Market Summary

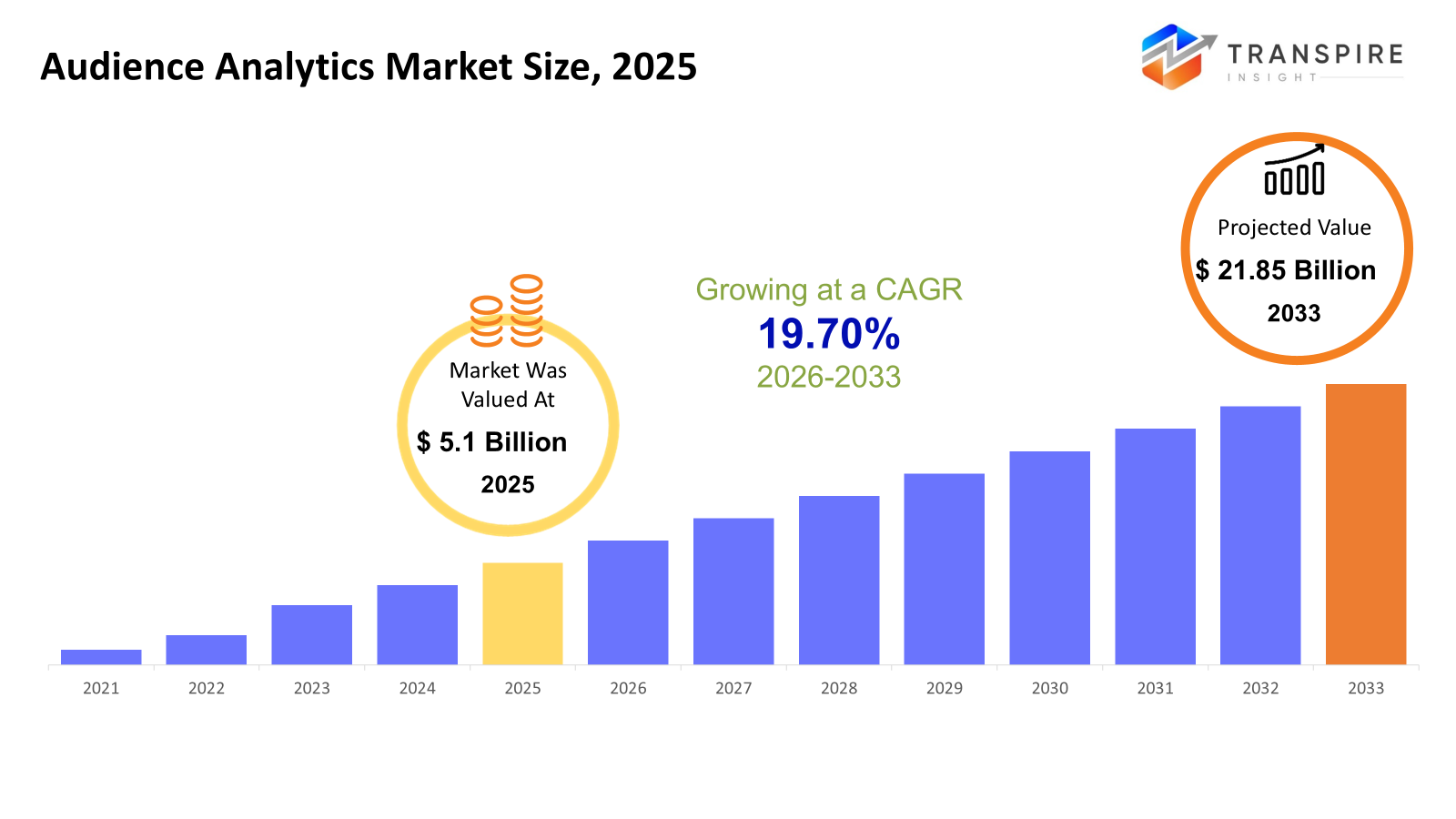

The global Audience Analytics market size was valued at USD 5.1 billion in 2025 and is projected to reach USD 21.85 billion by 2033, growing at a CAGR of 19.70% from 2026 to 2033. The growth rate of this market, or its CAGR, is fueled by increasing demand for data-driven decisions, digital content consumption, as well as customer engagement across omnichannel environments. Improvements in artificial intelligence, cloud analytics, as well as data processing, also drive growth across all enterprises.

Market Size & Forecast

- 2025 Market Size: USD 5.1 Billion

- 2033 Projected Market Size: USD 21.85 Billion

- CAGR (2026-2033): 19.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- With advanced digital infrastructure, high marketing technology spend, and a strong presence of analytics vendors, North America continues to present abundant opportunities for the rapid adoption of AI-driven audience insights across media, retail, BFSI, and technology enterprises that strive for measurable customer engagement outcomes.

- US continues to act as the core growth engine because of large availability, mature digital advertising ecosystems, and early adoption of predictive and real-time analytics. Enterprises give priority to personalization, attribution modeling, and ROI-focused campaign optimization strategies.

- The Asia Pacific displays the fastest momentum: with exponential growth in internet penetration, mobile-first consumer behaviour, and rapid e-commerce growth that is forcing enterprises to deploy scalable, cloud-based audience analytics for localized targeting and cross-platform engagement measurement.

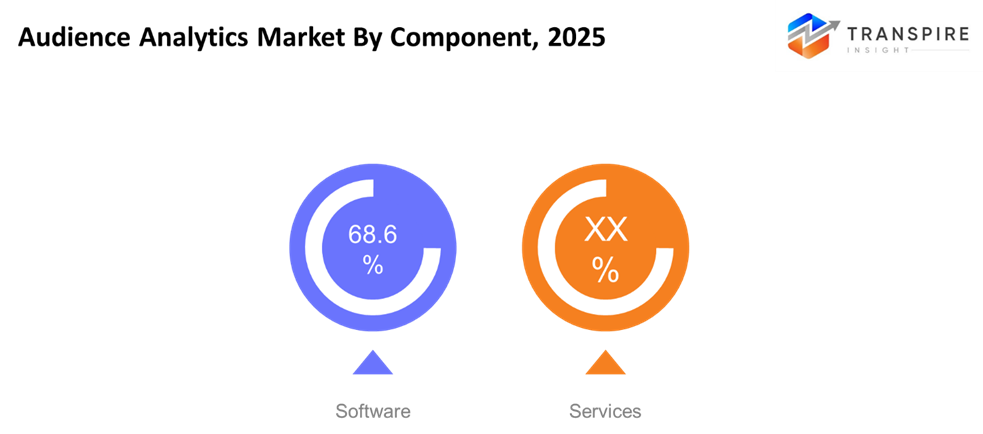

- The segment has the most extensive share under the software category, and this can be attributed to the rising use of AI-enabled tools for audience segmentation, behavioral modeling, and real-time visualization, which are largely scalable, provide automation advantages, and can interact with the CRM, automation, and digital ad landscape.

- Applications are driven by sales and marketing management, particularly as the need for hyper-personalization, campaign attribution, or conversion optimization continues to grow, as many companies use audience analytics to better match content, media, and timing to changing customer intent patterns.

- Large enterprises again dominate the usage landscape, owing to the availability of large data, intricate omnichannel operations, and substantial analytics spend, allowing for sophisticated usage scenarios like the development of predictive customer lifetime value, benchmarking across markets, and integration of organization-wide customer intelligence.

- The retail and e-commerce sector stands out as the industry vertical, which for most organizations is driven by more focus on personalizing product and service suggestions, predictions, and optimization, leveraging audience analytics capabilities.

So, The audience analytics market refers to software solutions or software packages, as well as associated services, which handle audience data gathered, created, or collected across digital as well as offline interaction modalities. These software platforms support organizations or entities seeking to make customer demographics, preferences, or behavior information-based. Audience analytics brings together various sources like social media data, websites, mobile applications, ad platforms, CRM systems, and transactional databases. The application of technologies like artificial intelligence, machine learning, and real-time analytics also improves the ability to predict behavioral responses, segment an audience, and track campaigns more accurately. The industry has become closer to the needs and objectives of businesses, which include personalization, revenue optimization, retention, and differentiation strategies. Many media, retail, BFSI, telecom, and healthcare entities are leveraging audience analytics for better personalization accuracy, content dissemination, and product or service availability according to consumer tastes. With growing significance for data privacy regulations and first-party data, audience analytics tools have also adjusted themselves to cater to data governance, data security, and data insight generation.

Audience Analytics Market Segmentation

By Component

- Software

Software leads the market, as organizations are increasingly dependent on such platforms for making sense of complex audience data. These tools help not just in number crunching but also provide clear, actionable insights that make the marketer confident in their decisions.

- Services

These form a perfect complement to software, because services help guide businesses through implementation and customization and strategy. They are the friendly hand holding enterprises through the sometimes confusing journey of turning raw data into meaningful audience stories.

To learn more about this report, Download Free Sample Report

By Application

- Sales & Marketing Management

This area ranks top due to the need for accurate marketing strategies and budget optimization and subsequent measurement. With analytics, organizations can now tailor marketing strategies to match consumer behavior for maximum ROI.

- Customer Experience Management

Analytics is enabling organizations to effectively improve the customer journey. This includes identifying Customer Pain Points, Customer Engagement, and Customer Preference Trends. Its adoption rate is growing, and the Personalized Experience has turned into a differentiator.

- Competitive Intelligence

Organizations use analytics for benchmarking, watching competitors' strategies, and finding opportunities. This segment appears to be gaining popularity, particularly in those industries where strategy plays an essential role.

By Organization Size

- Large Enterprises

Large enterprises tend to hold a strong position in the industry, primarily due to complex marketing activities involving different channels and a greater volume of big data. The investment in an advanced technology platform aids in facilitating insights at the enterprise level.

- Small & Medium-Sized Enterprises (SMEs)

SMEs are finding effective and scalable solutions that are based on the cloud platform and assist in obtaining actionable insights into their audiences at a lower upfront cost. Growth in these segments is driven by digitalization and increased awareness about making data-driven decisions.

By Industry Vertical

- Media & Entertainment

Analytics supports optimization of content, audience segmentation and engagement measurement. Growing consumption of digital content fuels the adoption in this vertical.

- Retail & E-commerce

This vertical leads due to demand for personalization, predictive recommendations and optimized customer journeys. Analytics enables targeted promotions, conversion optimization and retention strategies.

- Telecommunication & ITES

Adoption is driven by reducing churning, segmenting customers and optimizing service offerings based on behavioral data.

- BFSI

Customer profiling, targeting campaigns, and risk assessment are the most common functions. Financial organizations leverage insights to improve retention and optimize products.

- Healthcare & Life Sciences

Adoption of this segment includes patient engagement analytics, service utilization, and efficiency. Information gained can be used to enhance the efficiency of healthcare.

- Others

This consists of the automotive industry, hospitality industry, and the education industry.

Regional Insights

The segment refers to the North American geographic segment as a developed human analytics marketplace, and it identifies the USA as the most prominent Tier-1 subregion within this segment while the Canadian and Mexican markets feature as the Tier-2 segment. The Europe region indicates an increasing demand rate, mainly due to Tier-1 countries such as Germany, the United Kingdom, France, Spain, and Italy. In these nations, organizations are adopting data-driven marketing within a controlled environment. The Rest of Europe includes Tier-2 segments, where they are adopting analytics using cloud-based and GDPR-compliant solutions. The fastest-growing region for mobile engagement and e-commerce expansion is Asia Pacific, where China, Japan, India, Korea, and Australia & New Zealand represent Tier-1 markets. The Rest of Asia Pacific markets represent Tier-2, where digital infrastructure investments are being made.

Emerging market countries in South America have shown positive prospects, where Brazil is a Tier-1 market for digital commerce and audience analytics, followed by Tier-2 countries, i.e., Argentina and the rest of South America. The Middle East & Africa region continues to be developing, with Tier-1 markets like Saudi Arabia, the United Arab Emirates, and South Africa, while the Rest of the Middle East & Africa continues to advance with the Tier-2 markets.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 2025, Locality announced the release of its Advanced Audience Engine, which it claims to be "a powerful new tool to bring generative-AI technology into the world of identity and activation while also combining first-party, third-party, and viewership data to automatically segment audiences, target audiences, and trigger campaign activation in linear television and digital media alike.

(Source:https://www.tvtechnology.com/news/locality-introduces-advanced-audience-engine)

- In August 2025, In another significant development, Nielsen and WPP Media unveiled their plans for an advanced audience measurements partnership that will cover TV, online streaming platforms, and audio streaming services for using Nielsen ONE metric insights for its Open Media Studio..

(Source:https://www.tvtechnology.com/news/nielsen-and-wpp-media-ink-new-audience-measurement-deal)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 5.1 Billion |

|

Market size value in 2026 |

USD 6.2 Billion |

|

Revenue forecast in 2033 |

USD 21.85 Billion |

|

Growth rate |

CAGR of 19.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Adobe Inc., Google LLC, Oracle Corporation, IBM Corporation, SAS Institute Inc., Akamai Technologies Inc., Comscore Inc., NetBase Solutions, Unifi Software, AnalyticsOwl, Audiense, Telmar Corporation, Quividi, Salesforce.com Inc., Mixpanel Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Software, Services), By Organization Size (Sales & Marketing Management, Customer Experience Management, Competitive Intelligence), Recycling & Recovery Technologies), By Organization Size (Large Enterprises, Small & Medium-Sized Enterprises (SMEs)) and By Industry Vertical (Media & Entertainment, Retail & E-Commerce, Telecommunication & ITES, BFSI, Healthcare & Life Sciences, Others) |

Key Audience Analytics Company Insights

Adobe Inc. has managed to carve a place for itself as a major player in the audience analytics sphere through its integration of Adobe Experience Platform, data management, and AI-driven analysis capabilities. The offerings of Adobe allow companies to analyze customer behavior in real-time, optimize marketing campaigns, and analyze cross-channel activity, thereby letting companies integrate consumer data across various digital mediums. The greatest strength of Adobe, however comes from its ability to combine behavior, transaction and context data, letting companies personalize campaigns while facilitating ROI tracking. The widespread usage of Adobe across Fortune 500 companies, as well as its continued improvements in AI-driven automation continue to affirm its significance in terms of survival in such a competitive landscape.

Key Audience Analytics Companies:

- Adobe Inc.

- Google LLC

- Oracle Corporation

- IBM Corporation

- SAS Institute Inc.

- Akamai Technologies Inc.

- Comscore Inc.

- NetBase Solutions

- Unifi Software

- AnalyticsOwl

- Audiense

- Telmar Corporation

- Quividi

- com Inc.

- Mixpanel Inc.

Global Audience Analytics Market Report Segmentation

By Component

- Software

- Services

By Application

- Sales & Marketing Management

- Customer Experience Management

- Competitive Intelligence

By Organization Size

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

By Industry Vertical

- Media & Entertainment

- Retail & E-Commerce

- Telecommunication & ITES

- BFSI

- Healthcare & Life Sciences

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636