, so doctors recommend ongoing care now and then.

- Blood Disorders

Steady progress of Banking as a Service Platform helps manage anemia or low white blood cells, also tackling various related issues.

- Diabetes

More people are using insulin copies, particularly where prices matter most.

- Other areas cover lack of growth hormones, issues with having kids, and also uncommon health problems market is slowly growing.

By Organization Size

- In-House Manufacturing

This is preferred by large pharma companies with biologics infrastructure.

- Contract manufacturing

This is the fastest growing segments due to leveraging specialized expertise and less capital expenditure.

By Application

- Hospital Pharmacies

Dominant channel for high-cost and infusion-based Banking as a Service Platform.

- Retail Pharmacies

Growing adoption among the outpatients.

- Distribution Channel

This is gradually increasing due to the expansion of regulatory frameworks.

Regional Insights

Across North America and Europe, the BaaS scene holds firm, powered by well-built banking systems, solid digital networks, plus broad reliance on cloud platforms and APIs for finance tasks. The United States leads the charge here, where fresh fintech ideas thrive alongside a culture rooted in digital transactions and rules that back open banking models. Over in Europe, movement builds slowly but surely, thanks to PSD2 pushing access forward, easier money flows across borders, along with deeper ties forming between traditional lenders and tech-focused startups.

Down south of Asia, more people start using phone-based banking every day. A big chunk never had bank access before, now tapping apps changes that. Digital wallets spread fast in cities like Jakarta or Mumbai. Governments back these shifts with new rules and support programs. Online shopping rises, pushing stores to offer quick loans at checkout. Fintech firms get extra funding to build stronger systems. China moves ahead with voice pay and instant credit lines. Rural spots catch up through local startups and telecom help. Banking quietly slips into ride apps, food delivery, and even farming tools.

Out in Latin America, more people using mobile payments gives BaaS a boost. Digital wallets catch on fast, while quick transfer networks gain ground alongside new lending models. Over in the Middle East and Africa, phones with internet reach more hands every month. National efforts to push digital money meet startups building fresh financial tools. These changes create space for service-driven banking setups to take root. Step by step, both areas add momentum to worldwide growth trends through the years ahead.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 25, 2025 – Backbase launched the world’s first AI-powered banking platform, putting banks back in growth mode.

(Source: https://www.backbase.com/press/backbase-launches-world-first-ai-powered-banking-platform

- August 14, 2025 – Omniwire announced the official launch of its banking as a service platform and products.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 4.90 Billion |

|

Market size value in 2026 |

USD 5.62 Billion |

|

Revenue forecast in 2033 |

USD 14.68 Billion |

|

Growth rate |

CAGR of 14.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Solaris SE, Clearbank Ltd, GreenDot Corporation, Railsr, Treezor, Bankable, Fidor Solutions, Mambu, Q2 Holdings Inc., Treasury Prime, Synapse, Unit, BBVA Open Platform, Finastra, Galileo Financial, Marqeta |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Service Type (Payment Services, Lending & Credit Services, Account Management Services, Compliance & Risk Management, Wealth Management Services, Compliance & Risk Management, Wealth Management & Investment Services), By Deployment Mode(Cloud-Based, On-Premises, Hybrid Deployment), By Organization Size (Large Enterprises & Banks, Small & Medium Enterprises), By Application (Digital Payments & Wallets, Lending & Credit Management, Embedded Finance, Account & Fund Management, Cross-Border Payments & Remittances) |

Key Banking as a Service Platform Company Insights

Solarisbank AG (Germany) is a leading BaaS platform that provides modular banking services via APIs, enabling fintechs, startups, and enterprises to offer digital financial products without holding a banking license. Its platform covers account management, payment processing, card issuing, compliance, and lending services. Solarisbank’s cloud-native architecture allows rapid integration and scalability for embedded finance solutions across Europe. With strong partnerships with banks and fintechs, the company is driving innovation in digital banking while maintaining regulatory compliance and operational security. Its developer-friendly APIs and flexible platform have positioned Solarisbank as a top choice in the BaaS ecosystem.

Key Banking as a Service Platform Companies:

- Solaris SE

- Clearbank Ltd

- GreenDot Corporation

- Railsr

- Treezor

- Bankable

- Fidor Solutions

- Mambu

- Q2 Holdings Inc.

- Treasury Prime

- Synapse

- BBVA Open Platform

- Finastra

- Galileo Financial

- Marqeta

Global Banking as a Service Platform Market Report Segmentation

By Service Type

- Payment Services

- Lending & Credit Services

- Account Management Services

- Compliance & Risk Management

- Wealth Management Services,

- Compliance & Risk Management

- Wealth Management & Investment Services

By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid Deployment

By Organization Size

- Large Enterprises & Banks

- Small & Medium Enterprises

By Application

- Digital Payments & Wallets

- Lending & Credit Management

- Embedded Finance

- Account & Fund Management

- Cross-Border Payments & Remittances

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636