Market Summary

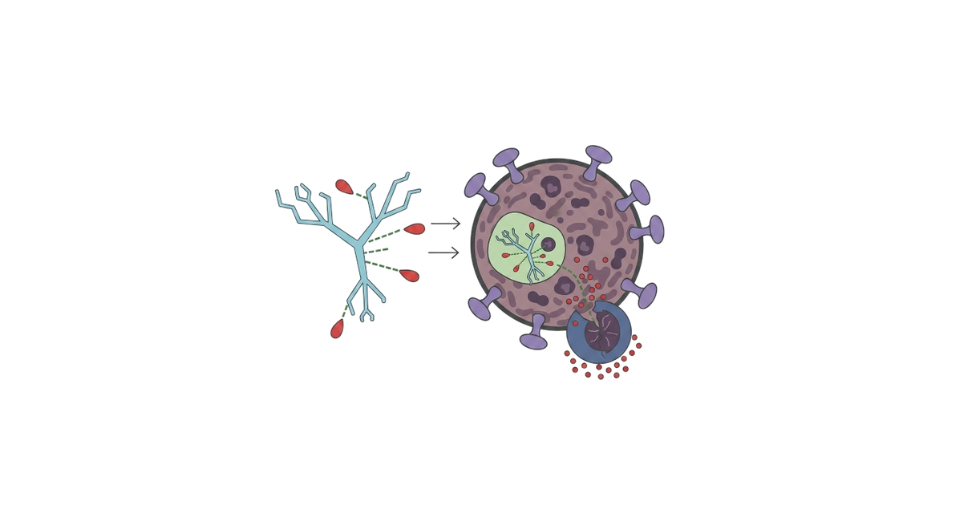

The global Antibody Drug Conjugates (ADCs) market size was valued at USD 14.48 billion in 2025 and is projected to reach USD 32.19 billion by 2033, growing at a CAGR of 10.50% from 2026 to 2033. The Antibody Drug Conjugates (ADCS) industry is rising a significant escalation due to the increased focus of the pharmaceutical industry on effective and targeted therapies against cancer. ADCs are integrating the ability of monoclonal antibodies and the effectiveness of cytotoxic medicines to target cancer cells without damaging healthy cells. Improvement and innovation in the fields of linker and antibody, and cytotoxic entities, have increased the effectiveness and safety of ADCs to a certain extent and have made the industry a suitable investment opportunity. Enhanced incidence of cancer and interest among the biotechnology and pharmaceutical industry are escalating the growth of the Antibody Drug Conjugates industry.

Market Size & Forecast

- 2025 Market Size: USD 14.48 Billion

- 2033 Projected Market Size: USD 32.19 Billion

- CAGR (2026-2033): 10.50%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The regions of North America are leaders in the global ADCs market, primarily because of a well-established biotech environment, a high prevalence of cancer, and a proactive approach to adopting cutting-edge targeted therapies. The presence of leading pharma giants and a strong clinical trial activity environment is quite conducive to the speedy development of ADCs.

- The United States leads in this region due to extensive investments in cancer R&D, many FDA-approved ADCs, and extensive use of precision and personalized medicine. Rugenica also mentions high levels of healthcare spending in the United States as an accelerator for the adoption of AD Carlson.

- The Asia Pacific region exhibits the most growth due to increasing cases of cancer, improvements in healthcare infrastructure, as well as rising biotech investment in China, Japan, and South Korea. Biopharma research support from governments, as well as manufacture costs, are also propelling growth within this component.

- Kadcyla has held the largest share of the ADC market historically. Its long-standing clinical use for HER2-positive breast cancer and extensive adoption contribute highly to its market leadership.

- Cleavable linkers remain the dominant technology in both approved and pipeline products, comprising the majority of the market. These linkers efficiently release the cytotoxic payload inside the tumor cells, hence enhancing targeted delivery and therapeutic effectiveness.

- The dominant application-based payloads are widely used in successful ADCs such as Adcetris, Polivy, and Padcev, based on MMAE (auristatin), which contributes to its strong share in the oncology space.

So, the Antibody Drug Conjugates (ADCs) market is based on the strategic convergence of the strong targeting potential of monoclonal antibodies with highly potent cytotoxic drugs for more effective and safe cancer treatment. ADCs are intended for the direct delivery of chemotherapy to cancer cells, sparing normal tissue as much as possible. Research in antibody-based engineering, linkers, and cytotoxic drugs has led to the improved stability, accuracy, and market potential of ADCs. In general, the majority of the approved and pipeline ADCs are based on the use of cleavable linkers that release the drug in the tumor cells, combined with the universal use of the MMAE (auristatin) cytotoxins, which have demonstrated significant clinical success in the oncology market. Kadcyla, a promising leader in the market, remains at the forefront due to its long-term successful treatment of HER2-positive breast cancer, while newer generations of ADCs are providing increasing possibilities for the treatment of both solid malignancies and hematologic malignancies. The ultimate aim of the approach in the ADC market is improved survival rates with reduced systemic toxicity with the potential for overcoming compromised treatment capabilities.

Antibody Drug Conjugates (ADCs) Market Segmentation

By Product

- Kadcyla

From over many years for an ADC and a significant indication in HER2-positive breast cancer. It has contributed greatly to establishing that ADCs have value in cancer treatment.

- Enhertu

A new-generation ADC with strong efficacy and a wider spectrum of cancers expressing HER2. It has propelled a strong growth rate for the market with its broader clinical applications.

- Adcetris

Indicated for specific types of blood cancers, the ADC was one of the first successes in the therapeutic domain of hematologic cancers. It brought a boost to the use of ADC in lymphomas.

- Padcev

This is an ADC developed for treating advanced urothelial carcinoma or bladder cancer in those whose options are limited. This success case clearly proves that ADCs can indeed cure solid cancers.

- Trodelvy

Developed as a treatment for difficult-to-treat cancers, including aggressive forms of breast cancer. Illustrates the potential of ADCs to fill a void within resistant and late-stage cancers.

- Polivy

This ADC is primarily used for treating blood cancers and is administered in combination with other treatments for better patient outcomes.

- Others

These include emerging and pipeline ADCs that target new cancer markers.

To learn more about this report, Download Free Sample Report

By Disease Type

- Breast Cancer

ADCs find broad applications in breast cancer treatment owing to their selectivity towards cancerous cells with minimal systemic toxicity. Effective treatment outcomes and broadening disease indication, making it the most prominent segment of the ADC market.

- Blood Cancer

ADCs have a significant place in the treatment of lymphomas and leukemias through specific antigens expressed on the surface of the cancerous blood cells. Encouraging response rates and synergistic therapies establish a strong foothold for the market.

- Others

These include solid tumors like lung cancer, bladder cancer, ovarian cancer, and gastrointestinal cancer. Clinical trials and the need for innovative treatments are setting the stage for the use of ADCs in other types of cancer.

By Linker Type

- Non-Cleavable Linkers

Such linkers are resistant to the bloodstream environment and release the drug only after the antibody has been completely degraded within the cancer cell. They are preferred for their increased stability and less off-target toxicity.

- Cleavable Linkers

Cleavable linkers are sensitive to tumor-specific conditions such as enzymes or pH. Market trends show they are most commonly used as they exhibit faster drug release mechanisms and greater anti-tumor effects.

By Target

- HER2

It is one of the foremost drug targets in the ADC market, predominantly found in breast and gastric cancers. Its high clinical validation and strong levels of expression make it a leading segment.

- CD22

It has mainly been targeted for the treatment of hematologic malignancies, such as some leukemias and lymphomas. The high specificity of CD22 for B lymphocytes has made it a preferred

- CD30

This target is widely deployed in lymphomas. It is a good target antigen for ADCs since it is constantly expressed on cancer cells. It has shown persistent clinical responses.

- Others

Encompasses emerging targets in solid and hematologic malignancies. Ongoing discovery of novel targets is driving the ADC pipeline forward continually.

By Payload Type

- MMAE/Auristatin

A highly potent cytotoxic agent that targets cell division, widely used because it has a remarkable efficacy profile for both solid tumors and hematological malignancies, one of the most prevalent payload classes.

- Calicheamicin

A DNAm-Damaging Agent with High Potency: Calicheamicin is a highly potent DNAm-damaging agent that has been employed in specific ADCs. However, its efficacy is accompanied.

- Maytansinoids

These are structure-based inhibitors of microtubule, and they are preferred due to their risk-benefit balance. Maytansinoids have a proven history of successful use.

- Others

Includes next-generation agents like topoisomerase inhibitors and novel cytotoxins. These are gaining popularity due to better efficacy and better penetration in the tumor.

Regional Insights

The overall worldwide market for Antibody Drug Conjugates (ADCs) varies in terms of regional growth trends, led by the healthcare infrastructure, cancer research, regulatory frameworks, and overall adoption of cutting-edge technologies in their respective geographies. For example, the most developed market is located in North America, led by Tier 1 adopters such as the United States and Canada, due in major part to their well-developed biotech communities, incidence of cancer, clinical trial sophistication, and overall pioneering adoption in the emerging area of personalized cancer medicine, while Tier 2 adoption in these geographies is enabled by growing university pharma partnering, as well as growing adoption in targeted cancer therapies.

Next is the European region with a steadily rising market; in this case, the Tier-1 nations are Germany, France, the UK, Italy, and Spain. These market regions have favorable regulatory environments, an increased shift towards personalized therapies, in addition to adequate public health systems in these regions; hence, innovative cancer therapies are promoted in these regions. Other regions of the second tier in Eastern Europe are seeing an improvement in the levels of ADC use in their regions.

The Asia Pacific region is the world's fastest-growing ADC market, supported by a rapidly rising cancer burden and expanding biopharmaceutical capabilities. Tier 1 markets in China, Japan, South Korea, and Australia are leading due to government support for biopharma innovation, increasing regulatory approvals, and growing domestic manufacturing capabilities. Tier 2 countries include India, Malaysia, Thailand, and Vietnam, which are rapidly adopting through improving oncology care access, cost-efficient clinical development, and partnerships with global pharmaceutical firms.

South America Emerging market, wherein Tier 1 sub-regions (Brazil and Argentina) are driven by an improving oncology infrastructure, growing awareness of advanced cancer therapies, including participation in global clinical trials. In contrast, Tier 2 emerging markets will look to adopt ADCs at a slower pace, generally through private healthcare systems and dedicated cancer centers. The Middle East and Africa: Still at a nascent stage, where the countries of Israel, Saudi Arabia, and the UAE are driving Tier 1 adoption owing to advanced healthcare-related investments and specialty oncology centers. Additionally, Tier 2 regions will be at an early stage of development, dependent on healthcare modernization and international support for expanding access to ADC-based treatments.

To learn more about this report, Download Free Sample Report

Recent Development News

- In January 2024, Pfizer announced plans to accelerate late-stage ADC clinical trials and expand manufacturing capacity, signaling a long-term strategic commitment to ADC-driven oncology growth.

- In December 2023, Pfizer completed its USD 43 billion acquisition of Seagen, integrating one of the strongest ADC portfolios and technology platforms into Pfizer’s oncology business. This marked one of the largest deals in ADC history and significantly strengthened Pfizer’s leadership in targeted cancer therapies.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 14.48 Billion |

|

Market size value in 2026 |

USD 16.00 Billion |

|

Revenue forecast in 2033 |

USD 32.19 Billion |

|

Growth rate |

CAGR of 10.50% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Seagen, Inc.; Takeda Pharmaceutical Company Ltd.; AstraZeneca; F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; Gilead Sciences, Inc.; Daiichi Sankyo Company Ltd.; antibody drug conjugates Therapeutics SA. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product (Kadcyla, Enhertu, Adcetris, Padcev, Trodelvy, Polivy, and others), By Disease Type (Breast Cancer, Blood Cancer, others), By Linker Type (Non-Cleavable, Cleavable), By Target (HER2, CD22, CD30, Others) By Payload Type (MMAE/auristain, Calicheamicin, Maytansinoids, Others) |

Key Antibody Drug Conjugates (ADCs) Company Insights

With its broad portfolio-including IoT-enabled precision equipment, autonomous machinery, and data analytics platforms-Deere & Company is a clear market leader. Its global presence and significant investment in research and development allow the company to continue to innovate, providing scalable solutions for farmers that help improve operational efficiency and sustainability. Deere's ability to integrate hardware and software ecosystems provides a competitive advantage, which fosters wide diffusion across large commercial farms worldwide.

Key Antibody Drug Conjugates (ADCs) Companies:

- Seagen, Inc.

- Takeda Pharmaceutical Company Ltd.

- AstraZeneca

- Hoffmann-La Roche Ltd.

- Pfizer, Inc.

- Gilead Sciences, Inc.

- Daiichi Sankyo Company Ltd.

- antibody drug conjugates Therapeutics SA.

Global Antibody Drug Conjugates (ADCs) Market Report Segmentation

By Product

- Kadcyla,

- Enhertu

- Adcetris

- Padcev

- Trodelvy

- Polivy

- Others

By Disease Type

- Breast Cancer

- Blood Cancer

- Others

By Linker Type

- Non-Cleavable

- Cleavable

By Target

- HER2

- CD22

- CD30

- Others

By Payload Type

- MMAE/auristain

- Calicheamicin

- Maytansinoids

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

APAC:+91 7666513636

APAC:+91 7666513636